SUMMARY

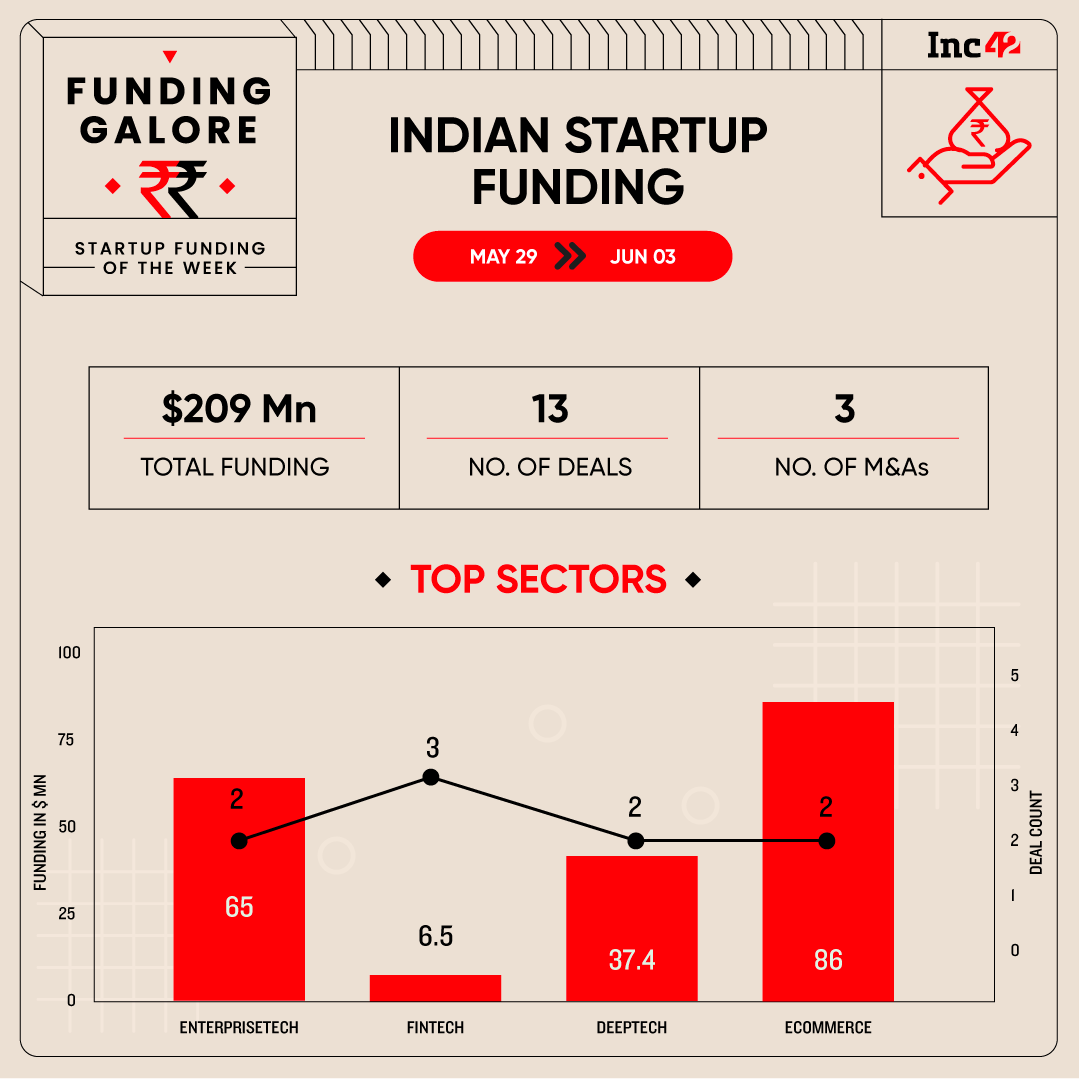

The Indian startup ecosystem secured $209 Mn funding across 13 deals in the last week of May

Consumer appliances brand Atomberg bagged $86 Mn in its Series C round of funding from Google -– making it the biggest fundraiser of this week

Aurum PropTech’s board approved the acquisition of NestAway for $10.93 Mn

After witnessing a sustained upward funding trend over the past couple of weeks, the last week of May plummeted again. Between May 29 and June 3, 2023, the Indian startups collectively raised $209 Mn across 13 deals, which is relatively better than most of the weeks since the onset of the funding winter. However, this week’s funding is 56% lower than the $476 Mn raised across 16 deals last week.

Still, this week’s funding is 22% higher than $171 Mn raised by Indian startups between May 15 and May 20 across 18 deals.

Key Startup Funding Deals Of This Week

- Consumer appliances brand Atomberg bagged $86 Mn in its Series C round of funding from Google -– making it the biggest fundraiser of this week

- Ecommerce secured the top spot this week with $86 Mn funding

- In total deal count, fintech sector clinched the first spot with three deals and $6.5 Mn funding

- Early-stage startups reported an incremental rise in funding with $6.8 Mn this week, a 152% jump from $2.7 Mn raised last week.

Startup Acquisitions Of This Week

- Sequoia-backed MedGenome has acquired Prognosis Laboratories to expand its geographical presence for an undisclosed amount

- Bengaluru-based upskilling edtech soonicorn Scaler acquired Delhi-based Pepcoding for an undisclosed amount

- Once a popular marketplace for home rental – NestAway is undergoing a possible distressed sale. Aurum PropTech’s board approved the acquisition of NestAway for $10.93 Mn

Other Major Developments From This Week

- Early stage VC Aeravti Ventures announced the first close of its maiden INR 100 Cr fund focussed on emerging tech startups

- Info Edge, one of the largest investors in Rahul Yadav’s 4B Networks, has hired Deloitte to initiate a forensic audit into the proptech startup

- This week, US AMC BlackRock reduced BYJU’S valuation by 62% to $8.3 Bn, whereas, Janus Henderson has reduced PharmEasy’s valuation by 52% to $2.7 Bn from $5.6 Bn

- SaaS unicorn Gupshup also got impacted by the valuation markdown. The US-based asset management company (AMC) Fidelity Investments slashed the unicorn’s valuation by 31.6% to $957 Mn.