Most startup founders that Inc42 spoke with believe that the 20% TCS regime on credit card spending will have a short-term impact, however, highlighted a lack of clarity as the major issue

The Souled Store’s CFO said that the move has the potential to impact the startup founders who use their personal credit cards for company-related purchases

The biggest casualty of the amendments seems to be investech startups, which could see a drop in volumes as customers looking to invest in US-based stocks will now be slapped with a higher TCS

The Union Finance Ministry notified the amended Foreign Exchange Management Act (FEMA) on May 16, omitting Rule 7 of the FEMA (Current Account Transactions) Rules, 2000, and bringing the usage of international credit cards outside India under the Liberalised Remittance Scheme (LRS) limit of $250K (INR 2 Cr).

This means, effective July 1, 2023, Indians will have to pay tax collected at source (TCS) at the rate of 20% for spending on credit cards outside India. This follows the Budget 2023 announcement, which hiked TCS for foreign remittances under LRS from 5% to 20%.

In simple words, if a user uses their credit card to purchase a travel package worth INR 10 Lakh, he will have to pay an additional INR 2 Lakh as TCS. However, the user will have the option of claiming the TCS at the time of filing income tax returns. Also, for any purchase above $250K, approval will be required from the RBI.

The Reserve Bank of India (RBI) is said to have urged the Centre to issue such norms to capture total spending under the LRS for prudent forex management and prevent circumvention of LRS limits.

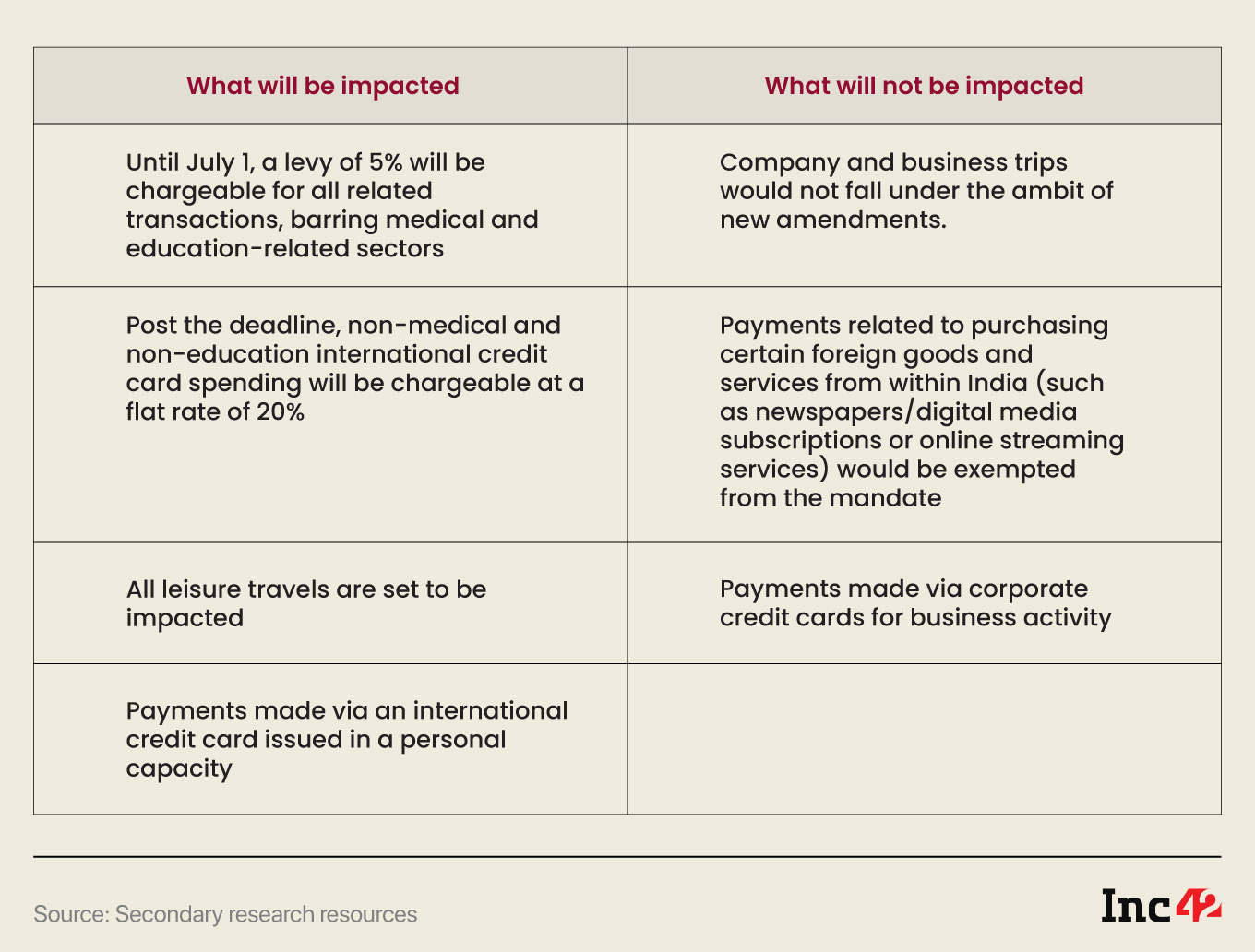

Here is a list of transactions, which will be impacted by the amendments and those which will remain unaffected.

Writing for The Indian Express, Aarin Capital Partners’ chairperson TV Mohandas Pai stated that the TCS of 20% on the use of global credit cards for overseas travel is an instance where citizens are put to greater discomfort, higher compliance costs and unnecessary harassment because the I-T department believes that it does not have the tools to find out if taxes are being evaded.

At a time when Indian startups are already on their toes following the collapse of the Silicon Valley Bank (SVB) and are troubled by the return of the angel tax, the latest move by the finance ministry has raised further concerns.

Lack Of Clarity A Major Challenge

Inc42 talked to a number of startups to understand the impact of the amendments on them. Most of them believe that the 20% TCS on credit card spend will have a short-term impact, as the TCS can be adjusted while filing annual tax returns. However, a lack of clarity was highlighted as the major issue.

Explaining the new rules, The Souled Store’s CFO Chirag Mavani said it will result in blocking of an additional 20% credit card limit over and above the currency conversion charges paid for the transaction.

This will affect the startup founders who use their personal credit cards for company-related purchases.

A fintech founder, who didn’t want to be named, told Inc42, “While for mid and large-size companies, corporate credit cards were always an option, for small companies, founders have been using their personal credit cards only for international purchases. This move will be quite heavy on the pocket of such founders.”

Although the RBI notification said that business travel would be exempted from the new amendments, there are many grey areas that need to be addressed.

BookMyForex founder Sudarshan Motwani said that banks cannot verify the purpose of each transaction and may straightaway deduct TCS if the payment has been made in personal capacity or the corporate credit card does not categorise it as ‘business’.

“For any bank or credit card issuer, it is not possible to keep tabs on the end use of the card and levy taxes as per transaction. A student taking a forex card for education is barred from TCS but what if he purchases a refrigerator for personal use with the card? Everything then boils down to the purpose for which the credit card is being issued and rules will be applicable accordingly,” he added.

SaaS platform LogiNext’s cofounder and CEO Dhruvil Sanghvi told Inc42 that this might be an attempt by the government to bring international credit card spendings under the ambit of GST.

The Next Steps For Fintech

The move seems to have sent alarm bells ringing for the homegrown fintech and investech startups. While the increased cost of travel could dissuade users from travelling abroad, fintech and investech startups could be staring at much bigger problems.

Here are some key factors they may have to take into consideration:

- Software revamp: The fintech startups offering such cards or services will have to add an additional feature to charge these cards for the 20% TCS while remitting the payment abroad, explained fintech startup PhiCommerce founder Jose Thattil.

- Terms & Conditions revamp: Although more clarity is awaited, if we agree to Sudarshan’s theory, then, in the near future, we can see a change in the arrangement that an individual or a company might have with the bank or issuer of the credit card ascertaining the purpose beforehand.

- Surge in corporate cards issuance: We may see banks issuing more corporate cards even to small-size startups, with an addition of collateral advance as the condition to issue the card.

- Preference to other modes of payments: To avoid hassle, startups may prefer other instruments of payments. For instance, D2C grooming startups for men Bombay Shaving Company’s founder Deepak Gupta shared that there will be a negligible impact on the company’s operation as most international payments are routed through bank invoices.

Although bank invoices and debit cards are an option, credit cards enable flexibility to make quick purchase decisions, avoid fraudulent transactions, and keep cash flows smooth.

“In the long run, this will certainly make cross-border ambitions of Indian startups expensive,” MapMyGenome founder Anu Acharya said.

The biggest casualty of the amendments seems to be investech startups, which could see a drop in volumes as customers looking to invest in US-based stocks could face higher TCS. There also seems to be no clarity on whether such TCS rates would also apply to transactions involving international stocks, where users have to convert INR to foreign currencies.

Bigger ticket sizes could easily drag these retail investors under the ambit of the new tax rules while smaller ticket sizes would not allow them to pare enough gains.

Consequently, a slew of homegrown fintech startups such as INDMoney, Vested Finance, and Stockal reportedly met government officials to address grievances arising out of the new amendments. In their plea to the Centre, the startups said foreign equity investments should be exempted from the new TCS regime or the mandate should be restricted only to HNIs.

Amid a hue and cry from industry stakeholders and the general public alike, the Centre on Friday (May 19) said that the 20% TCS mandate for overseas credit and debit card spending would only be applicable on payments above INR 7 Lakh per financial year.

In essence, any payments by an individual using such instruments up to a threshold of INR 7 Lakh would automatically be excluded from the LRS limits and will not be subject to TCS.

Startups applauded the announcement and termed it a step in the right direction. Phi Commerce’s cofounder and CEO Jose Thattil told Inc42 that the step is welcome and would lessen the burden on the startup ecosystem.

Another cofounder, however, added that while the INR 7 Lakh LRS limit would be beneficial for most startups, it could turn out to be a major hurdle for companies looking to set up base or offices abroad.

He also added that the limit of INR 7 Lakh is too low for startups looking to file for patents, invest in manufacturing abroad and setting up cross-border systems.

Can The Users Understand the Government’s Pain Point?

On what drove the decision to introduce 20% TCS, finance minister Nirmala Sitharaman recently said that such payments were escaping the tax net and had to be captured.

“It has been represented that payments for foreign tours through a credit card are not being captured under the Liberalised Remittance Scheme (LRS), and such payments escape tax collection at source (TCS),” Sitharaman said earlier this week.

The key reasons for bringing international credit cards under LRS are:

- To create parity with debit cards as the latter is already covered under the remittance scheme.

- Cases are being reported where certain individuals had misused the exemptions and issued cards above the LRS limit of $250K.

While the finance ministry and the RBI have their own set of reasons to enforce such norms, the move has not gone down well with a section of the population. As the news spread, a commotion broke out on Twitter as people lashed out at the announcement. Many termed the new amendments ‘tax terrorism’ while others called it a ‘speed breaker mindset’ that was designed to make everyone ‘suffer’.

“And 20% is too high…. It is clearly a provision that needs a rethink. The proposal to introduce it needs to be dropped. Overseas payments can’t go unnoticed. Agreed. But please don’t throw the baby with the bathwater,” said Tax Compaas’ founder and CEO Ajay Rotti.

A Twitter user said, “Tax terrorism from this govt, that’s all this new 20% TCS rule is. Pay when you buy, pay when you sell, pay to use highways, pay cops, pay fines, run from pillar to post for compliance. After all of this, get treated like a common criminal. Getting more and more tired of this.”

On the government’s concerns, users retorted that banks regularly reported all credit card forex payments to the RBI, adding that international credit cards were anyways not issued to non-tax paying individuals. The citizens also flagged concerns that the TCS on such spending would hold up cash flow and would be a ‘big hassle’ to keep track of.

As of now, Indian startups are awaiting more detailed guidelines from the RBI in this respect.

Ad-lite browsing experience

Ad-lite browsing experience