Lockdown 2.0 impact on digital lenders to be milder than what was witnessed in 2020

New business acquisition to be impacted by 30-40% in May due to lockdowns across states

Recovery rates likely to fall lower than 94% as the pandemic continues to infect large number of people

With most Indian states back to lockdown-like restrictions due to the disastrous Covid second wave, the digital lending ecosystem is up for another speed bump on the road to recovery from 2020 lockdowns. As of 15th May, India reported 3.26 Lakh fresh Covid-19 cases, taking the case tally to over 2.43 Cr. With 3,890 deaths in the last 24 hours, India’s death toll stands at 2.66 Lakh now with over 20 states under lockdown like restrictions.

The first impact in the lending ecosystem due to lockdown is always on the recovery cycle. With over $2.4 Bn invested in Indian lending tech startups between 2014 and Q3 2020, digital lending has been a frontrunner in the Indian fintech ecosystem.

India is home to approximately 1,263 digital lending startups, out of which over 147 (12% of the total 1,263) are backed by venture capital funding, according to Inc42 Plus analysis. With venture capital inflow in B2B lending startups growing at a CAGR (2015-2019) of 72%, it remains the most favoured sub-segment within the lending tech segment. But the lending sector is among the first to take a hit when lockdowns strike.

According to a report by Redseer, loan disbursals for all the key players had taken a hit by almost 90% on value post between March-April 2020 in the immediate aftermath of the lockdown, with MSMEs being the worst impacted borrowers. According to industry stakeholders and experts that Inc42 spoke to, the nature of the impact will be similar during the second wave, although it is expected to be milder given the staggering nature of lockdown so far.

Credit Demand Likely To Wane On Short Term

“Based on our preliminary observations, the demand for credit will see a reduction for a small duration, especially in the manufacturing sector due to reduction in the production output. The retail consumers also have reduced their spending owing to the uncertain times, and hence the credit demand is expected to be less from their side as well,” said Rishabh Goel, CEO and cofounder at Credgenics, a lending SaaS platform.

Goel also noted that as demand for better health services and medicines increase, more consumers will be seen going towards insurers and personal loans. Hence, healthcare will be the only sector expected to report growth in credit demand.

According to fintech analysts, the impact across kirana and small essential local retailers is likely to be lesser simply because their movement has not been impacted this time if they can manage deliveries. With digital transactions gaining steam over the past year, essential product and service retailers are on a safer footing this time. On the other hand, beyond essential services manufacturing small and medium businesses (SMEs) are likely to have a harder time. This is largely because digitising their workflow and payments requires a larger turnaround time. Given that they had barely recovered from the first wave, SME lenders will see higher requirements for credit as well as increased number of defaults compared to other borrower segments.

The lockdown has also taken a toll on loan approval rates across digital lenders as companies move to prevent massive defaults. A fintech analyst who did not wish to be quoted also pointed out that fintech startups are likely to be hit operationally as well during the second wave due to the virulent nature of the current wave.

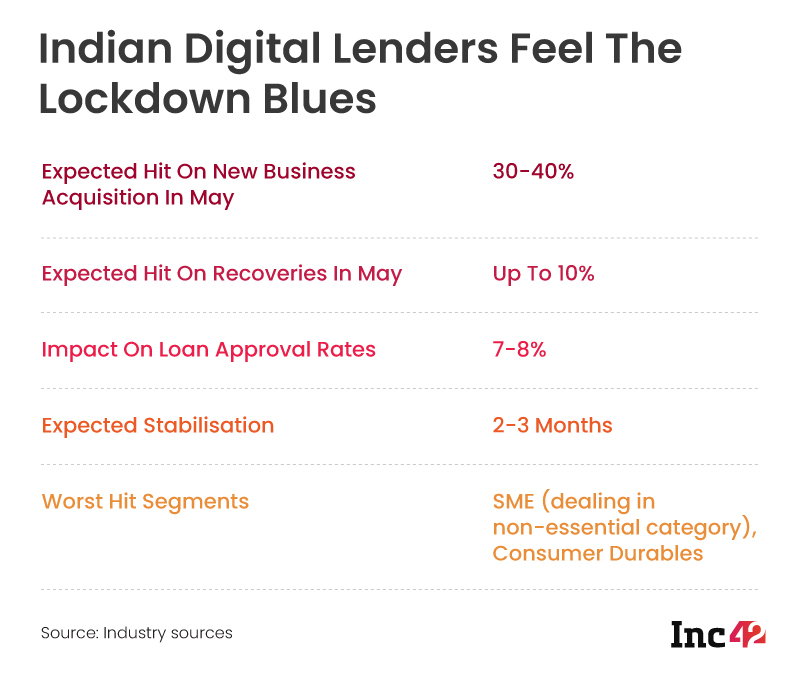

“We see large states that are announcing full state lockdowns to have an impact on the approvals process. The new business will be down by 30-40%. However, the enquiries volume may not see a large dip and post lockdown, the pent up demand will result in a high approval volume,” said Krishnan Vishwanathan, CEO and founder of Kissht, a consumer fintech company.

Kissht also noted that currently, loan approval rates have dropped by 7-8% since the second wave of lockdowns started. This has happened primarily due to environmental factors and inadequate repayment capabilities during the large lockdown phase.

According to discussions with the Digital Lenders Association of India (DLAI), though all types of loans may get affected in some way or the other, for fintech startups, primarily unsecured loans like consumer durable loans, personal loans will also get impacted. Since, these loans help customers fulfill their discretionary spend plans.

To add to the dilemma, states and businesses alike are still confused about what constitutes “essential” items, say analysts. This in turn has an impact on credit demand for the purchase of such goods. International Data Corporation (IDC) in its latest report has also noted that smartphone sales will be impacted by the second wave. Manufacturers like ASUS, Realme, POCO, Vivo, and Micromax have already postponed new product launch plans.

Overall, the fintech industry noted that new business opportunities will suffer as the population continues to reel under the stress of this second wave. To add to it, the slow rate of vaccination has not made it easier to forecast new opportunities on the horizon as a lack of vaccination and the growing number of cases will only extend lockdowns in the nation.

Loan Recovery To Stumble

After the impact on recoveries in the lending ecosystem last year, according to an April 2021 report by rating agency Crisil, the all-India average collection efficiency had stabilised to 90-94% in December 2020. This rate was likely to be impacted as the states started going into lockdown in April.

Vishwanathan noted that their recoveries are down by 10% already, as of 14th May. Similarly, Credgenics has also noted a month of decline in the recovery rates as large chunks of the population are facing immense physical and emotional turmoil at present.

According to an SBI research report, with the second wave and associated lockdowns/restrictions, economic disruption is now clearly visible. Even the monthly leading indicators, including GST e-way bills, vehicle sales, fertiliser sales have declined in Apr’21 compared to Mar’21. Can these challenges cause a spike in non-performing assets (NPAs)?

Anuj Kacker, co-founder of fintech platform MoneyTap and Executive Committee Member of DLAI, says that for the financial industry NPAs are expected to rise. “However, the recent RBI announcement of restructure 2.0 may ease the stress for both the customers and the financial organisations,” he added.

Also, as experts are quick to point out, it takes 90 days for assets to be declared NPAs, so it is not possible to gauge the immediate NPA impact at this point.

Can Digital Lenders Save The Day?

Despite the gloomy business forecast climate and massive serious health medical crisis facing the nation, there are some silver linings on the horizon, according to industry watchers. First, at an individual consumer level, digital transactions have taken off in a big way and that is keeping many businesses afloat.

The lending tech industry, which has found credit gaps in the traditional BFSI segment, has come up with numerous products in the last two to three years to cater to the decline in the spending capacity, rise in the millennial population who demand credit access and various other consumer and business-specific credit requirements. The outbreak of Covid-19 accelerated the growth of the buy-now-pay-later (BNPL) products by further impacting financial stability and income continuity, while also forcing consumers to adopt digital platforms. All of these factors have helped the digital lending industry gain confidence that they will bounce back faster from 2021 lockdowns compared to 2020.

It is also important to note that the uncertainties of 2020 created a major digital lending crisis with rogue lenders using the opportunity to prey on gullible borrowers. While regulatory bodies and platform enablers alike have taken note of these issues, the second wave will be critical in helping the ecosystem gauge how far they have managed to clean up the sector.

“The number of new loans issued in the last one year has been low across the industry. New loan analysis now invariably factors in fluctuation of income. Keeping this in mind, we are certain the impact of lockdown 2.0 on business will be significantly less. Most digital lenders are using additional parameters like ‘intent to pay’ to ensure well-deserving customers do not suffer due to drop in credit scores (following economic challenges),” said Kacker of DLAI.

Ad-lite browsing experience

Ad-lite browsing experience