9 are based out of Bengaluru and Delhi/ NCR each while Mumbai has 8 potential unicorns

Of these 10 startups fall into the ecommerce category, 7 in fintech and 4 in consumer services

This is part two of Indian soonicorns list by Inc42

Last week we showcased 15 soonicorns in the Indian startup ecosystem who have the potential to turn unicorn by 2020. This time we bring the second edition of Indian soonicorns, featuring the other 15 of the total 30 potential unicorns.

Of the total 30, 10 Indian soonicorns fall into the ecommerce category, seven in fintech and four in consumer services.

A broad geographical split of these Indian soonicorns reveals that most of these tech startups – around 9 – are based out of Bengaluru and Delhi/ NCR each while Mumbai has eight budding unicorns.

Let’s have a look at the Indian soonicorns!

Order The Report NowCapital Float

Capital Float, the digital lending platform, leverages technology and big data analytics to deliver innovative credit products to businesses and individuals across the country. It has developed partnerships to finance SMEs across various ecosystems such as ecommerce, manufacturing supply chains, retail, travel and hospitality, and digital remittances.

Capital Float has also partnered with over 250 companies to offer finance to consumers availing products and services in segments such as education, vocational training, and others. The company claims to have $186.52 Mn (INR 1,300 Cr) total assets under management with its 125K users.

In October 2018, Capital Float also acquired personal finance management startup Walnut for $30 Mn in a cash-and-stock deal.

Droom

An online marketplace, Droom is a Singapore Holding Company with subsidiaries in India and the United States. It has four marketplace formats i.e. B2C, C2C, C2B and B2B, and three pricing formats – Fixed Price, Best Offer and Auction.

Droom has in-built tech and data science tools to create the entire ecosystem around used automobiles, including OBV (pricing engine), Eco (121 points vehicle inspection), History (200 Mn vehicle history records), Discovery (dozens of pre-buying tools) and Credit (a marketplace for used vehicles’ loans).

The company is currently generating more than $1 Bn in annualised GMV run rate and growing at a rate of 150% Y/Y. Droom has a presence in 735+ cities across India, 275K+ auto dealers, and 44 Mn+ monthly visitors.

Mswipe

Mswipe is a mobile point of sale (mPOS) network provider that enables merchants to undertake plastic card payments through smartphones or ordinary feature phones.

Mswipe’s omni-channel platform offers merchants an easy and efficient way to accept digital payments like UPI, Google Tez, PhonePe, BharatQR, and BHIM, in addition to card payments using its payment terminals, mobile phones, tablets or PCs. It also acquired payment gateway services provider PayU India’s offline business in 2017.

The company raised its last funding round of $31.5 Mn in March 2019 and now looks to expand its services to the organised retail sector with features like inventory management, billing and others, added to card transactions.

It offers four different devices and is currently addressing a large market estimated to reach a CAGR of 55.91% by 2023, according to research firm Statista.

Pepperfry

Online furniture and home products marketplace Pepperfry boasts over 3,000+ merchants and offers last-mile deliveries to 500 cities in India. Studio Pepperfry, a line of concept stores and furniture design studios, was launched in December 2014.

The move incentivised Pepperfry’s customer acquisition by providing the missing ingredient of “touch and feel” to its customers. The startup now has these studios across 16+ cities in India, thereby being able to offer a more omni-channel experience to its customers.

It currently claims to have over 1 Lakh products on the marketplace. In February this year, it also launched the option of creating a Gift Registry on the platform. The company is expected to soon raise a fresh funding round of $100 Mn (INR 703.9 Cr) from its existing investors Goldman Sachs, Norwest Venture Partners and Bertelsmann India Investments to ramp up its game against global furniture retailer Ikea and other players.

It registered a 20% YoY increase in revenues at $41.6 Mn (INR 308.46 Cr) in the fiscal year 2018.

Power2SME

Power2SME aggregates raw material and product demands from SMEs and places bulk orders with suppliers and manufacturers, thereby ensuring competitive prices. The startup achieves its pricing power through the aggregation of demand from a large number of SMEs across the country and by negotiating a better deal for its customers with large suppliers in specific sectors.

Its portfolio addresses challenges in raw material procurement, finance, maintenance, repair and operations needs. Power2SME has more than one lakh SMEs on its platform. The fintech platform of the company — FinanSME.com — connects SMEs with empanelled and the SMEShops.com platform addresses the maintenance, repair, and operating supply needs of SMEs.

Practo

Practo is a healthcare platform that connects patients with healthcare providers around the world. It provides a single platform to help consumers with all their healthcare needs — from finding the right healthcare provider to online doctor consultations, diagnostic tests, managing health records, and even ordering medicines.

On the enterprise side, Practo’s customers include institutions such as Max Healthcare, Manipal, Cloud9, and many others, who use Practo’s software to provide a superior healthcare experience to their patients. Practo is currently present in 15 countries and over 50 cities around the world.

It claims to manage more than 50 Mn appointments on the platform annually and connects patients to over 100,000 healthcare providers.

Rategain

Targeted at travel companies, RateGain sells software to its clients in the hospitality and travel industry around the world to help them streamline their operations and sales. It specifically enables revenue management decision support, rate intelligence, seamless electronic distribution, and brand engagement.

Almost 90% of its customers are based outside India. As of today, it serves more than 12,000 hotel customers and several hundred large enterprises in travel and hospitality. These include big hotel chains, car rental companies, cruise liners, OTAs and big tour operators.

As of now, the company is focussed on acquisitions to grow its global footprints while chasing the unicorn status. It currently works with over 20,000 companies globally, including brands like Taj and Indigo in India

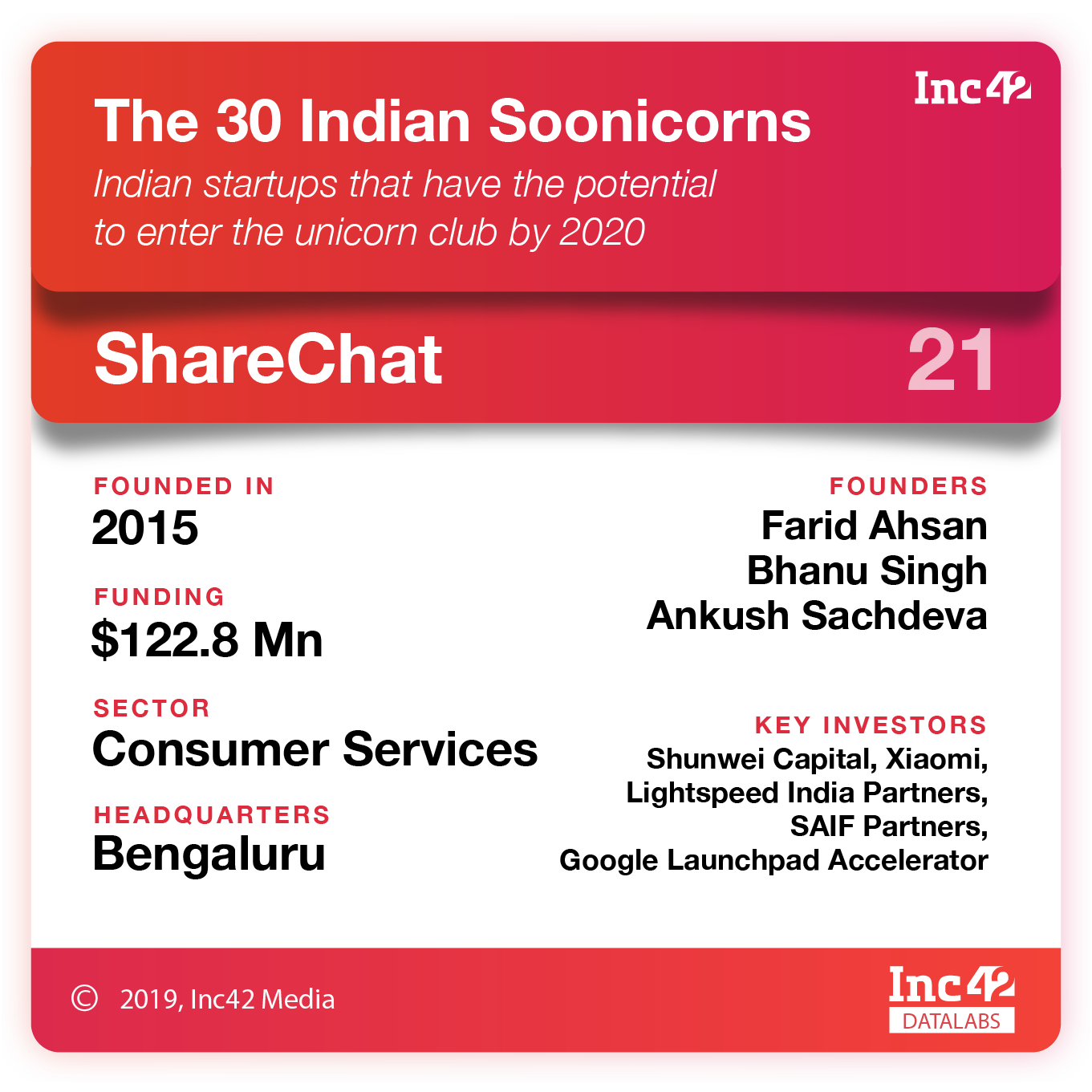

ShareChat

Sharechat was initially launched as a content-sharing tool for WhatsApp with users sharing about 100,000 content pieces every day. The platform gradually evolved into a regional, language-driven social networking platform.

Today, Sharechat enables its users to create, discover, and share content with each other, much like people do on Tumblr and Instagram. It allows users in India to post and communicate in 14 local languages, including Hindi, Tamil, Telugu, Marathi, Odia, Assamese, Bengali, Kannada and Gujarati. It has a monthly active user base of 35 Mn, as of January 2019.

Urban Ladder

Urban Ladder had announced a shift in its business model from online retail to a furniture brand in July 2017. Since then, it claims to have greatly improved its business economics and accelerated its growth. As of January 2019, its omnichannel strategy has increased the average order value (AOV) by 24% along with lowering its customer acquisition costs (CAC) by 43%.

The company is looking to aggressively grow its retail store-front presence by cultivating multiple outlets across 10 major cities of the country. It offers over 3000 products across 35 categories to more than 90 cities in India, with offline stores in Bengaluru and Delhi-NCR.

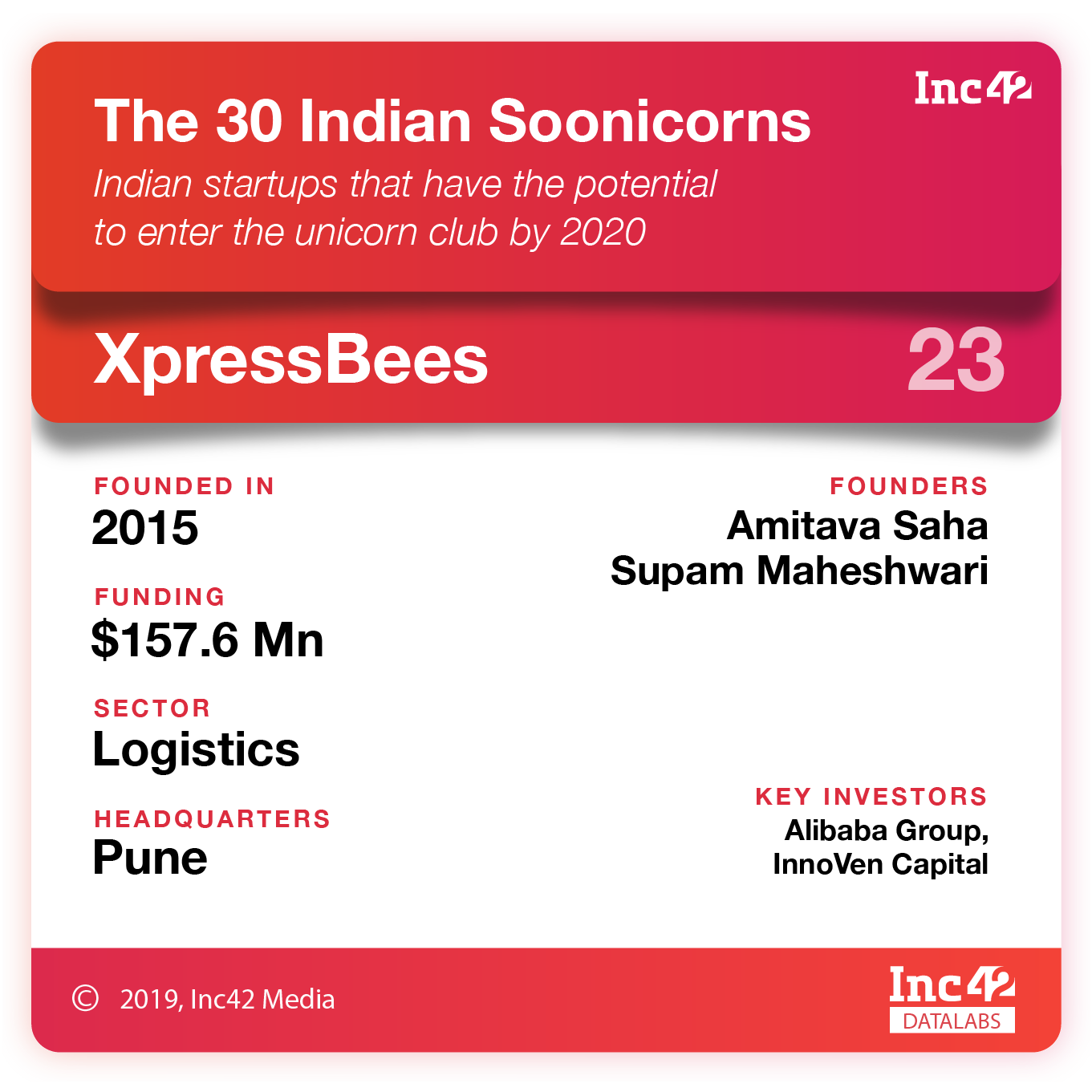

XpressBees

Xpressbees, the ecommerce logistics company, spun out of baby products retailer FirstCry. Owned by Busybees Logistics Solutions, Xpressbees provides services such as last-mile delivery, reverse logistics, payment collection, drop shipping, vendor management, cross-border services, fulfilment services and tailored software solutions.

The startup raised its last funding round of $4.9 Mn in February 2019. Currently, the company claims to have its presence in over 1155 cities and towns serving more than 10K pin codes with 53 hubs and over 1300 service centres across the country. It counts ecommerce giants such as Snapdeal, Paytm and Flipkart as its clients.

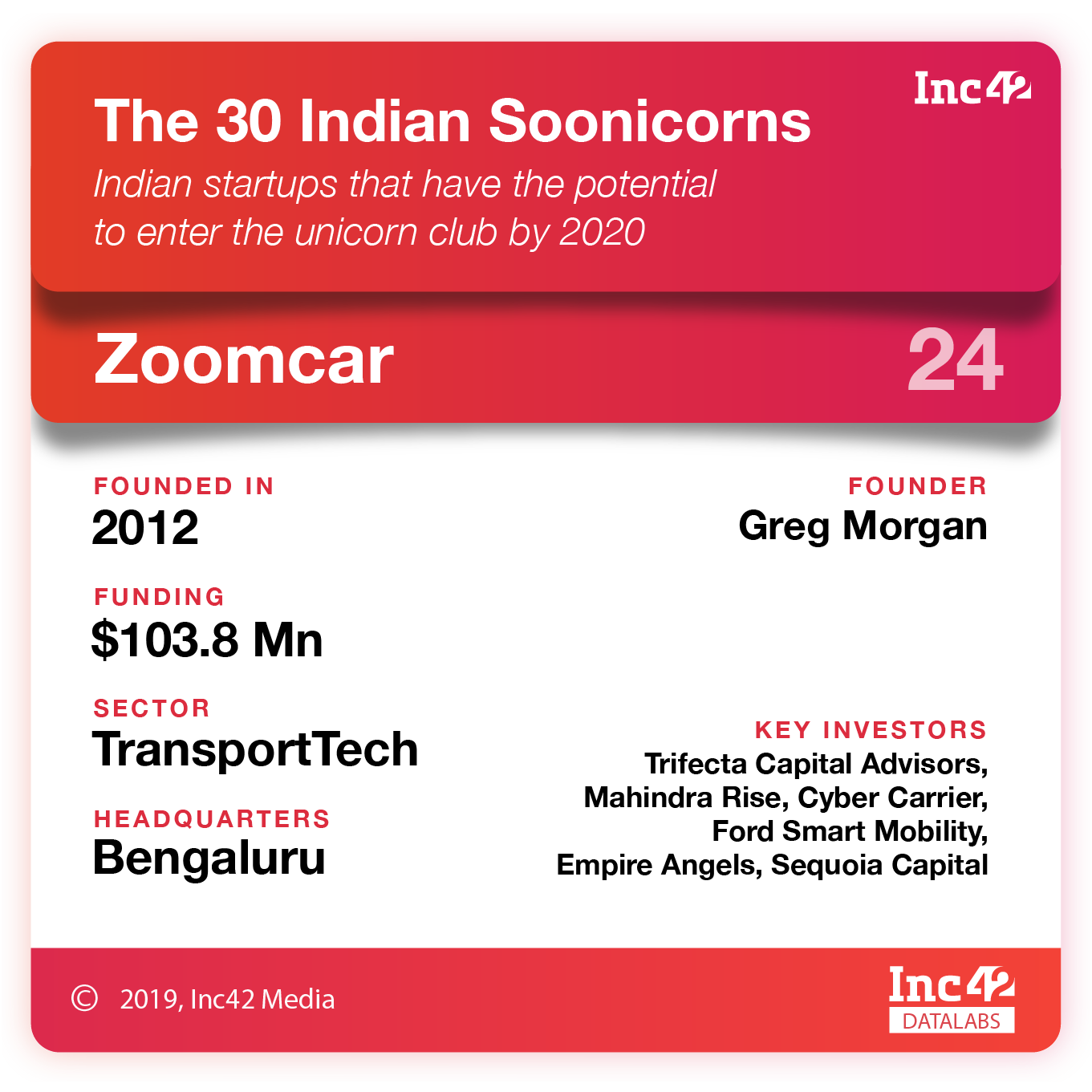

Zoomcar

Zoomcar is a self-drive car rental service that offers a membership-based service that enables individuals to rent vehicles on an hourly, daily, weekly, or monthly basis. The company claims to have a 70% market share with over 7,000 cars, catering to over 2000 rides every day. By the end of 2019, it aims to have 20,000 cars.

In October 2017, Zoomcar launched PEDL, India’s first dockless bike-sharing service. However, the service was discontinued in December 21, 2018.

Zerodha

Zerodha is an Indian financial services company (member of the NSE, BSE, MCX, MCX-SX) that offers brokerage-free equity investments, retail and institutional broking, currencies and commodities trading, and mutual funds. It is known for its discount pricing model and innovative use of technology.

As of 2019, Zerodha is the largest retail brokerage firm in India and commands a 15% market share in volume, registering 2-3 Mn trades daily with nearly 9 lakh active clients. Most recently, Zerodha has launched its learning programme ‘Varsity’ in a separate mobile application format.

Varsity, which was placed in the app store for a limited audience in March, has a 4.7 star rating and has been downloaded 20,000 times so far.

IndiaMart

IndiaMART is an online B2B listing platform that matches buyers and suppliers offering products while enabling SMBs to generate business leads, establish credibility, and promote their businesses. In 2011, IndiaMART introduced a dedicated forum for buyers to post their requirements and a search technology that helps them find the right supplier.

IndiaMART caters to more than 59.81 Mn buyers, 4.72 Mn suppliers, and offers 50.13 Mn product listings. In 2014, the company had launched Tolexo.com, an ecommerce platform for business goods and supplies, whcih boasts of more than 7000 sellers as of June 2018. The company also announced its plans to go public with an IPO of $88.24 Mn (INR 600 Cr) in July 2018.

Nazara

Nazara is a mobile games company offering gaming subscriptions in 61 countries across emerging markets. It offers gaming subscription services in Africa, Middle East, Southeast Asia, Latin America, and the Indian subcontinent.

In India, Nazara has licensed mobile gaming rights to popular IPs such as Chhota Bheem, Royal Challengers Bangalore, Motu Patlu, Mighty Raju, Shikari Shambhu and Suppandi. It has also created games with Virat Kohli and Hrithik Roshan in the recent past.

Nazara has been investing in segments like real money gaming, premium, e-sports and fantasy gaming among others. Nazara has taken a majority stake in Next Wave Multimedia Private Limited and Nodwin Gaming Private Limited in 2017.

Nazara has filed a Draft Red Herring Prospectus (“DRHP”). Prior to the filing of the DRHP, IIFL Special Opportunities Fund and Rakesh Jhunjhunwala had purchased the shares of Nazara. With Electronic Sports League’s (“ESL”) investment in Nazara and Nodwin’s securing exclusive rights of using the ESL system, Nazara is poised to exploit the expected opportunity in the e-sports business.

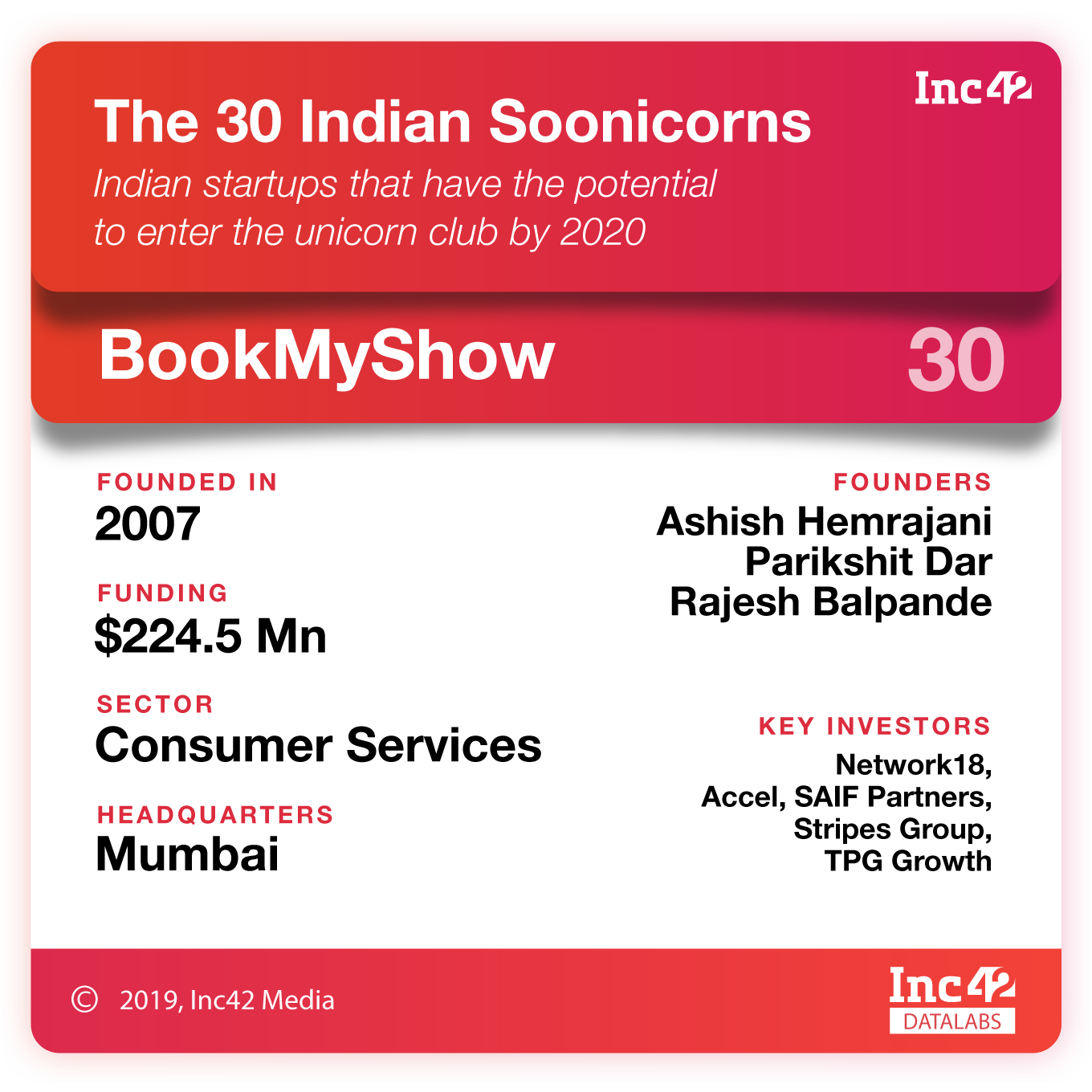

BookMyShow

BookMyShow was founded in Mumbai in 1999 and is currently present in more than 650 towns and cities covering 4,500 screens. The company caters to users in regional languages such as Tamil, Telugu, Hindi, and Kannada, besides the default English language option.

Over the years, the company has evolved from a purely online ticketing platform for movies across 6,000 screens to end-to-end management of live entertainment events including music concerts, live performances, theatricals, sports and more, all accomplished at par with global standards.

It has also expanded its operations to Dubai, Indonesia, Sri Lanka and Singapore amongst others and counts Ticket Green, Eventifier, Fantain, Masti Tickets, Townscript and Burrp amongst its key investments in the sector.

Order The Report NowThe Way Ahead

From a handful of startups in the early ’90s, the Indian startup ecosystem is now strong with 39K tech startups and is growing at a remarkable speed. With more than 10 Indian startups getting labelled as unicorns in 2018 alone, the year 2019 brings hope to beat this milestone. For the record, India already got two Indian startups getting the unicorn status officially — Delhivery and BigBasket.

For long, heavy funding has been a deciding criterion for reaching the desired $1 Bn valuations. But now bootstrapped startups like Zerodha are making their way into the unicorn club without hand-holding from VCs or angel investors.

As Mumbai-based VC firm Nair Ventures quoted in a tweet dated December 2018,

“The tragedy of our system is that out of 26 #Startup #Unicorns in India and of the 30 soonicorns, a third of them have their headquarters outside India; and out of all the investments into these companies, only 10 percent comes from domestic capital.”

We expect that in the coming years, India will get stronger roots to nurture its minicorns and soonicorns with capital raised from the in-house traditional businesses and family funds.

Order The Report Now

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2019/04/Unicorn-07.jpg)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![30 Indian Soonicorns That Have The Potential To Be Unicorns By 2020 [Part 2]-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience