Image Credits

Early stage technology investor, Blume Ventures has marked the final close of its second fund at $60 Mn.

The Mumbai-based firm had initially planned to raise $50 Mn when it was announced in early 2014 but decided to increase the size later. Last December, it announced the first close of $30+ Mn for the fund.

Valley-based ICONIQ Capital – a global multi-family office and merchant bank for a group of influential people including Facebook co-founder Mark Zuckerberg – participated in the first close as lead investor. About one-third of the total money that Blume Ventures has raised has come from domestic investors including IIFL Wealth Management Ltd and the government’s India Aspiration Fund, administered by the Small Industries Development Bank of India (SIDBI). Also, some other domestic family offices and founders of companies have backed it as well.

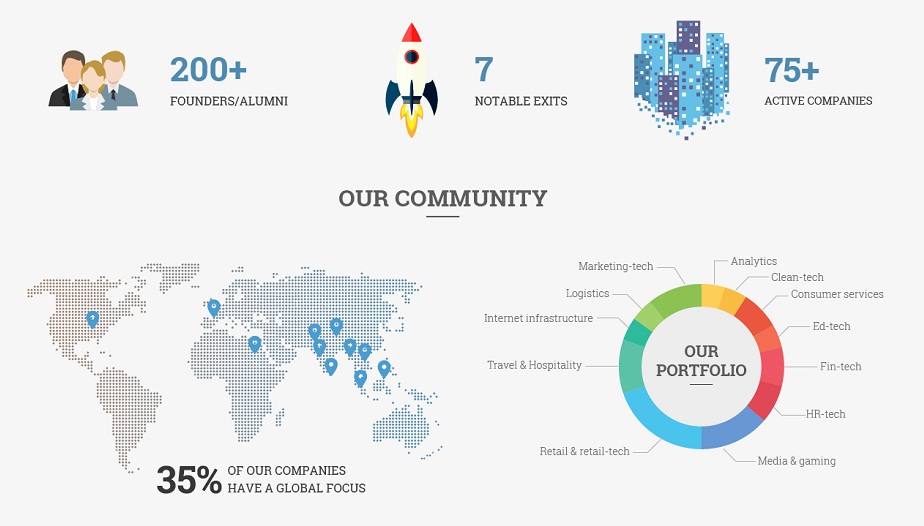

Founded in 2010 by Karthik Reddy and Sanjay Nath, the firm raised around $20 Mn for its debut fund in 2011. The venture funds early-stage seed, startups, pre-series A, series B, and late-stage investments. It has so far funded about 75+ companies.

This year, it has funded chat-based daily tasks management app dunzo, health and fitness app HealthifyMe, loyalty and marketing platform m.paani solutions, Bengaluru-based coworking space BHIVE Workspace, and online platform for free education Unacademy among others. The firm was one of the most active VC firms in India for a couple of months so much so that it had almost exhausted its first fund last year.

Speaking to Inc42, co-founder Sanjay Nath stated, “Our first fund was a pure seed fund and we invested smaller amounts between $100K to $250K. So both the ticket and round sizes were smaller as the first fund was mostly doing seed and angel rounds. But with the newer fund, the round sizes have also increased. So from this fund, we will be investing $500K to $750K.”

Consequently, the fund will be making 40-45 investments and half of the fund has already been deployed in its investments of the past 15 months.

Enabling More Enablers

Speaking about the type of investments the fund is looking to back, Sanjay added that it will be more of a thematic fund. Broadly, 40-50% will be in B2C businesses, while 40% in B2B. But even the B2C investments will be heavily around what Sanjay calls as enablers – examples being Chillr, Slicepay, Unacademy rather than simply marketplaces and verticals. Even in the B2B segment, besides SaaS, the fund will invest in deeptech, coretech and IoT, an example of the same being Tricog.

Taking a deep look at the tech sectors, Sanjay explained that the most common theme in such as fintech, healthtech, is the advent of the mobile-first approach. He explains,“So for instance Chillr, the P2P payments app or Unacademy in edutech, or HealthifyMe in healthtech, all these have been aided by the mobile revolution. So the mobile first approach and everyone bypassing the landline has enabled these sectors to breakthrough in a big way.”

The Next Big Thing: IoT & Fintech

As far as sectors which will see a lot of interest and innovation, Sanjay believes that IoT is one such sector which holds a lot of promise. So while the first fund invested in only GreyOrange in the IoT space, Blume’s second fund would actively invest in that sector – be it in wearables, or embedded firmware, or hardware. Fintech, he believes will be another such sector which will elicit a lot of interest. The firm has invested in many a startups in this space such as Chillr, Slicepay, and Turtlemint.

Speaking about the current funding environment, Sanjay noted that even though there is a bit of “funding slowdown”, what is really interesting is that almost all the funds (be it Accel, Kalaari, Sequoia) have raised funds two to three times of their earlier funds. He adds, “So amidst the funding slowdown, there is definitely a lot of cash. While 2016 was slow compared to the 2014-2015, the investment pace is picking up again. But investors are investing with much more scrutiny. Also, if earlier companies were given a runaway of 12 months, now that time period has become 12 to 18 months.”

Yet there has been one positive outcome of it all.

And that, according to Sanjay, is the better quality of founders coming now with actual startup experience. Earlier, it was copied experience but now many founders are coming out of startups such as Ola, Snapdeal, Flipkart, with actual startup experience. And this trend bodes well for both the investors and the startup ecosystem as a whole.