SUMMARY

Flipkart’s Investor Naspers Stated The Ecommerce Firm Has Seen A Rise In Market Share From A Year Ago

As per a financial report from Flipkart investor Naspers, the ecommerce firm has reported a growth of 43% in gross merchandise value (GMV) for the six months ended 30 September. The half yearly report by Naspers stated that Flipkart has seen a jump in its market share from the year-ago period.

Naspers’ latest growth and market-share numbers on Indian ecommerce are based on Flipkart’s estimates. However Naspers did not disclose Flipkart’s GMV.

As per the report, the Indian ecomerce firm further strengthened its position at the top during the recently-concluded festive season sale. Naspers said, “Flipkart, the group’s equity-accounted investment in India, continued its growth acceleration and further solidified its market leadership. During the recent festive season sales period, Flipkart captured around 70% of the total e-commerce market. Flipkart has also secured substantial capital from investors—including Tencent and SoftBank—to continue building its position as a leading business-to-consumer (B2C) platform in the fast-growing Indian market.”

According to the latest filing from Naspers, the South African conglomerate currently holds a 14% stake in Flipkart.

Flipkart , Amazon And The Growth In Ecommerce

The latest report from Naspers is an indication that India’s largest ecommerce firm is standing its ground against Amazon India after a tough 18 months during wherein it had lost market share. However Amazon India (Amazon Seller Services Pvt Ltd) has repeatedly disputed the claim that it trails behind Flipkart and has stated that its way of calculating gross sales could be different from that used by Flipkart.

In the first two quarters ended 30 June, Amazon has said that its unit sales grew by 85% and 88%, respectively, over the comparable period in 2016.

Meanwhile Naspers stated, “Flipkart increased its share of GMV to 58% (17 June), compared to 45% a year ago. Flipkart.com is the category leader in 12 of 20 focus categories, including mobile phones, TVs, laptops and fashion.”

This strong growth by Flipkart has also resulted in augmenting the value of Naspers’ holdings in the Indian ecommerce space. Naspers said, “Driven by increased scale and strong growth from Flipkart, classifieds and payments, e-commerce revenue growth accelerated to 38% YoY, a significant increase on the 24% reported in the prior year.”

As we reach the last month of this year, both Amazon and Flipkart are standing their ground solidly in the ecommerce space. While Amazon may have lagged behind behind Flipkart in this year’s festive season sales, yet it is nowhere close to settling at second spot. If Flipkart was rejoicing on account of its replenished coffers to the tune of $4 Bn thanks to SoftBank, Tencent, eBay and Microsoft, Amazon India has cut its happiness short. The ecommerce giant has almost doubled its authorized capital to $4.74 Bn (INR 31,000 Cr), matching its earlier capital commitment of $5 Bn made in June last year last month.

Just this week, as per filings with the Registrar of Companies (RoC), Amazon Seller Services posted a 41% increase in earnings to $485.4 Mn (INR 3,128 Cr) during the said period. Meanwhile, not be left behind, Flipkart received a valuation boost from one of its investors, Morgan Stanley, which marked up the valuation of homegrown ecommerce behemoth to $9.36 Bn for the quarter ended September 30, 2017.

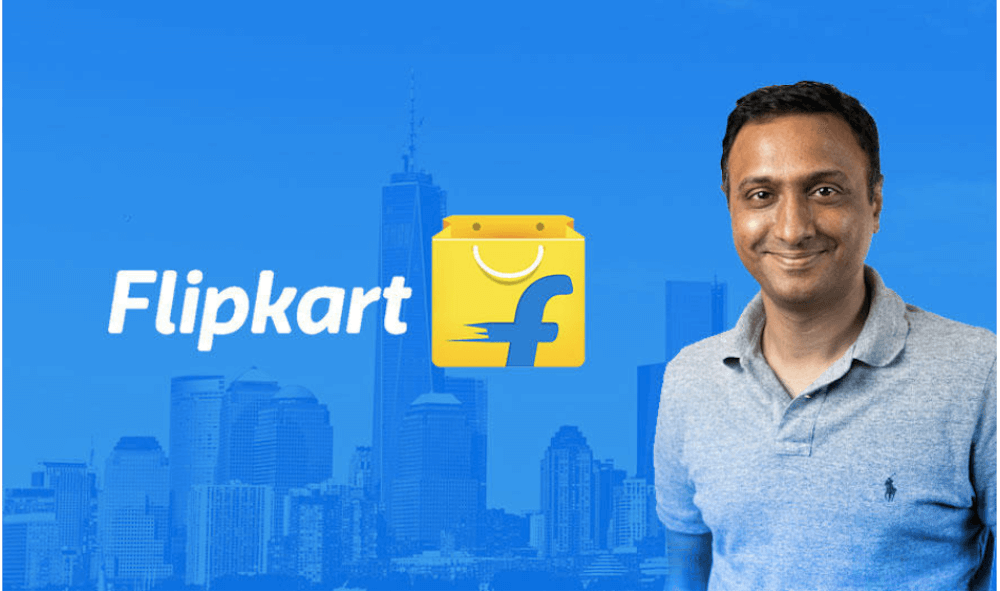

Although Amazon India has been very much successful in making its brand name in the country, it is still facing cut throat competition from Flipkart, which too is riding high on its turnaround engineered by former Tiger Global Management executive Kalyan Krishnamurthy who joined as the new CEO in January this year and its significant growth in market share in the last few years. For the moment it appears that the two giants will have to contend with the fact Indian ecommerce is not going to be a winner-takes-all market, which as per a recent report by Morgan Stanley, is poised to reach $200 Bn by 2026, expanding at a compound annual growth rate of 30%.

[The development was first reported by Livemint]