The fund will target start-ups across early and growth stages with cheque sizes up to INR 150 Cr

With the new fund, Alteria will effectively have over INR 4K Cr available for funding startups across venture debt and structured solutions

Alteria Capital which is currently investing from its Fund I which has a corpus of INR 962 Cr and has backed companies like Rebel Foods, Lendingkart among others

Alteria Capital has announced its plans to raise its second venture debt fund targeting an INR 1K Cr corpus with an additional green-shoe of INR 750 Cr.

Alteria Capital is currently investing from its Fund I which has a corpus of INR 962 Cr and has backed companies like Rebel Foods, Lendingkart, Zestmoney, Dunzo, Portea, Toppr, Spinny, Stanza, Vogo, Melorra, Mfine, Generico, Loadshare, LBB, Maverix, Country Delight, Clover, Happay, Cropin, Cityflo, Onco, Nua, Damensch, Faces Cosmetics and Universal Sportsbiz.

The fund promoted by venture debt veterans Ajay Hattangdi and Vinod Murali will use the capital to back startups that have already raised VC funding and provide them with debt solutions. The fund will target start-ups across early and growth stages with cheque sizes up to INR 150 Cr.

The VC firm said that Alteria Capital Fund II will be the largest pool of alternative debt capital available for early and growth-stage startups in India. With the new fund, Alteria will effectively have over INR 4K Cr available for funding startups across venture debt and structured solutions.

Alteria will retain its position as India’s largest and premium venture debt provider. and has expanded its Partnership team by adding experienced venture debt professionals Ankit Agarwal and Punit Shah. Alteria Capital Fund II is targeting a Rs. 1,000 Cr corpus with an additional green-shoe of Rs. 750 Cr. Alteria will retain its position as India’s largest and premium venture debt provider.

Speaking about how things are now changed for the fund, Vinod Murali, cofounder and managing partner said, “There is a growing appreciation for the venture debt asset class among Indian LPs who have seen strong performance despite Covid-19. This is a dislocated asset class with low correlation to listed stocks or bonds and hence provides a good hedge as part of their asset allocation.”

The company has also expanded its partnership team by adding venture debt professionals Ankit Agarwal and Punit Shah. Hattangdi, cofounder and managing partner said, “Adding two high caliber partners like Ankit and Punit will enable us to collaborate, identify and act more effectively against a rapidly growing market opportunity.”

Why Venture Debt Shone During The Pandemic

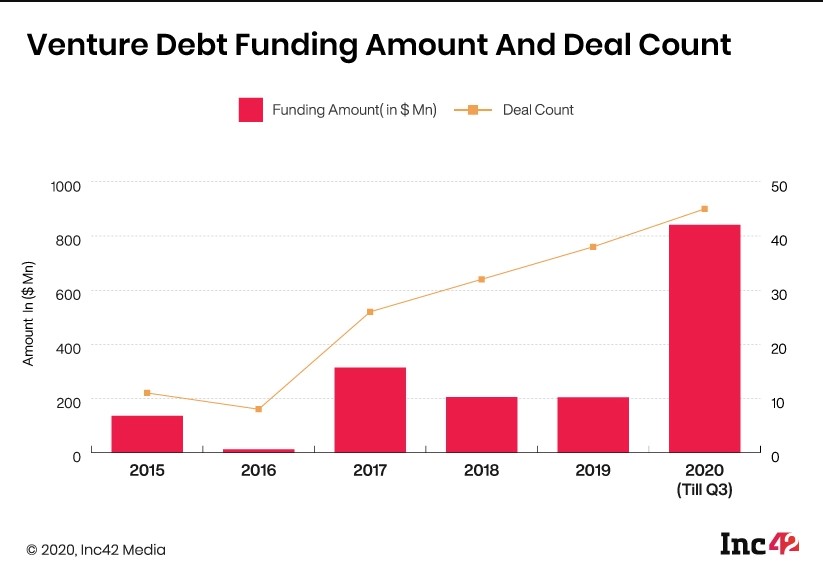

With venture debt deals accounting for $841 Mn in total funding till October this year, the total amount invested is already four times the venture debt funding for all of 2019.

A closer look at the funding data shows that these deals picked up from July as startups spent the first few months of the pandemic firefighting the disruptions caused by the lockdowns such as no-touch and supply chain breakdowns.

As a result, the deal flow in April, May and June was quite sparse but then a trend started to emerge.

Apart from the demand from startups, another key factor that has fuelled the venture debt surge is that many B2C companies have seen growing traction and while operations were hampered, the demand remained high. In a short time, many B2C startups had to rebuild capacity even as available workforce was scarce. This led to increased spending in many directions, even though the Covid-19 impact had dented the revenues of these companies as well.

Ad-lite browsing experience

Ad-lite browsing experience