Bengaluru-based Clover Ventures claims to provide a full-stack agronomy solution to the greenhouse farmers in the network, improving yields and standardising output quality

Backed by Accel, Omnivore, Mayfield and Alteria Capital, the startup has raised a total of $7.5 Mn in funding

With 220+ farmer partners in Bengaluru and Hyderabad, Clover delivers 600-700 orders per day across online as well as offline channels

A visit to KR Market in Bengaluru or Delhi Organic Farmers’ Market at Connaught Place, on a Sunday morning, paints a vivid picture where one gets to see people flocking from all the directions and crowding around the fruits and vegetable sellers, pinching irregularly shaped vegetables, gawking at the green, leafy produce and nibbling on some ready-to-eat natural treats, freshly pulled out a night before.

The farmers from the nearby villages and towns definitely know how to put on a great show. But, what outsiders often miss to notice is the effort and struggles that go into growing the fresh organic produce before it reaches our plates.

The competition is so high that, in reality, only a few make good returns, even as a large number of farmers don’t even make it to the markets or mandis because of the supply chain issue, lower yield, poor quality, fluctuating prices and dying crops. With most farmers in India belonging to small and marginal categories (holding less than 2-acre farmland) their ability to control prices in the market is non-existent.

This is the condition of 80% of farmers in the country. While startups like BigBasket, Grofers, AgroStar and Ninjacart among others, are working towards organising a large part of the supply chain, including logistics, last-mile delivery and ancillary infrastructure, they fall short of addressing the core part of it, which is the origin of produce.

Bengaluru-based Clover Ventures sees an opportunity in this market gap, and it’s standardising demand-supply issue by focusing around demand-led cultivation through a managed farm network and full-stack agronomy.

Founded by Avinash BR, Gururaj Rao, Arvind Murali and Santhosh Narasipura in 2018, Clover Ventures manages a network of greenhouse and small farms that are based in peri-urban and rural areas surrounding the consumption zones, thereby ensuring freshness and reducing spoilage.

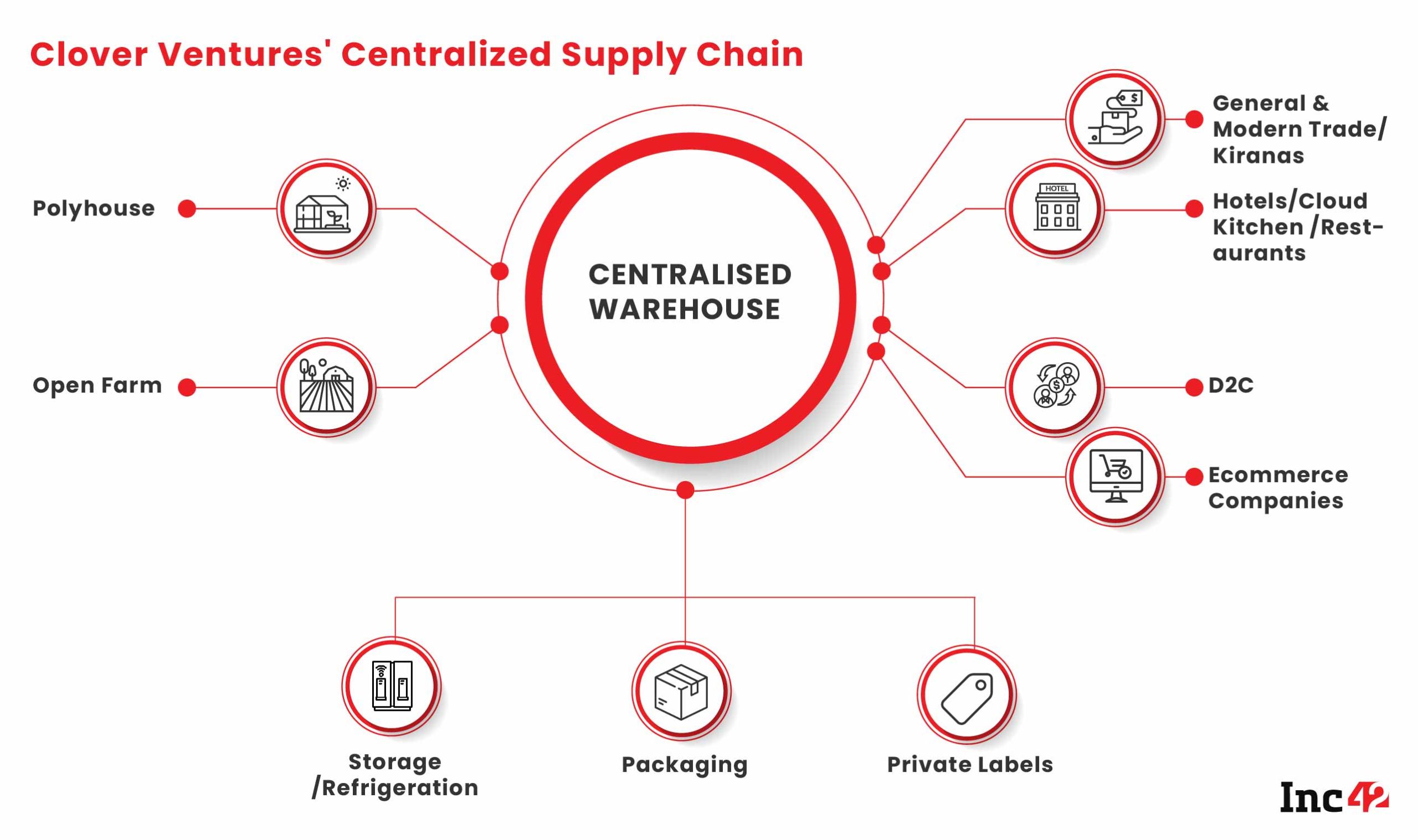

On the supply front, Clover claims to provide a full-stack agronomy solution to farmers in the network, improving yields and standardising output quality on a continuous basis. On the demand side, the produce is packaged and sold through the company’s omnichannel platforms.

Presently, in Bengaluru and Hyderabad, the company has partnered with over 220+ farmers, where 60% are polyhouse/greenhouse farms and the remaining 40% are open farms. However, the company looks to focus on working with more polyhouse farmers in the coming months. The average size of the Clover farm ranges from two to three hectares.

But, the question is how does Clover’s model work?

Before onboarding the farms, the company signs a deal (contract farming) with the farmers, ensuring end-to-end support and assistance throughout the crop cycle, along with managing the supply chain and last-mile delivery.

“Typically, contract farming tends to be a mono-crop agreement between the company and farmers, where it does not care about the latter on what they grow for the remaining year,” claimed Avinash BR, citing examples of potato chips manufacturers. However, in the case of Clover Ventures, the cofounder said that the company uses contracts, but its agreement with farmers is built on the basis of trust and outcomes. The company claimed to be dealing with about 50-60 SKUs.

Improving Margins

Besides helping farmers improve their yields by connecting them with agri- experts and agronomists periodically, the company also offers seed and nursery plants grown at its in-house farms. The company further claims that it procures 100% of the produce grown by its farmer partners to sell it to the customers, thereby eliminating all the hassles that they face at mandis or open markets.

The company said that its advisory service is free of cost as its purpose is to ensure quality output. The organic nursery plants grown in the company’s in-house farms are sold to farmers at affordable rates during the pre-harvesting stages.

Once the fresh vegetables and fruits are procured from the farms, post-harvest, Clover Ventures which follows a centralised supply chain system, transports all the produce to the nearest warehouses for packaging and rebranding of the produce.

Currently, the company runs four warehouses (three in Bengaluru (18,000 sq. ft) and one in Hyderabad (6,000 sq. ft)) with a total size of 24,000 sq. ft., on a rental basis. Typically, the cost of these warehouses could range from anywhere between INR 5 lakh to INR 15 lakh per month.

The company claimed to have reduced wastage of perishables by setting up warehouses at close proximity (100-250 km) near the demand areas, thereby cutting the food losses by 10%. The industry average of wastage in perishables stands at 30-40%, daily.

Backed by Accel, Omnivore, Mayfield and Alteria Capital, Clover Ventures has raised a total of $7.5 Mn in funding across multiple rounds. “As Clover Ventures is deeply integrated with its farmer partners, catering increasingly branded products to customers, the unit economics of the company looks quite strong,” said Mark Kahn, the managing partner at Omnivore, an agri-focused venture capital firm.

According to the company’s financial filings, Clover Ventures in FY19 recorded INR 1.3 Cr in revenue, INR 1.5 Cr in losses while the company’s total expenses stood at INR 2.9 Cr. Around INR 1.4 Cr was spent on stock in trade i.e. procurement of raw fruits and vegetables.

When asked about the latest revenue numbers, the company did not reveal the details, but said that from April to December 2020, the company witnessed 4x growth.

Besides Clover Ventures, other competitors in the space that are working towards bringing farm produce closer to customers, and are betting heavily on emerging farm technology such as hydroponic include UrbanKisaan, Simply Fresh, and Future Farms among others. Hydroponic is the technology that grows plants without soil. Majority of these startups are also developing full-stack solutions for alternate farming in the country, which is somewhat similar to Clover Ventures, and their hydroponic technology claims to reduce the wastage of food and water to a large extent.

“20% of our polyhouse farms use hydroponic technology,” claimed cofounder Avinash BR, “We do believe that hydroponic comes with a lot of structural and theoretical advantages. But, when it comes to adoption in India, there still exists a degree of scepticism among farmers when it comes to RoI.” The cofounder also claimed that Cover’s business model is asset-light as they are tapping into already existing infrastructure (greenhouses), which are in good shape, instead of forcibly convincing farmers to adopt hydroponic farming practices.

Further, he revealed that India has about 40,000 acres of greenhouses. He believes that every year more and more greenhouse farms are being installed, thanks to the subsidy programme run by both the state as well as the central government.

Building A Scalable Model

Omnivore’s Kahn believes that there is a great opportunity for Clover Ventures to further scale its business, both in Bengaluru and Hyderabad. “I am sure that at some point, Clover might start expanding into other cities, including Mumbai, Pune, Delhi NCR and Chennai,” he added, optimistically.

Further, Kahn said that the focus for Clover Ventures would be to build a highly visible and ubiquitous brand in these cities before expanding everywhere. On the demand front, at present Clover caters to about 600 to 700 orders per day across online as well as offline channels.

The cofounder told Inc42 that the company is beginning to see a pattern in terms of customer retention, and looks to have more clarity in the next three to six months. “When everything around farmers is unorganised, we are taking a structured approach to not just deepen the engagement with farmers, but also help them earn a higher income,” he added, claiming that in the last two years, most of Clover’s farmer partners have seen their income grow by 2x to 4x.

While Clover Ventures seem to have created a structured supply chain by integrating the production and retailing of perishables, the real challenge for the company lies in driving the demand for its private-label products in the coming months.

Previously, most of its products were being sold to B2B clients, including cloud kitchen, restaurants, hotels and catering companies among others. In September 2019, the company started reaching out to kirana stores and supermarkets like Nature’s Basket, Star and Spar Hypermarket among others. Currently, the company has 150-180 partners in the offline channel.

The D2C Play

After the pandemic disrupted restaurants, cloud kitchens and hotels, Clover Ventures saw a massive dip in sales with a majority of them cancelling the orders. However, on the bright side, it saw an increase in demand coming in from its B2C business, which led the company to reassess its focus into online distribution channels and subscription-based ecommerce platforms, alongside launching its D2C native website.

The company now is aggressively focusing on D2C and B2B2C business, where it looks to increase its market penetration. “We are not looking to increase our margins,” said Avinash BR, stating that it wants to give the cost benefits to both consumers and farmers, and no stakeholders should win at the cost of the other. “We always try to bring that balance,” he added.

While these words seem to increase the farmers and consumer sentiments, it doesn’t offer an insight into the profitability aspect of the company. When asked about other revenue streams, the cofounder said that it plans to add value-added products like ‘easy to cook’ range of products, along with more variety of fresh-cut produce, at affordable prices, ranging from INR 7 to INR 280 per unit.

In addition to this, the company is also looking to launch a mobile app in the coming months. Currently, it has only launched the D2C native website which is still in its nascent stage, and has a long way to go when compared to other players in the market like Zama Organics, Mera Kisan and others.

Besides its product focus approach, the company does not have any secondary revenue stream plans in the pipeline, which puts a big question mark over the growth prospects and the scale that the company can achieve in near future.

Ad-lite browsing experience

Ad-lite browsing experience