Jaipur-based D2C furniture startup Wooden Street says its customisation approach makes sense in the Indian market where furniture trends differ in each region

Currently growing at 70% YoY, cofounder Lokendra Ranawat said the company is earning close to INR 15-18 Cr in revenue on a monthly basis, with 5% positive EBITDA margins

With a clear focus on online selling in recent months, Wooden Street is looking to expand into international markets, particularly Netherlands and the UK in the next two to three years

The online furniture landscape in India is going through a massive flux after the Covid-19 crisis hindered the growth of many startups operating in the space. From Urban Ladder looking to sell its business to Reliance, to Pepperfry eyeing an IPO and Rentomojo, Furlenco and HomeLane surviving the harsh weather, Jaipur-based customised online furniture startup Wooden Street, on the other hand, claimed to have bounced back quickly compared to all the other heavily funded players in the online furniture landscape.

For instance, Pepperfry’s revenue grew by 47% to INR 206.7 Cr in FY19, while expenses grew 71% to INR 390.2 Cr, alongside the increase in losses at 72% to INR 183.48 Cr in comparison to FY18. Similarly, in FY19, Urban Ladder’s revenue grew 1.87X to INR 434 Cr, compared to the previous financial year, and at the same time, its expenses grew by 64.6%, to INR 382.34 Cr and witnessed profit of INR 52 Cr.

Industry experts believe that most companies in the online furniture business are in bad shape today. “Though they claim to be earning huge revenues, their operational costs and losses are really high,” said Lokendra Ranawat, cofounder at Wooden Street.

Ranawat added that being largely bootstrapped since its inception in July 2015 has helped the startup keep a check on unit economics.

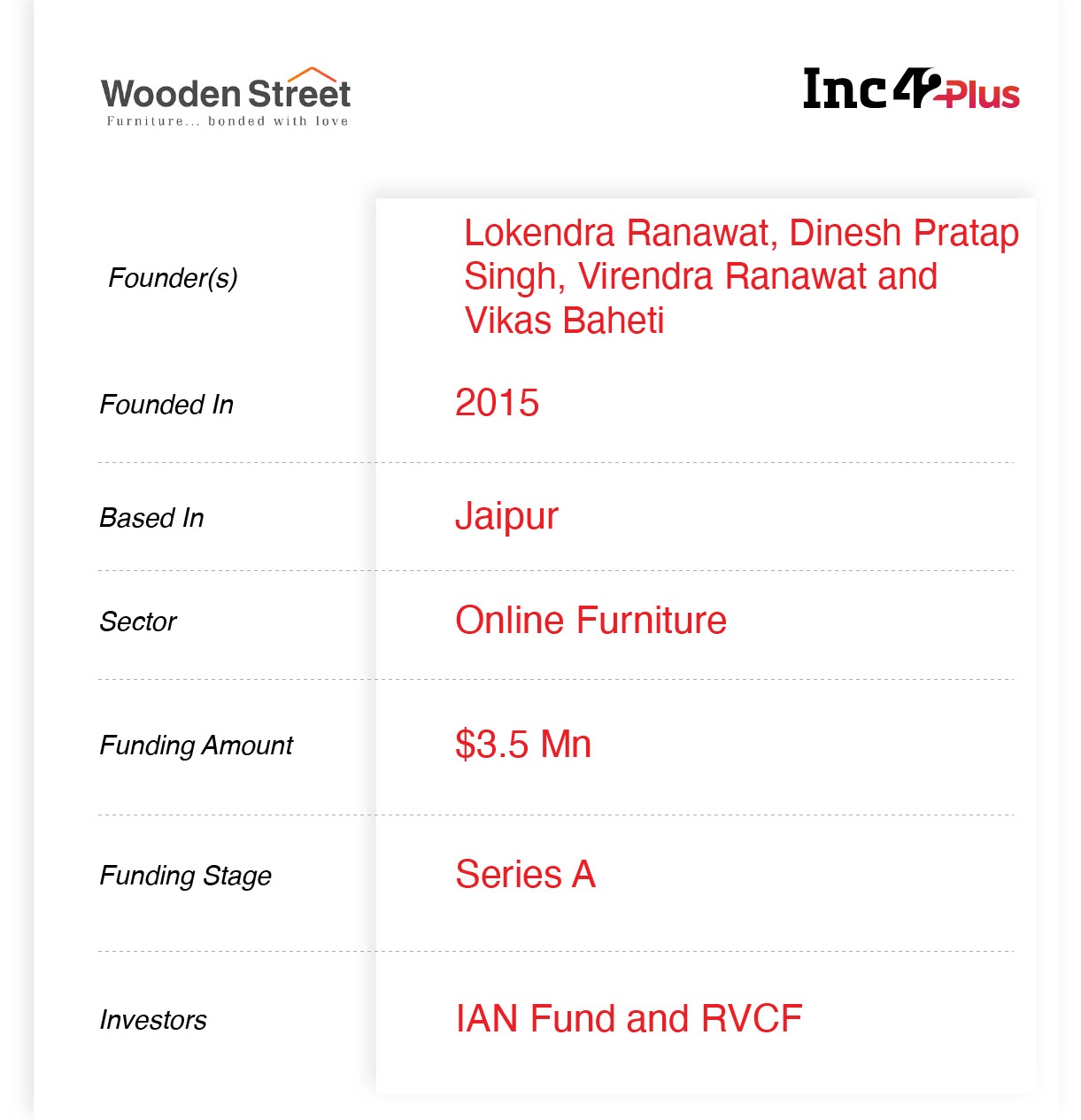

Having raised $3 Mn in funding from Indian Angel Network (IAN) Fund and Rajasthan Venture Capital Funds (RVCF) in June, the startup claims to be on pace to hit revenue of INR 120 Cr this year with 5% positive EBITDA margins, compared to INR 70 Cr annually. However, Inc42 could not independently verify this information. All this thanks to the huge growth in furniture demand from India’s metros and Tier 1 cities.

Currently growing at 70% YoY in terms of revenue, Wooden Street is valued at INR 600 Cr, and competes with online furniture startups like Pepperfry, Urban Ladder, HomeLane, Furlenco, Rentomojo as well as horizontal ecommerce marketplaces like Amazon, Flipkart and newly emerging online D2C brands such as Godrej Interio, Durian, Wakefit, which recently pivoted to online furniture space, and others.

It has to be noted that from March till April due to lockdown, Wooden Street witnessed a massive slump as the majority of its offline stores were shut with zero footfall. But, with work-from-home still being an option for many offices, the company said that it has tripled its sales across various categories. Now, its offline stores are also slowly coming back to normalcy, and Wooden Street aims to cross INR 300 Cr in the next four years.

With the latest funding from IAN fund and RVCF, the company is aggressively planning to expand its business outside India, and plans to set up stores in Netherlands and UK in the next two to three years.

“Pre-Covid, we were doing about INR 8 Cr-10 Cr MoM, but from June onwards, the sales have almost doubled MoM,” Ranawat said, claiming that the company is earning close to INR 15 Cr – 18 Cr in revenue on a monthly basis.

How Wooden Street Dealt With Omnichannel Business

Founded by Lokendra Ranawat, Dinesh Pratap Singh, Virendra Ranawat and Vikas Baheti, the company is known for developing wood furniture products across various categories, which can be customised by the consumer at its 27 experiential stores in India or online.

The founder claimed the startup’s business model is also quite different to other marketplaces and omnichannel retailers as it does not sell any of its portfolio furniture displayed at the store. A large majority of the sales happen on the website, but customers can touch and feel the product in the store and can get it customised as per their requirements, which is then delivered to the customer. The stores act as showrooms for the startup, which is similar to how Pepperfry is positioning its Studio Pepperfry stores.

Omnichannel in its approach till March, the pandemic has turned Wooden Street’s business model on its head. Now, 80% of the revenue comes from direct sales through its native platform, with almost 1 Lakh daily visitors, double since pre-Covid times. But as more stores open up, the business is expected to be split more evenly between online and offline sales.

“There is a very thin line difference between sales coming from online and offline stores unlike other consumer products, because at the end of the day when it comes to furniture, consumers still prefer to visit the stores and assess products, given the larger ticket price on products (beds, dining tables, sofas, etc),” shared Ranawat.

When it comes to furniture, Ranawat claimed consumers always prefer specialised players who can provide them after sales support and more customisation options. He added Wooden Street is the only ecommerce furniture player in the country to make custom furniture designs for customers — while Pepperfry can match the omnichannel presence, it does not offer custom designs. Plus Pepperfry’s marketplace approach means that it does not get the full revenue from the consumer. The closest competition to Wooden Street is Urban Ladder, which has a completely online model with dedicated collections under various brands.

“In India, no single furniture can be a good fit for all the homes,” Ranawat asserted, adding that custom furniture is embedded into the fabric of Indian homes everywhere.

Riding The ‘Vocal For Local’ Wave

Banking on the growing adoption for Made-In-India goods, Wooden Street also claimed that it sources all its raw materials locally, and manufactures the furniture in-house, with delivery centres present in over 100+ cities. In contrast, most other players in the space rely on third-party providers and manufacturers, which makes it difficult to maintain consistent quality and parameters.

Investing heavily in research and development, the company also claimed to experiment a lot with its designs, fabric and woodwork. “Today, a lot of Indians are preferring to buy Indian made products over Chinese products thanks to ‘vocal for local’ initiative, and a lot of sales have been driving our way because of this,” added Ranawat.

Ad-lite browsing experience

Ad-lite browsing experience