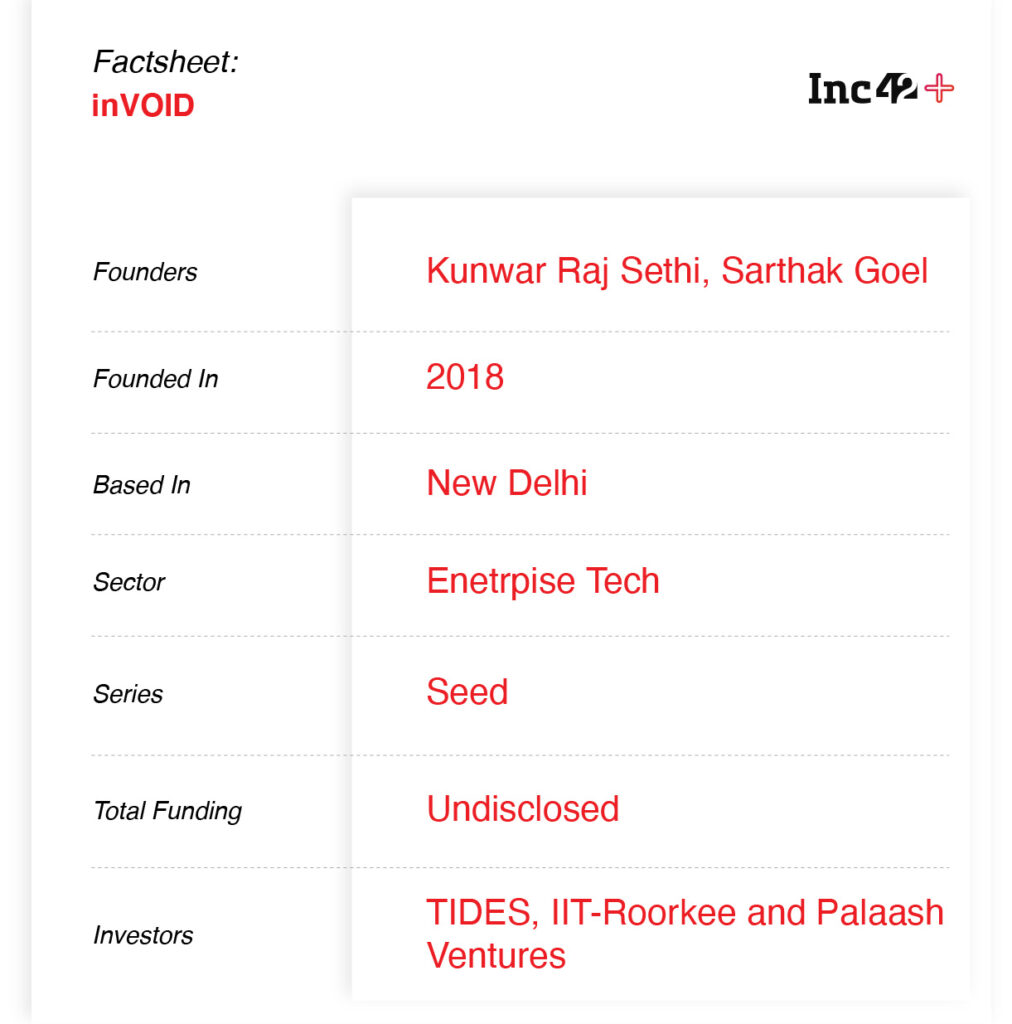

New Delhi based inVOID offers AI-driven SaaS-based eKYC and video-KYC to help businesses streamline and automate customer onboarding and verification

In the last three months, inVOID has witnessed a growth of 250% in terms of revenue due to remote onboarding and RBI’s video-KYC decision

Currently, inVOID competes with startups such as Signzy, Yoti, IDfy, HyperVerge, Helloverify, Syntizen, SignDesk, Veri5Digital and others in the Indian market

With the massive uptick in fintech adoption over the past few years, India is well and truly on its way to a digital banking and cashless payments future. But despite the massive opportunity, one of the hurdles that has slowed down growth is the friction in acquiring users. Not only do companies have to spend to get users transacting and using their platform, but there’s also the question of the know-your-customer (KYC) norms, which have posed a problem for fintech companies so far.

Having to physically conduct KYCs adds to the operational costs of startups and while Aadhaar-based KYC has been allowed in certain cases, there’s still a lot of friction when it comes to verifying users. But Reserve Bank of India’s (RBI) recent decision to allow companies to onboard customers remotely via video calls has made life much easier for startups. Fintech and digital non-banking financial companies (NBFCs) have called for this feature for years as a measure to cut costs in a massive way.

And with Covid-19 in the picture, businesses have no other option but to leverage digital onboarding or KYC tools. Cashing in on the opportunity and the new ruling is Delhi-based digital verification startup inVOID with its sector-agnostic eKYC and video-KYC SaaS tool.

The AI-driven platform claims to verify the authenticity of the documents uploaded by customers using facial recognition tools for video-KYC and automate onboarding. At present, the company conducts more than 15K KYCs on a daily basis, compared to pre-Covid times, where it was doing close to 6K KYCs per day. “We expect the same growth for the next quarter as well,” said Sarthak Goel, cofounder of inVOID.

Since the launch of its product in June 2019, the company has been doubling QoQ. However, in the last three months, it has witnessed a significant growth of 250% in terms of revenue with video-KYC on the rise. Founded by former KPMG and ixigo execs in 2018, the startup works closely with over 50 companies, out of which 30 belongs to the financial sectors, and the remaining in matrimonial, transport aggregation, cryptocurrency exchange, online rental and gaming platforms among other sectors.

Cofounder Kunwar Raj said that in the last three months, alongside scaling the engineering team, inVOID has partnered with companies in gaming and cryptocurrency segments which have witnessed a massive surge in user volumes due to the lockdown and regulatory clarity for cryptos. Some of its clients in the gaming landscape include Pocket52, Ewar Games and others. Besides this, it has clients in the fintech and mobility sectors including Equitas Small Finance Bank, Capri Global, Stashfin, Flexiloans, Pay1 and a few crypto trading platforms.

Since the lifting of a blanket ban on cryptocurrency by the Supreme Court earlier this year, the rise in new users and retail investors have seen a massive surge in the last four months. Also, the trading volume of cryptocurrency in India has spurred by 400% during the nationwide lockdown due to Covid-19 pandemic.

“Obviously, along with the rise in user base, the frauds will also increase,” said Goel.

To prevent frauds, inVOID’s system ensures that users cannot register using the same ID multiple times to avail benefits. Today, a lot of gaming companies have started to offer incentives for first-time signups. In the process, several users misuse the benefits and try to commit signup frauds. Using inVOID’s services allows these businesses to use AI to track user patterns and permits only genuine users. For instance, if a user tries to use already used ID cards or proofs to create a new account, the platform will reject the application.

“In crypto, however, the audience is different, and stringent protocols are followed while onboarding customers at each and every step of the process. But in gaming, we have seen a couple of frauds pop up lately because users try to create fake signups using forged IDs, duplicate documents, etc,” said Goel

Building Solution For The Masses

At present, the company is backed by TIDES, IIT-Roorkee and Palaash Ventures, and has raised an undisclosed amount of seed funding.

Currently, inVOID competes with startups such as Signzy, Yoti, IDfy, HyperVerge, Helloverify, Syntizen, SignDesk, Veri5Digital and others in the Indian market. While many of these have already received early-stage funding, inVOID is banking on its plug-and-play integration solution that it offers to its clients across sectors, including financial, NBFCs, gaming, transport aggregation, rental and shared economy spaces among others. Raj said that in the digital verification landscape its AI models work even on 2G networks and in low bandwidth areas. It claimed that this enables companies to onboard users from the remotest of areas.

Throwing light on the future roadmap ahead of the company, Goel told Inc42 that in the coming months it plans to expand its engineering team, explore strategic partnership opportunities and expand to international markets, particularly in the SouthEast Asian regions, where it plans to explore alternate data sharing and sourcing options to build a seamless onboarding experience for companies.

On the product side, inVOID said that it envisions entering the credit segment where it will be providing users easy access to the credit ecosystem across the country, and also develop a lot of capabilities around forgery detection and checking fraudulent activity.

Since the ban of Chinese apps such as Cam Scanner, alongside 58 other apps, inVOID said that it is working on an alternative to the document scanning app for the B2C segment. Allowing users to scan, save and store important documents, the company is looking to launch the product in the next few months.

“Our goal has always been to bring the best computer vision to the masses and make it more commercial, safe, and make it more sensible in terms of accuracy, authenticity and accessibility. Going forward, we will continue to innovate and bring in some more products into the market,” said Goel.

Ad-lite browsing experience

Ad-lite browsing experience