The OYO-ZO deal, which is yet to be completed, is facing another hurdle from OYO’s early investor Venture Nursery, reported ET.

According to the sources close to the development, VentureNursery is demanding the access to information that large investors typically receive from a company and the right to exit from the combined entity at a predetermined valuation, which is quoted to be $700 Mn.

Venture Nursery is a Mumbai-based angel-backed startup accelerator and also the first investor in OYO rooms.

OYO Rooms has raised about $225.65 Mn till date that also counts the $100 Mn, which recently was reported to be infused by its existing investors including Japan’s Softbank, Sequoia Capital, Lightspeed Venture Partners, Greenoaks Capital, DSG Consumer Partners and Venture Nursery.

The sources also informed that according to the terms of the negotiation, Tiger Global, an investor in ZO Rooms is likely to get the right to information in the merged entity.

ZO Rooms has a total funding of $47 Mn in its kitty and counts Orios Venture Partners, Sol Primero, and Tiger Global Management as its investors.

We have reached out to both the companies (OYO and ZO) and Venture Nursery to get more details. We will update once we receive the responses.

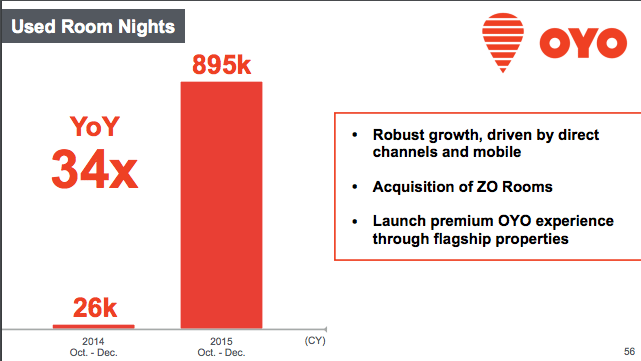

The OYO-ZO deal rumors surface the media in December 2015. While, the two confirmed the development in February this year stating that they are almost through with the deal, and there will be an official announcement soon. Softbank had also made a disclosure in its earning report about the Oyo and Zo deal and had confirmed the acquisition.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Ad-lite browsing experience

Ad-lite browsing experience