Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

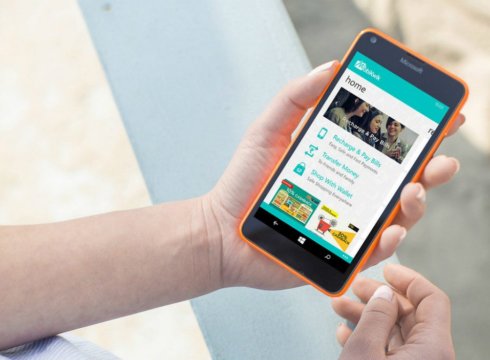

Gurugram-based mobile wallet company MobiKwik has now entered the short-term consumer loan segment. Users can now avail short-term credit loans from its platform. They can also register themselves for EMIs.

MobiKwik claims to be the first wallet company in India to roll out this service. The approval for loan request will be done within thirty minutes and initially a loan upto INR 50K will be available for the users, as per an official statement.

Commenting on the development, Upasana Taku, co-founder, MobiKwik said, “Only 1% of Indians have access to credit. This presents a great opportunity for us and we wish to pioneer the space by being able to provide personal loans to the rest of the population. We are excited to venture into the consumer loan segment as it aligns with our end goal of providing fintech services to all.”

Founded in 2009 by Bipin Preet Singh and Upasana Taku, MobiKwik is a wallet that enables users to pay in a flash for their mobile recharge and bill payments. It claims to connect 35 Mn users with 1 Lakh retailers and has partnered with over 50,000 businesses like Café Coffee Day, PVR, Domino’s Pizza, Pizza Hut, TastyKhana, JustEat, eBay, Jabong, Snapdeal, ShopClues, and HomeShop18 among others.

Earlier in March 2016, MobiKwik, ventured into the hyperlocal space with the launch of its new feature ‘Explore Nearby’. The feature is available on the MobiKwik app and enables discovery of neighbourhood stores, restaurants, cafes, etc. that accept wallet payments. Following that, in August 2016, it announced partial payment for ticket reservations in the bus-booking segment.

It has also partnered with Indian Railway Catering and Tourism Corporation (IRCTC). As a part of the exclusive partnership, MobiKwik will power e-cash payments on IRCTC’s e-catering app, Food on Track.

In December 2015, MobiKwik raised $6.5 Mn (INR 44 Cr.), in a mix of debt and equity funding from existing investors Sequoia Capital and Tree Line Asia. In May 2016, it raised an undisclosed amount of funding led by Japan’s GMO Payment Gateway and MediaTek.

In August 2016, South Africa-based Net1 UEPS Technologies Inc. invested $40 Mn for a subscription agreement with MobiKwik in order to mark its foray in India.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.