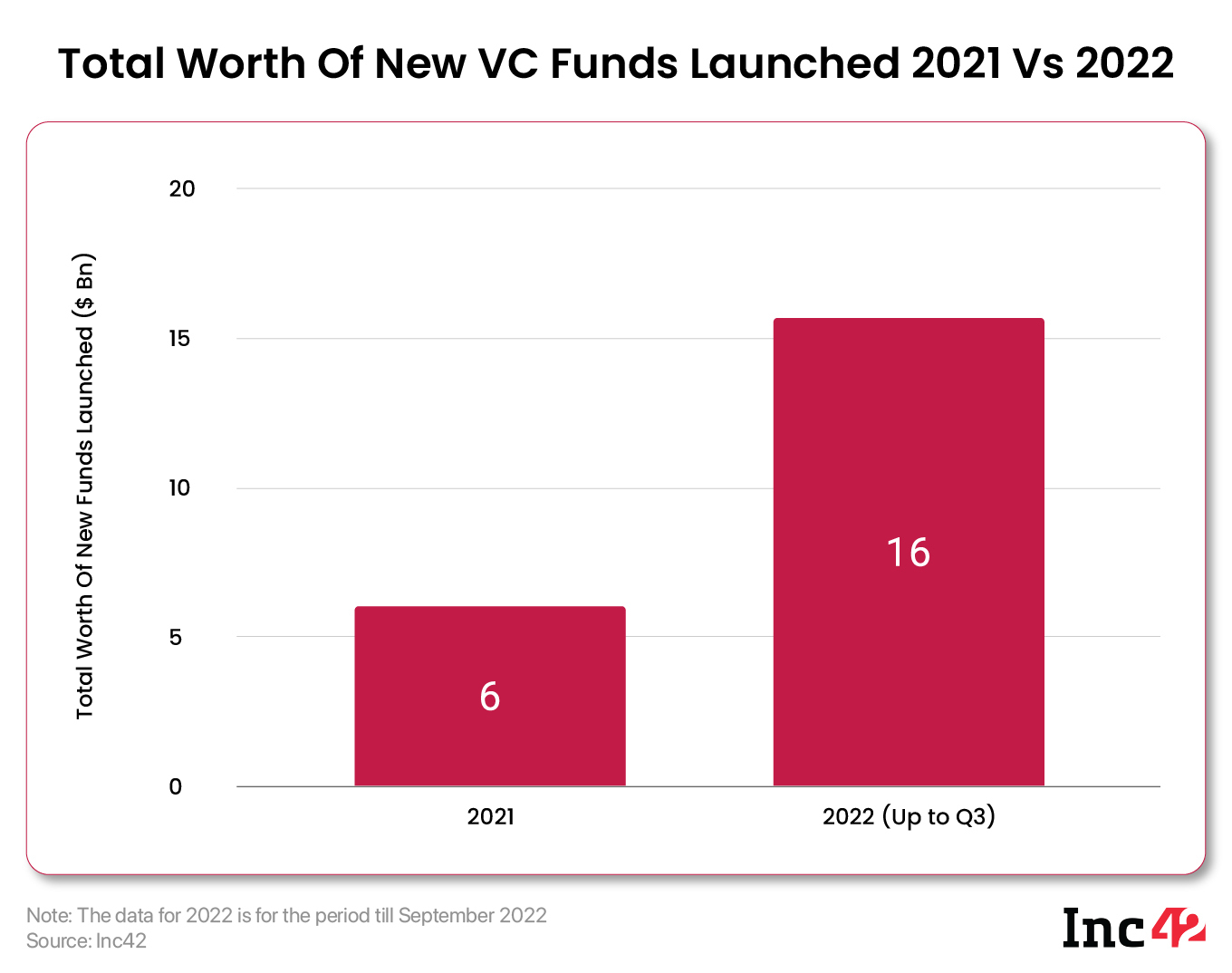

Investors are estimated to be sitting on dry powder worth $16 Bn based on data around new funds launched and raised in 2022

62 new funds launched in 2021 that raised $6 Bn in fresh capital, a big portion of which is yet to be invested

Although, as of now, VCs are making cautious bets, and startup funding has plunged as of September 2022

After a landmark year in 2021 that saw record fundraising and 44 new unicorns, the startup ecosystem in India is now firmly in the grip of a funding winter.

The current state of affairs is gloomy. Startup funding is sliding back to 2020 levels, layoffs continue to pile up, while revenues have dipped and losses deepened. Looming down rounds and deal reversals are becoming the new normal. Worse still, many founders and businesses have become caught up in income tax and other government probes.

The pain points have left stakeholders across the ecosystem in a state of uncertainty and flux.

But there is also some hope. Although the funding winter is expected to last for the next two to three quarters at least, things are expected to start looking up around June 2024.

Investors are estimated to be sitting on dry powder worth $16 Bn based on data around new funds launched and raised in 2022. This will need to be disseminated in the next 12-18 months, according to most estimates. Simply put, dry powder is nothing but the corpus raised by VCs and other investors but not yet disbursed for funding.

Beyond the funds raised by investors this year, one must not forget the 62 new funds launched in 2021 that raised $6 Bn in fresh capital, a big portion of which is yet to be invested.

After a slight setback in 2020 when only $12 Bn was invested in Indian startups as compared to $13 Bn in 2019, Indian startups bounced back in 2021 and amassed $42 Bn in funding.

VCs, HNIs and corporate investors chipped in generously — for some, it was the fear of missing out on an opportunity, while others wrote big cheques to keep portfolio companies afloat and fuel expansion sprees into newer business areas.

But towards the end of FY22, things had already started to look grim for many startups. Given hawkish global fiscal policy measures in the US and India, macroeconomic and geopolitical disruptions as the Russia-Ukraine war, and the consequent rise in inflation, interest rates, there has been a pall over the economy for the past 9-10 months.

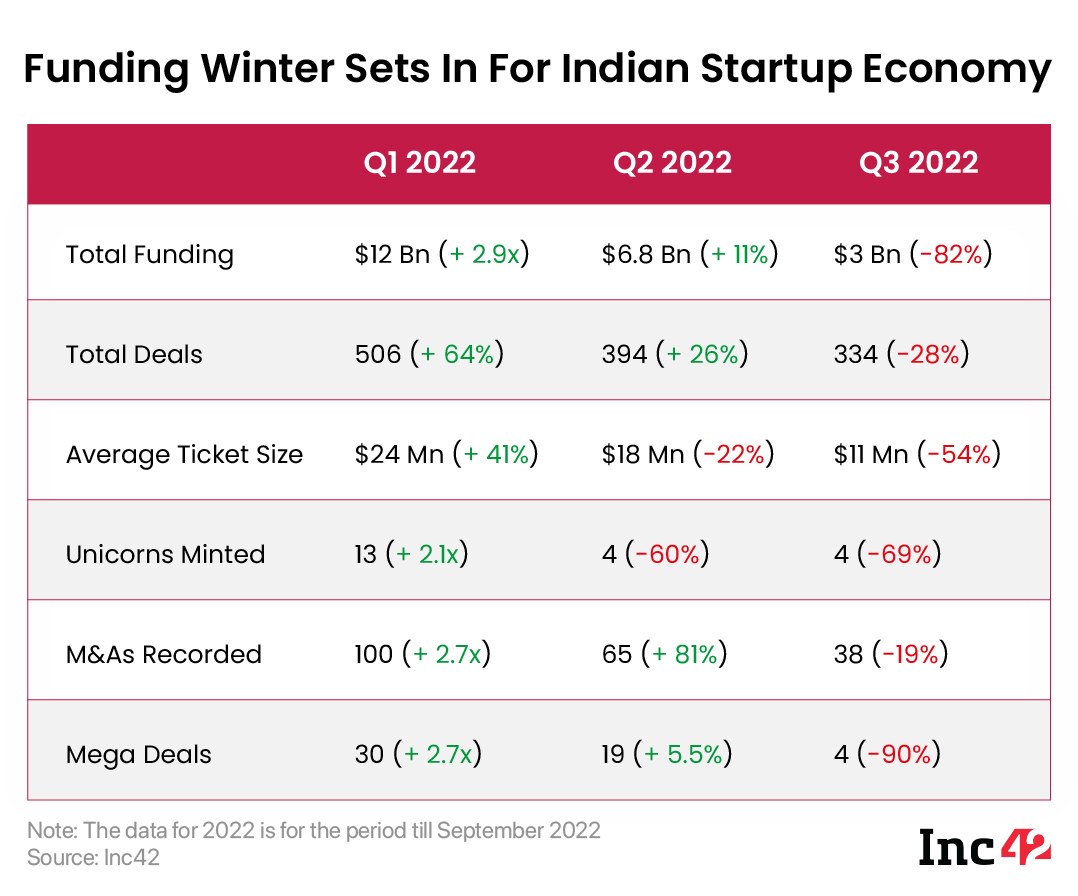

VCs are now making cautious bets, and startup funding has plunged as of September 2022, with only $3 Bn invested in startups in the July-September quarter.

Industry experts tend to explain this as a natural pullback from frenzied funding. But VCs have raised more funding in 2022 for their investment vehicles than in 2021, indicating strong optimism among limited partners and investors.

As on September 24, 2022, 104 new funds have been announced for the Indian market, according to Inc42’s startup funding report for Q3 2022. In the nine months between January and September, the number of funds raised by Indian investor groups is 2.2x higher than in 2021.

It is this fundraising and optimism that is likely to drive the next funding spree that is expected to follow this market corrections phase.

The typical venture capital fundraising journey explains the accumulation of this dry powder in 2022.

It typically takes up to two years for VC firms to raise a new fund — much of the time and effort is spent aligning all investors and LPs to a common set of terms. So many of the new funds announced in 2022 would have been in the process of raising their corpus between 2020 and 2021, when interest in startup investments was at an all-time high thanks to high valuations.

Some of these funds that VCs raised may already have been invested before the full target corpus was achieved. These would be recorded as part of the new fund after its closing. So a lot of the $16 Bn that VCs raised between 2021-2022 may already have been allocated to startups.

“Those who have raised capital in the past few years are under pressure to deploy as VC funds typically make most of the new investments in the first three years. The remaining corpus (50% or more) is kept for follow-on rounds. Hence, you still see a good number of early-stage investments getting announced,” Shyam Menon, cofounder and partner of Bharat Innovation Fund, told Inc42.

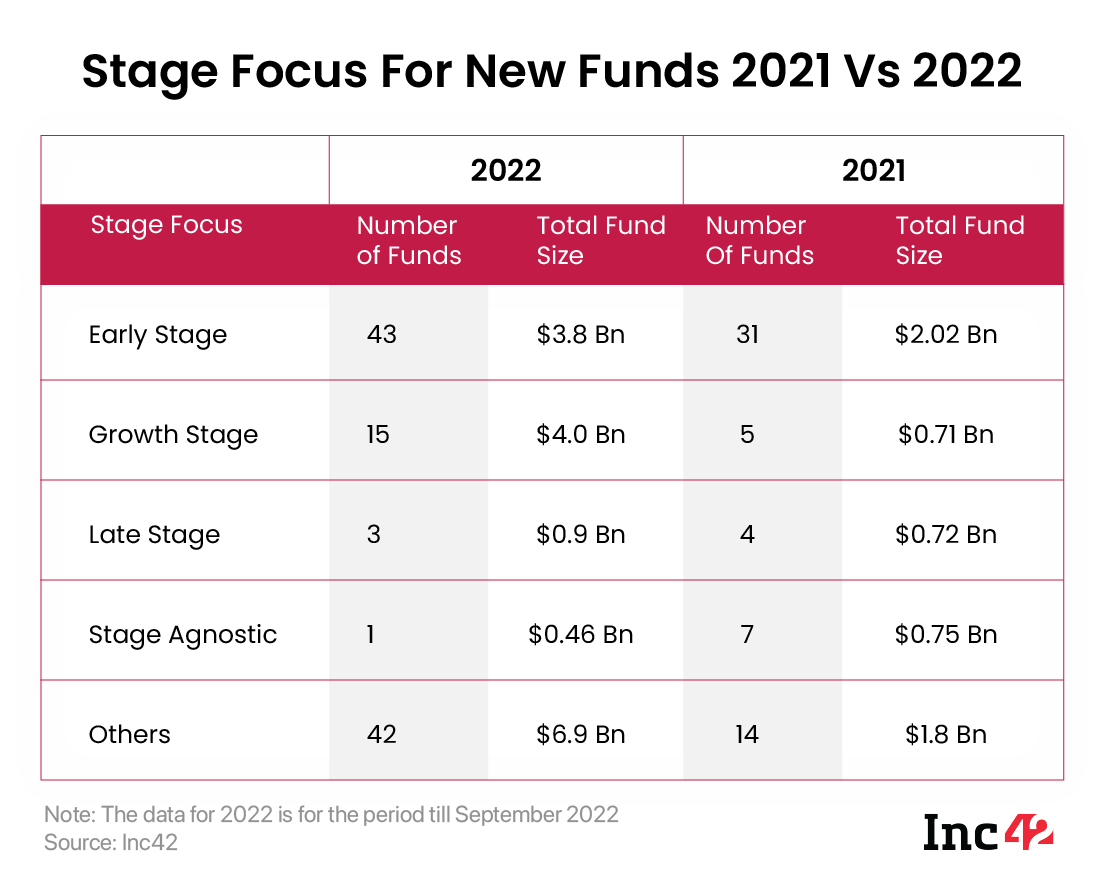

Out of the 104 new funds in 2022, more than 40% (with a corpus of nearly $4 Bn) are inclined towards early-stage startups. In contrast, only 15% of the funds target growth stage startups, while very few late stage focused funds have been launched.

VCs On Caution Street

VC funds constituted more than 64% of the new fund launches this year, with a total corpus worth $12.3 Bn. Although most of these funds were announced between March and July, the startup funding numbers did not line up with this corpus-building.

For instance, from $3.4 Bn in March 2022, the monthly funding fell by more than 67% in July, reaching an abysmal $1.1 Bn.

Most of this went to seed and growth-stage startups, with late-stage funding falling dramatically. And by Q3 2022 (July-September), alarm bells were well and truly ringing loud and clear.

As mentioned earlier, late-stage startups were the worst hit. On a YoY basis, late stage funding dropped by 91%, while the average ticket size for late stage startups was down by 64% in Q3 2022.

After 109 mega deals ($100 Mn or more) in 2021, this year has seen only 53 such deals in the first three quarters.

The drop in late-stage funding came as investors and founders were unable to align on valuation asks. Plus, the trickle down effect of the global macroeconomic bearish climate also created a chill.

A weakening rupee is further hurting their valuations in dollar terms, taking the sheen off many unicorns. The soaring valuations of 2021 are no longer commonplace in 2022.

Life After Funding Winter

According to Bharat Innovation Fund’s Menon, startup funding and investor outlook is expected to improve by next year. Some growth funds that are global in nature are likely to adopt a ‘wait and watch’ approach for the next two quarters at the very least.

Investors are urging their portfolio startups to cut burn rates and ensure clearer and faster paths to profitability in 2022. Sustainable revenue models are back in fashion and the focus is on fundamentals again.

Startup founders are being tested in every possible way given this cold weather. Either fall in line with revenue, unit economics and profitability expectations, or suffer the wrath of valuation slashdowns and working capital crunch.

But market correction can also be good news for late-stage startups whose huge paper valuations have long been questioned. A drop in valuation along with invaluable cash infusion might actually be a good thing as this will reduce the valuation pressure on the business. Consequently, founders could potentially offer better exit returns and multiples to investors in the event of an IPO or capitalisation events.

For instance, after their much-hyped public market debut, unicorns such as Zomato and Paytm were called overvalued. Zomato and Paytm also struggled to justify their respective rich valuations of $12 Bn and $19 Bn after listing. Currently, both companies are trading well below these private valuations.

On the other hand, the comparatively less rich valuation of unicorn Delhivery is something we might see in the future when startups hit the public markets. The logistics tech unicorn listed this year at a $5 Bn valuation and its market cap has remained steady since listing.

Will Dry Powder Fuel M&As?

Another positive outcome for startups currently struggling and looking for a new lease on life could come from consolidation and merger proposals. In 2022, we have recorded 203 mergers and acquisitions, which is just shy of the 210 M&A deals in all of last year.

However, funded startups accounted for less than 50% of acquisitions, indicating that pressure is not from the investors end. But if the M&A trend continues, it will certainly become a more solid exit option for investors and founders even in loss-making startups.

Indeed, we have seen large companies acquire loss-making startups such as in the Zomato-Blinkit and BYJU’S-Whitehat Jr deals. These are yet to pay off for the acquiring companies, but at least they show that the M&A opportunity does exist even for loss-making companies.

Sector-focussed investors are likely to back the winners in their portfolio and write larger cheques for them to enable acquisitions of their other portfolio companies. Besides this, startups with strong unit economics in their core businesses might earn cheques to take the inorganic route for growth, instead of building from scratch, which is typically costlier.

But that is the hope for the future — at the moment, investors are too occupied by distress sales, dissolutions and insolvency (as seen in the case of Lido Learning), operational and executional challenges and regulatory threats to focus on the good times ahead.

Startups and new-age businesses with strong moats and fundamentals will always find takers even in a funding winter. In other words, the dry powder is being saved away for a rainy day when even less certain bets may have a big upside.

Ad-lite browsing experience

Ad-lite browsing experience