Indian Tech Startup Funding Report Q3 2022

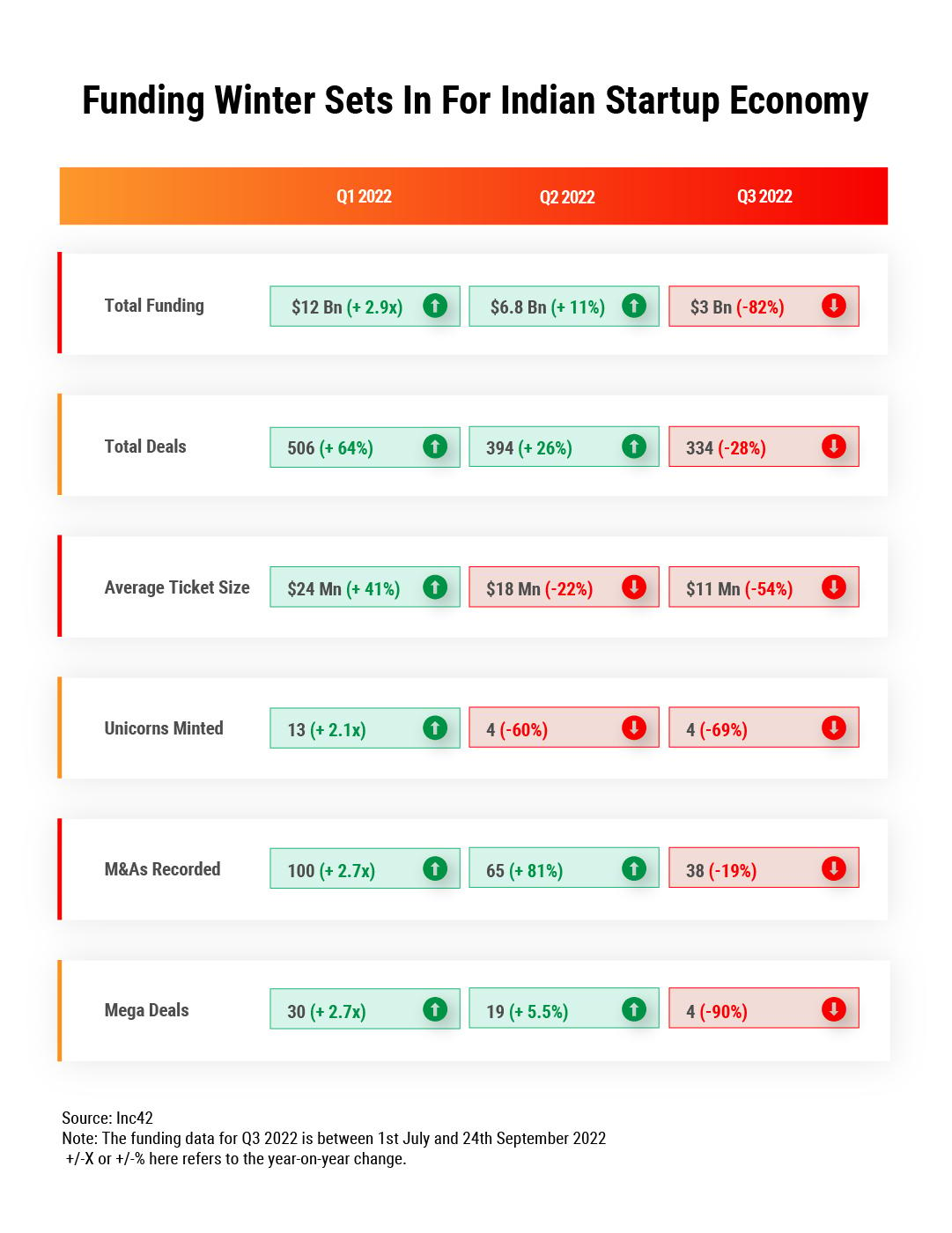

The Indian startup ecosystem has started witnessing a major decline in funding. In Q3 2022, Indian startups recorded an 82% year-on-year decrease in quarterly investments and a 90% decrease in the mega deals ($100 Mn or above), signalling the onset of major funding winter for the startup ecosystem.

Other indicators suggesting the same include — a 91%, 55% fall in late and growth stage funding inflow; and a 69% drop in startups attaining unicorn status.

Other indicators suggesting the same include— a 91% increase in the late stage venture capital inflow from $14 Bn in Q3 2021 to $1.3 Bn in Q3 2022, a 55% decrease in growth stage funding from $2.7 Bn (Q3 2021) to $1.2 Bn in Q3 2022 and 69% drop in new unicorn count from 13 (in Q3 2021) to 4 (Q3 2022).

Quoted & Trusted By

Key Highlights

$3 Bn

raised across 334 funding deals

895

total number of unique investor participation

$11 Mn

average ticket size of startup investments

Ecommerce

top startup sector in Q3 2022