BillDesk roped in large size companies, and government firms as clients, however, the firm failed to find a suitable buyer

The PayU-BillDesk deal would have propelled it as the strongest player in the digital payment ecosystem

The global market downturn, Paytm IPO debacle, and all-cash component of the deal could have blocked the second largest deal in the tech ecosystem, as per experts

India’s fintech ecosystem has been going through a rough patch for a while now — regulatory headwinds, inflation blues, stock market crashes and of course the funding winter. The fintech sector is grappling with some major growth issues owing to unstable revenue models as well. But not BillDesk, the one Indian fintech company which has withstood all these challenges for the past two decades.

Except in 2022, when its future is now looking less certain.

As one of the pioneers of India’s digital payments revolution, BillDesk

has many firsts to its credit, and naturally made for a very attractive acquisition for anyone looking to leverage this experience. So when global payments company PayU, owned by tech investment major Prosus, decided to acquire 20-year-old BillDesk in a $4.7 Bn deal in August 2021, not many questioned the reasoning. But now more than a year later, that deal is dead in the water.

What went wrong for BillDesk or PayU — especially given that the deal had received regulatory approval? It’s largely due to the macro market conditions. Follow along for the answer to the question we are asking in the headline.

PayU-BillDesk Deal: From Massive To Dud

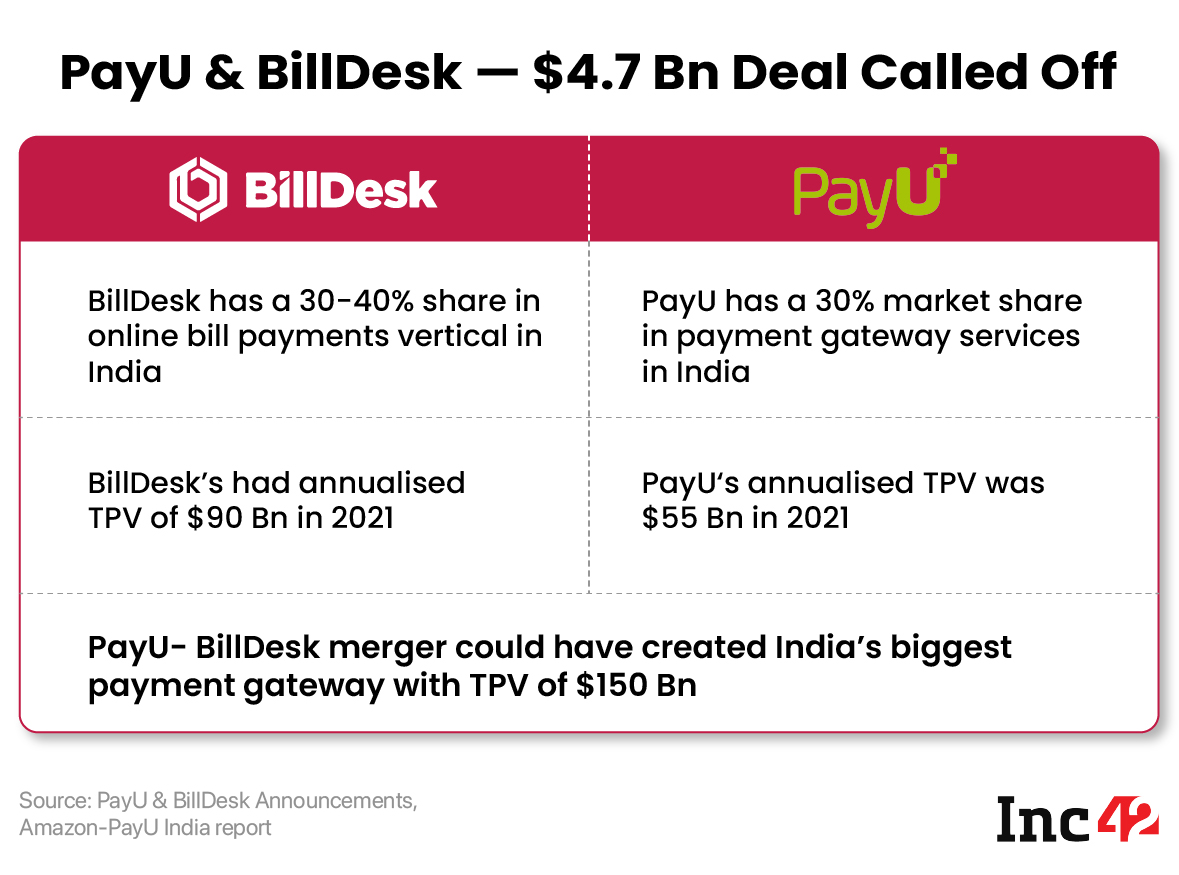

The BillDesk-PayU deal would have been the second largest acquisition deal in India’s startup ecosystem, behind Walmart’s $16 Bn Flipkart acquisition. With BillDesk, PayU would have a great advantage in the Indian market, given the annualised total payments volume of $147 Bn. Moreover, BillDesk had healthy cash flow, and the combined entity would have had a valuation of $12 Bn, according to Prosus’ investor presentation.

“We have a long and deep relationship with India, having supported and partnered with some of its most dynamic entrepreneurs and new tech businesses since 2005. We’ve invested close to US$6 billion in Indian tech to date, and this deal will see that increase to more than US$10 billion,” Bob van Dijk, group CEO of Prosus, had said while announcing the deal last August.

Just last month, the transaction received approval from the Competition Commission of India (CCI). However, this week, 13 months after announcing the deal, Prosus informed stock exchanges that the agreement has been terminated automatically due to the non-fulfilment of certain conditions.

“Closing of the transaction was subject to the fulfillment of various conditions precedent, including approval by the Competition Commission of India (CCI). PayU secured CCI approval on 5 September 2022. However, certain conditions precedent were not fulfilled by the 30 September 2022 long stop date, and the agreement has terminated automatically in accordance with its terms and, accordingly, the proposed transaction will not be implemented,” the filing said.

Prosus wasn’t clear about these conditions, but if the analysts tracking India’s fintech investment ecosystem are to be believed, the deal died because of the prevailing investment sentiments when it comes to large ticket deals in the tech sector. And it has little to do with BillDesk’s own operations.

The ripple effect of Indian fintech major Paytm’s public listing debacle and the all-cash component of the PayU-BillDesk deal could also have been a factor, since such a deal is rare at this transaction size.

BillDesk: In The Right Place, At The Right Time

Founded in 2000 by MN Srinivasu, Karthik Ganapthy and Ajay Kaushal, BillDesk seized the early mover advantage in digital payments by roping in large government contracts and enabling banks to retain customers by allowing digital bill payments solutions through their various touchpoints.

Ram Rastogi, the chairman of the governance council at the Fintech Association for Consumer Empowerment (FACE), believes that every startup that followed BillDesk used it as a benchmark. “You name any bank and BillDesk partnered with it including SBI, HDFC etc. It single-handedly gave a digital facelift to the payments system, when the likes of Razorpay, PhonePe, Paytm etc were not existent. And hence the legacy is strong,” Rastogi added.

According to Sathya Pramod CEO, Kayess Square Consulting , chunk of BillDesk’s business comes from government departments and legacy companies which has helped it create a solid base, and allowed it to gain a majority share in bill payments.

Fintech unicorn Razorpay, claiming an annualised TPV of $60 Bn, comes close, but Rastogi believes that BillDesk always had an edge when it comes to addressing challenges of payment failures and winning clients across large enterprises and government departments.

BillDesk‘s core business model, which revolves around recurring bill payments, is also a well-regulated sector. The Bharat Bill Payment System (BBPS), one of the flagship payment systems run by the NPCI, has also expanded its services. RBI has continuously increased the scope and coverage of BBPS by adding more billers over the years.

Most recently, non-resident Indians (NRIs) have been allowed to opt for recurring bill payments via BBPS, increasing the addressable for payments industry players.

According to data available on Statista, the value of BBPS transactions was worth INR 43,000 Cr, which is estimated to rise up to over INR 4 lakh Cr by 2026.

BillDesk leveraged the growing demand for digital payments over the years and this is well reflected in its financials. According to filings, BillDesk’s operating revenue in FY21 was INR 1,845 Cr, rising from INR 1341 Cr in FY20. The profit after tax (PAT) jumped to INR 270.9 Cr from INR 231.5 Cr in FY20.

Amid a chorus of loss-making fintech companies, BillDesk is a breath of fresh air for investors and is a rare profitable company with strong fundamentals. Plus, it operates in a segment that has a huge and growing addressable market, according to the founder of a fintech startup, who did not wish to be named.

However, the valuation of $4.7 Bn, (INR 3500 Cr), which is 19x BillDesk’s revenues, may have become a concern for Prosus in 2022, considering that markets worldwide, including large tech companies, are undergoing corrections in valuations.

“The point is that the Indian markets are highly sensitive to the US economy and the big ticket investments would usually follow the trends in the US. Hence, expecting large deals to come by at this juncture could be a little challenging. Tech investors like SoftBank, Prosus or the other giants including KKR, General Atlantic would still be bullish on India’s growth story, however massive corrections in valuations as well as large rounds will be difficult to come by at least for next 6-12 months,” Sathya Pramod, CEO, Kayess Square Consulting told us.

Ripple Effects Of Paytm’s IPO Debacle

Besides this, the failure of such a large deal needs to be seen in the context of what is happening in India’s fintech ecosystem. Paytm’s big drop after its public listing is one such event that has shaken the faith of some global investors. Remember, the PayU-BillDesk deal was announced well before Paytm’s much-hyped listing in November last year.

The payments businesses run on very thin margins in India. The catch in any fintech business, especially payments is customer conversion which is a tediously long exercise, says a Bengaluru-based investment banker.

“In the US, on the other hand, the customers are willing to pay for convenience and hence profitability may not be such a distant dream. Paytm’s lackluster listing and inability to explain the path to profitability even after foraying into various financial services has cautioned investors,” he added.

As a result, all fintech business models and profit projections are being closely examined, which means investors have rechalked their strategies in the past 8-9 months.

Furthermore, the revenue jump for BillDesk over the past three fiscal years has been in the range of 20%-30%, although the firm has been able to maintain profitability.

The feeling is that while rivals raised large rounds during the pandemic, BillDesk did not raise funds. Till date, BillDesk has raised $241 Mn from investors such as General Atlantic, Temasek, Visa and others. The last funding round came in 2018 during a corporate round led by Visa, which valued the fintech firm at $1.8 Bn. This round propelled the company to the unicorn club and saw participation from investors such as Temasek, according to the company’s regulatory filings. This was much lower than an expected $250 Mn funding which earlier reports claimed BillDesk was planning to raise.

Given its history, long-term investors in BillDesk and its founders, who hold 30% total equity, could also be looking for a partial or complete exit after two decades. The talks of buyouts with other companies, including Paytm had fallen through before PayU announced the deal.

“Most acquisitions are done in good faith but until the deal is closed, there’s no obligation to remain at the table. Businesses may change their plan of action due to various factors and large mergers especially require an optimal degree of compliance with the conditions of the transaction,” said Ashok Kadsur, cofounder of fintech startup SignDesk.

PayU has also been on an investment spree in India, having acquired CitrusPay in 2016 and investing in ZestMoney, LazyPay, Dotpe and Fisdom.

“These deals were in the size of $50 Mn – $150 Mn and they have strengthened PayU’s business in lending, wealth management, ecommerce verticals. The BillDesk acquisition would have enabled them to consolidate their position and establish dominance, pushing UPI apps, RazorPay behind. But the central bank as well as NPCI are closely monitoring the aggressively growing digital payments market,” an executive in a lending tech startup told Inc42.

As per a report in The CapTable in August, even the BillDesk-PayU deal had to go back and forth as the CCI had questions to both companies related to market dominance and PayU’s other acquisitions in India.

What’s Next For BillDesk?

Despite the acquisition deal fell off, BillDesk does not face any imminent challenge, especially when it still has large clients in its kitty. However, the problems in fundraising last year and given the current funding winter could become a major hurdle in the future. Negotiations with various investors for funding fell through, according to reports.

Pramod says that public markets could, in fact, be more viable for BillDesk in the future as markets come out of volatility. A company like BillDesk that has good margins for consecutive years could be well received by the stock markets.

However, it could be a further long wait for one of the pioneers of India’s fintech space. Can BillDesk overcome its funding challenge and scale up as rapidly as some of the startups it is now competing with?

While it may have enough in its tank thanks to its business history to compete temporarily, a cash infusion is certainly needed, if it has to go toe-to-toe with fintech startups that have not only scaled up rapidly, but also know how to play the evolving marketing and digital selling game in 2022.

Ad-lite browsing experience

Ad-lite browsing experience