UPI has made life easier for merchants and individuals, but has it become a bit of a burden for fintech startups?

It’s October 2023 and UPI is no longer a novel concept. More than seven years after its launch, India’s UPI has become an example for the world, but also something of a necessary burden for fintech startups.

That’s because, despite UPI’s growth, the payments mode has not become a bankable revenue source for fintech companies. Indeed, UPI seems to act as the top funnel, and without it, the actual revenue generating services and products for fintech startups stagnate.

While one cannot deny that it has made life easier for many merchants and individuals, has UPI become a bit of a paradox for fintech startups? We look to answer this question, but after a brief detour into our top stories this week:

- Shark Tank Spotlight: In just two years, Shark Tank India has given birth to the celebrity CEO culture, as more and more high-profile founders join the club

- Where Are The Unicorns? In 2023, we have only seen 17 mega deals (above $100 Mn) compared to 53 such deals last year. Does this explain the unicorn drought?

- Urban Company’s New Gamble: The consumer services unicorn entered the consumer durables space after 10 years as a service company. What explains this transition?

UPI’s Dream Run At What Cost?

There’s little doubt that UPI is the pièce de résistance in the Indian digital payments landscape. In September, 1,056 Cr transactions worth INR 15.8 Lakh Cr were processed by the network, the second straight month of 1,000 Cr+ transactions.

Even as it’s gaining new heights, UPI has also received upgrades from time to time. Just a few weeks ago, NPCI announced updates such as conversational payments, NFC-based offline payments, UPI Tap & Pay and credit line on UPI.

But how much of this growth has come only because UPI remains a relatively low-cost payments mode for merchants and is pretty much free for all individual users.

The zero merchant discount rate (MDR) regime means merchants and payment apps cannot get any processing charges, unlike say when a debit card or credit card is used. Naturally, many smaller retailers and those adopting digital payments have gone for UPI over more expensive PoS systems that accept cards.

Fintech’s Love-Hate For UPI

This transition to UPI has caused plenty of consternation for card networks. Mastercard CFO Sachin Mehra said this week that UPI has been a painful experience for ecosystem participants.

He raised concerns over the sustainability of the payments stack, since participants “all end up losing money as part of that proposition”. With UPI’s rise, debit and credit card usage has fallen significantly.

Plus as we wrote a few weeks ago, the new additions which take UPI into lending and offline retail payments has some startups worried. While startups fight off competition to gain market share in the UPI race, NPCI is fleshing out its own revenue streams by expanding the UPI network to all corners of the BFSI ecosystem.

Some startup founders claimed that NPCI does not seem to be worried because it is actually making money from UPI. The event saw a slew of launches from NPCI’s partners.

“For NPCI, the main focus is on adding new players to the network who have to pay fees to be part of the network and create solutions on top of UPI,” added a Bengaluru-based neobanking startup cofounder.

In FY22, NPCI logged over INR 720 Cr in net profit, whereas fintech startups are still struggling to break even. Is UPI becoming a burden rather than an enabler?

The cost of a UPI transaction is borne by the acquirer app as well as the issuing and acquiring banks as per mutually agreed terms. But since payments apps have to pay for the additional expense of acquiring merchants and customers as well, they deal with a higher overall loss.

The other part of the UPI network is of course the banking industry. Since UPI sits directly on the banking network, traditional banks do get benefits too such as lower costs associated with cash dispensing and ATMs. Soon, banks can also lend through UPI partners, reducing more of their overheads for loan origination. Unfortunately, these benefits do not apply to startups.

“As a startup, you cannot ignore UPI, but at the same time, one has to ask the government, when it will look to introduce some measures to boost revenue generation for the very players who are driving UPI usage,” a Delhi NCR-based founder of a B2B lending startup told Inc42.

Revenue Conundrum

The lack of revenues from UPI is not a new problem of course, and everyone in the industry knows about this. We wrote about it way back in 2020 too when Google Pay was the market leader ahead of PhonePe. Today, PhonePe is ahead of Google, but UPI’s revenue problem persists.

Fintech and payments apps are more or less forced to put UPI as their key product since that is what is driving repeat app usage and traction. In other words, without UPI, there’s no continuity in user revenue.

As a result, startups are literally using UPI as an acquisition channel to drive upselling of other products and services. It’s a must-have for payments apps even if it’s expensive to market, ensure network uptime and reduce failure rate.

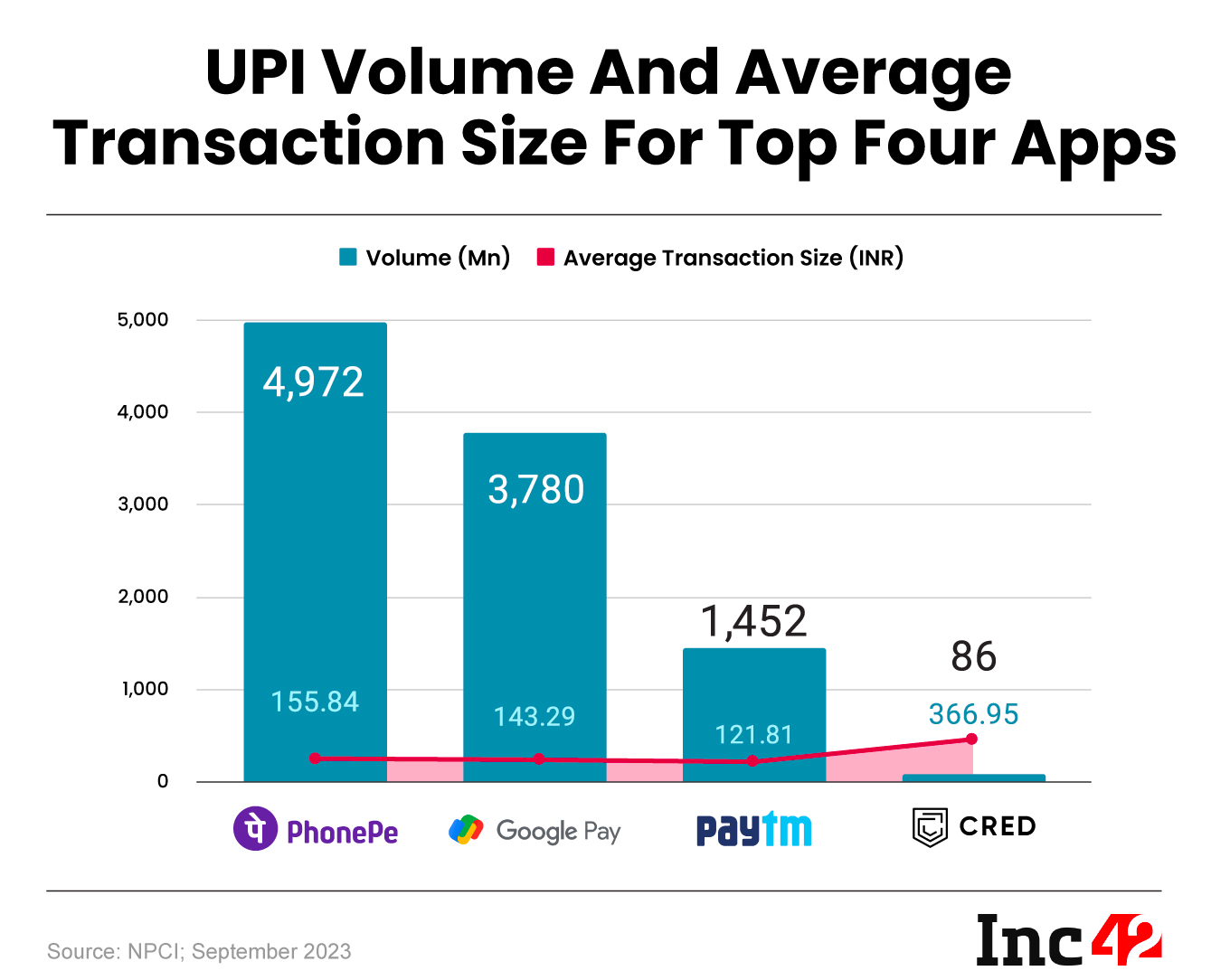

For instance, despite a belated entry into the UPI payments space, Bengaluru-based CRED spent heavily on marketing the service this year (FY24). Today, it is fourth on the most used UPI apps, behind PhonePe, Google Pay and Paytm as of September 2023. Interestingly, CRED has the highest average transaction size among the top four apps for September.

What’s Driving UPI?

Simply put, cashbacks are driving UPI usage. Example: One particular cashback scheme seen by Inc42 on CRED last month offered a guaranteed INR 5 cashback for peer-to-peer transactions. So sending INR 2 to someone else resulted in a bonus for the sender.

P2P transactions are essentially entirely free for individuals, so CRED is losing money on this transaction already, and the cashbacks only served to worsen the unit economics.

But of course, users were more than happy to move to CRED in the past few months because the actual UPI experience does not change much from app to app. User loyalty is entirely a factor of cashbacks and rewards.

Any app that decides to push the accelerator on this front, will find its UPI share growing. But is this growth worth it?

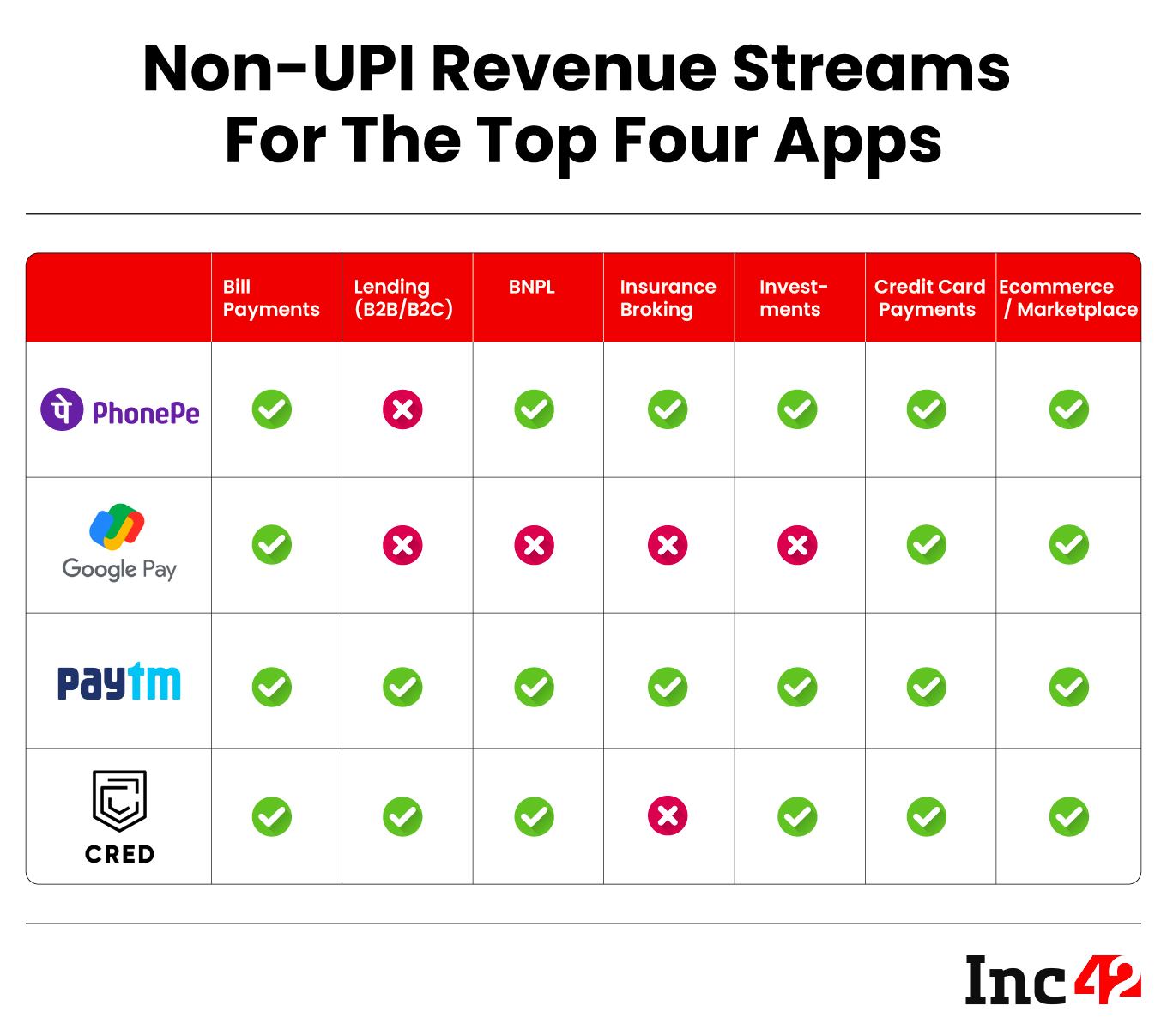

Essentially, UPI ends up costing startups a lot of money because of the revenue and fee structure. And it forces them to partner with banks that see most of the cost savings benefits. Startups have to spend money on adding other financial services and products to capitalise on the traffic that UPI brings.

There’s no ceiling for growth if a company has enough capital to burn, and the likes of PhonePe have built a warchest in 2023 to grab a bigger share.

While customer acquisition might work with some discounts and cashbacks, the challenge for fintech startups will be in retaining users after this cashburn. This is where the integration of other services and revenue streams will be critical.

UPI gave Indian startups a massive leg up, but fintech startups now have to look beyond UPI. What will this world look like?

Consumer Lending In Spotlight

Growing at a robust 22% CAGR, the digital consumer lending market is poised to nearly triple in size by 2030 on the back of several favourable socioeconomic factors and timely regulatory measures

While analysts believe that all consumer lending categories are growing at a similar rate, personal loans are expected to experience faster growth compared to B2B loans. So much so, that by 2030, the Indian digital consumer lending market is projected to be a $720 Bn-plus opportunity. This would represent 55% of the total digital lending opportunity

Read more in our State Of Indian Fintech Ecosystem Q3 2023 report

Sunday Roundup: Tech Stocks, Startup Funding & More

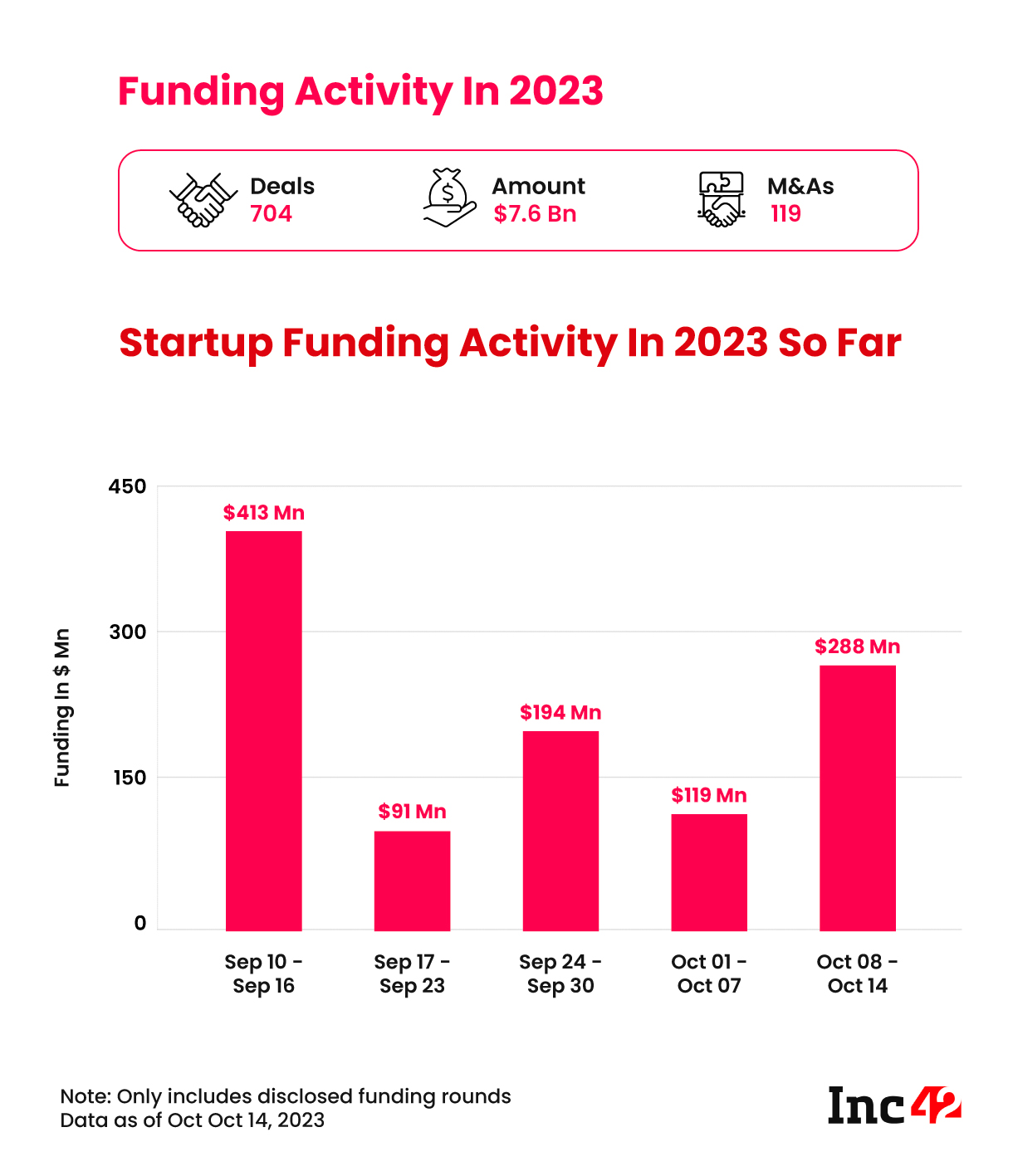

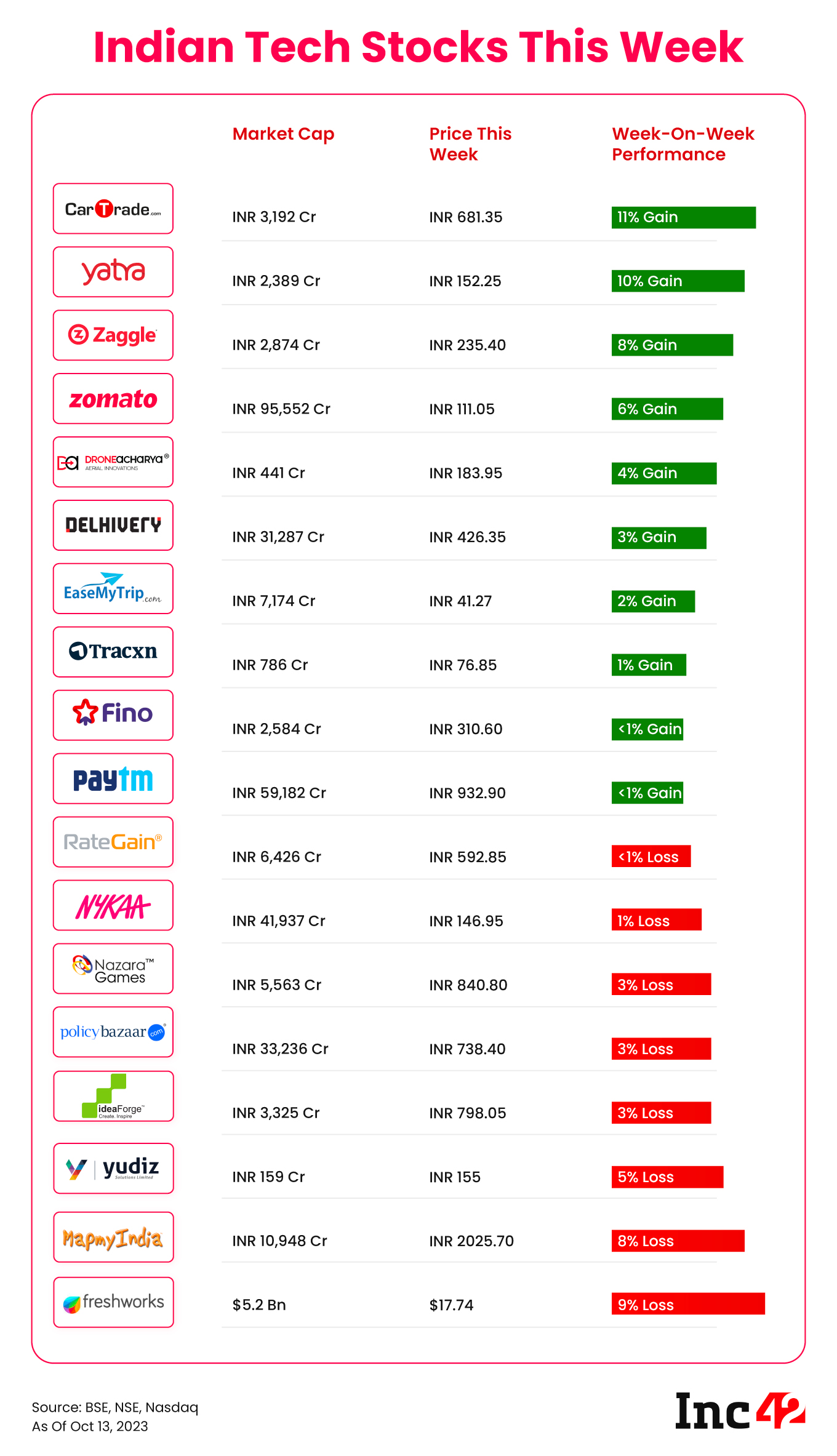

- Funding Picks Up: Indian startups raised $288 Mn across 24 funding deals, marking a 142% week-on-week rise in capital inflow, but the total tally for the year is still far away from even pre-Covid levels

- Mahadev Scam Unravelled: How an extravagant wedding ceremony caught the attention of ED sleuths who uncovered the Mahadev betting app scam

- Moglix’s FY23 Boost: The B2B ecommerce startup’s revenue for FY23 crossed the $500 Mn mark, but net losses increased by 12% to $23.5 Mn. See more FY23 numbers in our financials tracker

- Zomato’s Xtreme Move: Zomato is looking to take on Dunzo and Swiggy Genie with logistics app Xtreme, enabling parcel delivery service for merchants

- Dream Sports Scales Back: Dream 11’s parent company has decided to shut down its corporate venture capital arm Dream Capital to tackle the financial impact from the 28% GST on real money gaming

That’s all for this week. We’ll be back next Sunday with another roundup of the biggest stories and trends from the startup ecosystem!

Ad-lite browsing experience

Ad-lite browsing experience