The growth path of homegrown social media companies will be riddled with major obstacles

Dear User,

Less than two weeks ago, Twitter (or the people running Twitter) was threatened with a seven-year jail term for not complying with the Indian government’s directions to take down several accounts, which were allegedly fanning hate by spreading propaganda. Although the microblogging platform finally gave in to the diktat, the powers that be are not satisfied with its defiance.

Starting with commerce and industry minister Piyush Goyal, several government departments and high profile government officials have made a clarion call to the Indian public to move to a desi alternative of Twitter called Koo. And its sudden surge in popularity (around 1 Mn users in five days) reminds one of the TikTok ban last year that led to homegrown alternatives gaining millions of users overnight.

But what is behind this pattern? Why is there a fall out between the government and foreign social media giants time and again? We will look at that story another time, but today, it is all about how fast India’s homegrown social media can win over users and their advertising dollars.

The rise of online social networks in the first decade of the millennium was perhaps the apogee of globalisation. You could befriend strangers from the farthest corners of the globe, people you would have never met in person, and share your thoughts and experiences with them. Since then, the flat world is no longer an imaginative construct, at least in terms of reaching out to people. Tagging a politician or a celeb when you voice your grievance or adulation may soon elicit a response. Content creators have also realised that they are no longer at the mercy of studios and publishers for reach and publicity. Views and likes are the new currency for media and entertainment.

All of us have reaped the benefits of this hyperconnectivity. But a handful of American companies are the biggest beneficiaries as they rake in billions of dollars from the business of social media. Then there are humongous amounts of user data that the likes of Facebook, Twitter, YouTube and WhatsApp attract and access. Given the data leverage, it is no wonder that these companies can target ads with surgical precision and engineer public opinion anywhere in the world.

China understood this reality long before any other country and put itself behind what is popularly known as the great firewall. Overseas internet firms were not allowed to enter its territory, but that kind of ‘iron curtain’ did not deter it from exporting its homegrown social networking platforms to other countries for substantial business gains. Chinese apps like TikTok, Bigo, WeChat and LIKEE also gained ground in India alongside the U.S. social media platforms.

Until recently, the made-in-India social media platforms had to take a back seat as they could not compete with the massive user bases and the money power of overseas technology giants. But a protracted border skirmish with China, which led to a ban on most Chinese apps, and the alleged misuse of user data on the platforms of the U.S. companies signalled a break from the status quo. The call to action by the Indian prime minister to support India-focussed campaigns like the ‘Atmanirbhar (self-reliant) Bharat’ and ‘Vocal For Local’ further rekindled the social media ambitions of Indian entrepreneurs.

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media](https://inc42.com/wp-content/uploads/2021/02/Outline53_CN_graphs_Final-05.jpg)

If Koo has capitalised on the government’s confrontation with Twitter, short video apps like Chingari, Mitron, Moj, Trell, MX Taka Tak and Josh are among the few homegrown apps looking to fill the void created by TikTok’s forced exit. But these apps collectively logged 271 Mn downloads between June (end) and November 2020, while TikTok had 467 Mn downloads in India when it was blacklisted in June.

“Indian startups were waiting for the right cocktail of factors to capitalise on the Indic language social media gap in the market. Low data prices and smartphone penetration were important, but a large-scale adoption also required a strong call to action. The atmanirbharta emotion triggered that. Also, India as a country is genuinely tired of being asked where’s your Facebook, where’s your Twitter, where’s your Microsoft. So, a lot of people who grew up hearing that are now saying: Let us build India’s answer ourselves,” says Siddarth Pai, founding partner of the VC firm 3one4 Capital that has invested in Koo and Mitron.

Can they capture the imagination of hundreds of millions of Indian internet users like the American and Chinese technology majors had done before? Their success in the long term hinges on two factors — network effects and capital.

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media](https://inc42.com/wp-content/uploads/2021/02/Outline53_CN_graphs_Final1.2-01.jpg)

Network Effects Of Splintered Demographics

Simply put, the network effect in the social media context means it becomes more valuable for users to join a particular platform or spend time there as the user base continues to grow. For instance, if eight of your 10 friends are on Instagram and two are on Snapchat, you are likely to spend more time on the former.

But network effects are not limited to how many friends one has on a particular platform. It is also about the movie stars, sportspersons, thought leaders or other celebrities you follow religiously. If they are on a specific platform, it is bound to capture your eyeballs, and you are likely to stay there for a longer period. So, this will be the first challenge for any Indian player as the American giants have a well-established moat of ‘heroes’ spanning cultures, countries and specialised fields.

Raheel Khursheed, a former top executive at Twitter and Snapchat who was instrumental in setting up their operations in South Asia, sounds doubtful. “Why would Elon Musk want to join Koo? If Indian celebrities (with dedicated fan bases) decide to join homegrown social media platforms, many of their fans will follow. But there is a vanity element associated with social media as you want the world to see you. Would they (the Indian celebs) delete their Twitter or Instagram accounts for an India-only audience?”

Moreover, the fact that Indian social media platforms are shouting from the rooftops about their vernacular capabilities is ironic for two reasons. First, be it Facebook, Twitter or YouTube, users can always access these platforms in multiple local languages, and they can also consume enough hyperlocal and vernacular content. For example, a user from Bihar can easily watch loads of Bhojpuri music videos on YouTube and listen to Hindi political commentaries on Facebook or Twitter.

More importantly, if users limit themselves to using vernacular languages and homegrown platforms only focus on local languages and regional users, it will take a long time to develop a pan-India product.

For a clear understanding, let us extend our previous example. If 10 of your friends communicate in their respective mother tongue (it could be three or more languages) on a social media platform, you will not interact much among yourselves unless all of you speak the same language or have a fair understanding of them all.

A look at the national numbers will complicate matters further. India has more than 400 Mn social media users and more than a dozen major languages spoken by at least 2 Mn people. Any social media platform that increases the number of languages will risk divvying up its addressable market into micro-segments and has to make individual efforts to win those. Moreover, native speakers will feel alienated if their languages are not included, and they are forced to speak in another language that is not their own.

It is difficult to reach a solution here. To a great extent, English is the ‘neutral’ language of India, as Cred founder Kunal Shah says.

Of course, politicians will always try and gratify the parochial instincts of their constituents for votes, but technology companies have a different mandate. They have to tap the aspirational, upwardly mobile youth who can generate enough returns on investment through digital purchases.

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media](https://inc42.com/wp-content/uploads/2021/02/Outline53_CN_graphs_Final1.2-02.jpg)

Why Big Investments Matter For Social Media

In the social media space, capital is the biggest obstacle for all and sundry before the business can grow and thrive. The global scenario is proof enough. Twitter attracted more than $1 Bn in funding in the first four years of its existence and then took another seven years to turn a profitable quarter. A look at those at the lower end of the funding spectrum reveals that Instagram had raked in $50 Mn in its first two years before Facebook acquired it. WhatsApp, too, raised upwards of $58 Mn before it came into Facebook’s fold at a $19 Bn valuation.

According to Pai of 3one4 Capital, “India investors have the appetite but not the access to capital to make long-term investments in social media platforms. On the other hand, Facebook and Google could remain private for an extended period because they had larger institutional investors coming in, especially domestic investors. I would rather say there is a lack of regulation here, which prevents Indian institutional capital from being invested in this business model.”

The early-stage VC was referring to the fact that the country’s pension funds and insurance companies, which hold billions of dollars in cash, are not allowed to invest directly in startups.

Although the ban on Chinese apps has seen short video apps like Chingari and Mitron raise a few million dollars in the past one year, the long-term trend observed in the past decade clearly indicates that social media has been a no-go area for investors in the country. There are two exceptions though — Twitter-backed ShareChat (it also owns short video app Moj) which has attracted $264 Mn and Dailyhunt’s short video app Josh which has attracted $100 Mn in funding.

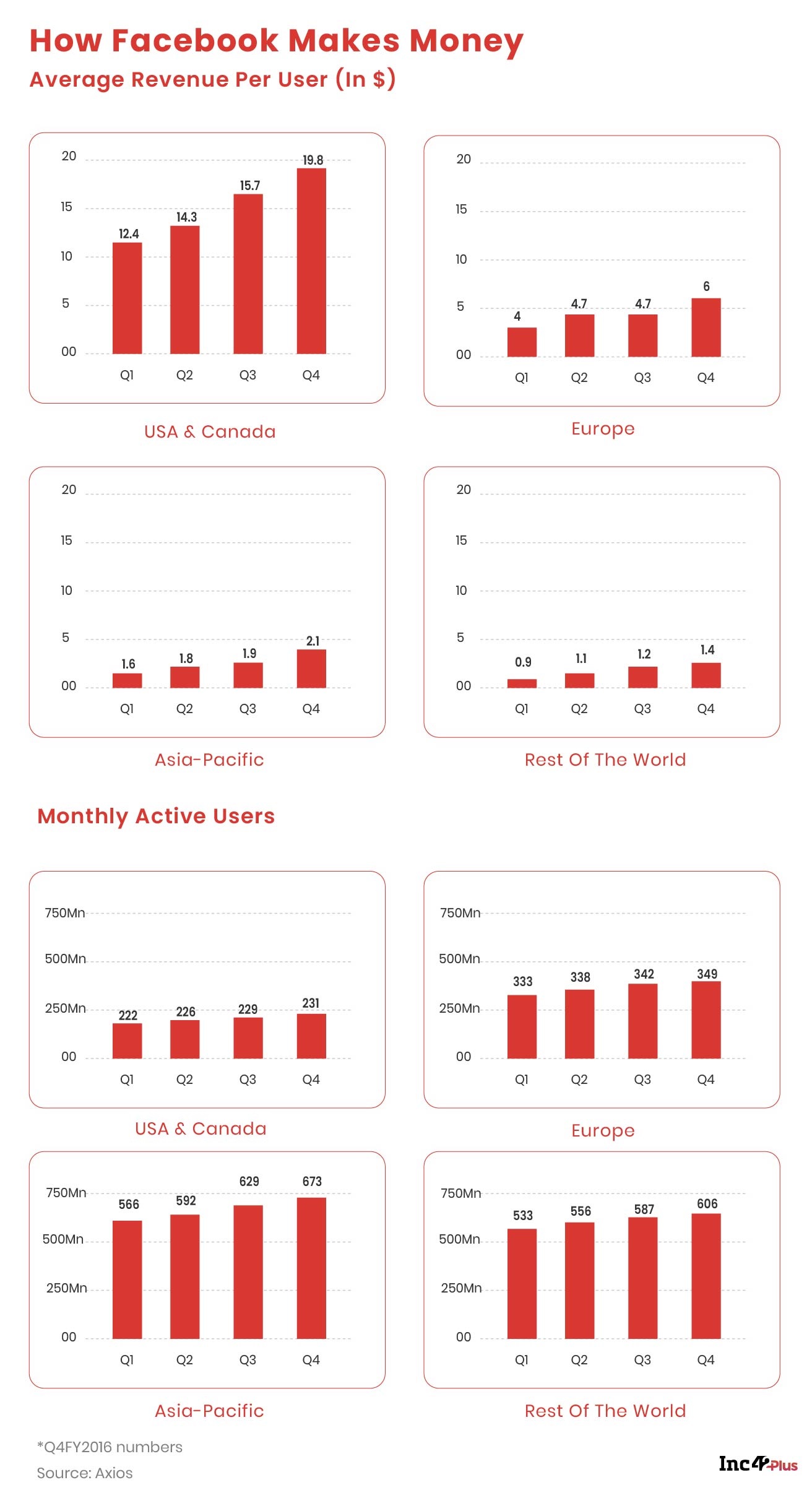

The key concern for investors is monetisation as Facebook and Google (which owns YouTube) account for 85% of India’s digital advertising market. But overall, the American giants’ average revenue per user from the Asia-Pacific (which includes India) is very small compared to the US and Europe.

“Vernacular ads really took off in India in the years 2016 and 2017. From then on, Facebook has remained the most attractive platform for local language advertising, and it will remain the flavour of the season for a long time. Although brands will increase their vernacular ad spends, I do not see them making a big shift to homegrown social media platforms,” says Shudeep Majumdar, cofounder and CEO of Zefmo, an influencer marketing company that connects 125,000 influencers to brands.

There is another big issue brewing. With data privacy regulations getting more stringent all over the world, American social media giants must have realised that much of their sophisticated ad-targeting capabilities will be curbed soon. It will be no different in India as the Personal Data Protection Bill is slated to become a law in the ongoing session of Parliament. It means even the desi platforms will have to realign their user data strategies in sync with the new regulations.

Even new channels of monetisation may come under the regulatory lens. Here is a case in point. Chingari founder Sumit Ghosh has recently tweeted that the app is entering the social commerce fray: “Introducing video-commerce on Chingari short videos. Every video that gets uploaded to Chingari is parsed frame by frame and all detected objects are then matched with a live catalog(ue) of Amazon and each video becomes shopping enabled in real time by the time it hits your feed.”

Will it be possible for a company to scan so meticulously a piece of user-uploaded content when the data protection law is in place? Only time will tell. What we know for certain is that the path to becoming a social media giant in the vernacular language space will be strewn with many thorns and spikes.

ShareChat’s Quest For Revenue

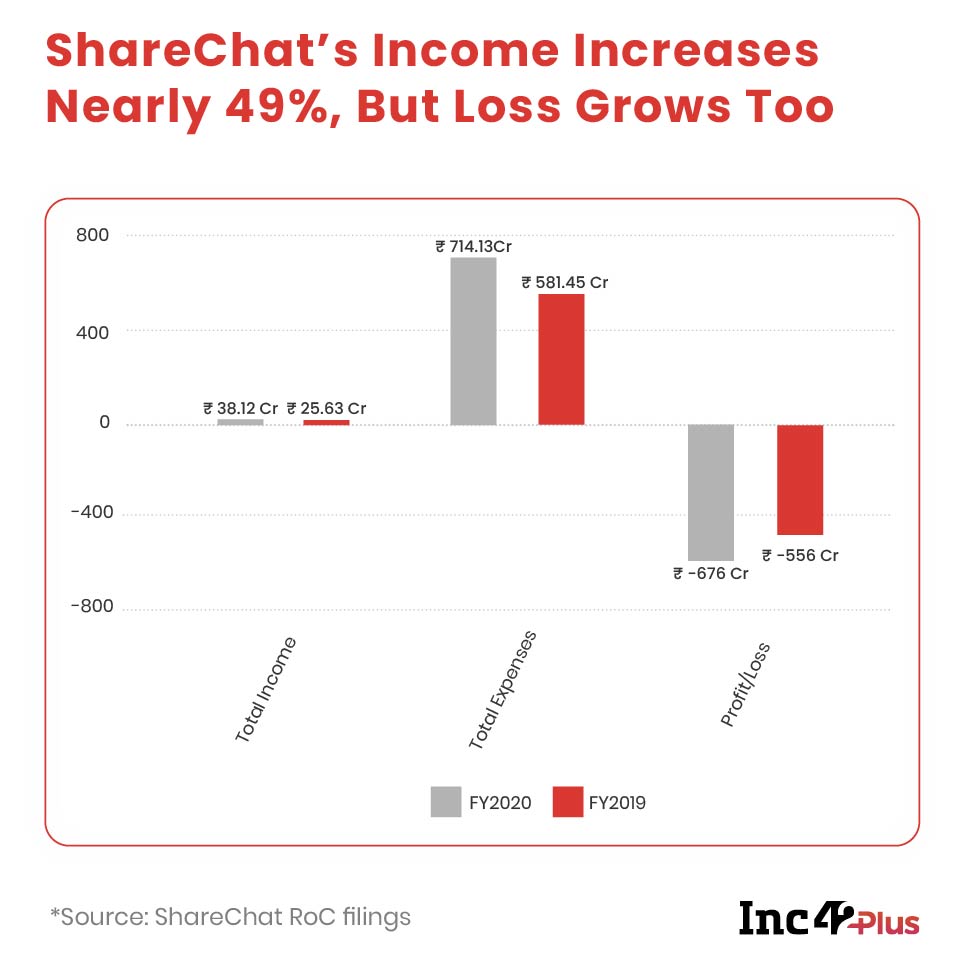

The monetisation pain of a vernacular social media platform was validated last week when ShareChat’s financial results for FY2019-20 came up. Its revenue for the financial year stood at INR 38.12 Cr and grew 49% year on year, from INR 25.63 Cr in FY19. But hidden in plain sight is the fact that only 25% of its earnings came from operations.

Out of its operational revenue of INR 9.38 Cr, INR 8.92 Cr was income from advertisement contracts. These contracts guarantee ShareChat’s business customers a predetermined number of views/impressions/instals via the platform. The company also owns a fantasy sports/gaming platform called Jeet11, offered in 14 Indian languages besides English but could not monetise it during the year.

The company’s expenses grew by 23%, from INR 581.45 Cr in FY19 to INR 714.13 Cr in FY20, and its net loss went up by 22%, from INR 556 Cr in FY19 to INR 676 Cr in FY20, bringing to the fore the tricky nature of building a new-age social media platform, geared towards users from Tier 2 and Tier 3 locations.

But ShareChat is not the only well-funded Indian social media platform with a revenue hole. Hike, an instant chat app floated by Airtel scion Kavin Bharti Mittal, saw its revenue from operations crash to $5,000 for the year ended March 2019 (the latest year for which data is available), from $81,000 the year before, according to research company Tracxn’s data. Losses from continuing plus discontinued operations for FY19 stood at $235 Mn.

Mittal is now working on bolstering the company’s revenue via two new channels on Hike — a by-approval-only social networking platform and a gaming platform. Not unlike his previous effort, the billionaire scion might find out that he is late to the party again.

Entrepreneurs’ Quest For Valuation

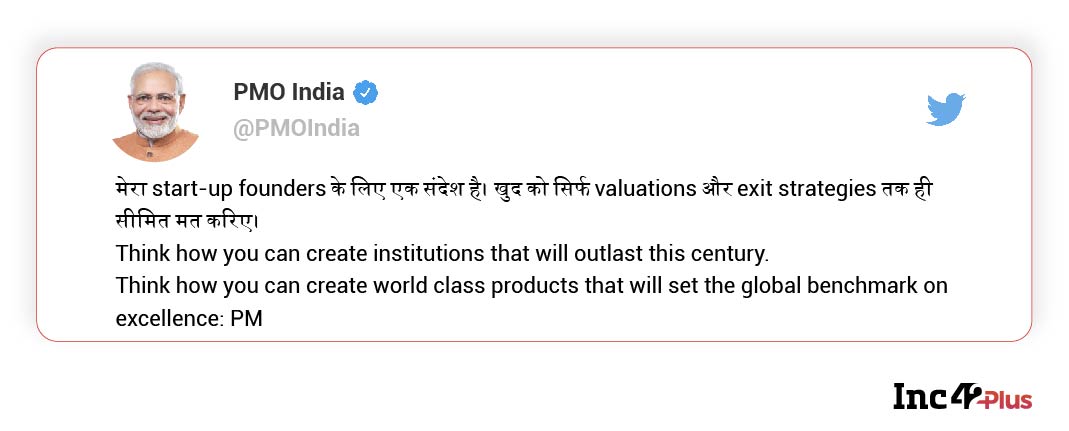

Prime Minister Narendra Modi has a message for startups: Don’t limit yourselves to valuations and exit strategies. Modi, who frequently tweets about the startup community, tweeted that entrepreneurs should rather focus on creating long-lasting institutions and world-class products.

India’s Quest For Mapping Innovation

India has finally released a set of official guidelines for mapping services (Google Maps, Apple Maps, MapmyIndia and the likes) that explicitly makes the location-based services on our smartphones legal. For years, the government has rigidly regulated the space covering mapping, ground surveillance and geolocation data, but the authorities concerned have been less than stringent in enforcing the law. However, the Survey Of India said in 2017 that Google Maps was not approved by the government and, therefore, unfit for official use.

Interestingly, the new guidelines also permit the export of maps above specified threshold values (1m horizontal resolution and 3m vertical) and allow their storage in the cloud. A close look also reveals how the government is clearly doubling down on the atmanirbharta factor and planning to democratise all existing geospatial datasets to spur domestic innovations in the field.

This will reduce homegrown companies’ reliance on foreign resources — and is one way to ensure a level playing field for Indian firms and not allow big tech companies take an unbeatable lead as has happened with social media.

Until next time,

Deepsekhar

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2021/02/Outline53_CN-02.jpg)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] India’s Quest For Desi Social Media-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience