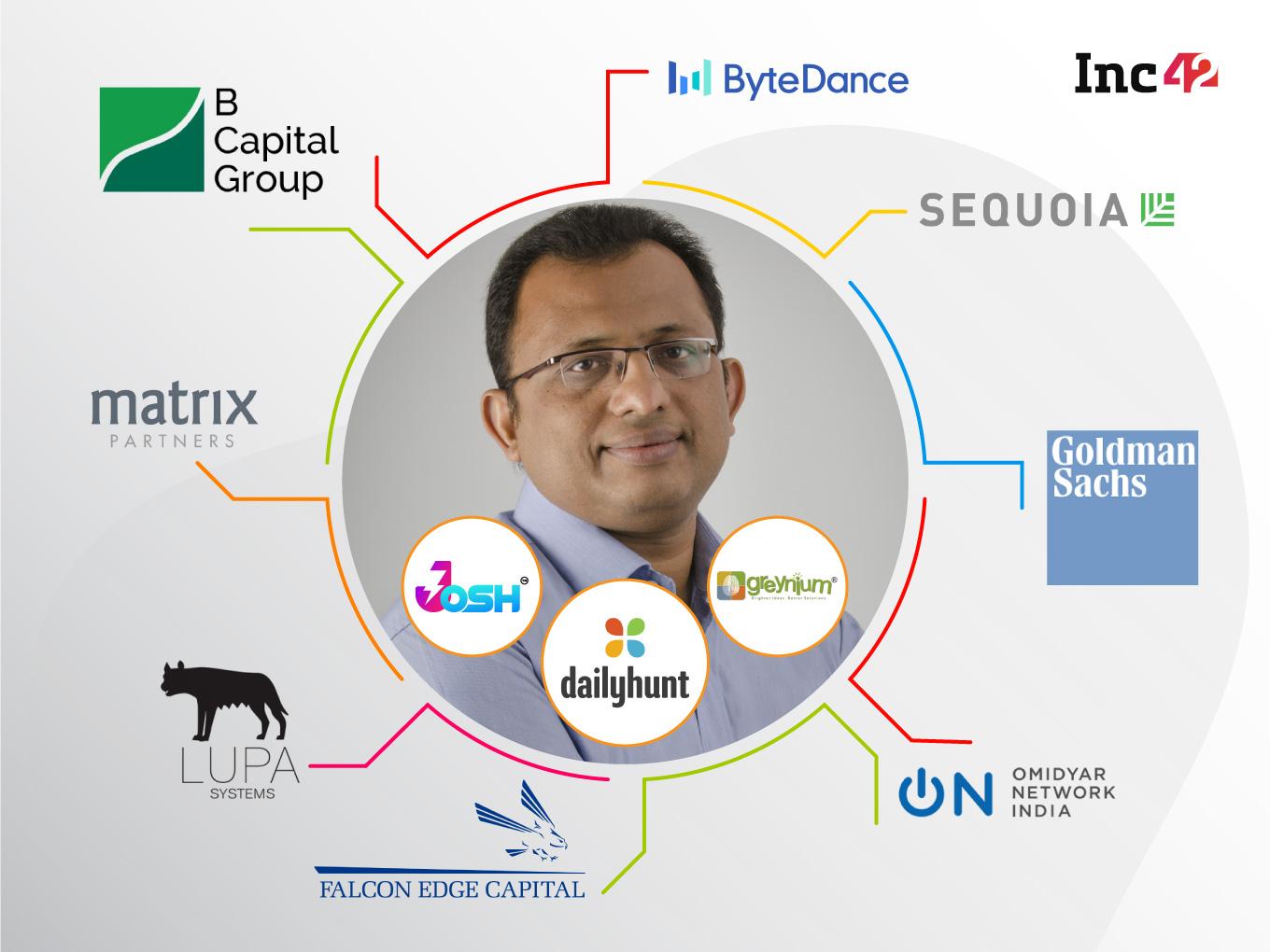

The group raised around $175 Mn in back-to-back funding rounds in 2020 and joined the unicorn club

Dailyhunt’s short video platform Josh has a TikTok-like vibe. But despite huge investments in customer acquisition, the app ranking is sliding in the past one month

Investments from Google and Microsoft are considered a massive opportunity as these tech behemoths may push Dailyhunt as a default app across most digital devices

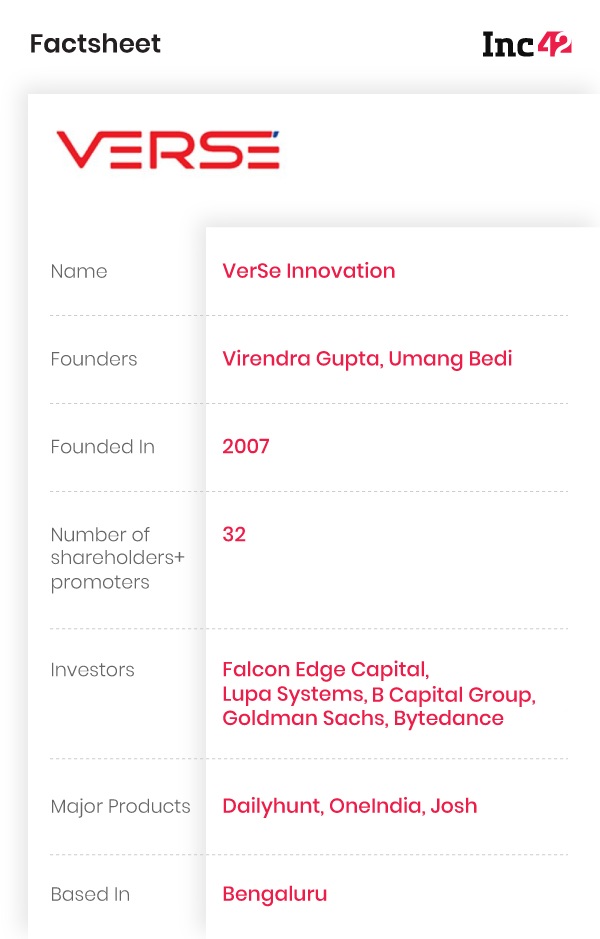

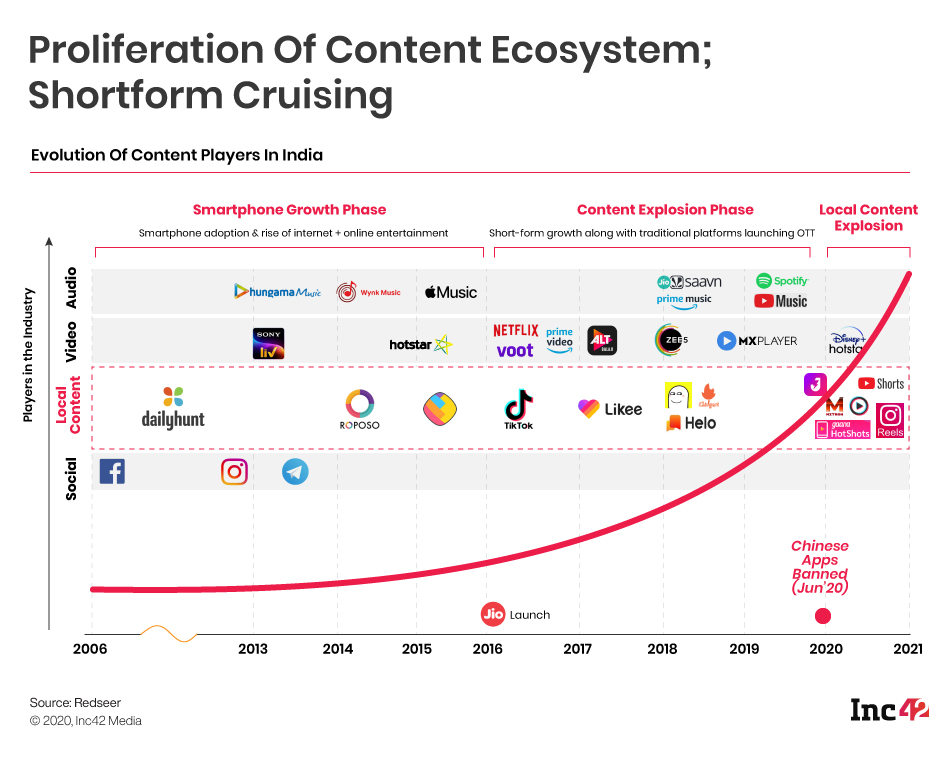

Regardless of the Covid-19 pandemic, the year 2020 saw a record number of 11 startups from India join the coveted unicorn club. Among them is VerSe Innovation, but the company stands out from the rest for several reasons. To start with, VerSe is home to multiple businesses. The parent company of the news aggregation platform Dailyhunt focusses on vernacular content, and hence, appeals most to non-English-speaking readers. It has recently launched a short-video platform called Josh. And lastly, there is Greynium Technologies, which runs around 10 content platforms such as Oneindia, Gizbot, Boldsky.com and CareerIndia.

Until now, the Dailyhunt group has raised a total of $320 Mn in funding across 14 rounds. However, 2020 turned out to be a landslide year. The group raised around $73 Mn, led by Falcon Edge Capital, Lupa Systems and B Capital Group, followed by a $100 Mn funding round from global investors AlphaWave (a unit of Falcon Edge Capital), Google and Microsoft. Existing investors Sofina Group and Lupa Systems also took part in that round.

The parent company entered the unicorn club powered by those fresh funding rounds. But what matters most is that investors are betting on a news aggregation platform from India when the segment has witnessed quite a few setbacks. HuffPost, one of the most popular news aggregators and blog platforms (loss-making, nevertheless), was acquired by another loss-making aggregation platform Buzzfeed last year and shut down its India operations in late November due to stricter FDI rules. ByteDance, one of the investors in Dailyhunt, also shut down its earliest product TopBuzz, an AI-based news aggregation platform, in mid-2020.

“Dailyhunt has benefited as an early entrant to the vernacular news market. But in my view, the company’s Amazon-like quick response to possible market opportunities and the way it caters to the ‘Bharat’ segment on a scale unlike other platforms are the key reasons which clicked with the investors,” says an analyst on the condition of anonymity. His firm was earlier appointed by one of the investors in the group for validating its valuation.

How Evolution And Innovation Became Game Changers

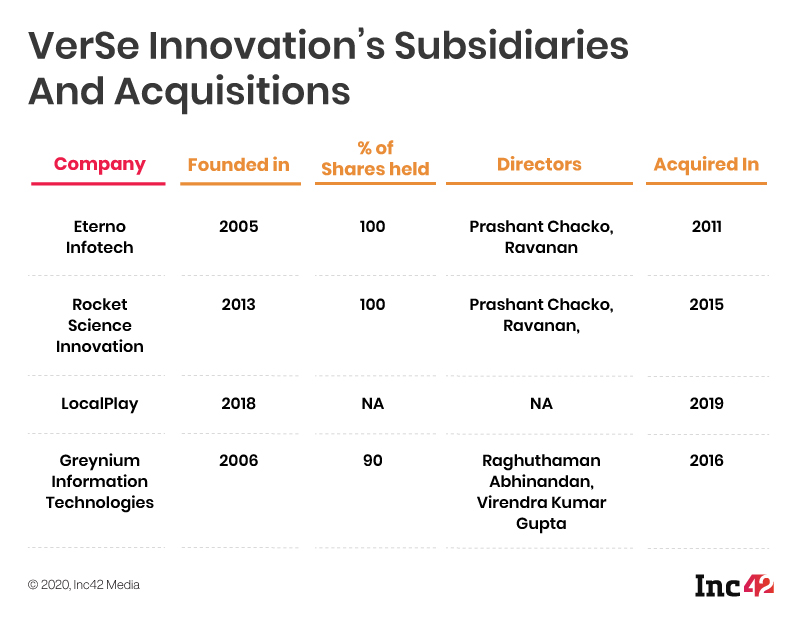

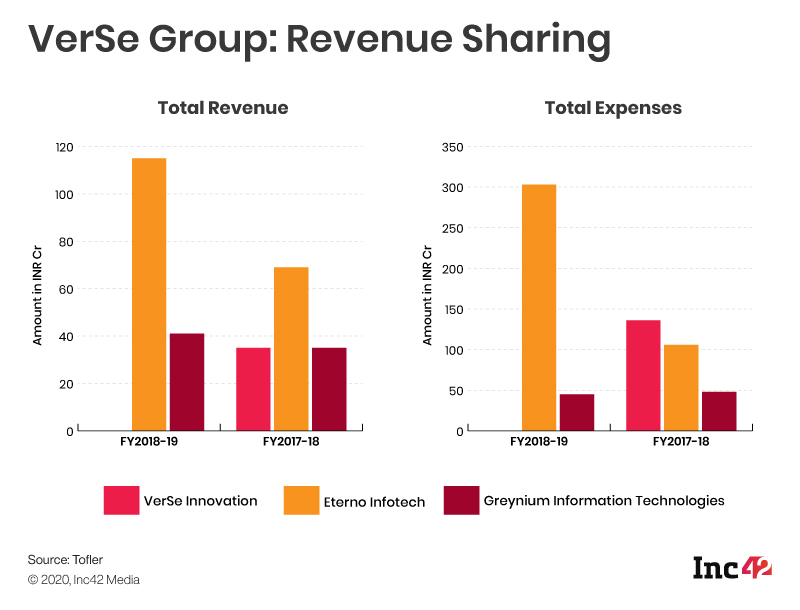

The narrative, in this case, is not about the survival of the fittest. Instead, it is all about ‘evolving to survive’. Founded by Virendra Gupta in 2007, VerSe Innovation, a B2B company, catered to telcos and mostly provided SMS alerts on jobs, property, matrimony, news and education subscribers across India, Bangladesh and Africa. It decided to enter the B2C game in 2011 when it acquired Eterno Infotech, the parent company of Dailyhunt (the news aggregator), set up by Umesh Kulkarni and Chandrashekhar Sohoni.

Set up in 2005, Eterno Infotech launched Newshunt in 2009, which was rebranded as Dailyhunt in 2015. Before launching Newshunt, Eterno had developed mobile apps and platforms with a focus on Indian Languages. These included IndiSMS, a P2P messaging app preloaded in some of Nokia’s popular S60 handsets; IndiServer, a bulk SMS platform adapted by telcos like Airtel and IDEA; IndiMate, a click-and-get platform that powered Rediff’s mobile email, and shortcode services, trials of the Nokia life tools and IndiTunes, a mobile music discovery and streaming platform.

Eterno earlier had Rediff as one of its investors and launched a news aggregator platform called Newshunt in 2009. It was the time when a slew of crawling software engines/web crawlers arrived in the market and the likes of Yahoo News, Google News, Techmeme and Huffington Post enjoyed unbridled popularity as news aggregation platforms.

The success stories varied, though. Google News saw a partial shutdown in Spain. Yahoo News and Techmeme survived successfully. And some of the early popular launches, including Wikimedia’s Fabrice Florin’s NewsTrust (later operated by the Poynter Institute), Bloglines, Thoora and Newsvine shut down their services between 2012 and 2017.

Unlike its peers, the Dailyhunt group survived on a well-diversified portfolio of short-term and long-term products. In 2011, the company doubled its revenue to INR 35 Cr through its B2B products such as classifieds delivered through SMS and USSD (a GSM protocol for sending text messages). During 2012-2015, the group mostly depended on ebook sales. Then its focus shifted towards the short video market and it launched Josh in the second half of 2020.

Dailyhunt: Staying Ahead In The Bharat Race

As mentioned before, the Dailyhunt group has three broad offerings – a news aggregation platform called Dailyhunt, an entity called Greynium Technologies that house news and other content platforms such as Oneindia, Gizbot, Boldsky.com and CareerIndia, and the newly launched short-form video app Josh. What is common across these platforms is the focus on vernacular languages. While Dailyhunt currently offers its content in 14 Indian languages, Oneindia and its sister websites are available in nine Indian languages, and Josh is available in 12 languages, including English.

“We are on a mission to include a billion people in the nation’s digital narrative, powered by one fundamental — local languages. We believe that with Dailyhunt, a social revolution around local languages is taking place,” cofounder Umang Bedi said earlier.

A look at the relevant numbers further underlines the importance of localising the digital content. For example, the number of Indian language internet users grew at a CAGR of 41% between 2011 and 2016. It is now growing at a CAGR of 18% and expected to hit 536 Mn by 2021. In contrast, the English-language user base is growing at 3% and is expected to reach 199 Mn by 2021, according to a KPMG and Google report.

That is a huge difference, to say the least.

Moreover, English content has already reached its full maturity, and content providers in this space may have to compete with reputed global companies in terms of quality. Of course, one cannot ignore the growing competition among local content creators. But few have extensive investors’ backing like Dailyhunt when it comes to catering to the entire Bharat segment.

“People like personalised digital content and not the generic thing provided by most content creators. This is where Dailyhunt scores over others as it uses technologies like artificial intelligence (AI) and machine learning (ML) for curating and improving content,” said the analyst.

The group says Dailyhunt has 100K content partners and creators who publish 250K news and content pieces every day in 14 languages. It claims to have 263 Mn monthly active users (MAU) across all platforms. The Dailyhunt group also boasts a 500-strong workforce.

How Dailyhunt Fares Against Its Competitors

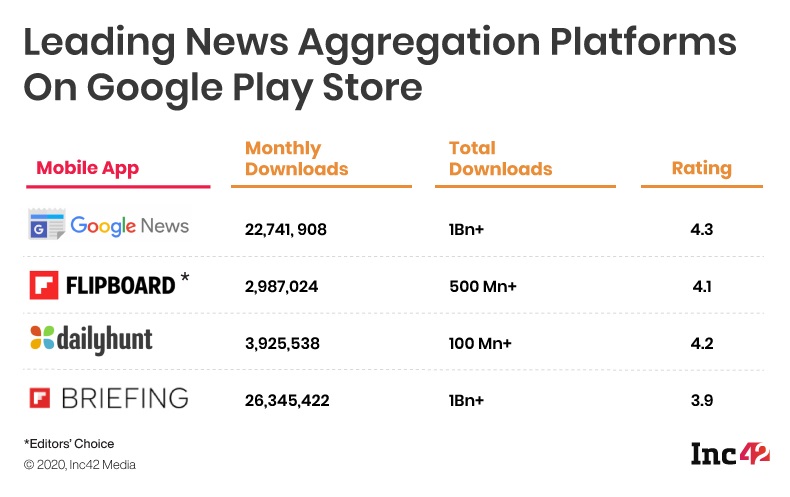

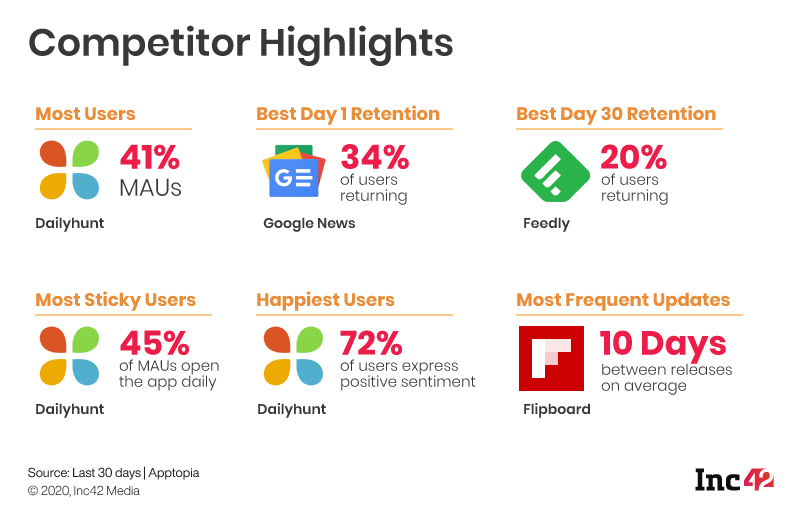

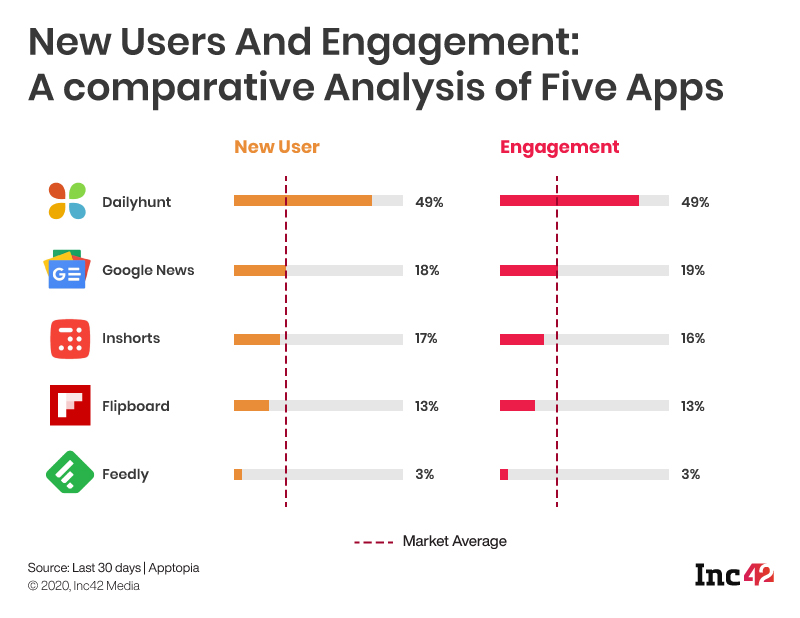

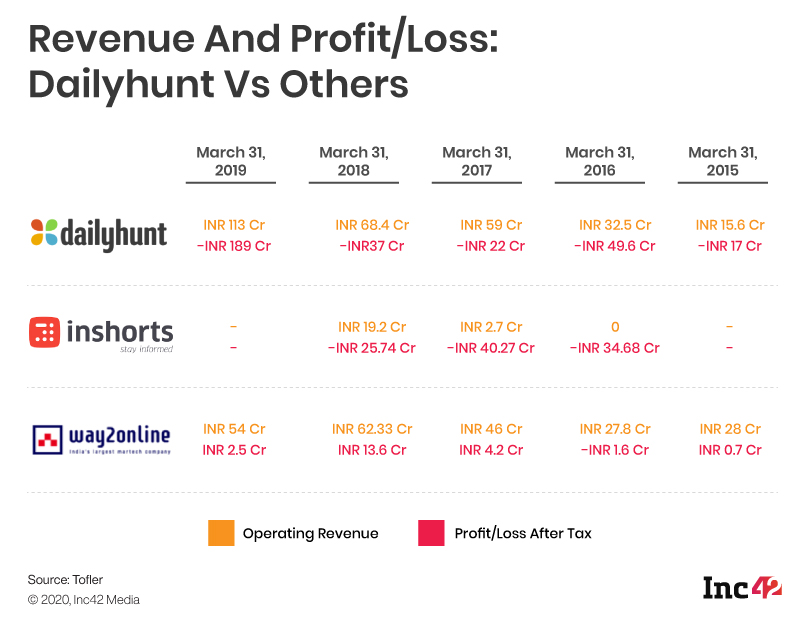

Google News, Flipboard, Inshorts and Dailyhunt are the leading news aggregation platforms on Google Play Store. But according to an app intelligence provider Apptopia, Dailyhunt leads this space in MAU, happiest users and new users.

Google News tops the list under the Best Day 1 Retention category while Feedly is ahead of the rest under Best Day 30 Retention.

Much like Google News and Flipboard, which were earlier offered as default news consumption platforms on a slew of mobile devices, Dailyhunt has also partnered with leading mobile manufacturers to record 300 Mn users. Leading companies such as Samsung, Xiaomi, Oppo and Vivo have been offering it as the default news app on their select mobile devices. Dailyhunt currently records around 30 minutes spent per user per day. Bedi says it has been possible because the company has launched 543 TV channels within the app.

Josh: A Newborn Becomes A Market Leader In Three Months

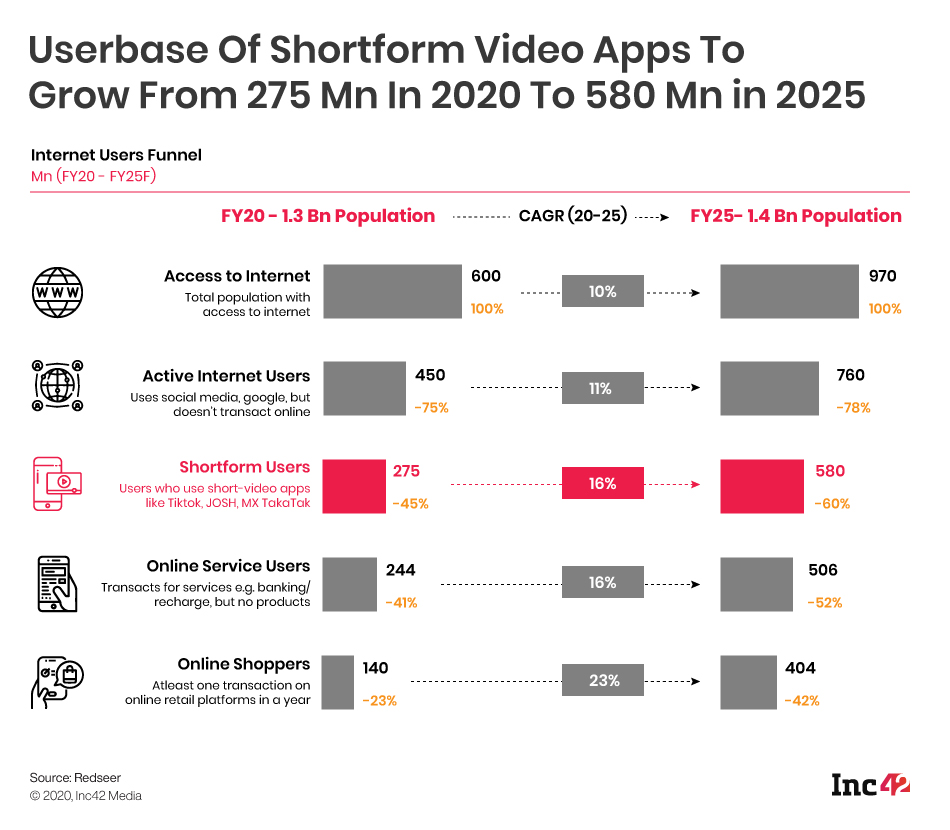

According to a RedSeer Management Consulting report, India’s short video market is estimated to grow by 4x on the total time spent and reach 400-450 Bn minutes a month in the next five years (2020-2025) from the current 110 Bn minutes. This is despite the fact that TikTok, once an extremely popular Chinese app in India, was banned in June 2020 due to the ongoing Sino-Indo standoff.

There was a clear void in the market that triggered huge traction on existing apps such as Sharechat, Chingari and InMobi’s Roposo. A slew of new apps like MX TakaTak (a Times Group app backed by Tencent) and VerSe’s Josh also came up to bridge the demand gap.

“We launched Josh literally in two weeks (in July 2020). Our short-video app has been proudly made in India. It is the fastest-growing and most-engaging app in the country,” claimed Bedi.

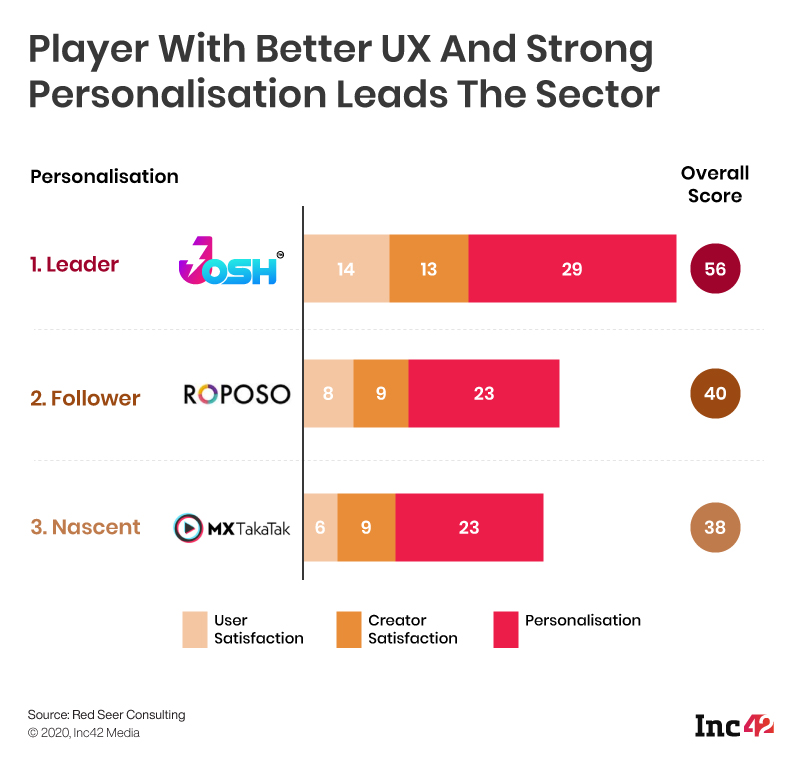

In spite of competing with a dozen+ short-video apps, some of which are owned/backed by big players like The Times Group, Tencent and Inmobi, Josh went on to become a market leader within three months.

Josh brought on board around 200 leading TikTokers who have a collective follower base of 300 Mn+ across social media platforms. Within a few months, it has become a top-rated app with 50 Mn downloads and 23 Mn daily visitors, each spending an average of 21 minutes on the app. Josh records a billion video plays a day and claims to have 5 Mn content creators.

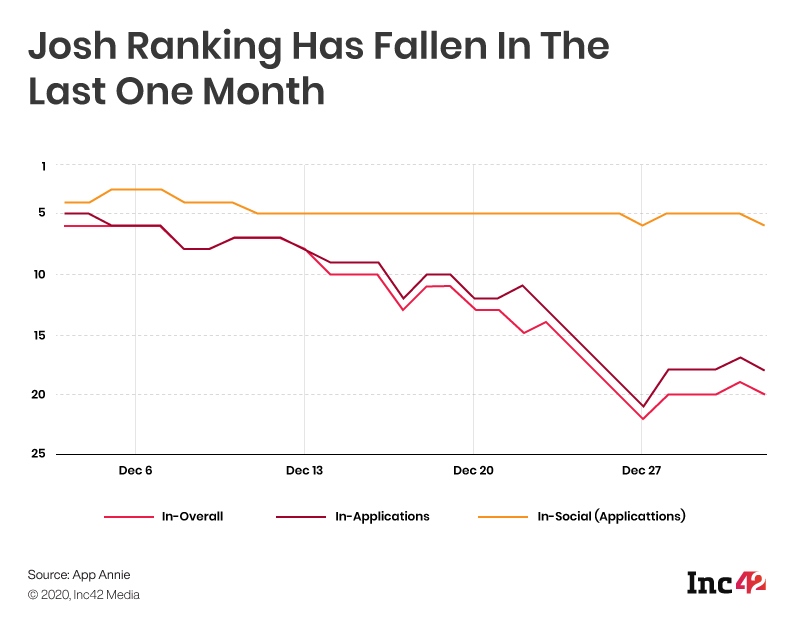

In an interview, Bedi hoped that the MAU would double from 50 Mn in October 2020 to 100 Mn by December 2020, but it is still 25 Mn short of the mark.

However, both App Annie and Sensor Tower recorded a sharp fall in Josh’s ranking in the past one month.

Nikhil Dalal, a senior consultant at RedSeer, thinks that the app, in its current format, is still a market leader in India. “Based on our recent analysis, we still see Josh as the leader in the market. Of course, each player is modifying its product and content to gain more users and retain them. But even with these changes, we would say Josh is doing well and Moj, a short-form video app from the stable of Sharechat, is also coming up now, given the multiple supply and demand sides of things.”

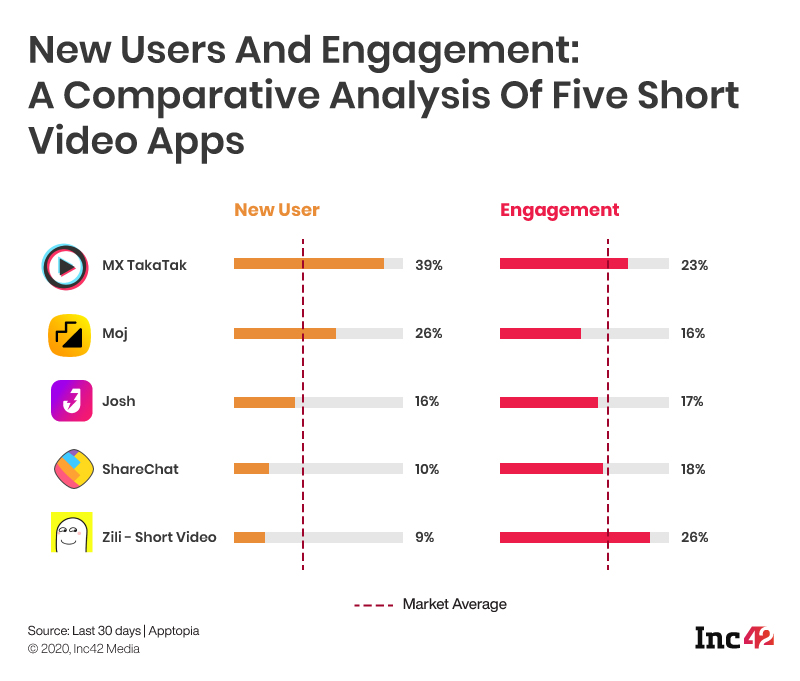

According to a comparison on Apptopia, MX TakaTak has the most MAU and Josh has the maximum number of happiest users.

Incidentally, none of these short-video apps is focussing on revenue generation at this stage. They are still investing a lot on user acquisition strategies and paying huge amounts to social media influencers to join and stay on their platforms.

“We do not see these platforms earning money in the next three-six months as they will take time to show organic users to advertisers,” says Dalal of RedSeer. “Once the reach is big enough and organic, leading players like Josh, Moj and MX TakaTak can start monetising their platforms through ads. The next thing could potentially be social commerce on those platforms. Again, social commerce will take some time, but ad revenue will be more immediate.”

There is immense potential for the short-form video market in India. Some of these entities may venture into other segments like edtech, news and other sectors. However, Dalal thinks that the most significant use case is entertainment – that is the core of these platforms. Only entertainment videos can earn these platforms more traffic, engagement and user retention. Although leading platforms like Josh and MX TakaTak have become perfect alternatives to TikTok and made their mark, it is too soon for them to enter other genres like education or news.

Only when these platforms gain sufficient retention rates, they can venture into other streams. Otherwise, they may lose their current user base as people mostly come on board for entertainment. TikTok also entered the edtech space after it had a loyal user base but failed to make an impact even after a year, he adds.

According to Dalal, Josh needs to improve its content quality constantly to retain its market leadership. Continuous improvement and product upgrades based on user feedback are the key to success while the platform must identify and retain loyal users.

Will There Be A Content Boost Post Funding?

Besides Josh and Dailyhunt, the group also owns Greynium Technologies, but all may not be hunky-dory at that end. Initially founded by B.G. Mahesh in 2006, it is home to Oneindia and nine other digital content platforms, covering a total of 11 categories, including news, entertainment, lifestyle, technology, automobile, personal finance, sports and more. Collectively, these portals publish content in nine languages (English, Hindi, Bengali, Gujarati, Marathi, Tamil, Telugu, Kannada and Malayalam), attract more than 100 Mn unique users and generate 1,000 Mn page views per month, the company claims. But Greynium clearly lacks the skill base, funding and technology support it needs. Most of its apps such as 60Secondsnow, OneIndia, Newzly and click.in have been taken down from the Google Play store.

Understandably, Oneindia ranks quite low in the revenue scale – it holds the ninth spot among its top 10 competitors, according to Owler, a company tracker platform. But given the latest 26% FDI limit, the back-to-back funding of $175 Mn recently raised by the group is likely to be diverted to market-leading products like Josh.

The group already indicated it would spend more on Josh’s customer acquisition by empowering the large and indigenous ecosystem of hundreds of millions of users and talented video content creators in every nook and corner of the country. It is also planning to deploy the new capital to scale up Josh and work on AI and ML innovations to ensure the growth of its made-in-Bharat-for-Bharat short-video platform. The group aims to augment its local language content offerings. But it is unclear how Oneindia and other content platforms under Greynium benefit from the latest funding in the long run.

Revenue Lags Despite Potential

Besides the Bharat appeal, the group managed to post some impressive numbers during the pandemic year. Bedi said in an interview, “The way I look at it is that we grew revenue in a Covid quarter (Q2, FY2019-20) by 100% year on year because, by that quarter, 70% of the revenue was on performance-based advertising.”

In FY18, Dailyhunt clocked its revenue at a run rate of $40 Mn through advertising and aimed to reach $100 Mn by the end of FY19. However, there is no official confirmation regarding the company’s current run rate.

Dailyhunt’s closest competitor in India is Google News. Although Google India has not revealed its income from Google News, the search giant’s revenue grew from INR 4,147 Cr in FY19 to INR 5,594 Cr in FY20, registering more than 35% growth. Globally, Google earned more than $4.7 Bn from Google News in FY19. But unlike Dailyhunt, Google News has a huge advantage over news indexing as the Google search engine automatically prepares it in real-time. In contrast, Dailyhunt focusses on content localisation instead of directly competing with Google News.

Among Dailyhunt’s other competitors are Inshorts and Way2News. Interestingly, both Inshorts and Way2Online (parent company of Way2News) managed to show impressive numbers in terms of operating revenue and profit/loss. Way2Online, a company launched in 2006, has a diversified source of income and launched Way2News, a hyperlocal vernacular news aggregation app, in 2015. Inshorts too was incorporated in 2015.

Will A Cash-Rich Dailyhunt Retain Its Edge In India?

As pointed out by various reports, India is the most lucrative market for content consumption and remains far ahead of key global markets like China, the US, Australia and Canada. According to the report, the average time spent by a smartphone user in India per day stood at 288 minutes in FY20 compared to 264 minutes and 210 minutes in China and Canada, respectively.

But the question remains: With little funding attribution to Dailyhunt, which claims to be India’s largest vernacular content aggregation platform, can the group retain its leadership position in India?

According to the analyst quoted earlier, unlike news platforms, aggregation platforms do not need huge investments. Dailyhunt already has its technology in place, and hence, will not require a lot of capital for product development or upgrades. But again, there is a catch. Unlike news platforms, news aggregators do not have loyal readers or a dedicated user base. Citing how news consumption has shifted to social media platforms like Twitter and Facebook, the analyst says that a platform with more personalised content and more diversified offerings may not take long to beat Dailyhunt. Similar is the case with Josh as short-form video users have not shown much loyalty so far.

Also, a significant portion of the Indian market is still untapped and Dailyhunt, which focusses on local consumption, is expected to see its user base grow over the years. Besides, it has started exploring other markets, including Sri Lanka, Bangladesh and Africa, for better growth.

Even then, the group is bound to face a plethora of challenges. Some of its products such as classifieds and ebook stores have already lost their market relevance. Besides, new technologies are disrupting both products and consumption patterns, creating new opportunities and killing traditional business propositions. Will the Dailyhunt group remain relevant for the next 15 years by responding to change and shifting its product base accordingly? How will the Indian market evolve when AR and VR redefine the future of news and entertainment?

The answer may lie in the group’s Amazon-like agility that calls for future-preparedness and adapt-fast strategy. Add to that the strategic investments from forward-thinking tech behemoths like Google and Microsoft, a big opportunity that may push Dailyhunt as a default app across most digital devices, and the company may well lead in the next era of differentiation.

Ad-lite browsing experience

Ad-lite browsing experience