The Jio juggernaut rides on the hope of integrating its multiple acquisitions and telecom success

Dear subscriber,

Reliance’s funding onslaught continues unabated in 2020 and so does its acquisition spree. Even as it is locked in a legal tussle with Amazon over Future Group, the acquisition of a distressed Urban Ladder has raised a few eyebrows. But what’s becoming apparent is that the oil-to-telecom conglomerate is completing the last leg of the preparations for an entry into the ecommerce sector.

Reliance’s shopping binge began with acquisitions in B2B technology and telecom connectivity — AI-based chatbot maker Haptik, cable broadband companies DEN, Hathway and Datacom, last mile delivery fleet Grab A Grub, omnichannel ecommerce enabler Fynd, AR/VR software and hardware maker Tesseract, among others.

The second thrust was towards content companies — music streaming platform Saavn, entertainment companies Eros and Balaji Telefilms, and edtech startup Embibe coming on board to supplement Jio’s data plans with content

These acquisitions cost the conglomerate about INR 37K Cr as per disclosures, whereas Jio Platforms attracted over INR 152K Cr in capital and raised over INR 53K Cr from its rights issue earlier this year.

This means that Reliance can add more companies to its universe, and while it may still acquire more, the question is will this deliver Ambani’s vision of owning all layers in India’s tech ecosystem — telecom, hardware, ecommerce and OTT services?

Fitting In The Various Pieces

Experts believe the success of Jio or lack thereof will be down to two factors — how well it integrates its multiple acquisitions to create a cohesive offering and how the telecom business, the foundation of this juggernaut, fares.

On the former, there are now movements within the company to align its acquisitions towards a singular goal. As the founder of a startup that Reliance acquired last year told us, “It’s only slowly that we realised that they are acquiring talent and a lot of our capabilities are being repurposed for Jio. The Netmeds, CSquare, Fynd, Grab A Grub and Haptik teams are all working on JioMart.”

This is also how the Netmeds deal came about.

The team within JioMart was too focussed on creating a right product for kiranas, but couldn’t figure out how to crack the B2C angle, particularly for niche verticals. That’s when their eyes fell upon Netmeds, an epharmacy that already listed Reliance pharma products. So JioMart decided to flip the equation by acquiring the online pharmacy and adding a pharma category within its ecommerce platform, also bringing NetMeds’ B2C capabilities under its umbrella in the process.

This buy-and-drop-in approach may work for some categories, but Reliance needs to be wary of replicating this for every acquisition. “Integrating technology companies is comparatively more challenging than integrating traditional asset-based businesses. In technology companies, workforce is typically the major asset which is trickier to integrate in disparate work cultures,” believes Deepak Panda, a valuation expert and director at financial consulting firm Duff & Phelps India.

Decades-old conglomerates such as Reliance and Tata are well-versed in acquiring asset-heavy businesses and stringing them into their enterprise chain. For example, Reliance took over the public sector undertaking Indian Petrochemicals Company Limited (IPCL) between 2002 and 2007 — adding downstream capabilities and reducing the tax burden on itself. But acquiring tech companies rarely has such a direct impact on the bottomline.

Times Internet, the digital investment arm of the 182-year-old behemoth Times Group, learnt this lesson the hard way with the acquisition of Haptik, a chatbot company that it ultimately sold to Reliance Jio in 2019.

Initially, the plan was to embed a chatbot across the entire ecosystem of products and make it easy for users to avail services through voice interactions. But as Satyan Gajwani, the vice chairman of Times Internet, said, such direct integrations are not always welcome by users or customers. “We learned that creating super apps is not as simple as just putting stuff in front of customers. The truth is that when a user is reading the news on Times of India, they aren’t looking to book a movie ticket,” Gajwani said at Inc42’s The Product Summit last month.

Of course, the INR 700 Cr price tag for Haptik makes sense now, given that it boasts of marquee clients such as Ola, KFC, Disney, Disney+Hotstar, HDFC, among others. However, the same cannot be said of acquisitions such as edtech startup Embibe, delivery fleet Grab A Grub or even Urban Ladder, which didn’t have successful business models by themselves.

“If you have to buy a digital company, buy a startup that is highly successful because if you buy an unsuccessful startup and think you can (simply) change the people, then you are taking away the 70-80% of what the company is doing. Because there are no processes and physical assets to speak of,” cautioned a veteran executive at the Tata Group, who did not wish to be named.

Will Reliance’s profligacy come back to bite it?

Building Around A Telecom Core

Being an asset light digital company is at the core of Jio’s strategy.

For this reason, Reliance’s tower and fibre assets were hived off into a separate investment trust last year. At the time it was seen as a preparation for a public listing, but it turned out to be a precursor for billions in funding and convincing investors.

By hiving off the low yield telecom infrastructure assets from Jio’s balance sheet, the company became more palatable as a high-growth technology company for investors.

But the prospect of high growth is a double edged sword. Since Jio Platforms is a subsidiary of Reliance Industries Limited (RIL), the share market’s faith in the telco has taken the RIL stock from around INR 500 in November 2016 to around INR 2000 at present. This groundswell is pinning its hopes on Ambani’s ambitious plans and investments by big-ticket players like Google, Facebook, KKR, Silver Lake, Abu Dhabi Investment Authority, among others.

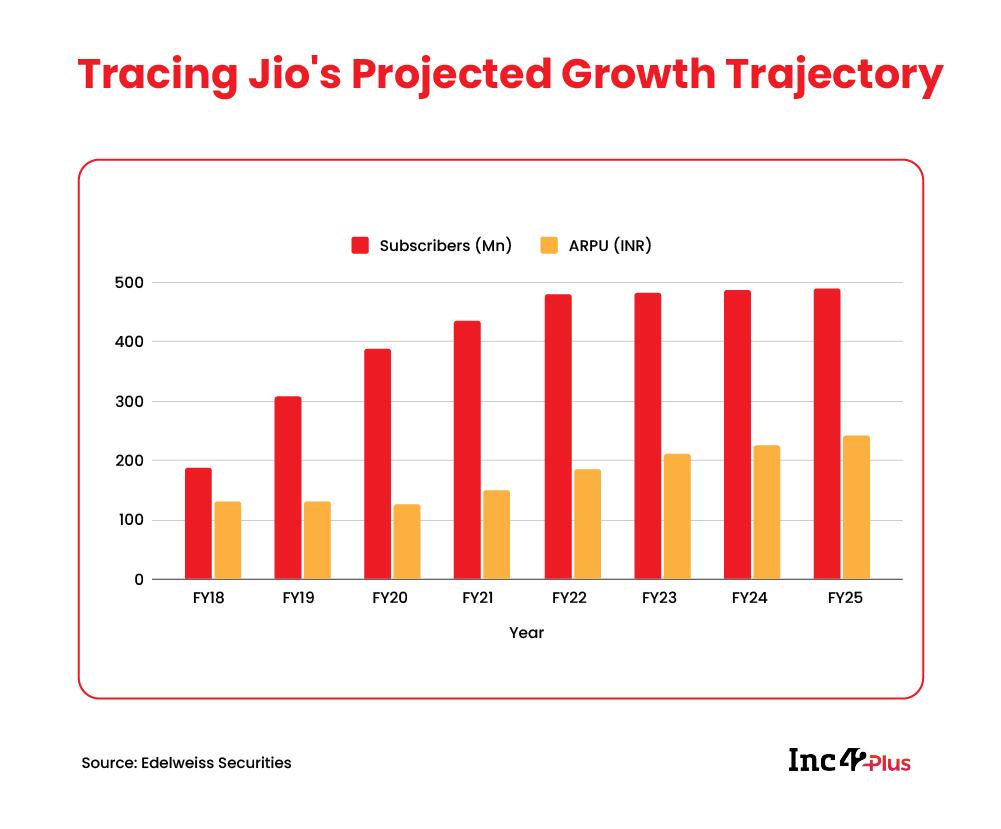

“Our 2-stage reverse-DCF shows the market is baking in high EPS growth, particularly for Jio (35% p.a. for 10 years),” said a note on Reliance Industries by Edelweiss Securities.

This means the stock market is booming on the assumption that the earnings per share of Jio will grow 35% each year for the next decade — a tall ask considering that the telco’s subscriber growth has slowed down in recent months, as a result of its already huge base of over 400 Mn and the increase in prepaid tariffs by up to 39% last year.

“If you look at the numbers, the returns are not commensurate to the investment that they’ve made in the telecom business. At some point in time, they would definitely want to increase the tariffs and get more returns on the investments that they’ve made. But for them, immediately that tariff hike issue is not there because they are making profits and don’t have the AGR payments to deal with”, said Ankit Jain, telecom analyst and assistant vice president at ratings agency ICRA.

Moreover, Airtel topped Jio in monthly subscriber additions in August, notching up 1 Mn more users than Jio. But user growth is only one dimension — another factor is ARPU (average revenue per user) where Airtel has a healthy lead over Jio — INR 162 vs Jio’s INR 145 for the June-September quarter.

Now, the ground is being prepared for 5G, where Jio is said to be in the lead with ‘limited participation’ expected from Airtel and Vodafone, who are reeling under a huge tax burden. The government is not expected to launch 5G spectrum auctions till late next year.

With 5G on the horizon and its multiple acquisitions lining up to form a cohesive ecosystem, it might be the case Jio would now focus on the future revenue and service strategy. Its eyes are set on 5G rather than widening the margins in the 4G play. Once 5G is rolled out, the speed of content delivery will see a huge shift, catapulting India into the next generation of telecom services.

It’s hard to see Jio not being at the centre of this — Ambani has made certain, there’s no piece missing.

Can Indian Ecommerce Stitch Itself Together?

Though Reliance’s rise to the top of the telco tree seemed like a breeze — taking place over three short years — the battle for ecommerce is expected to be prolonged.

Amazon’s Jeff Bezos is not about to wave the white flag in the battle for the Indian market. The US ecommerce giant is putting up a legal fight against Reliance’s acquisition of Future Group, claiming that it has veto powers on the basis of its 49% shareholding in Future Coupons, which in turn has a 9.8% stake in Future Group.

While courtroom arguments resumed this week after the Diwali break, the ecommerce market could hot up further as the government is looking to consider up to 26% FDI in ecommerce through the automatic approval route for countries that share a land border with India, including China. This decision is likely to accelerate more than 100 pending investment proposals that got stuck after the FDI policy was amended in April.

Can UPI Stitch Itself Together?

While foreign funding has helped Indian startups grow and scale up, there’s definitely a case to be made that global tech giants have made the most of the booming Indian tech market.

While Amazon is chiefly focussed on ecommerce, it has also invested in payments and UPI services, just like Google and Walmart (post the Flipkart and PhonePe acquisition). The pouring of billions of dollars by tech giants has skewed the UPI space despite inclusionist digital payments policies, given the state of businesses in this space.

UPI was supposed to be India’s response to the US card systems and its monopoly across the world. However, despite having achieved 2 Bn transactions a month, it’s ultimately the US companies Google and Walmart-owned PhonePe, who together control over 80% of the UPI transactions.

With merchant discount rate on UPI payments remaining zero, there’s very little incentive for smaller payments startups to enter the space, leaving the bigwigs to dominate. The foray of these big tech companies which can afford to foot the bill of zero MDR has created a lobby of sorts, while smaller Indian fintech startups continue to search for sustainability.

As Big Tech continues to seek greater influence over policy across sectors, it would be interesting to see how the ecommerce turf war unfolds between tech giants and India’s richest man.

Until next time,

Deepsekhar

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Can Jio Stitch Itself Together?-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience