If there has been one running theme to fintech in 2022, it is the RBI’s roving regulatory eye

With just a few days to go in 2022 , we have seen the year gone by through the lens of Zomato, Paytm, Amazon and other tech giants, it’s also pertinent to talk about the broader undercurrents in key sectors, particularly India’s fintech ecosystem.

If there has been one running theme to fintech in India in 2022, it is the RBI’s roving eye on the unregulated fintech business models, particularly around digital lending. We’ll see how this has thrown a spanner in the works for fintech startups in 2022, many of whom claim the rules favour the existing legacy banking ecosystem.

Before we dive into the fintech startup vs banks debate, here’s a look at our top stories this week:

- BharatPe Vs Ashneer Grover: The fintech unicorn has filed a criminal complaint and is seeking damages from Ashneer Grover and Madhuri Jain Grover. Here’s our story going behind the latest legal tussle

- Layoffs & The Law: With over 18K layoffs at tech startups this year, labour minister Bhupender Yadav has said that some downsizing can be deemed illegal, if it is not compliant with the Industrial Disputes Act

The Indian Fintech Story: Startups Vs Bank

Many of the regulatory changes in the fintech ecosystem in 2022 have to do with how startups worked in grey areas in the financial sector, which have an impact on a vast swathe of the population.

The RBI has spoken out about the influence of big tech companies on banking and finance, claiming it has systemic risks. And this was in the context of payments as well lending, where the influx of loan apps has created a major public interest problem.

“Even though innovations claim to thrive best when free of regulations, regulations/ legislations are needed for sustainable growth of a sector,” an RBI report in May said.

Lending Guidelines Eat Fintech Pie

Soon after this, the central bank changed the rules around lending through PPI or digital wallets, which had grown prevalent thanks to fintech startup partnerships with banks and NBFCs. Almost overnight, the likes of Slice, Uni, Jupiter and LazyPay had to change their lending model and rework features that disrupted operations.

Further, RBI also released the long-awaited digital lending guidelines, which includes the potential for legislative intervention in the segment. While the guidelines primarily apply to banks and other RBI regulated entities, it has created some scaling-up challenges for digital loan apps who work with these players.

Lending is really the only vertical that is providing sustainable revenue growth to startups given that the zero MDR ruling for UPI has made revenue generation tricky for apps in this space. So the RBI’s heightened focus on lending is definitely a headwind for fintech apps.

Banks Missed The UPI Bus

Many of the regulations have attracted criticism from the wider fintech ecosystem for being protectionist of the legacy banking infrastructure. And there’s certainly some credence to these claims given recent statements from RBI officials in the context of fintech startups.

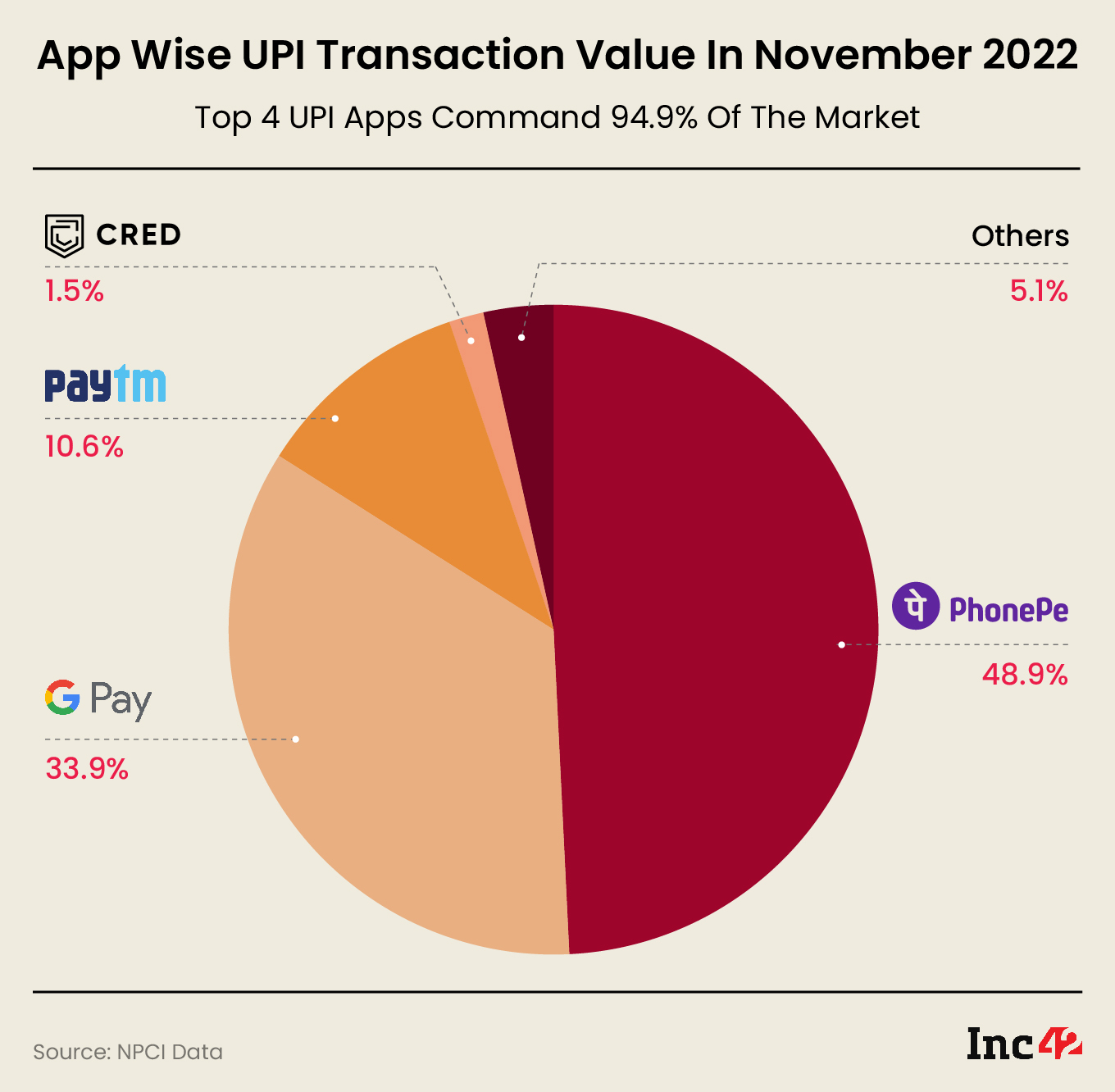

For instance, the current market leader PhonePe was one of the key players involved in the early stage of UPI development, along with YES Bank, which was the maiden banking partner for the fintech giant’s UPI play.

The companies associated with UPI development have been alleged to have gained a significant leg-up over regulated banks without whom the UPI network would not work.

Earlier this month, RBI deputy governor T Rabi Sankar claimed that banks had ceded the UPI race to fintech startups and non-banks who are dominating a major chunk of the digital payments space.

He also warned that disruption from fintech players can have a cascading effect on the wide business of banks because of how dominant these apps are in everyday use.

The comments came after the NPCI walked back its deadline for the rule limiting the transaction share of third-party UPI apps to 30%. While apps with a lower market share failed to scale up, the likes of PhonePe and Google Pay have cemented their position at the top of the UPI pile over the past four-five years.

Interestingly, Axis Bank MD Amitabh Chaudhry claimed a day after Sankar’s comments that banks do not have money to burn for building loss-making businesses. “We didn’t have ₹3,000 crore of money to make a loss on,” he said pointing to the lack of cash flows and high valuations for the likes of Walmart-backed PhonePe.

We have written about the need to evolve the UPI beyond its current state to ensure a level playing field for all players.

While finance minister Nirmala Sitharaman recently said that the goal is to cross 1 Bn UPI transactions per day in the next five years, doing this will require significant changes. Especially if the RBI wants to check the rampant growth of private fintech players.

Uphill Climb For Neobanks

Opposition to the rise of fintech players is not new. In the past, the RBI had claimed that it would regulate big tech entities and fintech companies that are applying for non-bank finance licences.

Backed by the quality of their retail asset holdings, large banks are filling the tech gap which is what fintech players had banked on as a differentiation. But the fintech threat is very much a big one for smaller NBFCs and some state-run lenders that may not have the capacity to build tech stacks.

In particular, the threat arrives in the form of neobanks that not only have the VC money to acquire users by the millions but form partnerships with banks to offer digital banking services.

Currently, neobanks in India cannot operate without partnerships with regulated entities. This locks out the likes of Niyo, Open, Freo, Jupiter, RazorpayX, Fi.Money and others from running their own banks. Founders in this space believe that RBI’s regulations are a necessary leash, because India’s digital banking infrastructure is still not very robust, especially in the long-tail of the market.

“We understand that there is a real threat because a lot of small NBFCs and cooperative banks do not have the VC money to compete, so the RBI regulations are necessary till the time the Indian banking customer base does not mature to a greater extent. And that will take years,” according to the founder of a Bengaluru-based neobanking startup.

Will Jio Upset The Indian Fintech Cart?

Even as fintech startups look to compete with banks while also collaborating with them in many ways, a major disruption could arrive in the form of Jio Financial Services (JFS), the Reliance company that is set for demerger and listing.

According to a report by Macquarie Research in late November, JFS could become India’s fifth largest financial services firm after HDFC Bank, State Bank of India, ICICI Bank, and Axis Bank in terms of the net worth.

The Mukesh Ambani-owned company announced in October that JFS will acquire liquid assets to back its lending play and incubate verticals such as insurance, payments, digital broking, and asset management over the next three years. It also claimed to have the regulatory licences to run these financial services.

Analysts had already pointed out that Paytm and other fintech giants could face great risks from the entry of Jio. While Reliance may not be able to get a universal banking licence given the RBI’s strict scrutiny on dominance in the market, it already has an NBFC licence for lending to consumers and merchants.

Plus it has the retail network and telecom user base to capitalise on its fintech play. Jio’s entry is still some way away, but along with the RBI’s evolving regulations, it’s yet another headwind for fintech startups.

2022 In Review: Our Much-Awaited Annual Recap Is Here

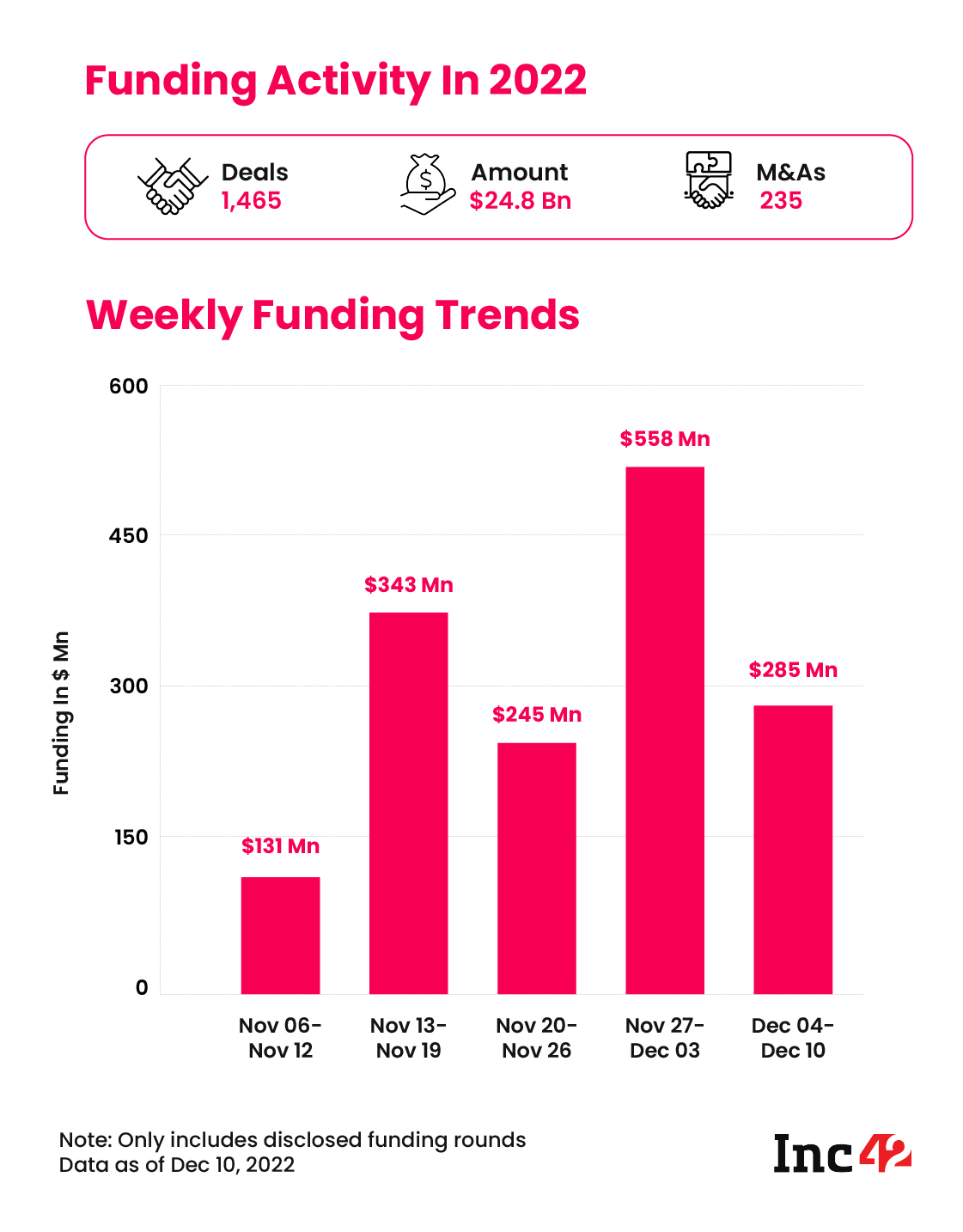

Inc42’s 9th Annual Review series went live this past week, where we are recapping the year that was — from the highs to the lows. From euphoria and record-breaking funding in 2021 to caution and slowdown in 2022, we have seen a big swing.

Join us as we revisit the downfall of edtech, the increasing number of founder exits, the state of M&As, and answer the question: what’s next for Indian startups in 2023?

Bookmark this page to read our entire 2022 in Review series

Sunday Roundup: Startup Funding, Top News & More

- Funding Update: Indian startups raised $285 Mn this past week, with HealthKart’s $135 Mn Series H accounting for half of this tally

- Tesla In India: Union minister Nitin Gadkari yesterday said that Elon Musk’s Tesla is welcome to launch in India only if the EV giant makes its cars domestically.

- Paytm Buyback: Paytm’s board will meet later this week to consider a proposal for share buyback, with its share price plummeting in the past month amid a massive sell-off

- Snapdeal Pushes IPO: The ecommerce giant has shelved its $152 Mn IPO plans given the prevailing negative public market sentiment around new-age tech companies

- India Streaming: India is reportedly home to around 423 Mn users of OTT streaming apps in 2022, with paid subscriptions being dominated by male users

That’s all for now. We’ll see you again next week with another weekly roundup.

Ad-lite browsing experience

Ad-lite browsing experience