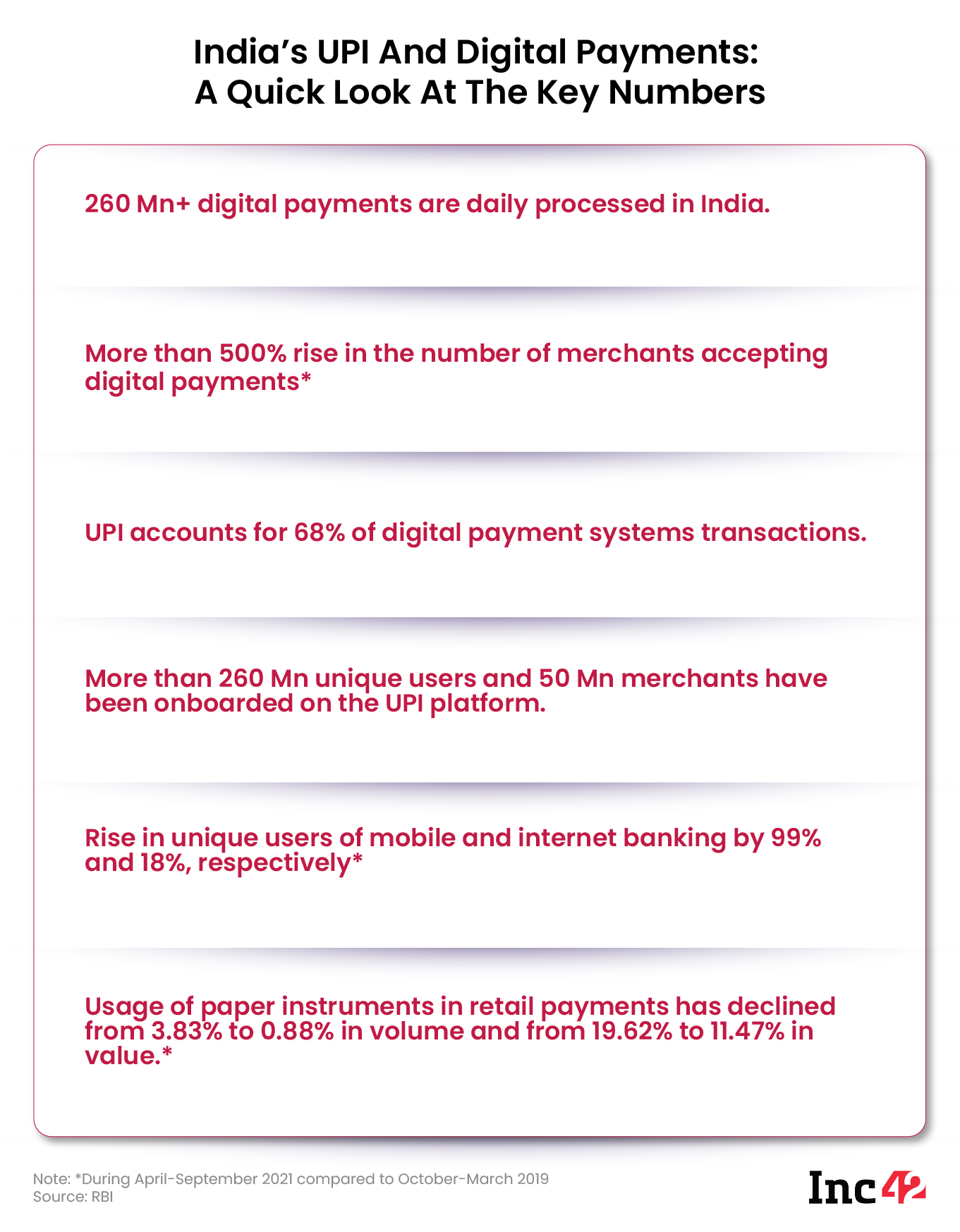

UPI transactions account for 68% of the 260 Mn+ digital payments daily processed in India

With UPI123Pay which enables UPI payments for feature phones, the RBI wants to tap another 400 Mn users

Despite its success, India’s homegrown digital payment system is facing many challenges, such as onboarding a billion users, providing adequate support, zero-MDR and the behavioural inertia towards cash payments

In the past few years, the ubiquitous UPI (Unified Payments Interface) has changed how India makes real-time payments every day. The good thing about the shift from cash to cashless convenience is that the digital payment ecosystem has gone beyond the privileged and the tech-savvy. It has brought its benefits to the masses, thanks to the push from the government, consumer-payments apps and the new-age fintech startups.

Even roadside vendors like Vineeth use it for their everyday transactions. He sells coconuts on 100 Ft Road, Indiranagar, and the business is booming. “Digital payment has increased our sales by 50% or so,” he pointed out.

“When using cash, it took double the time to serve each customer as I had to give them the correct change. Sometimes, customers just went away because we did not have change. With QR codes, it is time-efficient and easy for everyone. Customers need not carry their wallets anymore; their mobiles will do,” Vineeth summed up the UPI impact on his business.

A quick recap of the underlying technology will not be out of context here. At the core of Indian digital payments is UPI, based on the JAM (Jan Dhan, Aadhaar and Mobile) trinity. Launched in August 2016 by the National Payments Corporation of India (NPCI), it is an instant, real-time payments (RTP) system that allows interbank peer-to-peer (P2P) and person-to-merchant (P2M) transactions through QR code payments on UPI-linked mobile apps. In brief, UPI has done away with all traditional silos and democratised digital payment in a country of 1.4 Bn.

Vinay Rajak, a software engineer and a regular customer at Vineeth’s stall, leisurely sipped his coconut water and recalled the benefits of the digital payment system. It was particularly helpful and he managed to live cashless for many months without using his credit/debit card.

“From tea and cigarettes to food, rent, utility bills and everything in-between are paid via UPI. It has reduced my dependency on cards and made a big difference in my life,” he said.

But it is not the story of India’s Silicon Valley alone. Since the demonetisation in November 2016, people from rural and remote areas were hugely impacted as cash had always been the bedrock of the Indian economy. Still, the country slowly changed tack and moved towards digital payments, especially UPI, due to its ease of use and a no-fee format.

Setting the goal for UPI, India’s finance minister recently averred that UPI target is to cross 1 Bn transactions per day in the next five years.

The Payment Revolution Rocks

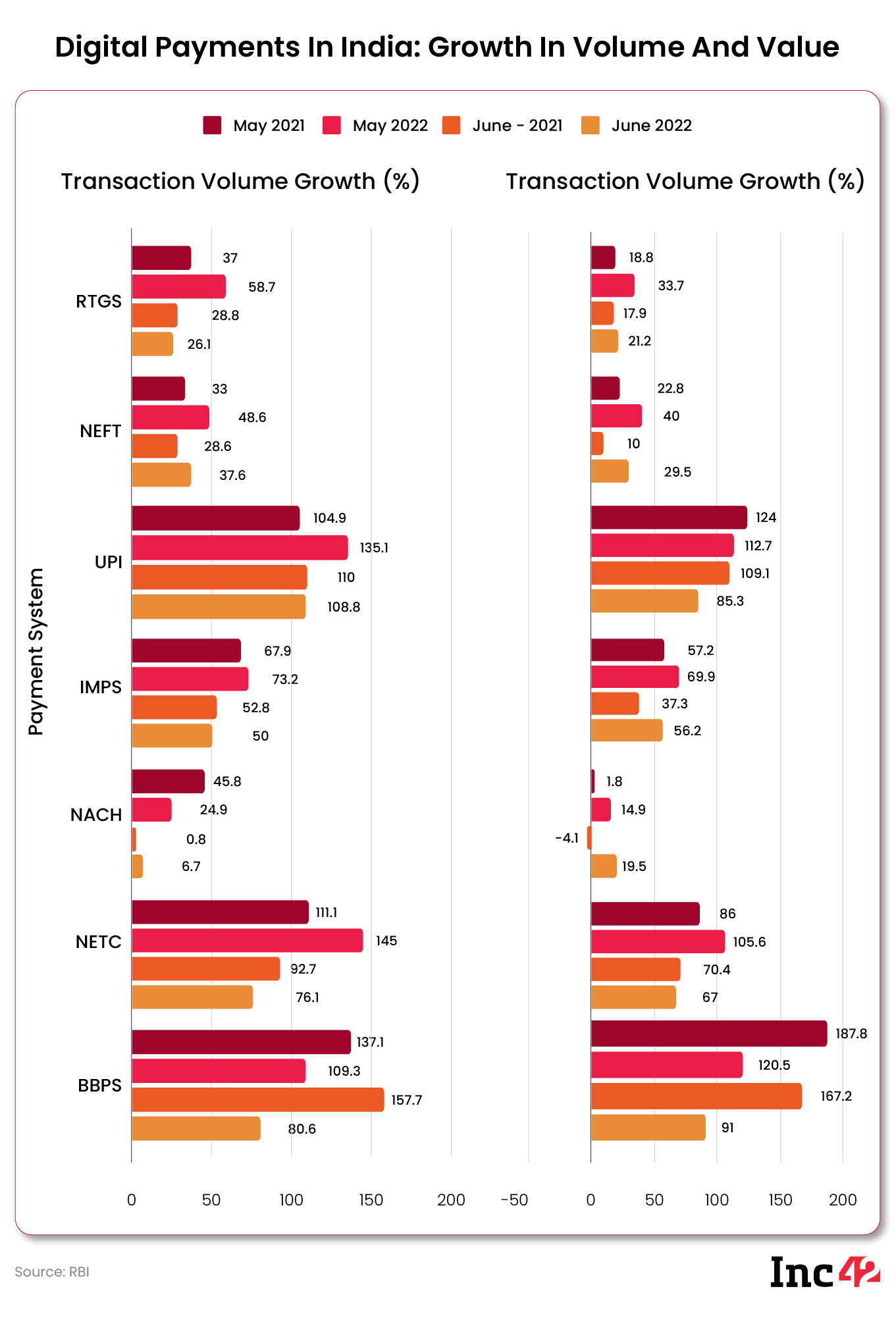

India recently celebrated its 75th year of Independence and made its mark across the digital payments landscape by offering a wide spectrum of services. “The country has made significant progress and moved to a leadership position in large value payment systems and fast payment systems, which contributed to rapid growth in digital payments,” an RBI report on benchmarking India’s payment system stated in July this year.

Commenting on the way forward, the report said that several UPI-linked solutions and interfaces could be used to ensure smooth transactions for cross-border payment enhancement, bestowing upon this popular system a truly global status. This also underlines that its USP lies in its ‘universality’ and varied use cases.

“Whether you are paying a flower vendor or a milkman or something as complicated as cross-border payments, UPI has evolved from a possibility to a preferred approach or a de facto method to pay anyone, anywhere in the country,” said Sanjay Swamy, partner at the Bengaluru-based early-stage micro VC fund Prime Venture Partners. “Recently, I was vacationing at Hampi and a paraplegic was there, selling guidebooks. When I asked him how I could pay him, he pulled out a QR code on UPI.”

The success and growth of UPI have been unprecedented, not just in India but globally, according to Swamy. Currently, India has nearly 26 Cr of unique UPI users, with the transaction count crossing 628 Cr in July 2022 and the value up at INR 10.63 Lakh Cr. Better still, the Reserve Bank of India has recently allowed the linking of credit cards to UPI platforms, starting with RuPay. Prior to that, only debit cards linked to savings/current accounts could be connected with the UPI platform.

UPI payments are currently available in seven countries, including Nepal, Bhutan, such as Singapore, Malaysia and the UAE, among others. India is already in talks with 30 more countries for UPI integration.

“A lot of that credit should go to the design and architecture of the platform,” said Swamy. “As we were trying to mimic cash, three things were required. First, transactions must happen in real time. Next, it should ensure 100% value transfer. And finally, there should be anonymity (like we experience in cash transactions). Barring the last one, UPI has fulfilled the other two criteria, and that is quite significant. The security and convenience of digital payment is a big factor as you don’t have to carry cash all the time.”

Could there have been better alternatives to UPI? Before its launch, digital payments in India were going the US way – plastic money or cards, to be precise. But it was a credit-focussed system neither meant for every Indian nor feasible to replicate on the current scale. With UPI innovation, India has toppled the global norm of digital payments, making things faster, safer, more scalable and affordable.

Commenting on UPI, New York-based economist Nouriel Roubini and professor at New York University said, “This is the true Fin Tech revolution in digital payment systems. Billions of users and transactions at very low or no cost.”

To furher strengthen the UPI network, the RBI has announced plans to launch RuPay credit card on the UPI network, low-value transaction focused solution UPI LITE, and Bharat BillPay Cross-Border Bill Payments.

Speaking on the sidelines of Global Fintech Fest 2022, RBI governor Saktikanta Das said, “In collaboration with the stakeholders, three exciting new products are being launched…Two of these pertain to enhancing the feature set of UPI by facilitating small value transactions through UPI LITE and linking credit cards to UPI. The third initiative is the enablement of cross-border inward bill payments using Bharat Bill Payment System (BBPS).”

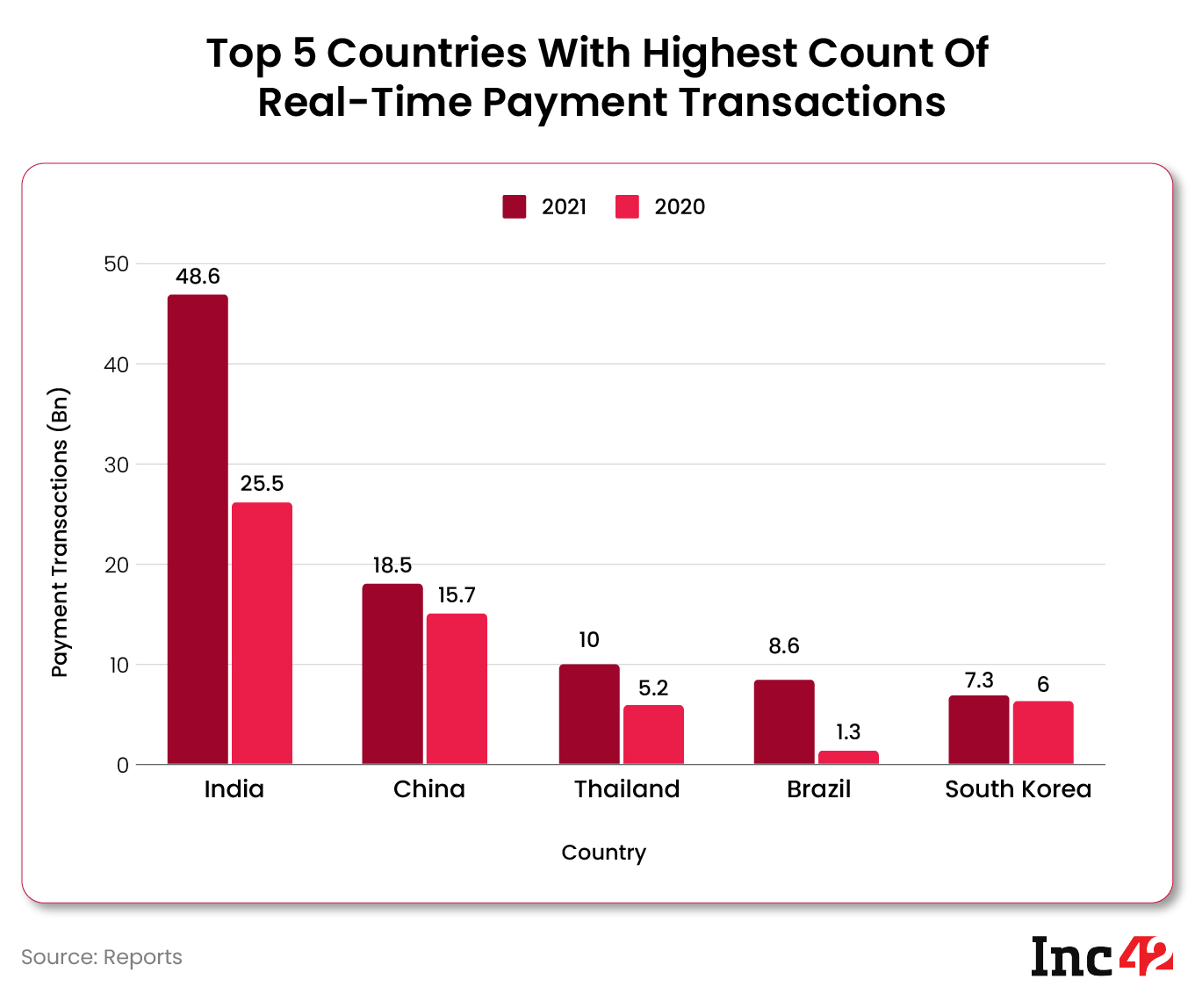

India Accounts For World’s Largest Real-Time Digital Payments

“India leads the world in real-time digital payments by clocking almost 40% of all such transactions,” PM Narendra Modi

With 48 Bn+ digital transactions in its kitty, India topped the global list in 2021. It was almost 3x the transaction count of China, a distant second clocking 18 Bn, and 6.5x the volume of the US, Canada and the UK.

However, the most significant achievement of UPI is to help people outgrow their overwhelming dependence on cash. Millions of people are now comfortable with digital transactions, said Sanjay Jain, Fellow at the Gurugram-headquartered think tank iSPIRT Foundation and chief innovation officer at the Ahmedabad-based Centre for Innovation, Incubation & Entrepreneurship (CIIE).

“The confidence in the local ability to build world-class products has gone through the roof. As a result, we have seen a significant bump in made-in-India products,” he added.

iSPIRT is the umbrella organisation that helped develop UPI, Aadhaar, account aggregators and other software solutions to fulfil the requirements of a digital Bharat.

A BCG report also estimates that the digital payments market in India will more than triple to $10 Tn in the next five years, with non-cash contributions constituting nearly 65% of all payments. It means two out of three transactions will be digital by that time as opposed to two out of five transactions today.

UPI Drives The Rise Of Fintech Startups In India

Of the 21 billion-dollar startups in the fintech space, nine are payments unicorns, and all of them have integrated UPI solutions for a seamless checkout experience across platforms. Among these are storied companies like Razorpay, CRED, PhonePe, Pine Labs and Paytm. However, PhonePe led the UPI space with 47.7% market share in July 2022 and processed transactions worth INR 5.24 Lakh Cr.

But Swamy of Prime Venture Partners thinks this is only the beginning.

“It is fair to say that UPI is the backbone and helps fintechs with payments, lending, insurance, investments or other financial solutions. But we are yet to see how fintechs truly leverage the power of data generated by UPI transactions. The power of UPI – in terms of personalised and instant/just-in-time credit – has not been fully utilised yet,” he observed.

“The right business model to use this advantage should be co-lending with banks/NBFCs. That’s how fintechs can go mainstream in the coming years, especially with the Account Aggregator (AA) framework being rolled out now.”

Incidentally, AA is an RBI-regulated entity with an NBFC-AA licence that allows individuals to digitally access and share their financial data across all organisations on the AA’s network. Think of it as a large ‘open’ bank or FI, operating fast without silos and acting securely to meet a person’s custom requirements.

Challenges Galore Despite Advantages

Taking UPI To A Billion Users: As per the latest data, India has 260 Mn unique UPI users, but that may not be enough. The central bank, the NPCI and all other stakeholders are keen to take this indigenously developed real-time payments solution to every mobile phone user in the country. The growth potential is huge. A Deloitte report pegged the number of mobile subscribers in India at 1.2 Bn in 2021, of which about 750 Mn are smartphone users.

To expand digital payments further, the RBI has now launched UPI123Pay, which brings UPI to feature phone users.

“The initiative will deepen the digital ecosystem and financial inclusion,” said RBI Governor Shaktikanta Das. As there are more than 40 Cr feature phone subscribers in the country, the new solution will materially improve their options to access UPI, he said.

Ensuring Adequate Customer Support: Until recently, the UPI system offered zero consumer support, leaving the likes of Vineeth in the lurch.

“Sometimes consumers show us print screens that say payments have been made, but we do not get a timely confirmation. Then again, UPI payments fail and we don’t get the money. What’s more, there is no customer support. And nobody, neither Google Pay, Paytm, nor the banks are ready to look into the matter,” he complained.

Vineeth had a tough time when he tried to be in charge of the payments he received. Showing his Paytm QR Soundbox, he said, “I bought this Paytm machine for INR 2,000. However, I cannot realise the cost from my customers. They decline to pay anything extra.”

[For the uninitiated, Paytm Soundbox is a smart device that provides instant audio notification as soon as a merchant receives payment.]

Asked how best such issues can be resolved, the vendor had a helpful suggestion. “The current payment status must be displayed on the app and we should know where exactly the money is, the way Amazon shows the delivery status on its app.”

Aware of these pain points, the RBI launched a complaint management system in 2019 for filing transaction-related issues. But the system is cumbersome and still suggests contacting one’s bank for resolution. Now the central bank has developed a 24×7 helpline called DigiSaathi to respond to all product queries via a dedicated website, chatbot or toll-free calls.

UPI Is A Game Changer, But Who Will Bear The Cost?

UPI, one of the most successful digital public goods (DPG), is the best thing to happen to a Bharat where the fruits of innovation have largely eluded the masses. But it is not so this time. Like Vineeth, even the smallest merchants/vendors have adopted it and benefited. For both buyers and sellers, the outcome has guaranteed a smooth and inclusive payments ecosystem without the chaos and hassles of plastic money. The only glitch? Nobody is ready to pay for the newfound convenience.

Given the philosophy behind the policy of the public good (think of a children’s park built with taxpayers’ money but free for use), UPI services are currently free for customers and merchants. However, banks and payment service providers/third-party admins like PhonePe and Google Pay are struggling to cope with costs incurred in the zero-MDR (merchant discount rate) regime as merchants are no longer paying them the service charge.

Although the government has been compensating the banks on an ad-hoc basis, all non-banking PSPs/fintech startups in this space rue the lack of a sustainable revenue model as they have no other income to cover their costs.

Effective January 2020, the MDR issue has been a thorn in the flesh for all TPA/PSP stakeholders. According to a Mint report, the industry is estimated to lose INR 5,500 Cr from UPI and RuPay MDR made zero.

“Last year, the Govt gave INR 1,300 Cr to banks for UPI txns. So each taxpayer paid INR 600 approx for UPI to already profitable banks. TPAs like PhonePe, Google Pay and the like made nothing. While Paytm Bank gets some incentive from the Govt on UPI, Paytm as a TPA can literally unlock INR 800 Cr annual revenues from UPI MDR. Guess what that can do to its stock price,” tweeted Deepak Abbot, cofounder of IndiaGold and former product head of Paytm.

The latest RBI initiative to link UPI with credit cards will also have growth implications. To begin with, customers will have a wider choice of payments, and big-ticket purchases will rise now. Second, MDR will be back for all credit cards, including RuPay. The rate has been fixed at 2% of the transaction size, barring small merchants with turnover up to INR 20 lakh. Of this, 1.5% will go to the card-issuing bank as interchange, and the rest will be split as fees among RuPay (or other networks when they come in) and all acquiring entities.

Now comes a whole lot of tricky questions. Will merchants want to pay MDR after a long, lucrative zero-MDR spell on UPI? How will the charges vary for RuPay debit and credit cards? (According to media reports, transactions up to INR 2K on RuPay debit cards are MDR-free, while others have a 0.9% cap). Will networks like VISA and Mastercard experience a level playing field compared to RuPay? And finally, will the zero-MDR regime continue to push the number of acceptance outlets?

On the other hand, if the MDR exemption is gradually withdrawn, UPI, as the ubiquitous digital payment platform, may soon lose its charm, much like the BNPL model that thrived on short-term, zero-interest consumer loans.

There is some early thinking about this – MDR and transaction costs as you know are only a means to fund the payments network costs – not meant to be profitable large companies, says Swamy. “I think we will go through a bit of price discovery and “value based pricing” experiments – and companies will have to move into a model of ensuring consumers and businesses get value beyond movement of money if they want to build viable businesses in these sectors,” he added.

Are We Truly Heading Towards A Less-Cash Economy?

Adding to the challenges galore is the growing cash in circulation. Despite multifold increment in digital payments, the cash in circulation has increased by 9.2% as of March, 2022 to hit an all-time high of INR 31 lakh crore compared with INR 28.5 lakh crore in the year-ago period. In FY21, it was 14.5% of GDP.

According to an RBI official who spoke to Inc42 on condition of anonymity, there are reasons why cash is still stronger.

“It’s true that UPI payments have triggered a behavioural change in society. But the change is not fully organic. It has been fuelled by two consecutive events. First, the demonetisation, and second, the Covid-19 pandemic. As a result, a section of society was not comfortable with change and retained their cash-first mindset,” the person said.

Adding to that is the zero MDR, that has kept UPI ahead of the competition, he added.

On increasing cash vs digital economy, Swamy said, “Whether it’s demand for cash or digital payments, both indicate a growing economy. So, I would not take steps to control the cash flow. However, digital payments are bound to grow in many ways. Consider the low-value transit payments like bus or metro fares. If everything goes digital in a structured way, the numbers will rise significantly. But we must deal with infra issues (read network connectivity) before going fully digital.”

Ad-lite browsing experience

Ad-lite browsing experience