It’s been a year where the credibility of edtech has been questioned time and again, underlined by a major funding crunch, huge losses, restructuring and layoffs

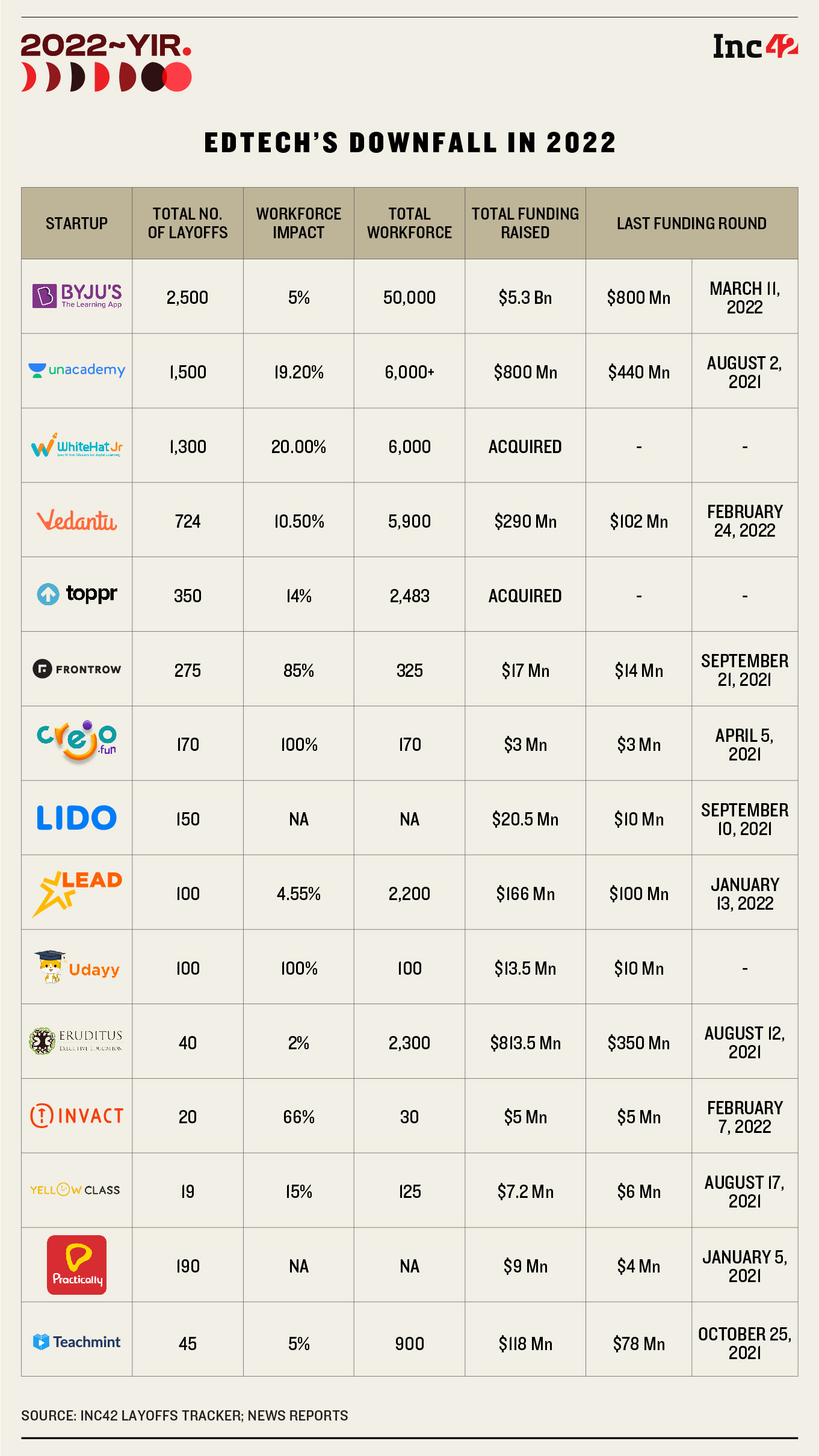

Over 7,500 employees — contracted and full-time — have been impacted by the downsizing in edtech, while five startups have wound up operations

By the end of 2023, investors believe some of the wheat will be separated from the chaff and this could result in a major push towards consolidation

This should be a forgettable year for Indian edtech startups in many ways — but having spent the past 11 months examining edtech’s frailties, we can tell there’s a sense that the hard lessons of 2022 will have some bearing on the next few years.

After the golden era of 2020 and 2021 when edtech adoption peaked and when funding was flowing in, the reopening of schools and colleges has made scaling up considerably more expensive for online learning startups.

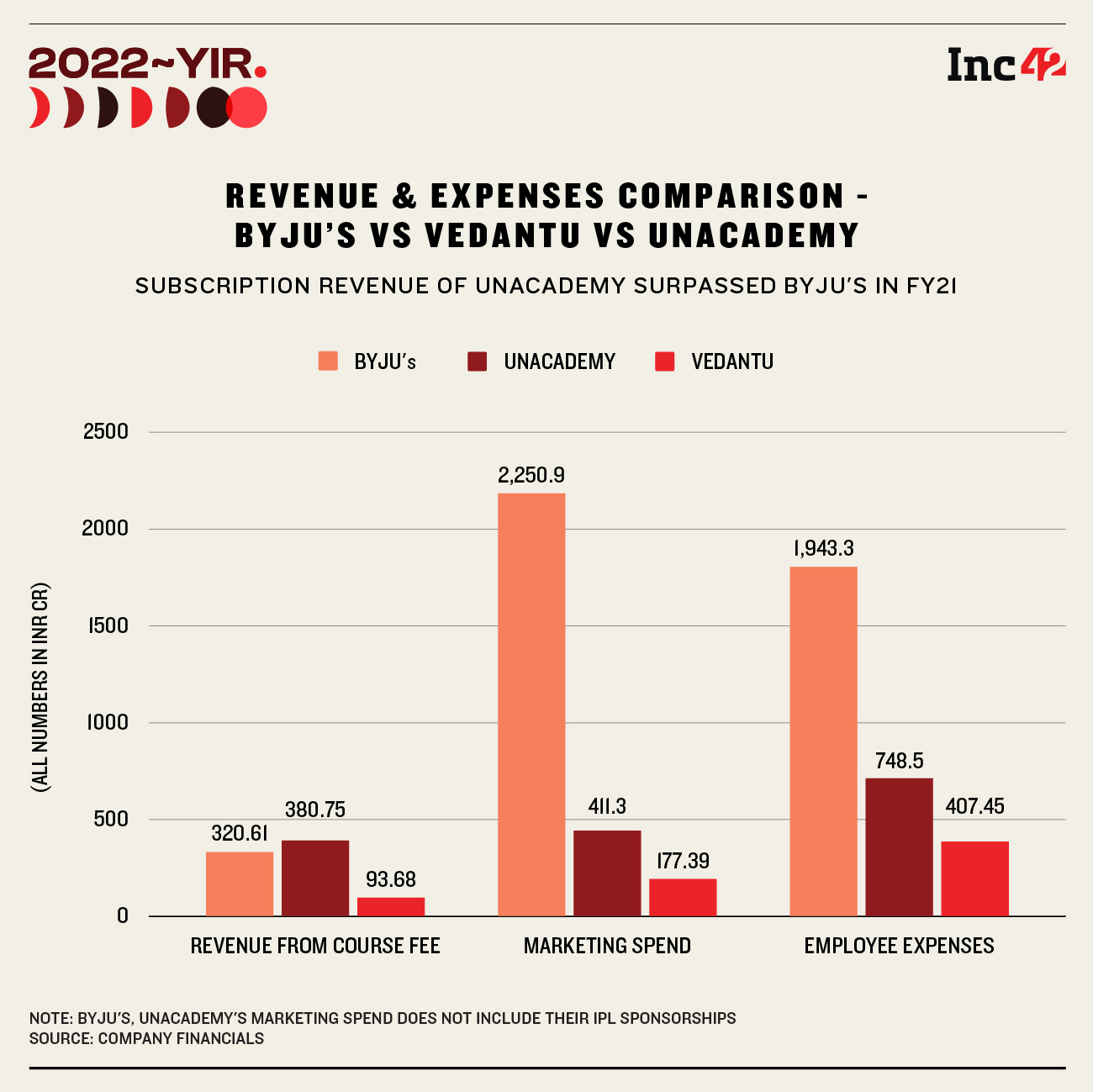

It’s been a year where the credibility of edtech has been questioned time and again, underlined by a major funding crunch leading to downsizing, restructuring and layoffs at BYJU’S, Unacademy and Vedantu — in other words, the three largest K-12 and test prep edtech unicorns. It was also a year where the extent of losses at edtech companies came under the glare.

Download Annual Funding Report 2022Besides the number of layoffs, edtech also saw the most number of shutdowns this year. We’ll come to these unfortunate casualties as well, but the biggest change in edtech has been the push towards hybrid or phygital models that has become the new turf war.

Investors are putting across a tough lesson to founders in relation to ambitious revenue projections and roadmaps for new products, which involve heavy marketing spend. New lines of business will also require more hiring.

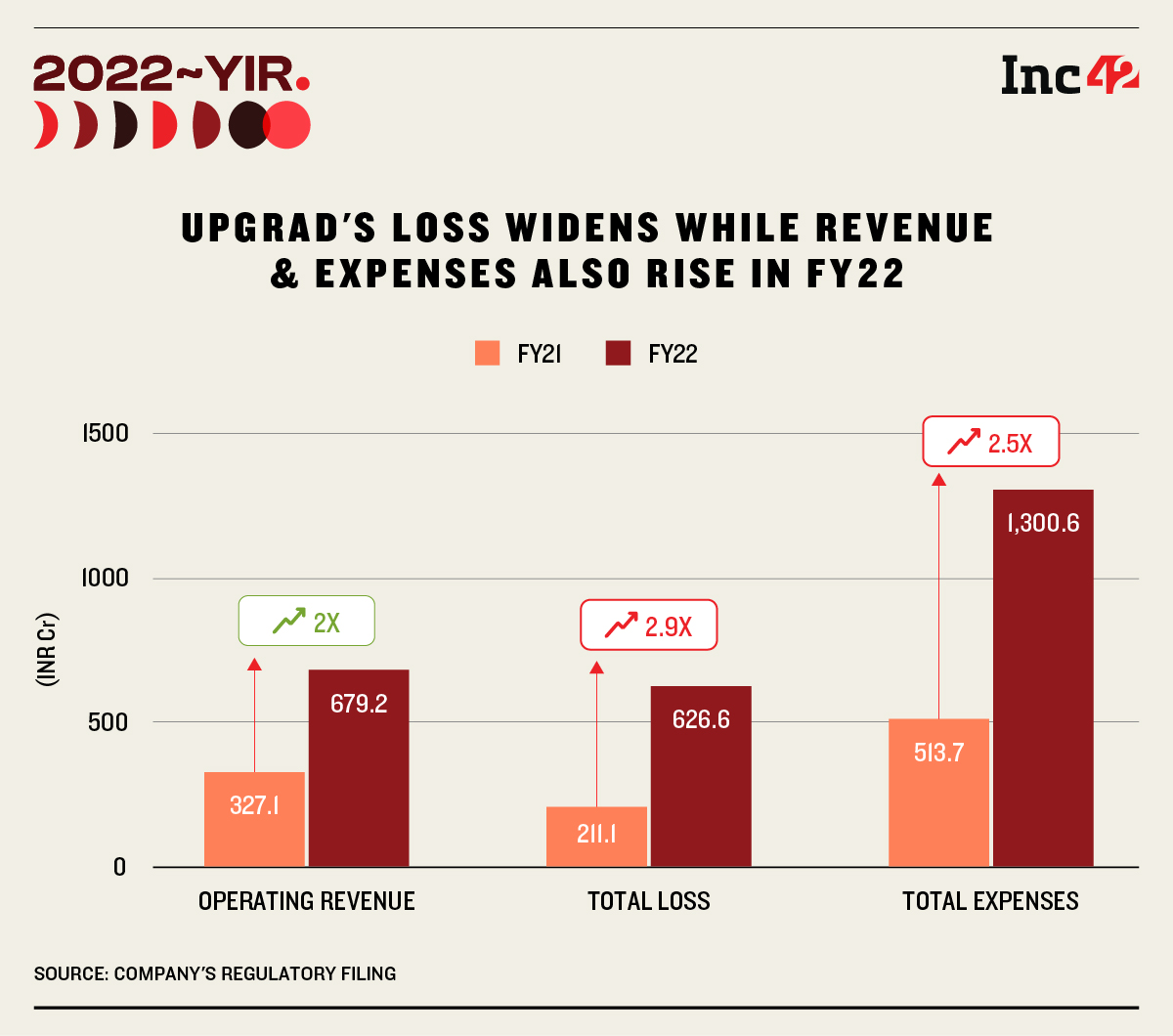

On the other end of the edtech spectrum were the skill development, certification and jobs-focussed models, which seemed to have gathered momentum as K-12 and test prep went through the grinder. But even here, the challenges are not small; for instance, losses have tripled for the likes of upGrad in FY22.

It would be unfair to analyse all these startups and their varied models under one edtech umbrella — some such as tech upskilling startup Scaler don’t even call themselves edtech for instance. But it would not be a stretch to say that this has been the toughest year for edtech as a whole.

Layoffs Hurt Confidence In Edtech

The biggest challenge for edtech startups in 2022 has been around layoffs, which has dented the livelihoods of thousands but also the confidence in the sector. Over 7,500 employees — contracted and full-time — have been impacted by the downsizing, with Teachmint’s layoffs this week being the latest instance.

These layoffs are a combination of macroeconomic factors as well as the push towards profitability, which has become the most critical metric for investors in 2022. While the global economic slowdown has brought in liquidity crunch and growth headwinds, the pressure from investors has been especially telling.

The fallout has also seen startups like Ronnie Screwvala-backed Lido Learning, Crejo.Fun, Udayy, Qin1, SuperLearn shutting operations.

Many of these companies are in the market to raise new funds and the cost-cutting this year is likely to narrow losses come March 2023, when the fiscal year ends. Will this moment of sustainability last though?

When it comes to losses, most edtech unicorns have fallen deeper into the red. Unacademy’s FY22 loss of INR 2,700 Cr came soon after BYJU’S reported INR 4,600 Cr losses in FY21.

According to BYJU’S investor Prosus, the company’s revenue has grown by nearly 90% during the first half of FY23, thanks to its acquisitions and BYJU’S FutureSchool growth outside India. But no word on whether this has resulted in a profit.

BYJU’S is yet to report its FY22 numbers, and had earlier claimed that it had reached INR 10K Cr in top-line revenue for the financial year. But this is not likely to have come at a profit, since the company has gone ahead and laid off over 2,500 employees, shut offices in nearly 60 cities and restructured its sales team completely.

All indications are that Vedantu will have another loss-making year in FY22, but its FY23 revenue is likely to be boosted by the Deeksha deal.

Edtech unit economics were not helped by the boom during the pandemic which had created a bubble for startups who perhaps did not envision the slowdown. Ignoring the difference in scale between these various companies, the millions burnt in promotions and marketing that have not brought in the desired results.

Beyond K-12, on the higher education side, upGrad saw its loss swell up to INR 626.6 Cr in FY22 from INR 211.1 Cr in FY21. Acquisitions and an increase in advertising spending meant that upGrad’s total expenses jumped 2.5X to INR 1,300.6 Cr outpacing the 2X growth in revenue.

Gazing At The Edtech Crystal Ball

Investors and valuation advisors believe that such spending without a clear and measurable ROI has sharply corrected startup valuations. This is particularly true about the test prep and K-12 segment.

Hybrid Is The New Focus

But ultimately, the offline business has taken precedence and the cost-cutting is largely on the online learning side where the growth has been less profitable. BYJU’S, Unacademy, Vedantu, PhysicsWallah (PW) have all ventured into offline classes for test prep. In response, existing legacy coaching centres — particularly Allen Career Institute — have ventured into hybrid models too.

Setting up offline centres, hiring teachers for centres is also an expensive proposition.

BYJU’S acquired Aakash for $1 Bn to enter this space and has expanded its Tuition Centre hybrid model for K-12. Vedantu spent $40 Mn to acquire offline learning chain Deeksha, soon after layoffs of more than 700 employees.

Unacademy has taken on Allen and others with its new centres in Kota and other student hubs. This offline learning foray includes 2x-3x pay hikes for teachers being poached from Allen, with annual income ranging between INR 1 Cr and INR 10 Cr for some of the more high-profile educators, as per our sources.

PhysicsWallah raised $100 Mn to set up its first physical learning centre in Kota this year and has rapidly expanded to other cities. PW ended FY22 with a profit of INR 98 Cr, the only edtech startup to be in the black when it comes to financials.

K-12 Takes A Backseat

Umakanta Panigrahi, Kroll India valuation advisory MD, told Inc42 earlier, “The correction is already ongoing. If you see the new normal, flat rounds are considered to be an up-round. And right now, investors also expect a better return on investment in physical learning rather than edtech.”

On the other hand, skill development and certification startups feel that their business models are more resilient to changes in offline and online learning. Bengaluru-based tech upskilling startup Scaler believes that while K-12 was always going to be prone to a slowdown after the pandemic receded, the need for job-focussed platforms remains as high as ever.

“Even though tech giants [Amazon, Meta etc] are going through layoffs, these are mostly in the US and international operations. In our experience, they are hiring just as much in India as before, if not more,” founder Abhimanyu Saxena told Inc42.

Similarly, upGrad is banking on the need for Indians to go through college-level courses that result in better job opportunities.

Even so, any slowdown in K-12 edtech adoption is likely to have some trickle-down effect downstream to test prep, certification and job-focussed skill platforms. It’s very possible that Unacademy and others might step into this arena, like BYJU’S acquired Great Learning for $600 Mn to take on upGrad’s core model.

Educators laid off at Vedantu, Unacademy and other companies believe the rush to expand offline and pay so-called star teachers huge salaries shows edtech giants have the resources to pay those they fired.

Indian Edtech’s Crucible Moment

The road ahead will not be easy for edtech unicorns. Investors are likely to infuse capital in Unacademy, BYJU’S and others as these giants look to make the run towards the IPO line.

As Unacademy’s Gaurav Munjal has hinted already in the past, the so-called edtech winter will get worse in the next few months. Many employees at BYJU’S and Unacademy fear that the cost-cutting measures and restructuring of teams will result in further layoffs.

For instance, the recent move to inside sales for BYJU’S has sparked fresh concerns among employees about the pressure to deliver targets.

While the hybrid model is the hot trend now, if it doesn’t prove to be the magic bullet that edtech startups expect, edtech giants will need to move swiftly to something else.

Any devaluations to edtech giants will have deep ramifications on the entire startup ecosystem, given that there is a lot at stake within this sector.

There’s still some bullishness that edtech will turn the corner, but the short-term horizon for edtech startups does not look rosy. We still don’t know whether the offline push will have desirable results for all startups.

Divya Gokulnath, cofounder of edtech decacorn BYJU’S, told Inc42, “With education, everything is for the long run. So, it’s tough to predict what exactly will happen in the next one year. However, it is certain that the outlook is positive for 2023 and beyond. BYJU’S is working hard to achieve group-level profitability and we continue to grow briskly in not just India but also across our global markets”

The competition will boil down to consolidation and the well-funded edtech startups are likely to sweep up smaller coaching centres in their rush to expand.

By the end of 2023, investors believe some of the wheat will be separated from the chaff — the startups that have managed to overcome the worst of the winter will be in a better position to capitalise. And this is primarily why the lessons of 2022 might not be so easily forgotten.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience