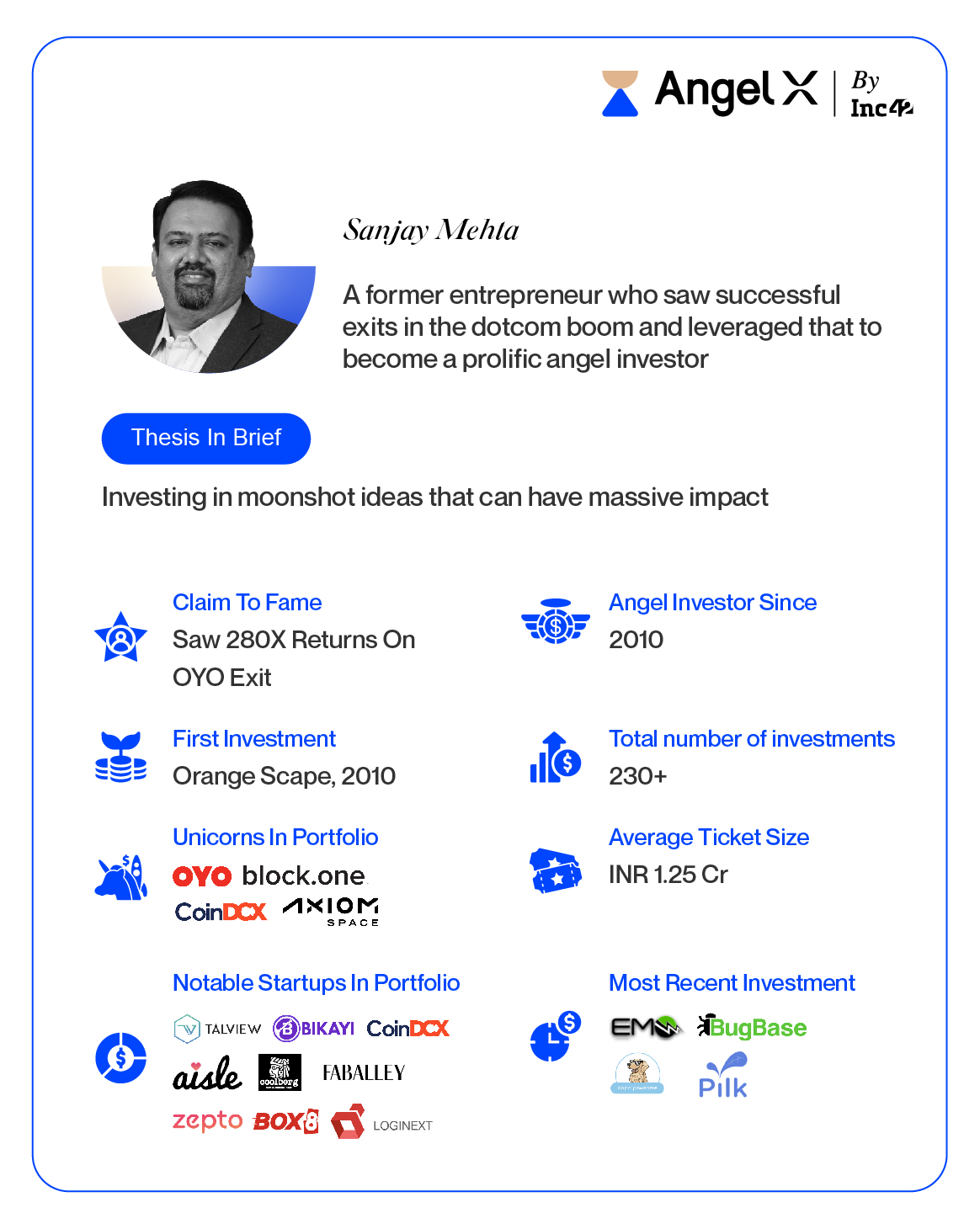

With four unicorns in his portfolio, a massive 280X exit from OYO and a burgeoning portfolio of promising soonicorns, Sanjay Mehta is one of the most prolific angel investors in the Indian market

Even as the investment and startup world is talking about a slowdown, Mehta and 100X.vc have decided to double the ticket size for investments to make most of the opportunity in green deals

Mehta believes that if angel investors can survive this turbulence with a healthy portfolio of growth stage and early stage bets, then they can reap bigger benefits from the bullish times that we expect to see in two years

With four unicorns in his portfolio, a massive 280X exit from OYO and a burgeoning portfolio of promising soonicorns as well, it is hardly a wonder that Sanjay Mehta attracts a huge following in the world of angel investments.

The Mumbai-based serial investor is habitually among the most active angel investors in India and has been a regular figure in the startup ecosystem since 2010, when the limelight was smaller and muted. After investing as a limiter partner in funds and through angel networks, in 2019, Mehta founded 100X.VC with a cohort-based investment model and an INR 125 Cr corpus (over $16.5 Mn) to back 100 early-stage startups.

Now in April, even as the world is talking about a slowdown, Mehta and 100X decided to double the ticket size for investments, because as the man says, “There’s no crisis. All angel investors should be in acceleration mode.”

That’s something he even professed during the early months of the pandemic in 2020, given that he is a firm believer in the power of technology to change the world.

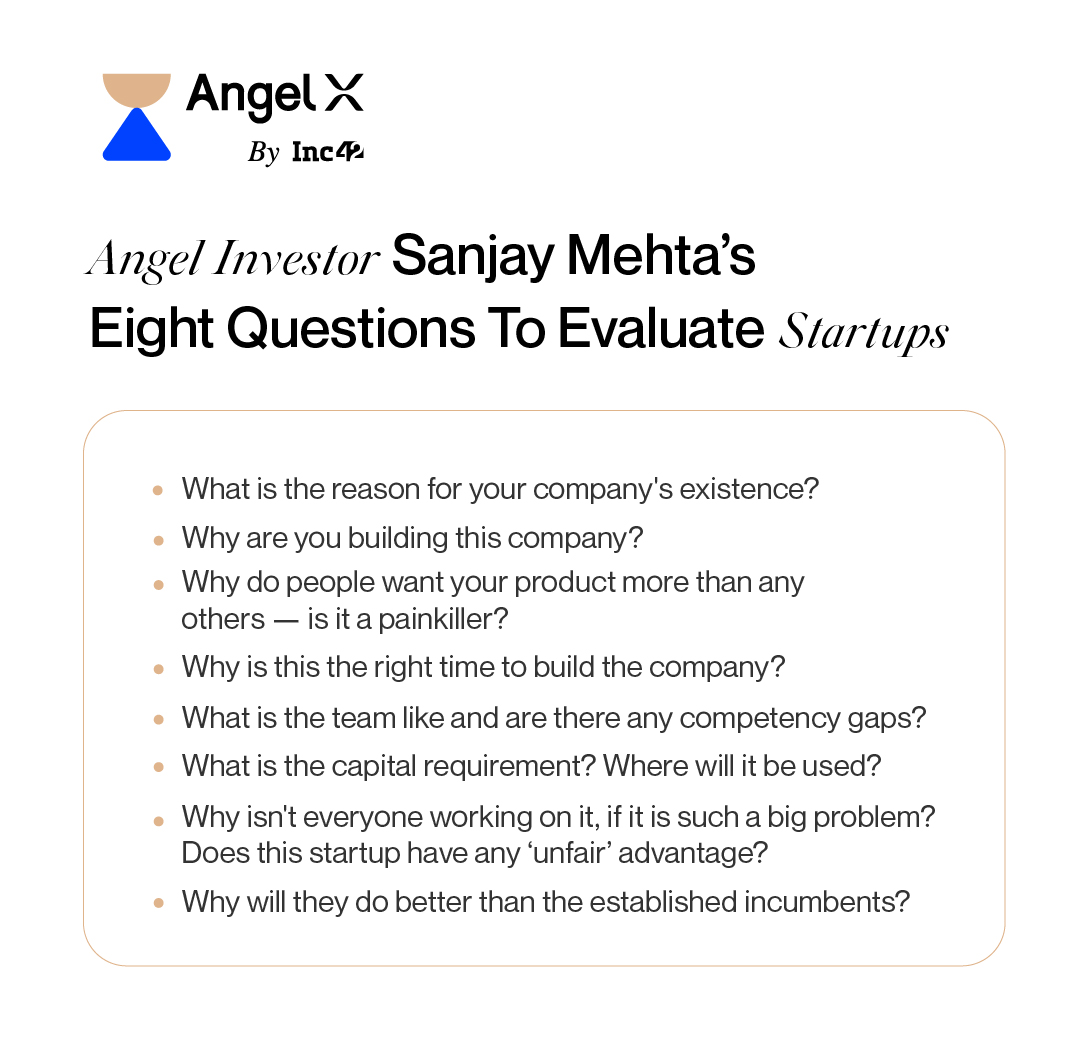

Speaking to Inc42 about how he approaches investment in this day and age, Mehta says his questions to founders and startups have remained more or less the same over the decade-plus of being an angel. He spells out the eight questions that should help all angels get to the bottom of the potential opportunity in any startup.

Edited excerpts

Inc42: How did you get your start as an angel investor? And you have seen the startup and tech ecosystem grow and mature tremendously — what were the landscape like a decade ago?

Sanjay Mehta: But I am someone who has seen the dotcom bust and my biggest learnings have come from how entrepreneurs deal with the whole cycle of ups and downs. What do they feel when ideas fail and when things go down? How do they hire and fire? And I have seen that up close.

I started as an entrepreneur myself and exited two software companies. My first brush with investments was as an LP actually in 2010. When you have exited companies, typically wealth managers come and pitch you to become an LP. So I started out with the Aditya Birla Private Equity Fund, which was the first homegrown private equity fund. That was my first exposure into this asset class, but I found it very passive. It was like receiving quarterly reports but that wasn’t really that exciting.

I also knew Harish Mehta, who is the founder of NASSCOM, and I was part of the regional council. In one of the meetings, he said, ‘Why don’t you join Indian Angel Network?’ He said that as angel investors, they always need insights on the companies that come their way he sensed that I can evaluate tech companies better. So I joined in and that’s where the real journey started.

Things were obviously much slower then. But unlike say being an LP I used to enjoy the process of evaluating deals that came from all over India. This was like active investing and I could contribute to startups. But becoming an investor was not by design, it just happened to me. I have been lucky in that sense.

Now 10 years later, I would say that it has worked out very well. I have four unicorns in the portfolio. I have constantly expanded my horizon and invested in various other asset classes, and now web3 is coming up, which can change everything again.

Inc42: Is luck such a big factor? And what exactly do you mean by you got lucky? Surely your experience as an entrepreneur in evaluating companies also has a role to play in this success?

Sanjay Mehta: I may be wrong or right I don’t know but this is my belief that you know, if you are committed to your cause, committed to whatever you are building, you will definitely see luck coming your way. I mean strokes of fortune built on hard work. And you also get lucky when you spend time around people who have already benefitted from this so-called luck in their past.

The most successful ones are the ones that commit themselves to success. Luck is a result of whatever actions you took earlier no matter how seemingly insignificant they are.

Like if I had not committed small capital to OYO, I would not have earned that success, but I saw the promise and because I committed I saw the upside. This so-called luck was a byproduct of hustle and hard work in backing the startup throughout its journey. And you obviously still have to have a thesis and can’t just say that luck will take you there.

Inc42: So let’s jump into how you did it.

Sanjay Mehta: I think of the thesis as a compass. It gives you direction. And it’s a living statement; you have to revisit it continuously as the information flow comes in, as you get more and more enriched by the changing environment. There’s a standard pattern for building an investment thesis, building blocks so to speak.

The first piece is the investment horizon: For someone who is starting out, it can be something like three years or five years, and then as you mature, it can grow to a ten-year horizon.

The second is your risk appetite — This answers the question of what kind of capital you want to invest and when you want the liquidity.

Third, we will figure out the sectors — Some sectors you will know well and others you may not. But that does not mean you pass up the opportunity for the latter. Find other angel investors, who are experts in that and piggyback with their expertise. This is also where the network comes in. Once you step into a new sector, learn as much as you can about it.

Lastly, we will demarcate our corpus and create a structure for the first cheque and the follow-on for the winners in the portfolio. This will give us the ticket size. There’s a saying in venture capital — Feed the winners, starve the losers. It may seem unfair, but that’s how it is and angels need to reserve capital for follow-on rounds.

These are the basic questions that will help anyone arrive at their thesis. But it will take at least six to 12 months to answer them properly. The first few deals can be a spray-and-pray approach, but by the end of the first year, one needs to have a bankable investment thesis.

Inc42: The horizon aspect is interesting because in the past two years, we have seen a lot of public markets mindset in startup investing. Did you have to alter your mindset when you started out? And how would you advise unfamiliar investors to approach this asset class.

Sanjay Mehta: I had an advantage. I was never a public market investor, because I was very focused on building companies. I always had a mindset of building things in India. And the same goes for my startup investing principle till today. At 100x.vc we don’t invest in any company outside India. Of course, I have a family office with my brother who stays in LA, so we invest into everything through that. But my personal thesis through 100x is to invest in Indian companies.

A lot of people think startups are a risky asset class. But for me, this is not a risky asset class, because this is the only asset class — the only asset class — where as an angel I can influence the outcome. If I buy Reliance shares, I can’t move it up or down. Same with real estate or gold or anything else.

But as an angel in a startup, I get the chance to work closely with founders, and I can influence the outcome. I give them introductions to VCs and customers, and help them build the product or in hiring. This is a huge advantage in comparison to the public markets.

So I believe private markets are the best places to earn a fortune — we ride the upside till the very end.

While you can influence outcomes, the exits are arbitrary, but there are opportunities where your risk is 1x and the upside is unlimited. Once you have that 20 companies, your capital is preserved and once you cross those 20 startups, you will see 2x, 3x, 5x returns across your portfolio. So a portfolio approach is very, very important, because that will automatically give you the long horizon.

My advice to anyone starting out is to start with a three-year horizon, and as your portfolio grows and you get reports after the first year, you will realise that you need to keep on investing. And as your portfolio grows, the horizon will automatically stretch.

Inc42: How did you build your playbook for evaluating startups and growing your portfolio?

Sanjay Mehta: At the stage we invest in, it’s so early that in many cases the product is pre-revenue or there’s no product market fit. So I have distilled down my 12 years of journey for other angel investors.

- The first question you answer is is there money to be made in this?

- Then I look at the team — will these people help me make that money?

- And third — perhaps the most important — the valuation. Essentially how much money will I make?

Sometimes the founders may be great and the idea may have the right timing, but the valuation is exorbitant. So even if I enter, I may not make more than 2x or 5x. So the valuation ceiling is important at this stage.

Then I ask some very clear 7-8 questions..

An angel investor is the investor who helps in discovery of startups. So I need to have solid conviction because then I can go out and sell my portfolio to VCs, saying this is a great deal. And that’s where you will get those eye-popping returns.

Inc42: When it comes to angels, founders always say that angels are not just investing capital, but it is their time and expertise and reach that’s more important. What’s your thought on this?

Sanjay Mehta: See more than anything it is about having faith in the founder or startup’s vision which is also something you have invested in. I invested in a company called Poncho Hospitality, which was a quick service restaurant chain. They wanted to bring Mexican cruising to Indian masses and believed that the taste and ingredients are similar enough to sell well in India.

Unfortunately, it didn’t work, because consumers did not think of Mexican as an alternative for Indian food and even today, that market has not grown in a big way. But the founders had grit and hustle, and pivoted to Box8, which took off.

And then I doubled down on it and now there’s no looking back. Now it’s a soonicorn with the name EatClub and a set of healthy brands. My first round was at an INR 2.5 Cr valuation and now it’s at more than INR 2,500 Cr valuation. It’s a soonicorn.

I invest not because the idea will not fail, but I invest thinking that it can become big and create a huge impact. I don’t take a defensive approach.

Working with founders closely and helping their idea succeed is my forte. I work very closely with the founders and I see that in India, by and large, founders are very easy to work with and very accepting of feedback.

And we are talking about first-time entrepreneurs in many cases. So the questions are very typical and anyone with a decent amount of experience will be able to guide them. How to hire a big gun or maybe even fire someone in a key position. In the case of B2B, some customers may be problematic so founders need to find the right balance to please them but not go overboard in servicing their needs.

Inc42: Let’s come to portfolio building. Why is it a key and what are your guidelines or rules in this regard? What has worked for you?

Sanjay Mehta: This is a non-negotiable for any angel investor — I have over 230 startups in my portfolio overall and four unicorns, including two in the US and some exits, but also 25-odd failures. But in perspective, there is something which is called power law. A small percentage of your portfolio will give you the highest returns.

Any successful investor’s portfolio will have more failures than successes. Focus on the magnitude of success, not on frequency of success. I may be wrong most of the time but whenever I am right I am bloody right.

For instance in OYO, I got a 280x return. And we exited it at a valuation of 700 Mn and in hindsight, someone might say I exited prematurely. At the post-unicorn valuation, I might have got a 7000x return. Same goes for CoinDCX, LogiNext and other companies.

When you invest, you should be convinced about the startup giving you at least 20x returns. And when things go right, you will be able to build a very large outcome, but if things don’t work out, that can happen even after Series C, Series D round.

Inc42: How should new angel investors look at the current market situation? Many hot takes about investing in a down market — what’s your thought about this?

Sanjay Mehta: So this is a double-edged sword. Because as an angel, one might have startups in the portfolio who may be able to raise funds even in a down market, but they will not be going for a bullish valuation which hurts your perceived upside. But on the other hand, I get green deals at a great value. So there’s some need to balance the portfolio that is tapering down and the new value deals.

If angels can survive this turbulence, then they will reap bigger benefits from the bullish times that we expect to see in two years. As someone who has invested since 2010 and 2011, I’ve seen negative sentiments many times, behaviours change in the climate of uncertainty, but this means more opportunities for entrepreneurs and investors also.

Now is the best time to build a business, startups can hire talent at the right cost, customer acquisition costs are always going down, competition is ever-present but right now people are not spending as much money. So if anyone is able to find a better business in this time, they can not only survive, but thrive. And that’s where I am putting my money.

This year I have already adjusted to the changing weather by deciding to increase the average cheque size to INR 1.25 Cr in this financial year. Angel investors everywhere are in acceleration mode.

In my mind, there is no crisis. We have been here before and we have done well. And any entrepreneur who is coachable and with the right investor, their relationship will survive and thrive in these times.

Ad-lite browsing experience

Ad-lite browsing experience