India has gone from 4G to 5G since Netflix’s arrival, but the OTT giant has still not figured out the Indian market

At a time when ChatGPT is creating a revolution in 2023, the pre-4G world of 2015 seems quaint and outmoded. But that was the time when the likes of Netflix, Hotstar (before Disney+) and Amazon Prime Video arrived in India with great ambitions.

Over the past eight years, a lot has changed though — as we will see — and we are now at the dawn of the 5G age. But somehow for Netflix, it might still feel like year one in India.

At least it feels that way, given that Netflix has still not completely figured out the Indian market. So, what went wrong in India for one of the first movers in the OTT space globally and how did rivals overtake the streaming giant? We’ll look to answer that, but first check out our other top stories from the week gone by:

- GoMechanic’s $30 Mn Distress Sale: Months after GoMechanic admitted to a fraud, it has reportedly found a buyer in the form of listed automobile ecommerce platform Cartrade

- The SVB Legacy: With the collapse of Silicon Valley Bank, will Indian startups with global operations find a safe haven that can replicate the SVB playbook?

- Announcing MoneyX: Building upon Inc42’s mission to accelerate India’s tech and startup economy, we are bringing MoneyX this July to unlock India’s domestic capital

Netflix’s Identity Crisis In India

From 4G to 5G and from metros to villages, the Indian internet revolution has well and truly set in and it has changed how Indians access all kinds of services, including entertainment. So, what is likely to frustrate Netflix more than anything is that it has not been able to influence behaviours of its subscribers beyond the cream of the Indian market.

From pricing to content, Netflix has had to constantly chop and change to find the India fit.

Analysts watching this space believe that Netflix has positioned itself as a TV substitute, which works well for mature users who eventually would have cut the cord anyway. But the global streaming giant has not been able to make deeper inroads where consumers are looking for a TV supplement, not a replacement.

“If you look at their journey, their pricing strategy has become more and more aligned with the positioning of a TV supplement, not a replacement. This is why they decided to launch mobile-only plans in India before anywhere else,” a private equity firm’s SVP who looks into the digital media sector told Inc42.

Down The Subscriber Funnel

India is not a new problem for Netflix. Even in 2021, founder and co-CEO Reed Hastings had said the platform is still figuring out the product-market fit for India, calling it “a more speculative investment” than South Korea or Japan. The India opportunity as a result remains an elephant in the room.

What complicates matters is that Netflix is bringing on subscribers at a slower pace overall. It added 7.6 Mn subscribers in Q4 2022 vs 8.2 Mn new subscribers in the same quarter of 2021.

Co-CEO Ted Sarandos said India saw a 30% increase in engagement and a 25% rise in revenue in 2022. But as it struggles with growth overall, this bump is not enough and has potentially come at a massive cost of roughly $400 Mn since 2019. It also set up its first wholly-owned, full-service, post-production facility in Mumbai in 2021.

Even as it cut subscription prices in India for certain tiers, Netflix is more expensive than Prime Video or Disney+ Hotstar for comparable plans. It’s also mulling an ad-supported model to boost revenue.

Netflix’s India subscriber numbers are unclear. Disney+ Hotstar’s paid user base stood at 57.5 Mn for the October-December 2022 quarter, while Amazon Prime Video is estimated to have over 17 Mn subscribers, as per an early 2022 report by Media Partners Asia. The same report claims Netflix had over 5.5 Mn subscribers in India.

As Hastings said after the December earnings results, “The great news is in every single other major market, we’ve got the flywheel spinning. The thing that frustrates us is why haven’t we been as successful in India, but we’re definitely leaning in there.”

The SVP quoted above added that a lot of Netflix’s problems stem from the fact that it relies heavily on data to add to its programming slate in India, and does not pay attention to the intrinsic cultural nuances that make the Indian market different.

Wiping The Originals Slate Clean

But no one in the industry is willing to count out Netflix yet. That’s not the point given how large the Indian market is and under penetration in OTT streaming. But there’s definitely a mismatch in terms of what Netflix makes in the name of originals and what works in India.

“The likes of Amazon Prime Video and Hotstar adapted for India, but Netflix continued to churn out dubbed foreign shows, which have a very limited audience in India. Netflix needs to copy Prime Video,” according to a Mumbai-based media buying director at an advertising agency, talking specifically about Amazon’s focus on Bollywood and Indian language originals.

In recent weeks, reports have emerged about Netflix changing its content strategy in India, after tweaking its pricing strategy for cheaper mobile-only plans. The company is looking to trim its Indian originals content budget by around 35%-40%, but this was not officially confirmed by Netflix. The streamer took its total Indian originals tally to 100 last year with 28 new titles in 2022.

The streaming giant is likely to focus more on marquee Bollywood and South Indian films to attract new subscribers. As a result, its original lineup in India is likely to thin down and become more localised. After the success of Oscar-winner RRR, for which Netflix reportedly paid close to INR 300 Cr, the company is banking on blockbusters to bring in new subscribers.

Reports indicate Netflix has decided to not renew originals as the investment in production and marketing is not generating much in terms of subscriber revenue.

With this change in strategy, like Prime Video and Disney+ Hotstar, Netflix is looking to win bids to licences for the biggest Indian movie titles to boost revenue and engagement. After years of experiments with global titles, perhaps Netflix has realised the game is about to get tougher and it needs to follow the herd for a short while.

Over-The-Top Rivalry

Complicating matters further, India’s streaming and OTT segment is more than Netflix, Amazon Prime Video and Disney+ Hotstar. JioCinema has entered the fray, and SonyLIV (having launched in 2013 before anyone else) is still plugging away. VOOT, Zee5, AltBalaji and a host of other platforms have been around for years too, besides several regional players such as Ullu, Stage, HoiChoi and others.

The entry of Jio Cinema has ruffled many feathers. Disney+ Hotstar has given up on major properties such as IPL and even HBO shows such as Game Of Thrones in recent months, which could cost it millions of subscribers.

When Netflix cut its prices in 2021, Disney+ Hotstar and Amazon Prime increased the subscription prices, which still remain lower than comparable Netflix lower-priced plans. These rivals realised that the only way to capitalise on their subscriber base is to keep giving them more or what they want and charge a little more. Perhaps they had an eye on JioCinema too, some analysts point out.

“The ARPU in streaming or OTT is going to fall like the ARPU in telecom soon after the Jio 4G launch. JioCinema being free is one of the largest acquisition bets in the history of tech. It will be an interesting few months in this space for Netflix and others,” the SVP quoted earlier added.

The problem is pretty much everyone else acknowledges that digital entertainment in India is largely about Indian movies and cricket, with animated and superhero content perhaps coming in third place.

As we take a look at the Indian OTT landscape, JioCinema has gone big on cricket with its $2.7 Bn IPL bet. Disney+ Hotstar gave up on IPL to focus on cash cows such as Star Wars or the Marvel Cinematic Universe. Zee5, SonyLIV and others are largely banking on Bollywood for success with a sprinkling of sports. Amazon Prime’s bundling of ecommerce services and video streaming works well given the audience overlap for both.

What moat does Netflix have? Not much today, if you ask those in the industry.

Sunday Roundup: Startup Funding, Tech Stocks & More

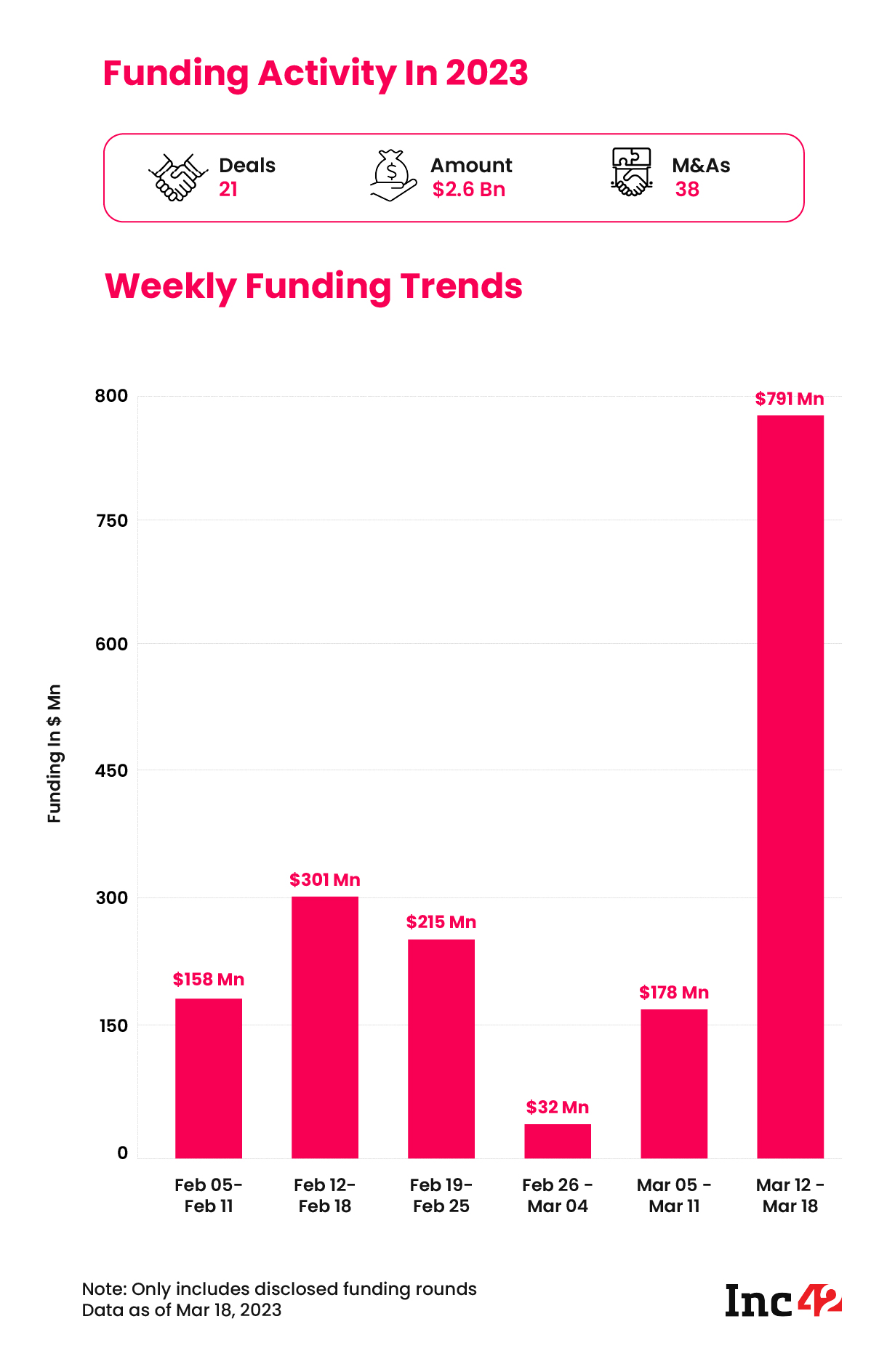

? Lenskart, PhonePe’s Mega Rounds: Lenskart and PhonePe accounted for almost all the funding raised in the past week. Their cumulative $700 Mn fundraise made up more than 88% of the total $791 Mn raised across 22 deals.

? TMS 2023 Is Here: With less than a week to go for The Makers Summit 2023, meet the headliners from the tech ecosystem who will decode the product strategies of India’s fastest-growing startups.

⌚ ixigo delays IPO: The travel platform has put its plans for a public listing on hold owing to the current macroeconomic environment.

? Apple Store In India: After much delays, Apple’s first brand-owned outlet is about to open in Mumbai at Reliance’s Jio World Drive.

? India’s Digital Rupee Data: Retail CBDC worth INR 2.73 Cr is in circulation as of February this year, as per the RBI’s responses to an RTI filed by Inc42. Here’s more about the digital rupee project.

Ad-lite browsing experience

Ad-lite browsing experience