Is video commerce or ‘vcommerce’ ready to step up and change the Indian ecommerce game?

Dear reader,

Here’s a piece of nostalgia for the 90s kids among us — teleshopping networks.

While my own parents were not particularly keen on buying the snazzy butterfly ab workout gadget that vibrated your whole belly or the 100-in-1 kitchen tool, the oversized village that was my apartment complex definitely had a few homes that did.

In many ways, teleshopping was the peak of TV broadcasting innovation.

It had all the trappings of what makes for good entertainment — showing not telling, interactivity, the mystery and excitement of price reveals. It kept the consumer engrossed, at least until ecommerce became the retail therapy of the 90s generation and transcended TV shopping.

Ecommerce as we know it today, though, is facing its biggest test in many ways. Marketplace giants are facing some really stern competition and regulatory threats, at a time when new models of engagement, consumption and commerce are emerging.

The one with the biggest potential is video commerce or ‘vcommerce’ as some call it.

Vcommerce essentially covers any platform that primarily uses video as an online shopping touch point. It’s intrinsically tied to rampant and exponentially-growing social media usage, a vibrant and growing creator economy and the penchant to buy online.

All three pillars are rising at roughly the same pace in the Indian market. Which explains the investor backing for vcommerce, live commerce and social commerce platforms.

If Instagram became a social network first and then entered into ads and shopping, these new-age social commerce platforms are taking a steeper ramp and going for it all at once. And in the aftermath of the TikTok ban in 2020, this is even more true.

The Prime Contenders

The most prominent model is an ecommerce platform backed by short videos — broadly known as social commerce — where influencers, content creators, celebrities and everyday consumers can create shoppable videos or sell products through affiliate links along with their videos.

Startups such as BulBul, Chingari, Trell, Moj, Josh, Woovly, MX TakaTak and others have carved out niches within this segment.

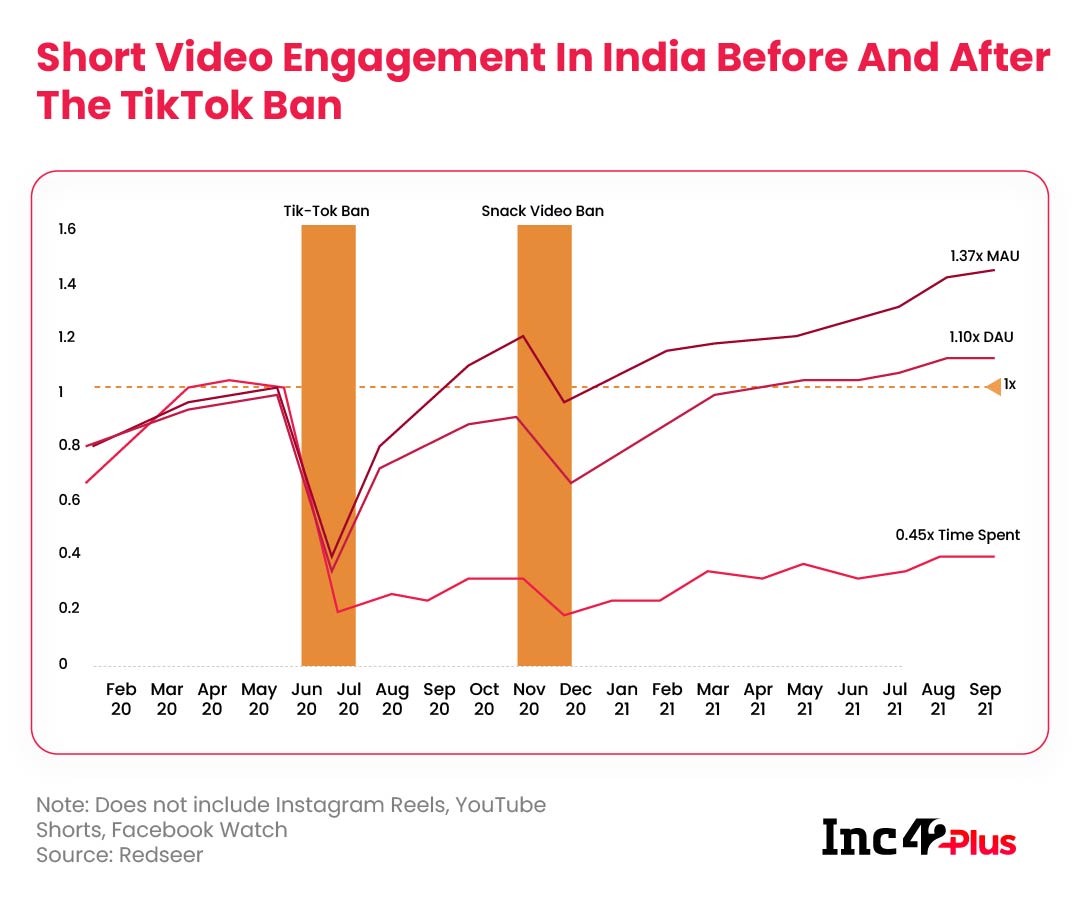

Time spent in Indian short video apps has almost doubled, while monthly and daily active user counts have grown by 50%-60%, according to a RedSeer report. This acceleration brought brands to the short video apps and the brands resulted in video and live commerce apps.

The short video market is expected to see a 3x growth in users in the next five years in India. Such is the growth in 2021 that consolidation is on the cards even at this early stage.

InMobi Group’s Glance, which owns short video platform Roposo, acquired social commerce startup Shop101 in June this year. YouTube stepped up its efforts in video and social commerce through the acquisition of social commerce startup Simsim in July.

Last month, Trell acquired women-centric community and influencer platform Womaniya, while Moj’s parent company Mohalla Tech was reported to be in talks to acquire Times Internet’s MX TakaTak.

Chinese Playbook In India

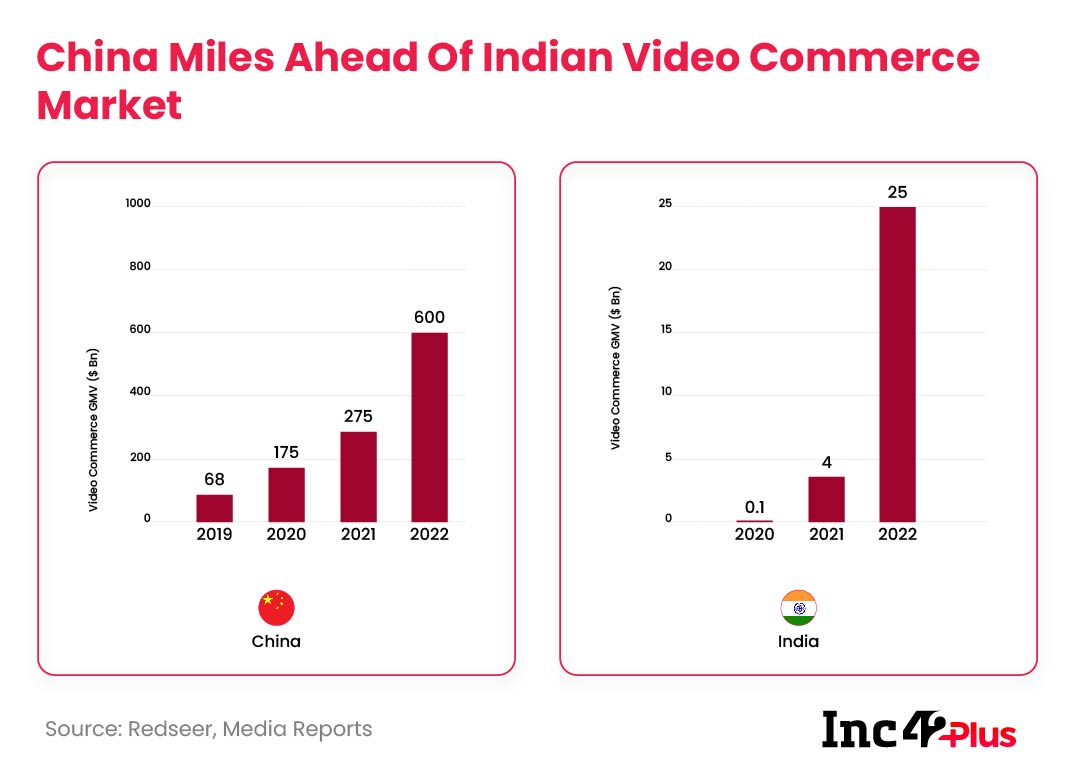

The fact that China, in particular, has managed to see massive growth in video commerce is also one of the driving factors. Typically, Indian startups look to the Chinese market for validation of models, but on this occasion, perhaps, the comparison is premature.

The Indian video commerce market in 2030 is projected to be just a fraction of the current Chinese market dominated by Taobao Live, Douyin (TikTok), Kuaishou (Kwai). So what’s the missing piece in the Indian vcommerce puzzle?

Digital retail and ecommerce analysts believe that one factor is per capita income, while another is the penetration of video commerce and digital payments. Most of the Chinese business comes from two or three economic zones, whereas the Indian market is more spread out, and companies need to cover hundreds of cities to achieve scale.

This makes video commerce operationally expensive in India, if one is serious about owning the chain and the customer journey.

Another major drawback in India is that new-to-ecommerce users will first have to go through the platform phase before trusting video commerce. Generally speaking marketplaces have built years of trust, which is paying off with new users, but their hold on new users is less strong these days. Even so it’s early days for vcommerce.

Up to 8% of Indian ecommerce will be driven by live and video commerce. Growth factors include the rise of D2C brands, which have deeper connections with social media, as well as the potential to help new-to-internet shoppers.

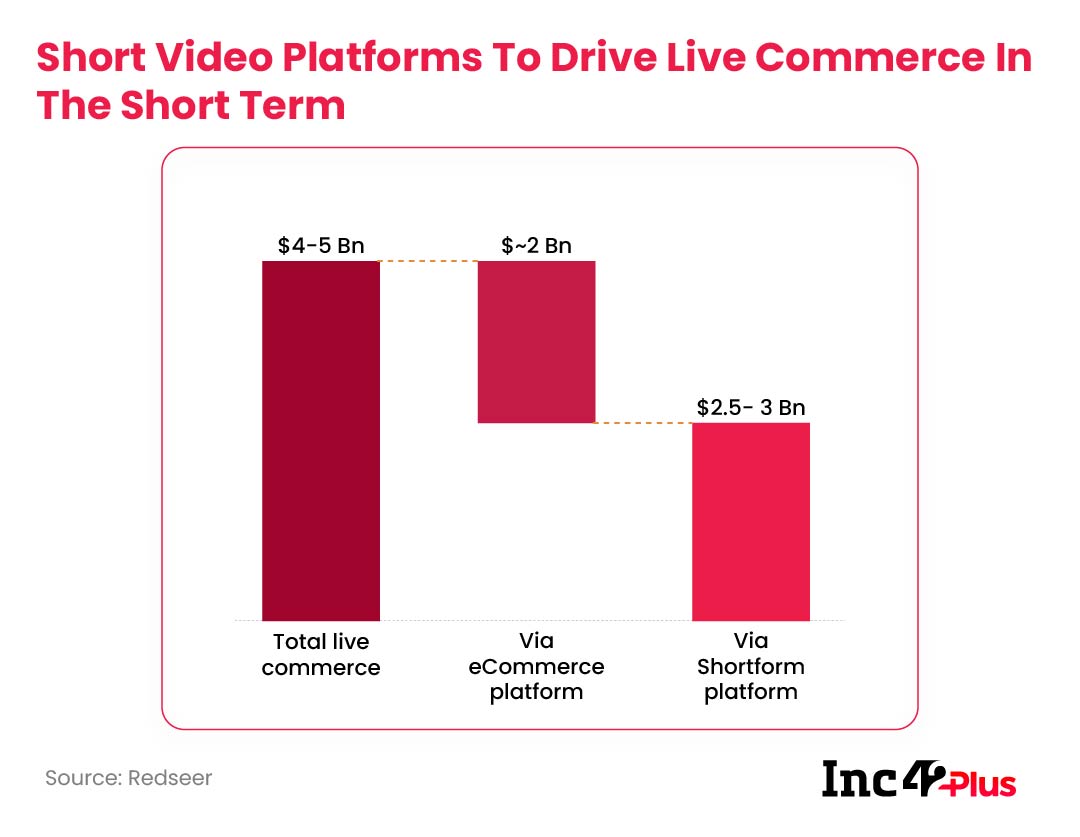

An earlier RedSeer report claims that short form video content is expected to majorly drive live commerce up to $3 Bn by 2025. Of all the categories, beauty and personal care (BPC) is expected to grow the highest with more than $1 Bn in GMV through live commerce. These are also incidentally among the D2C categories that are growing fastest.

“There exists a chasm for all D2C brands, but especially the new entrants. This chasm appears when a brand reaches a monthly recurring revenue of INR 35-50 Lakh. It is important to scale and escape this chasm, or a D2C brand may risk stagnating and shutting down,” according to Trell cofounder Bimal Rebba, who added that D2C brands need short video and video commerce platforms as much as the platforms need them.

But it is a cycle that could be virtuous or vicious. It all hinges on content and engagement, which largely depends on the ability of creators to engage their audience and keep them coming back for more.

Tug Of War: Content Vs Commerce

Even though not many video commerce companies would like to admit it, currently, they are just more technologically-advanced teleshopping networks, with their influencer hosts pretty much using the same click-bait titles and content to generate sales. Platforms such as GlowRoad and Woovly rely on micro-influencers, but even here the game is all about content.

But not all video commerce startups want to bank on content and mega influencers, even though they understand the power of video as well as the trust factor that having real people builds among shoppers. So a major opportunity that is quickly emerging in the Indian context is assisted ecommerce through video.

The dependence on content has forced startups to ask themselves whether they are a media business or a commerce platform. And efforts to move into commerce-first territories has resulted in assisted models emerging even within the vcommerce space.

For instance, Chennai-based BigBox is looking to bring video-powered sales to retail outlets, where salespersons interact with consumers on video while taking them through the catalogue. Another example is Pankhuri, which is targeting the weddings vertical within fashion ecommerce through style recommendations from designers and video catalogues.

335bazaar is looking at live streaming from stores and plans to open 100 stores in the next six months across all neighbourhood markets in Delhi and then expand to other cities thereafter.

Admittedly, these are just a few examples in a sea of short video social commerce apps.

At the moment, though, video commerce is nothing but teleshopping for the smartphone generation, but that’s largely because it is still early for the Indian market, according to one founder who is working with retail stores for video-based sales.

For example, we might see live events turn into mega shopping festivals, or entire fashion catalogues in future movies and shows on digital media platforms. Augmented reality or AR could play a role in turning any livestream into a shoppable stream without any intervention from the user.

It all depends on the pace of maturity for this market, and how quickly India bounces back from Covid stasis.

On the flip side, content is a key factor in any online transaction and cannot simply be ignored. So the balance will always be required, no matter which side of the middle you fall on.

More innovative video commerce models will emerge from India, but for now, we might have to bear with this slightly boring phase. On the bright side, it’s certainly not as cringey as its TV version, and in most cases, it’s just a short video.

What we must appreciate is that it’s all just starting and in that sense, the best is yet to come.

Till next week,

Nikhil Subramaniam

Images: Gayatri Sharma

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Let The Vcommerce Games Begin-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)