SUMMARY

Exit trends such as IPOs and M&As are a positive sign for startups, but there’s a flip-side too

Dear reader,

The first domino fell in February last year, and it’s only now that the domino effect is being seen across India. The pandemic is the biggest unforeseen challenge thrown up for businesses. But things that changed in 2020 have led to a 2021 that’s quite unlike any other year in the Indian startup history.

It has led to this perfect storm in the Indian startup ecosystem today, where funding is at an all-time high, startups are bullish about going public, founders and investors are seeing exits through acquisitions by corporates and late-stage startups, and some startups are even providing exits to legacy companies.

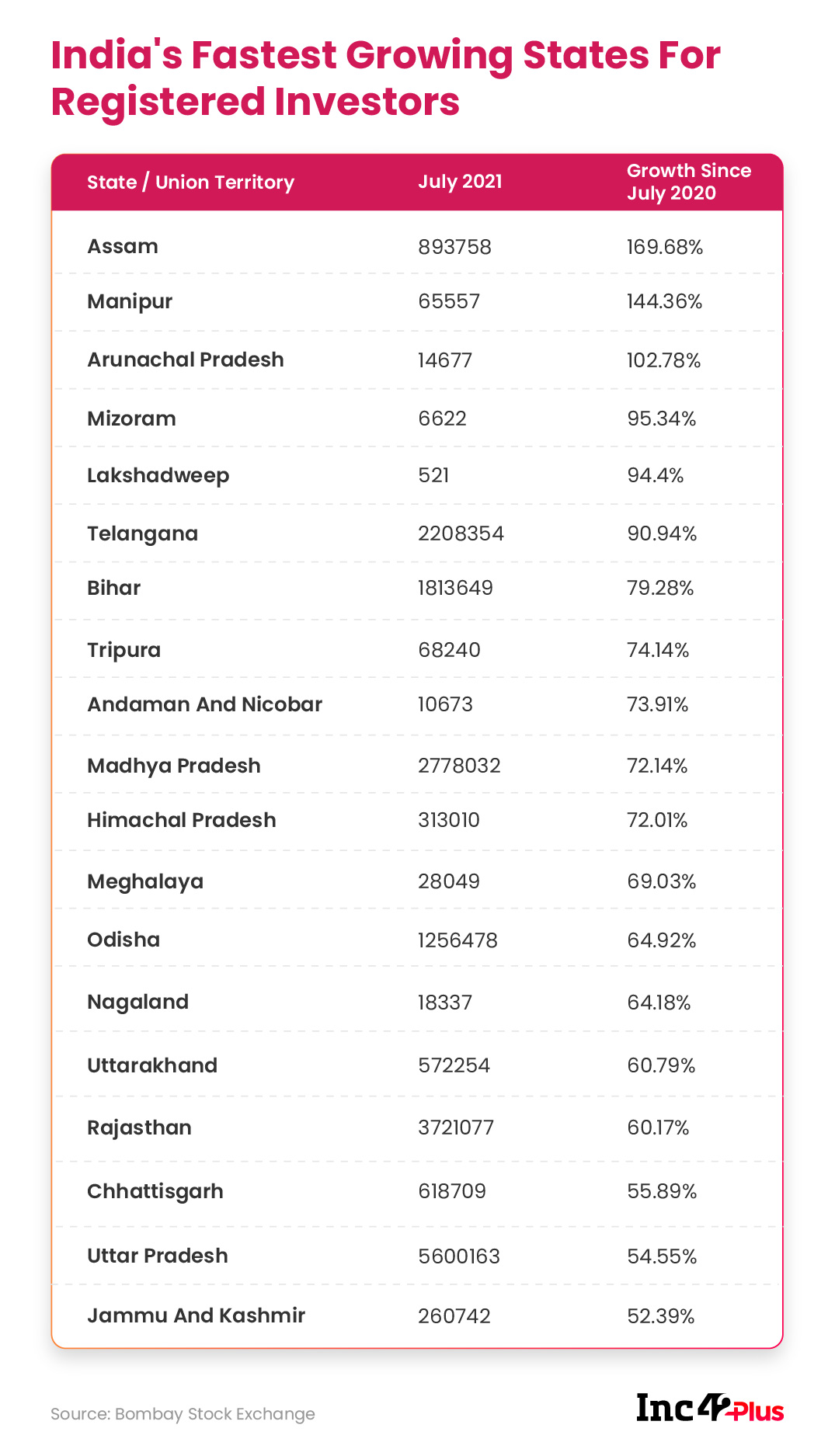

Ironically, the trigger for startups going public was the stock market crash in February last year. An event like this always brings in new investors as the bar for entry is lowered in a down market. The share of individual investors in the cash market turnover has also risen to 45% from 39% in a year, National Stock Exchange data shows.

Data from June 2021 shows that the Bombay Stock Exchange now has 70 Mn registered users. The exchange added 10 Mn new users between February and June 2021, and 20 Mn new users since October last year. Moreover, more than 60% of new users in 2021 came from the age group of 20-40 years, which is considered more upwardly mobile and tech savvy. The rise in valuation for unicorns Zerodha, and Groww, as well as Upstox in the past year, is a testament to the growing user base of these investment tech platforms.

As new investors came into the market, there was a higher propensity for tech stocks — Paytm and others even added support for trading in international stocks such as Tesla, Apple and others. The signs were clear, the Indian retail investor is looking to invest money in modern new-age businesses. And now Indian startups that were capitalising on the digital transformation wave want a piece of the IPO action.

The IPO Route

Under trying circumstances last year, businesses curbed their marketing spending and also took positive strides in unit economics, by focusing on those areas of the business that had the highest margins. Zomato, for instance, posted positive unit economics with a contribution margin of INR 22.9 per order on average from April to December 2020. This was a massive improvement from the negative INR 30.5 margin logged in FY20 (or March 2019 to March 2020), which means Zomato is actually making money per order on an average, rather than burning cash to fulfil deliveries.

Having done this and with a clear path thanks to the new listing rules brought in by Securities and Exchange Board of India (SEBI) last year and early this year, startups had a legitimate chance at going for IPOs. This is where we are in the domino effect if we pause.

Investors believe that this is the true test of the Indian startup ecosystem. While the startup industry has grown furiously in the past five years and now the real uphill climb begins for the startups who have outlasted major crises in the past and emerged on the other side. The likes of Zomato, Paytm, Delhivery, Policybazaar, PharmEasy, Nykaa and others that who have been around for many years now.

All this means investors have pushed startups to go public in many cases. The pressure was most evident when SoftBank inserted an IPO condition in its funding round for Paytm, which the fintech company is now close to fulfilling.

The bar for going public was too high for startups in a maturing tech economy like India till regulations changed, and besides that, they had relatively easy access to capital, if they demonstrated growth. So there was never really any need to turn to the public markets. Exits through IPOs were definitely rarer than unicorns. But now investors demand it.

Another investor said that the fact that Walmart-owned Flipkart has not jumped to go for an IPO suggests that it is not under the same kind of investor pressure as some of the other startups that started out at the same time. Flipkart saw a massive investor exit just three years ago and only recently has it raised a big round of external funding, with SoftBank re-entering the captable. And while Walmart has claimed that it is in no hurry, that might change very soon.

Indeed, the startups that are lining up for IPOs all have significant VC stakeholders and continue to raise large rounds even before the IPO. When Zomato launched its IPO this week, the talk in startup circles was about Indian tech startups finally coming of age and looking beyond VC money, though Zomato did raise close to INR 4,200 Cr before its IPO.

“There’s no doubt that VC funding is important and even that is flowing in now. But as a company, you have to evolve. You cannot rest on external funding and hope to grow. Because investors want to see that value and now even regulatory hurdles have been cleared,” said a partner at a VC firm, who did not want to be identified due to investments in several of the startups that are said to be going for an IPO this year.

Public market analysts are bullish about tech stocks overall and even among the VC investor community it has brought in some renewed enthusiasm about exits, said Jatin Desai, managing partner at tech VC fund Inflexor Ventures. In India, retail investors have always gone for traditional companies which have conventional valuation methodologies and remained shy from backing tech startups. There was no understanding of the technology value-addition or the model, he added. The reception for IndiaMART in 2019 and then EaseMyTrip and Nazara Technologies in early 2021 show that the tastes have changed and the appetite now exists.

The fact that Zomato’s IPO was oversubscribed by 6.93 times in the retail portion and 29.87 times in the qualified institutional buyers portion despite the high valuation sought by the company is another indication of the appetite.

Now, startups are capitalising on it. The successful performance of the first few public ‘startups’ will show whether the current IPO parade will have a long runtime.

The M&A Story

In the context of startups, maturity of the business is never guaranteed, so actually riding the tumult of the market amid a pandemic and simply not sinking is a big achievement in itself. But an IPO is not within reach for everyone. While late-stage startups go after IPOs, these startups are also gobbling up competition.

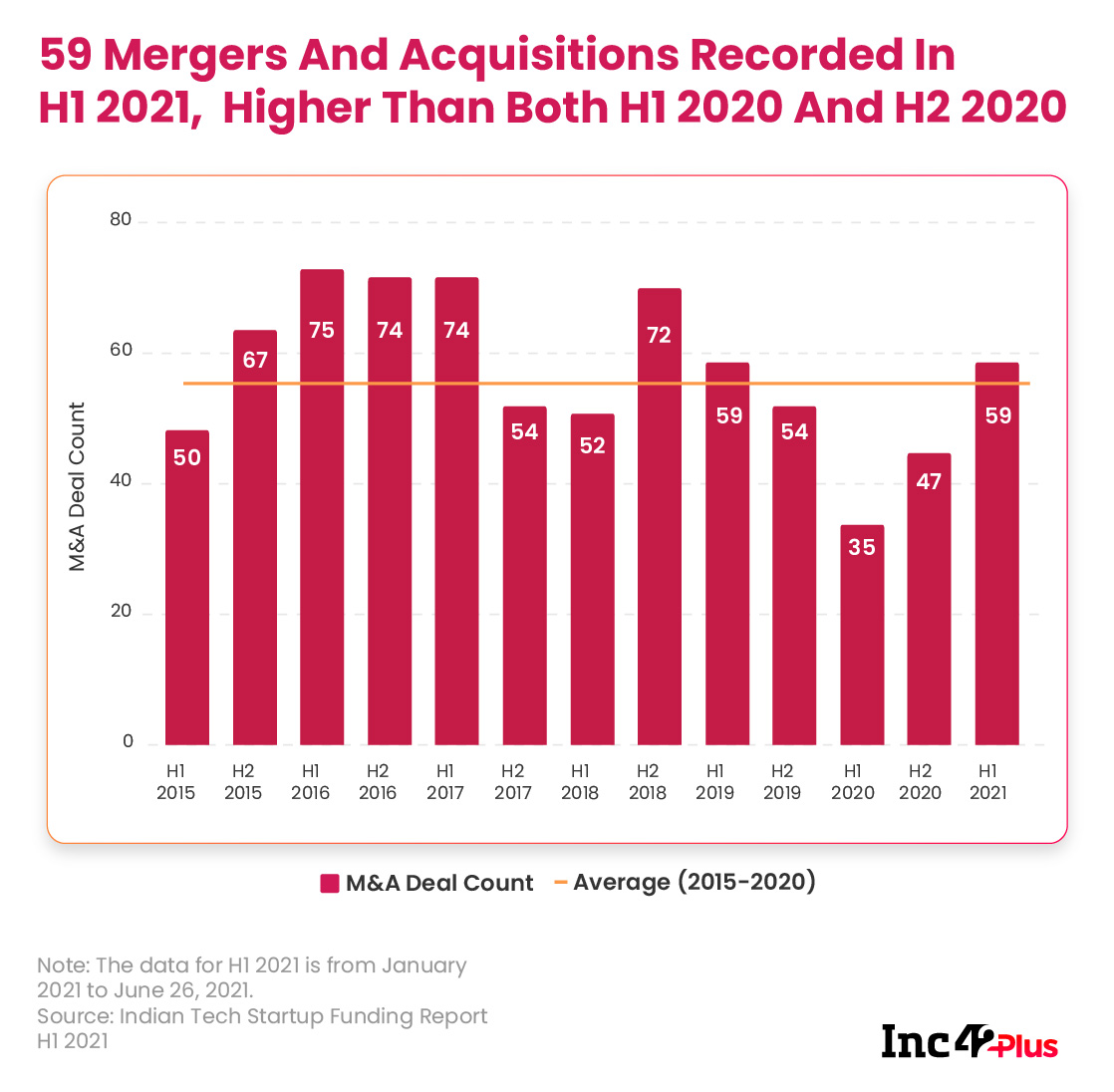

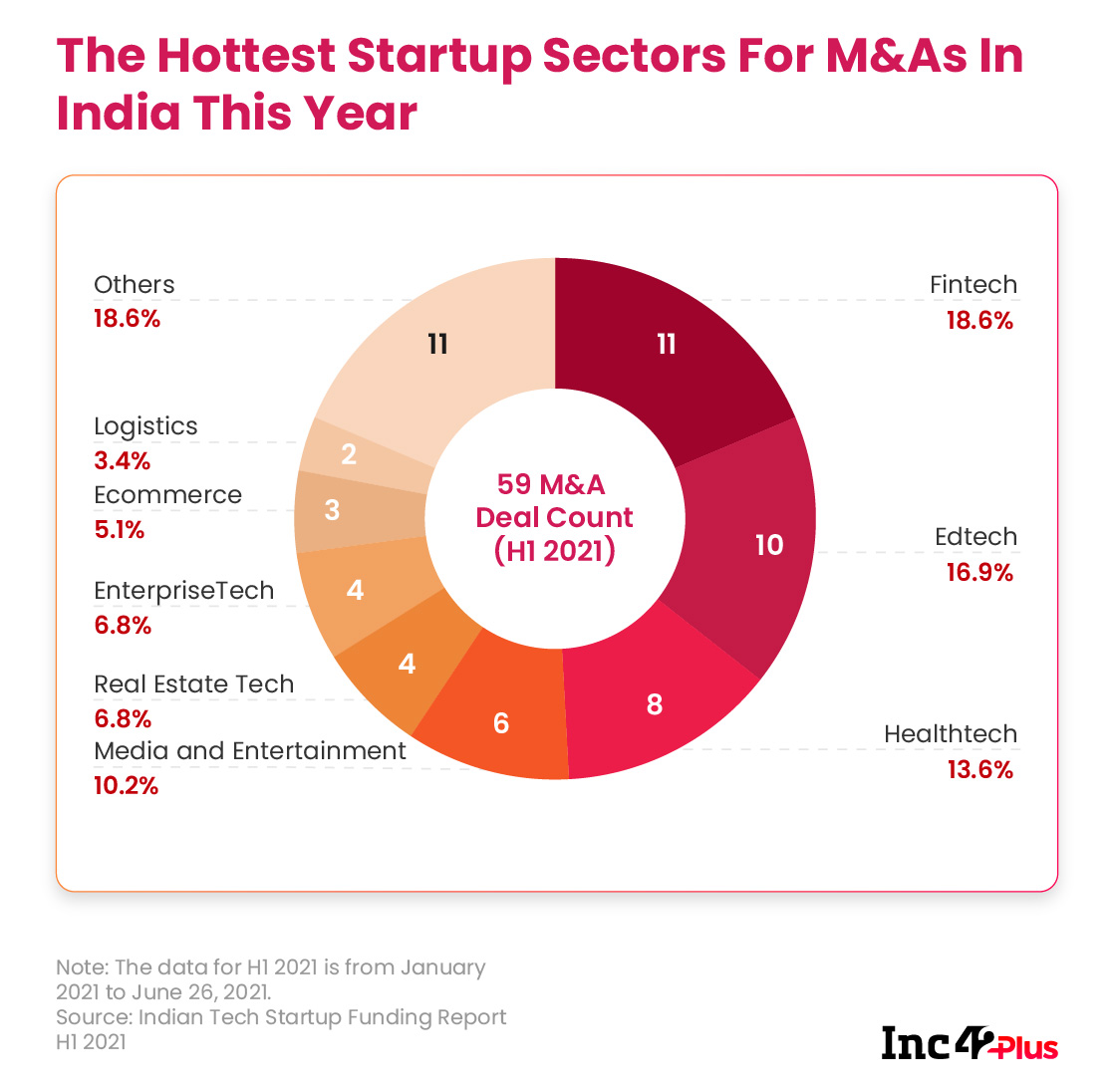

And at the same time, growth-stage startups are acquiring early-stage startups for network and talent. Tech startups are even going after legacy companies, like the PharmEasy-Thyrocare deal or the BharatPe acquisition of PMC Bank. Those two deals this year, coupled with the BYJU’S acquisition of Aakash, highlight that M&As are growing rapidly, but here are the numbers: 59 M&A deals till June 2021, and the streak has continued.

This month, Clear (formerly known as Cleartax) acquired Y Combinator-backed enterprise payments startup yBANQ, while B2B ecommerce and services unicorn Moglix acquired ecommerce platform Vendaxo. In one of the largest deals in the Indian startup ecosystem history, gaming startup PlaySimple was acquired by Swedish gaming company MTG for more than $360 Mn.

Early-stage investor GSF Accelerator founder Rajesh Sawhney, who saw 25x and 50x returns on exits from Pokkt and DailyRounds in the past two years, says the M&A trend will keep growing as startups go for IPOs. Public companies need to show value and growth constantly. The likes of Apple, Google and others acquire dozens of companies a year.

Zomato is an example of how public companies (though in Zomato’s case it was just before the IPO) have an advantage. It negotiated with grocery delivery Grofers last year for an acquisition, but was pushed back. This year, Zomato seems to be in a much better position to bargain and is set to acquire a minority stake of 9.3% in Grofers, with a potential acquisition down the road.

The same could be said for Paytm, which filed its draft red herring prospectus for an IPO this week. Paytm was reported to be in exploratory talks with three payment gateway firms — BillDesk, PayU and BSE-listed Infibeam Avenues — for a possible acquisition, merger or picking up a substantial equity stake in these companies. Going public is only going to help Paytm grow its bargaining power in the market.

Startups Make Distress Calls

Of course, there are good M&As, where everyone involved is happy with the deal or where it is celebrated as a success, but there are bad ones also — where investors either put pressure on founders to sell to stop a loss or cut deals on the side which leave founders powerless, as in the case of Milkbasket.

“Sometimes, a founder has no choice. You have investors to answer to, you have creditors to pay back. When the business is doing well, these things never matter, but when there is a crisis, everyone lines up to get paid first and therefore wants you to sell,” says the cofounder of a company that has recently been in the news for a distress acquisition.

Distress sales are so common in the Indian context that the running joke is if you have a user base in the double-digit millions and offer something that Reliance doesn’t have, chances are Mukesh Ambani will buy you out, even if you don’t have any growth.

Last year, Reliance snapped up Urban Ladder and Netmeds, neither of which were on a growth trajectory at the time of the acquisition. It is said to be close to acquiring cash-strapped Milkbasket and reportedly also eyeing a majority stake in classifieds and listings giant Justdial, which has seen slow growth as dedicated service and ecommerce platforms have emerged.

The Perils Of An Exit Market

Beyond Reliance too, distress sales are everywhere, earlier this year, food and snacks maker Wingreens acquired Raw Pressery in a distress sale, while Cleartrip was acquired by Flipkart under similar circumstances. These are all signs that companies that stray too deep into the red will get acquired for pennies on the dollar.

In the past couple of months, Shuttl and Drivezy have emerged as two other startups currently going through the pains of becoming acquisition targets where the founders have no bargaining power. Both are struggling with the pains of the travel sector and facing funding pressure, and finding investors is a struggle in this time. “There’s no doubt in my mind that companies that struggle with unit economics or those that don’t have the right pivot will end up on the chopping block and be sold cheaply. In a long-tail market, public companies hold the bargaining chips and that’s what we will see in India too,” said Anand Lunia, the founding partner of VC fund India Quotient.

There’s so much happening in the M&A space and with IPOs that investor exits are now more frequent than they were a year ago. But at the same time, investors are also wary of bets going south when it comes to early stage bets. Many reminded us about the crash of 2016, where more than dozen startups shut down in six months, after the high funding amount in the preceding year. There could be some slow down in this regard in the next few months.

With the highs come the reminders of humility. While the funding and exit trends such as IPOs and M&As are a positive sign for startups not all will benefit from it. Choosing the right investors will be more crucial than ever in an exit market. Early-stage startups still depend quite heavily on funding and will continue to, in a scenario where the Indian market will have a few tech giants and many small startups. Will these startups get a fair shake from investors or indeed the newly public giants?

Till next time,

Nikhil Subramaniam

Featured image & graphics: Aprajita Ashk

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story](https://asset.inc42.com/2021/07/The-Ouline-74-Featured.jpg)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] IPOs, M&As And Distress Sales — The Indian Startup Exit Story-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)