With over $10 Bn planned Chinese investments, will the latest FDI rule backfire given the state of the economy?

FDI aims to bring in new technology as well as capital so the policy should be structured accordingly, said former FinMin official Subhash Chandra Garg

At least 81 Chinese investors have invested in 144 Indian startups in the last six years as per DataLabs by Inc42 analysis

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

‘Minimum government, maximum governance.’

Even before Narendra Modi became the prime minister of India, he had announced this as his mantra for making policies. However, despite creating a slew of task forces, working groups across the ministries, drafts, barring few instances, the government has failed to meet the policy requirements at large and their transparent implementation across the sectors. This includes drones, ecommerce, data privacy, crypto, foreign direct investments and so on.

Of course, there have been some significant developments on the policy front. Besides Startup India policies, GST is one of the biggest policy reforms which changed the way India used to collect taxes. In many of these sectors like drones, data privacy, the government in fact had to start from scratch and hence the delay could be understood. However, in most of the cases, it’s the policy flip-flops, back and forth moves which have caused discomfort among investors and other stakeholders, poking uncertainty in terms of policies from the government end.

Take FDI for instance, where the Modi government has been arguably doing better compared to its predecessors when it comes to FDI reforms. The then finance minister Arun Jaitley in his budget speech of 2017-2018 had said, “Foreign direct investment (FDI) increased from INR 1,07,000 Cr in the first half of last year to INR 1,45,000 Cr in the first half of 2016-17. This marks an increase by 36%, despite a 5% reduction in global FDI inflows.”

The late minister had then gone on to say,

“Our government has already undertaken substantive reforms in FDI policy in the last two years. More than 90% of the total FDI inflows are now through the automatic route.”

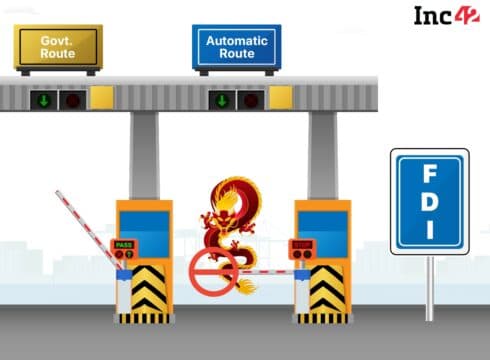

Cut to today, the government has decided to roll back the automated route to approval route for FDI inflows from certain countries. The government recently issued a notification that all FDI from countries sharing a land border with India would require prior government clearance. This will be applicable for routed investments too where the actual investment traced back to the immediate neighbouring countries.

Given that the investments from Bangladesh, Pakistan were already through the approval route and Nepal, Bhutan and Myanmar don’t have any such significant investments which could attract the government’s attention, clearly, all fingers were immediately pointed towards the Chinese investments in India especially in Indian tech startups which have been rising exponentially in the Modi government’s regime.

Speaking to Inc42, former secretary at department of economic affairs, ministry of finance Subhash Chandra Garg said, “This change in policy is obviously aimed at compulsorily scrutinising all FDI proposals, irrespective of the sector and extent of investment, by the Government. No blanket ban has been placed on Chinese FDI in India. However, the scrutiny process might be utilised to deny or delay permissions. The scrutiny process, after the abolition of the Foreign Investment Promotion Board in 2017, is carried out by the sectoral Ministry/ Department concerning the type of investment. They are generally not very well disposed towards foreign investment.”

So, as the Modi government issues a new rule pertaining to the FDI in India, there are questions that remain unanswered. For instance:

- How would India treat the native investments from Hong Kong and Taiwan? Is it going to be under an automatic or approval route?

- Are the amendments temporary or permanent?

- What will be the impact over the Indian startup ecosystem which is currently being led by Chinese investments?

As we delve into India’s reactionary FDI reform policy, let’s try to find clarity over the issues, which the government hasn’t officially done yet.

FDI Policy: What Triggered The Immediate Response

The notification came right after a day when the People’s Bank of China (PBOC) announced the increase of its stakes in India’s largest private sector bank HDFC to over 1%. PBOC had earlier 0.8% stake in HDFC.

Besides, Chinese leading group Alibaba has invested over $2 Bn in Indian startups and has planned to invest an estimated $8 Bn in India by 2022. China’s Bytedance which runs apps like TikTok, Helo and Vigo video has plans to invest $1 Bn in India. Among the Chinese banks are the Industrial and Commercial Bank of China (ICBC) and China Investment Corporation (CIC) which have already kept aside over $600 Mn to invest in India’s financial sector.

Another Chinese major Huawei which has invested over $3.5 Bn in India so far had earlier threatened to pause its India investment plans if India denies 5G permission. The company later received the approval for 5G trials.

And, there are reasons behind Chinese increased investments in India, With Paytm, Ola, Flipkart while many of the Chinese investors have already tested the investment benefits in the Indian startup ecosystem, there is another side to the coin as well. According to a ChinaVenture research report, China’s deal-making activity for startups in the 1st half of 2019 had halved from a year ago to 1,910. The amount invested in domestic startups during the first half of 2019 plummeted 54% to $23.2 Bn.

If we look at India numbers, about 81 Chinese investors have invested in 144 Indian startups in the last six years, as per a recent study concluded by DataLabs by Inc42. While the majority of investors are based out of China, 26 are from Hong Kong remaining few are from Taiwan.

What’s The Scope And Broad Impact Of New FDI Rules

In a discussion with Inc42, Girish Vanvari, founder, Transaction Square – a tax, regulatory and business advisory firm noted that the new rules restrict all Chinese investments — direct or indirect — even with as little as 1% stake. He noted that if the government examines any investment, there would be some Chinese investor behind it, maybe across layers. Getting clarity on this element as crucial as in this interconnected world, it’s practically impossible to preclude such investments as China has become a major investor in the world stage. Pai and Vanvari both added that for now Foreign Portfolio Investments (FPIs) have been left out of this circular.

Clarifying the confusion over the FDI inflows from Hong Kong and Taiwan, former secretary Garg said that Hong Kong is clearly part of China. Therefore, the same scrutinising process should be applicable to FDI originating in Hong Kong. However, “I don’t think it affects Taiwan as it does not share a border with India.”

“Chinese FDI has been coming quite aggressively in the sectors where Make In India policy encouraged setting up of manufacturing facilities in India and in the venture capital-backed startups. These sectors are likely to suffer,” Garg added.

The FDI Glitches: Can We Trace The Actual Beneficiaries?

Until a few years back, over 2/3rd of FDIs inflow to India is routed through tax haven countries. According to the Centre for Budget and Governance Accountability (CBGA), a Delhi-based think tank, among the top 10 countries, the main countries to be used for routing investment flows are – Mauritius, Singapore, Cyprus and Netherlands, with the share of routed funds as 97%, 90%, 94% and 83% respectively.

Over the years, this has become a classic case of tax abuse by investing through establishing shell companies in these tax haven countries. According to a report published by members of the Financial Transparency Coalition, developing countries lose nearly $416 Bn from tax abuse annually.

In India, funds from the US, UK and China have been frequently routed through these tax haven countries. According to the CGPA statistics, close to a third of investments coming from Mauritius are actually made by USA-based investors, while 25% are actually by Indian entities. USA investors are the major players in all four countries, so are the Indians except in the case of the Netherlands.

While the US, UK have been practising this for a long time now, recent direct and indirect investments from China have been phenomenal. According to a Brookings India report, the Chinese investment has grown from $1.6 Bn in 2014 to over $8 Bn in 2017. The figures now stand at $26 Bn including planned investments. The data however does not include routed investments such as Xiaomi’s $504 Mn through its Singapore subsidiary and hence the actual figures of investment could be much larger, by almost 25%, the report estimates.

However, it’s not only about the firms, but Chinese LPs do also have investments in global funds which have further routed its investments in India through some other countries. In such cases, is it possible for the government to trace the ultimate beneficiary?

Garg responded that LPs make investments in funds and asset management companies run by GPs, which invest both in portfolio investments as well as FDI. FPI investments are not affected by the policy change. SEBI is reportedly examining the issue of portfolio investment by investors coming from the neighbouring countries. No regulatory decision has been made as yet.

“For FDI investments originating from private equity, it should not be difficult to disclose who the ultimate beneficiaries are. There are well laid out systems in the country to report on and scrutinise ultimate beneficiaries in FDI.”

The Mauritius Lesson: Why India Is Cautious With Chinese Investments

India had received $368 Bn of FDI between the period January 2000 and December 2017, out of which Mauritius alone had contributed to around $125 Bn, 34% of the entire inflow. A country spread over 2000 Sqm and has an annual GDP of $12 Bn and with hardly 1.3 Mn population has been the driving force behind India’s FDI growth. India with a GDP nearing $3 Tn and a population of 1.3 Bn. Including the likes of TMI, Cairn, Oracle, Merrill Lynch, nine of the 10 largest foreign business organizations or companies investing in India have capital operations in Mauritius.

Global companies set up their subsidiaries in Mauritius with no operational capabilities within the country domain. However, not only the corporate firms have been allegedly practising this treaty shopping at tax haven countries, but a large number of VC firms have also been caught in this.

Last year, the Mauritius Leaks by ICIJ which published a series of reports based on 2 lakh leaked documents from Mauritius found global investors like Sequoia Capital too have been routing funds through its Mauritius subsidiary in order to save millions of dollars of taxes. Sequoia has so far invested in around 90 Indian startups.

The primary reason behind Mauritius being a tax haven country has been the effective tax rate. According to an ANI report, although Mauritius has a corporate tax rate of 15%, the effective tax rate is 3%. This coupled with no withholding tax and no capital gains tax on dividends makes it a good destination for companies to set-up entities to do business in India.

Suspected of tax phishing, the European Union, in 2015, had placed Mauritius on the top of tax blacklist nations and the 2018 Financial Secrecy Index gave it a 72.3 score out of 100 for enabling questionable tax avoidance manoeuvres.

CBGA in its report ‘FDI In India And The Role of Tax Havens’ observed that the majority of the funds are routed through jurisdictions which are commonly known as tax havens and / or secrecy jurisdictions. The unfairly negotiated double tax avoidance agreements (DTAAs) open up new loopholes for profit shifting, abusive treaty shopping, and other forms of cross-border tax avoidance too. Despite evidence that DTAAs cause considerable and unnecessary loss of revenue from countries in the Global South, many developing countries, in particular, are by design forced to enter into exploitative and unjust treaties to attract FDI in the absence of any alternatives.

Mauritius since then too has taken some stringent measures and agreed to modify its DTAA with countries including India. In July, last year, the EU had finally removed its name from the tax haven list. In May 2016, India successfully renegotiated its DTAA with Mauritius which allowed it to tax capital gains on transfer of Indian shares starting from April 2017. A similar arrangement was signed with the Singapore and Cyprus governments.

Among the key changes were:

- Source-based taxation of capital gains from the transfer of shares acquired on or after April 1, 2017

- A corresponding tax adjustment mechanism to prevent economic double taxation, and

- Application of domestic laws to curb tax avoidance or tax evasion

However, India had already lost billions of dollars of taxes during the period.

In its Budget 2020, in order to encash FDI from Singapore, the Indian government has dropped the Dividend Distribution Tax, paid by dividend payers. Instead, the dividends will be taxed in the hands of the recipients, i.e. shareholders of the dividend distributing company.

While India is in the process of revising its DTAA with every major economy, the decision to introduce fresh FDI rules prohibiting Chinese FDIs under automatic route is a well-thought plan, many experts believe.

At one end, India’s trade deficit with China is already too high to ignore, on the other end, with Chinese greenfield investments rising exponentially the repercussions would be huge, making Indian economy a parrot of Chinese stakeholders, guided by their state government.

Pankaj Raina, MD, Research & Investments, Zephyr Peacock believes that changing from automatic to approval-based does not mean that the government is dismissing genuine investments.

“I think eventually, the industry will work with the government to come up with a structure which does not impact or impede the deal making ability of businesses and investors in India in general. I would sense the move as that the government is being more cautious. However, we need to have a structure which would work for all.”

As India Looks To Fill The Loopholes, Will It Backfire?

India’s FDI policy has largely been through a reactionary reform process. As a result, while it has missed some of the genuine investments in the past, it has also attracted a lot of investments from shell companies.

On FDI reforms’ possibility, Garg said

FDI meets two significant needs of India. One, it brings new technology along. Second, it meets the capital deficit. The FDI policy should be structured to serve these two objectives clearly.

At a time when India is facing one of the longest economic slowdowns, which has turned into recession and is here to stay for the next few years, the latest move is set to discourage aggressive investors, particularly from China.

This is when 18 of the 34 unicorns are directly funded by Chinese investors. Almost all the flagship startups in India — Flipkart, Paytm, Ola, Byju’s, Zomato, Bigbasket, Dream11 — have either Alibaba or Tencent as their major investors or shareholders.

According to DataLabs, between 2014 and 2019, over 234 funding deals occurred with Chinese participation (either directly or indirectly). Of which 49% were in the growth stage and 39% at the late-stage.

In such a situation, particularly when India is already seeing a dip in its FDI, some experts are seeing the latest move as it may also backfire in the near future if not well thought through.

In a recent interview, Dr Rakesh Mohan, former deputy RBI governor commented, “If we want manufacturing to be moved from China to India, it is not going to happen if we close our borders to Chinese investment. Remember that FDI in China did not come through the US or from the west, it came from the south, from the overseas Chinese. So if we have an ambition, which we ought to, to take advantage of this crisis and have activities moving to us from China then this is a wrong thing to do.”

On the possible impact, Zephyr Peacock’s Raina said, “It’s true that as investors we seek exits, and if there’s a lot of capital flowing from China, which offers those exits, then that is beneficial. But historically, there has been no evidence of a lot of exits being provided by Chinese investors. Now, the success rate in venture capital or startup investing is a well-known statistic. And if you count all the factors in, it’s just going to delay the exit process.”

It should also be seen as a corrective measure to check if the Indian startup ecosystem is too dependent on one geography. And, this is part of the governing measures instead of blocking investments, Raina added.

However, if we look at the FDI policy in totality, a lot has to be done. Transaction Square’s Vanvari said, “I did a deal in my life, which was a Fosun deal, which took three years.” This is something that changes the entire investment dynamic as the demand-supply balance has been changing fast and after even a few months, the investment impact may no longer be the same as investors might have desired while exploring the investment plans seriously.

Raina too agreed for a faster processing window for FDI in India. Like fast-tracking the visa application, there has to be a way out for FDI too, he reckons.

After industry reactions over the possible impact of the latest FDI policy amendment, Modi has reportedly directed the concerned authorities to take proactive steps in order to help strengthen the local investors and LPs ecosystem in India. Will it matter when so much of the growth for India’s biggest startups has come thanks to overseas investors? And even optimistically speaking, will newer Indian investors be able to convince global LPs about their power to find the right deal? Those are big questions for the government and the investor ecosystem to answer as the impact of this FDI rule change ripples through the tech economy.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.