India's BNPL segment is on fire in the festive season amid ecommerce sales but there is a flipside to this growth too

Dear reader,

In pretty much every neighbourhood in India, there’s that one shop which has a ‘no credit’ sign hanging, politely reminding customers to not ask. Although larger stores might have a monthly credit system for the regulars, the smaller shops almost always turn away those seeking ‘udhaar’ or credit for purchases.

These days, though, a smartphone is pretty much all that you need to get past this barrier. With digital payments more widely accepted, a new avatar of credit has emerged in the form of buy now pay later or BNPL.

From fintech startups, ecommerce giants, NBFCs to banks — everyone has jumped on to the BNPL bandwagon and it’s easy to see why. India’s low organised credit penetration means that not many consumers or businesses have credit histories and this leaves them out of the traditional lending umbrella.

Credit cards and large personal or business loans are out of the question for this segment of the population, so BNPL has stepped in.

As we head into Diwali week, there will be a lot to celebrate, and we don’t want to put a dampener on any of that. But there’s good reason to be cautious about the BNPL spurt — in particular, the ease of access to credit, which could have long-term implications on the indebtedness of Indians.

Regulatory scrutiny into the rampant growth of BNPL and customer debt management risks are the key potential challenges in the roadmap for this lending segment, even at this inflection point. We’ll see why BNPL might come in for regulatory oversight soon and also see the potential threats for the existing players, but first let’s take a peek at the hype.

The BNPL Brigade

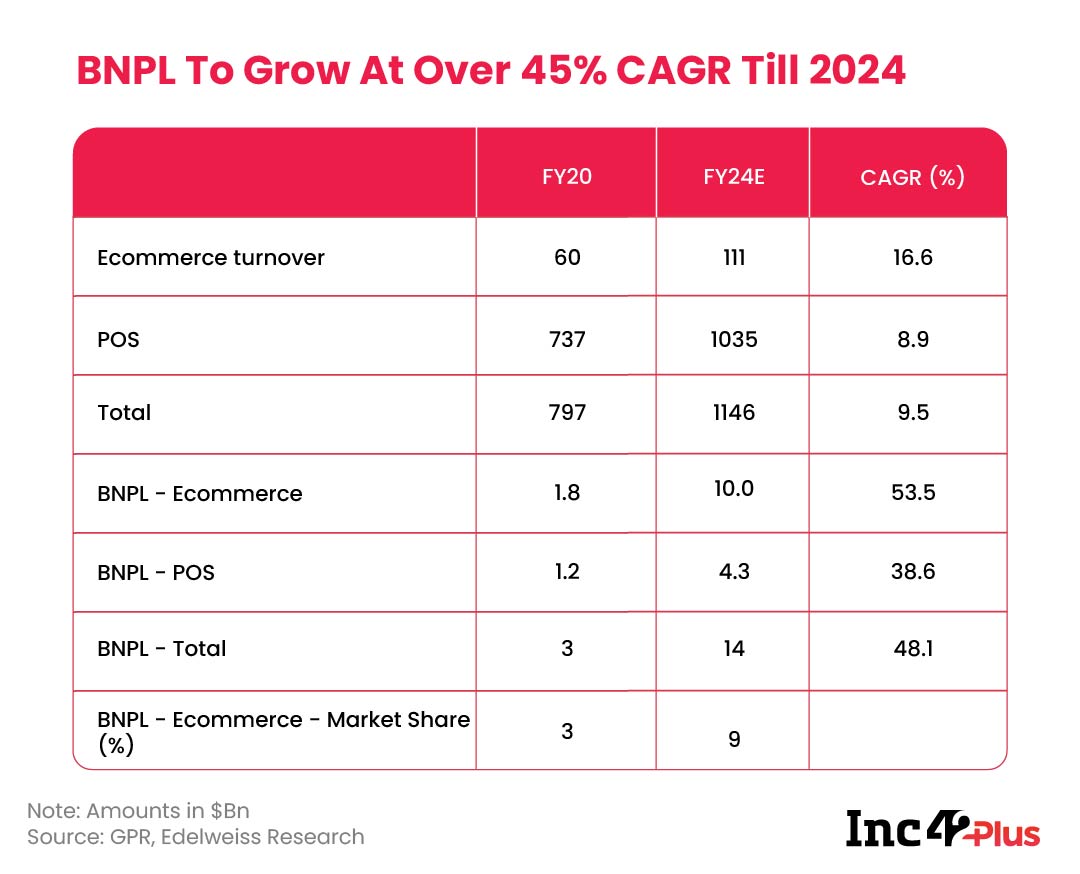

According to Edelweiss Research analysis, BNPL is set to record a CAGR of over 45%, and form a $15 Bn opportunity by 2024, accounting for a whopping 9% of all ecommerce payments. Adding a new dimension to retail credit, BNPL accounted for $3 Bn – $3.5 Bn in disbursals in FY21 on the back of ecommerce boom and the rise in adoption of delivery services.

Indeed, fintech startups are the first movers, but banks have been agile to jump in and NBFCs too are joining in. It’s no wonder then that the BNPL ecosystem in India has grown to over 30 players.

Startups such as Simpl, ePayLater, Zestmoney, Bharatpe (Postpe), LenDenClub, CashE, Paytm Postpaid, PayU’s LazyPay, Amazon Pay, Flipkart Pay Later among others have carved out the BNPL market among themselves, with more and more joining each year.

The BNPL segment continues to scale new heights as post-Covid income crunch has limited consumer spending capacity. Secondly, BNPL targets the largest addressable market in India that is the low-to-mid-income population and third, and perhaps most importantly, is that it adds value to the demand and supply side of the commerce chain.

According to the World Resource Institute data, over 70% of India’s population has a gross annual income of under $2000, while another 15% earn between $2000 and $5000 per year. This is the audience that BNPL primarily targets.

On the customer side, the things working for BNPL include near-instant access to credit at low interest rates and relatively lower exposure on credit score and it involves less documentation.

On the merchant side, the biggest factors behind offering BNPL to consumers are the higher average order value or AOV, retention and conversions. This is, of course, in a B2C scenario, while on the SME lending side, the benefit for merchants is working and procurement capital.

Thirdly, on the supply side, for fintech lenders, NBFCs and banks, adopting BNPL means better reach and the possibility of onboarding customers for other verticals and perhaps even high-value lending.

BNPL And The Bank Threat

To be clear, BNPL is not new by any means. Essentially, it’s a personal or business loan that is structured in a different way than a typical bank loan. Fintech startups have adopted innovative credit risk models and leveraged lending partnerships to reach consumers through BNPL at retail points of sale, ecommerce checkout screens and on delivery apps.

There are primarily two models of BNPL that are typical in India, one is driven by convenience for consumers and the other by enabling credit for consumers (Simpl, Lazypay, Amazon, Flipkart etc.) as well as small businesses (Zip, Solv, ePayLater, Pine Labs). But both involve partnerships and tie-ups with banks and lenders, because startups cannot lend from their books, but only act as intermediaries.

This brings us to the biggest challenges for the BNPL segment are the threat of banks controlling the dynamics and the potential debt problem among the customer base.

Internationally, the BNPL space has seen some mega acquisitions — Square bought out Afterpay in a $29 Bn deal, while PayPal forked out $2.7 Bn for Paidy. In India too, M&As will come into play, but for startups the objective will be to cut the reliance on banks by procuring NBFC licenses through such deals.

While many do not want the hassle of running an NBFC right now, in the long run, this is likely to be the course. Specifically, the fact that banks can cut ties and turn competitors overnight should keep BNPL startups without lending licenses on their toes.

In fact, banks are getting increasingly wary of startups such as BharatPe (with its small finance bank license and big customer base) and IPO-bound Paytm (massive payments bank base and capital to scale) and their moves towards offering competitive retail banking services. Banks have embraced BNPL for their own customers, becoming competitors as well as partners to startups.

The gap between fintech offerings such as BNPL and traditional banking products is narrowing and BNPL being a high-growth segment is attracting all the partnerships right now, but when push comes to shove, will partnerships be upheld over the bottomline?

Moreover, banks are the most likely to benefit from the credit maturity being brought about by BNPL’s growth, since the next logical step for the customer is a credit card. Credit card giants Mastercard and Visa themselves are evolving to meet the BNPL terms and conditions.

Will BNPL Create A Debt Crisis?

The second big problem is a potential debt crisis driven by flooding the market with credit without adequate risk modelling. The high growth in recent months means the regulator’s eye cannot be far from the BNPL segment.

In a recent speech, RBI M. Rajeshwar Rao, Deputy Governor, said, “Innovation should not be at the cost of prudence and should not be designed to cut corners around regulatory, prudential and disclosure requirements. Responsible financial innovation should always have customer at its centre and should be aimed at creating positive impact on the financial ecosystem and the society.”

He also pointed out the RBI’s actions on predatory and unauthorised loan apps, which resulted in a massive cleanup on the app stores. Internationally, financial regulators have started taking note of BNPL, will the same course be followed in India too?

Predatory lending does not always mean aggressive collections or high interest rates; it can also take a softer avatar in the form of misleading messaging or failure to remind creditors of the impact, however minor it may seem.

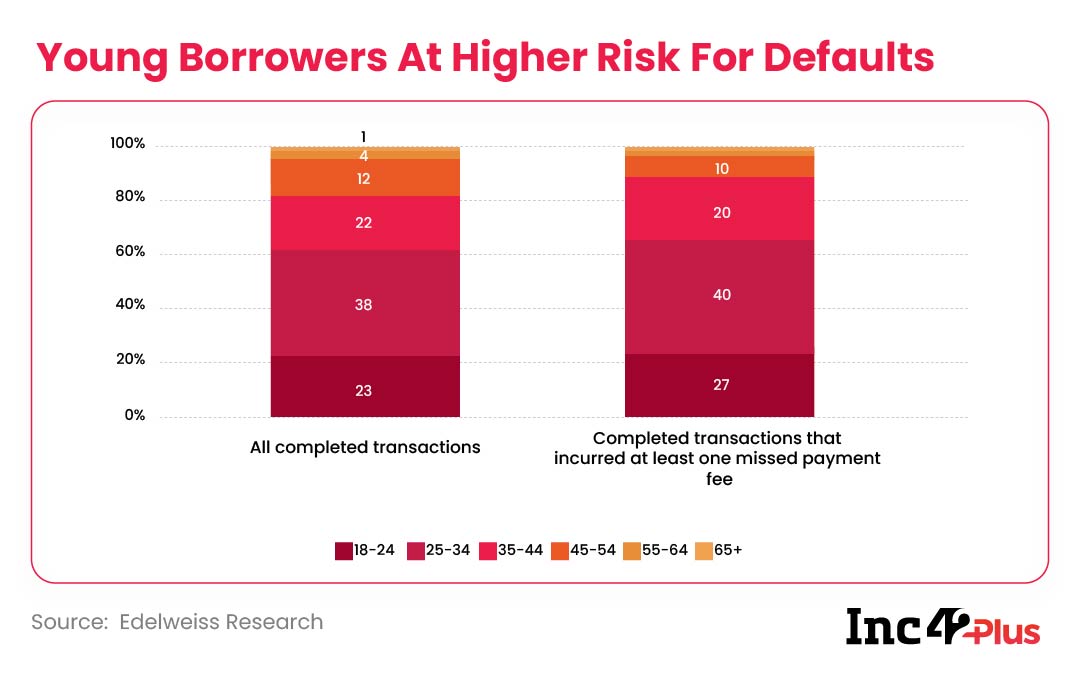

Like personal loans, BNPL payment defaults or delays impact credit history and can have severe consequences for young and new-to-credit individuals and small businesses. These are also the customers most likely to default, as per studies.

Thus, multiple reminders for payments are a norm in the BNPL segment, or at least need to be. To which degree players follow this is not currently monitored.

A situation involving a high number of defaults and grievances against BNPL providers over lack of communication is not far away, so the RBI may very well soon step in.

The brunt of the regulatory impact will be on startups. Banks and NBFCs, after all, only lend as per RBI norms, even when lending via a startup partner, so they are likely to push the compliance burden on the lending partners.

India is also looking to bolster its customer protection laws and regulate ecommerce segment, which involves oversight into what kind of incentives are offered to customers. BNPL players could very well also have to step up their KYC norms to tackle any potential impact from this.

At the moment, these troubles are not at the top of the industry’s mind.

The focus is on capitalising on the growth seen in the past month. Amazon India and Flipkart both reported a 10X surge in BNPL usage during their festive sales. Growth has been rampant for incumbents Paytm, Simpl, CashE, LazyPay, LenDenClub and others, while newcomer fintech unicorn BharatPe is bullish on the segment and is spending millions on promoting Postpe.

Suffice to say, Diwali in India this year is powered by BNPL.

Till next week,

Nikhil Subramaniam

Images: Gayatri Sharma

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] The BNPL Diwali-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience