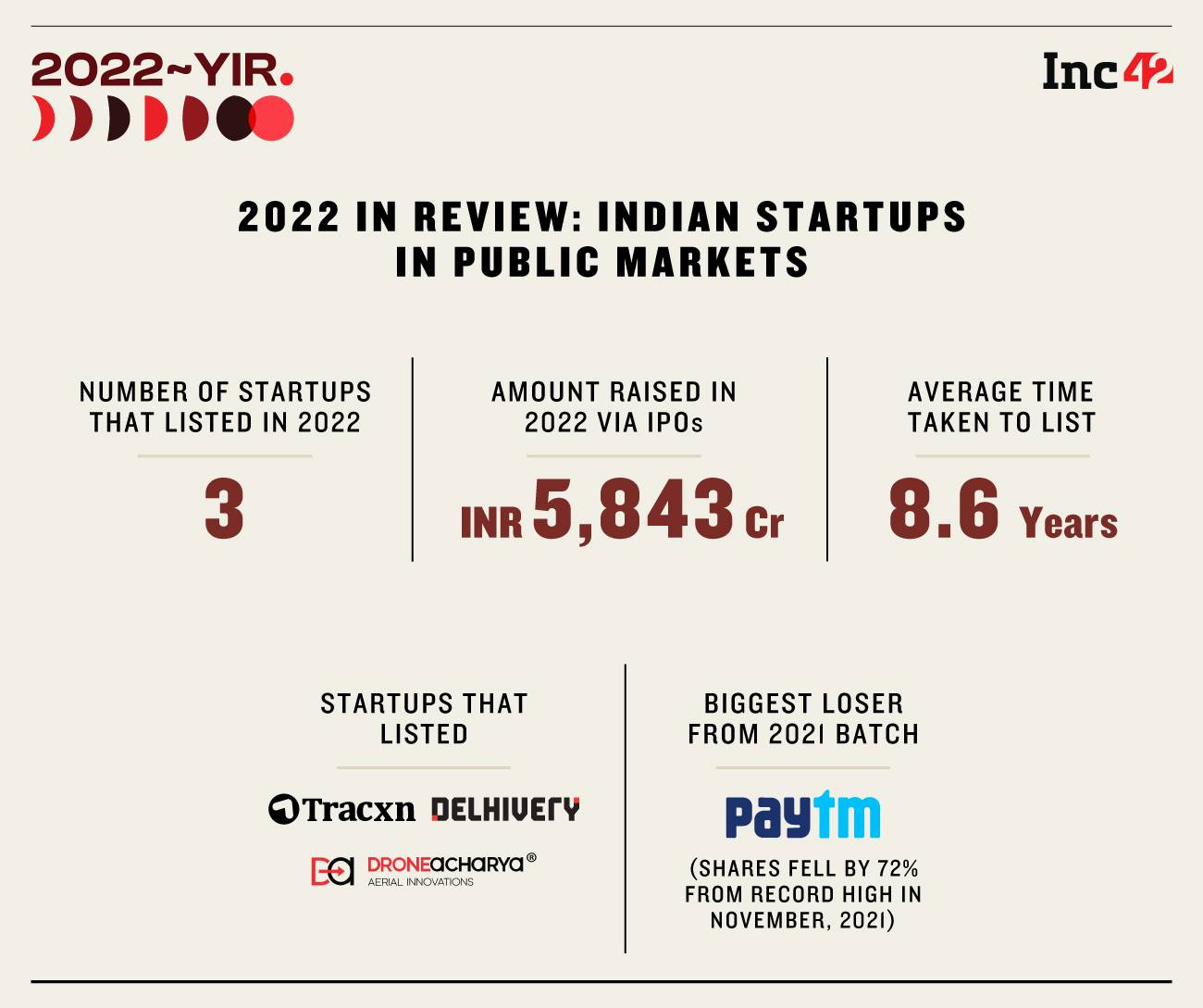

Against 11 startups that got listed on the Indian stock exchanges in 2021, a mere 3 startups went public in 2022

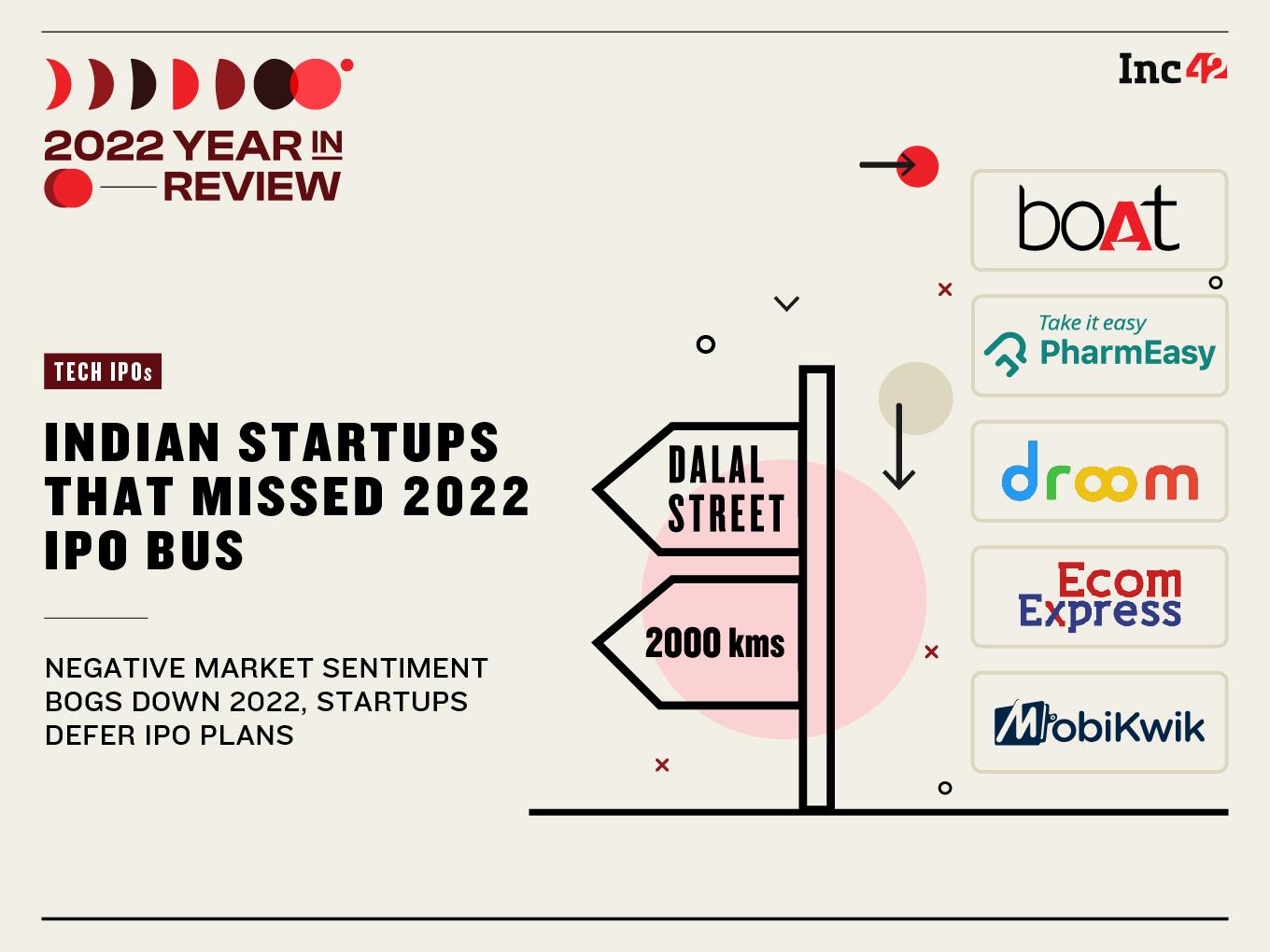

The year saw giants such as PharmEasy, MobiKwik and Droom shelving their IPOs amidst roaring negative market sentiment

Startups like Paytm, Zomato and Nykaa, which went public in 2021, were caught in the eye of the storm in 2022 and wiped millions of dollars of investors’ wealth

As 2021 approached its end, new-age Indian tech startups were brimming with hope as a record 11 startups listed on the bourses during the year. The idea of a market listing seemed not so far-fetched and elusive.

Heavyweights like foodtech giant Zomato, fintech major Paytm, beauty ecommerce platform Nykaa and online travel aggregator (OTA) EaseMyTrip went for their initial public offering (IPO) in 2021.

Download Annual Funding Report 2022The IPOs received good response from the market, with many of the loss-making ventures ending the year on a high. Shares of many listed new-age tech startups ended 2021 at record highs, and it seemed that their stellar debut on the stock exchanges and the response from investors was a sign of much greater things to come. Then came 2022.

War, High Inflation Derail IPO Dream Run

The start of the Russia-Ukraine war in February made investors gloomy, with equity markets across the world, including in India, coming under pressure. To add to the woes, central banks across the world raised interest rates in the next few months to curb the rising inflation. The consequent fall in liquidity resulted in listed startups coming under selling pressure and those planning IPO rethinking their plans.

Spooked by the inimical market forces, the 2021 IPO dash came to a grinding halt within a few months into 2022. In total, the year saw only three startups going for IPO – Delhivery, Tracxn and DroneAcharya.

The adverse macroeconomic conditions, coupled with the fears of a looming recession, disrupted the IPO plans of startups. The markets fell as investors sold off stocks. Retail investors also dumped their stocks and shares of new-age tech companies tanked.

The matter was further complicated with the onset of a funding winter in the early months of 2022 in the Indian startup ecosystem. With venture capitalists and private equity funds wary of investing in new startups, players began to feel the cash crunch.

As incidents involving startups with lax corporate governance norms grabbed headlines, investors ramped up their due diligence, further snuffing liquidity from the market. As a result, profitability and sustainability again became the buzz words, even as Indian startups continued to bleed cash without a clear path to profitability.

All this came together to form a bad mix that posed critical challenges for the Indian startups in 2022.

A Year Of Deferred IPOs

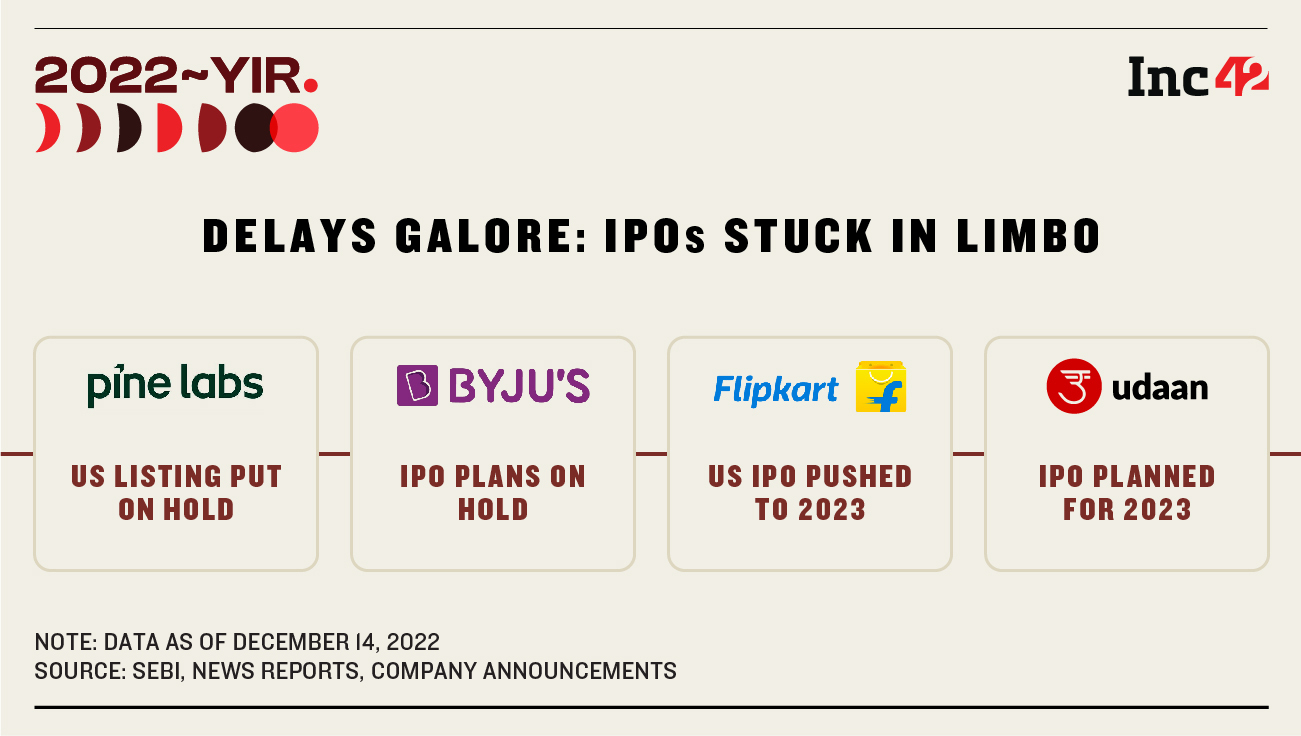

As many as eight startups that filed their draft red herring prospectuses (DRHPs) in 2021 were slated to go public in 2022, including PharmEasy, MobiKwik and Droom. However, only three of them went public in the year.

Besides, 10 new-age companies also filed their DRHPs in 2022 such as consumer electronics brand boAt, healthtech startup Portea, insurtech major Digit Insurance, among others. However, reading the prevailing market conditions, most of these startups decided to defer their public listing and wait for the markets to stabilise.

While MobiKwik’s SEBI approval for INR 1,900 Cr IPO expired in October 2022, OTA ixigo’s approval for INR 1,600 Cr public listing will expire at the end of December.

Other companies such as Droom (INR 3,000 Cr), PharmEasy (INR 6,250 Cr), Ecom Express (INR 4,860 Cr) and Snapdeal (INR 1,250 Cr) withdrew their DRHPs citing reasons ranging from ‘market conditions’ to ‘strategic considerations’.

There is also no clarity about SaaS platform Capillary Technologies’ INR 850 Cr planned market listing.

Among the new applicants, boAt, which is one of the few profitable D2C startups in India, also delayed its plans for an IPO after filing its DRHP for INR 2,000 Cr listing in January 2022.

Meanwhile, SEBI has put Sequoia-backed insurtech major Digit Insurance’s IPO in ‘abeyance’.

Sachin Bansal-backed Navi also filed its pre-IPO documents with the market regulator in March this year and subsequently received the nod for INR 3,350 Cr offer in September. However, there is no clarity on whether the company will proceed ahead with its listing plans.

Other major startups such as hospitality major OYO, Portea and fintech player Paymate are also looking to list on the stock exchanges. They have filed their DRHPs and are waiting for SEBI nod.

The Scarred 2021 Batch

The market rout of 2022 hit the new-age tech startups which listed in 2021 hard as their share prices hit rock bottom and refused to stabilise.

The biggest loser was fintech juggernaut Paytm, whose market capitalisation has fallen by more than 73% since its listing, as of December 14.

On similar lines, Zomato shares also plummeted about 70% from its record high. Shares of Nykaa have also fallen to unprecedented levels.

Such has been the fallout that the expiration of the lock-in period for pre-IPO investors saw the exodus of a large number of institutional investors from Zomato, Nykaa and Paytm. Many prominent names such as Sequoia, Lighthouse India, TPG Capital, Tiger Global, Moore Strategic Ventures, Uber, SoftBank and Alibaba offloaded a portion of their stake in these startups.

Valuations of other startups listed in 2021 such as fintech platform Policybazaar, gaming startup Nazara, and car marketplace CarTrade also fell by a big margin as investors continued their selloff.

Despite this, Delhivery, Tracxn and DroneAcharya went ahead with their IPOs this year. First on the list was Delhivery. Its shares listed on the exchanges at a premium of about 1% to the issue price. However, the prevailing market sentiment caught up with it and the stock went on a downward spiral in the following months.

As of December 14, Delhivery shares were trading 25% below the listing price on the BSE in May 2022.

Meanwhile, Tracxn, which listed in late October, has been on a rollercoaster ride, oscillating above and below the listing price of INR 83 on the BSE. While Tracxn posted a profit of INR 1.54 Cr in Q2 FY23, Delhivery has still not turned profitable.

Deeptech startup DroneAcharya, whose IPO opened on December 14, will list later in December. The issue witnessed strong response on the first day, getting subscribed 22.94 times. While it is still early to pass judgements for DroneAcharya, the startup appears to be the last new-age tech startup that will get listed in 2022.

With market valuations of startups falling far below their pre-listing prices, SEBI has also increased its scrutiny around over-valuation of these new-age tech companies. While the markets regulator was reportedly mulling asking startups aspiring for IPOs to reconsider their valuations, SEBI chief Madhabi Puri Buch later stated that it won’t interfere in the valuations of these startups.

Meanwhile, SEBI is also looking to soon notify new mechanisms such as confidential filing of IPO documents to prevent disclosure of critical company data.

The market watchdog also recently approved a new framework whereby SEBI could ask the IPO-bound startups to furnish information about details such as valuation, key performance indicators (KPIs), among others as part of their DRHPs.

Will 2023 Be Different?

Despite the dearth of IPOs in 2022, many Indian startups are eyeing public listing in 2023. Startups such as Zoomcar, BYJU’S and Flipkart are looking for SPAC listings in the US.

A number of startups also plan to list on Indian stock exchanges in 2023. Payments giant PhonePe, egrocery startup Bigbasket, and car marketplace CarDekho have planned their public listings for 2023.

However, as the war in Europe refuses to end, the current downturn in the market is likely to continue in 2023 as well amidst the geopolitical tensions. High oil prices are also likely to keep the inflation high, and some experts have even warned of a global recession during the year.

An analyst recently told Inc42 that Indian markets are only expected to bounce back once the US markets return back to normalcy. Citing better dividends for investors in the US, the expert added that recovery will first be seen in Nasdaq as far as tech stocks are concerned.

All this is expected to keep investors’ sentiment negative, which can lead to new-age startups cancelling or further deferring their listing plans.

As most of the listed new-age tech startups hit rock-bottom valuations in 2022, analysts are hopeful that they wouldn’t see sharp falls in 2023 and their share prices may even stabilise. However, it remains to be seen if unlisted startups take the risk to go for IPOs in a volatile market in 2023 or choose to wait for the storm to pass away.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience