Delhivery’s IPO opened on May 11 and closed on May 13, and was subscribed 1.63 times

The company’s shares listed at INR 493 per share on the BSE and INR 495.2 on the NSE, up from its IPO price of INR 487

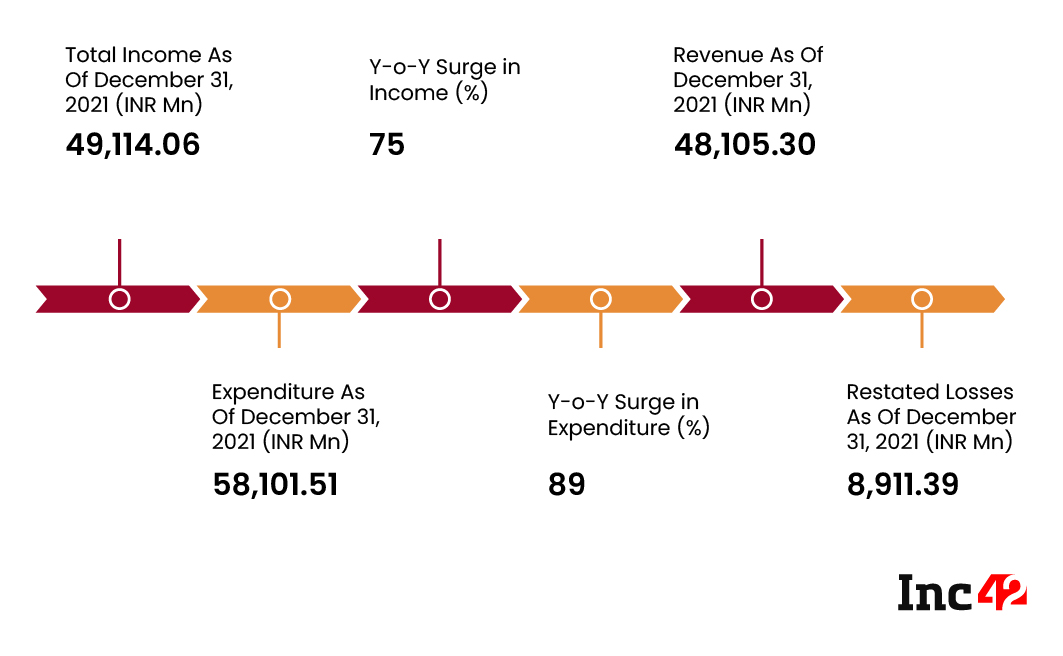

Delhivery marked INR 4,911.4 Cr in total income in the nine months ending December 31, 2021, while losses stood at INR 891.13 Cr

Shares of Gurugram-based logistics unicorn Delhivery

The scrip listed at INR 493 per share, 1.2% higher than its issue price of INR 487, on the BSE. On the NSE, the shares listed 1.7% higher at INR 495.2.

However, the shares continued to gain on the listing day, closing almost 9% higher at INR 537.25 on the BSE. On the NSE, the startup’s shares ended 10.1% higher at INR 536.25.

Founded in 2011 by Mohit Tandon, Sahil Barua, Bhavesh Manglani, Kapil Bharati and Suraj Saharan, Delhivery provides a full suite of logistics services:

- Parcel Transportation

- FTL (full truckload) and LTL (less than truckload) freight

- Reverse Logistics

- Cross-border Logistics

- B2B & B2C Warehousing

- End-to-end Supply Chain Services

- Logistics Technology Services.

Delhivery IPO

The logistics startup filed its draft red herring prospectus (DRHP) for an offer worth INR 7,640 Cr in November 2021.

However, Delhivery decided to reduce the offer by almost a third to INR 5,235 Cr due to market volatility.

While the market volatility has only increased, with stock markets falling globally and a funding winter underway, Delhivery went ahead with the IPO.

Ahead of the IPO, the logistics unicorn raised INR 2,347 Cr from 64 anchor investors, including Tiger Global, Bay Capital, Steadview and Fidelity, among others.

The IPO was subscribed 1.63 times, driven by qualified institutional buyers (QIBs).

Delhivery’s Financials

Delhivery’s total income stood at INR 4,911.4 Cr in the nine months ending December 31, 2021. During the same period, the company’s losses increased almost 200% to INR 891.13 Cr.

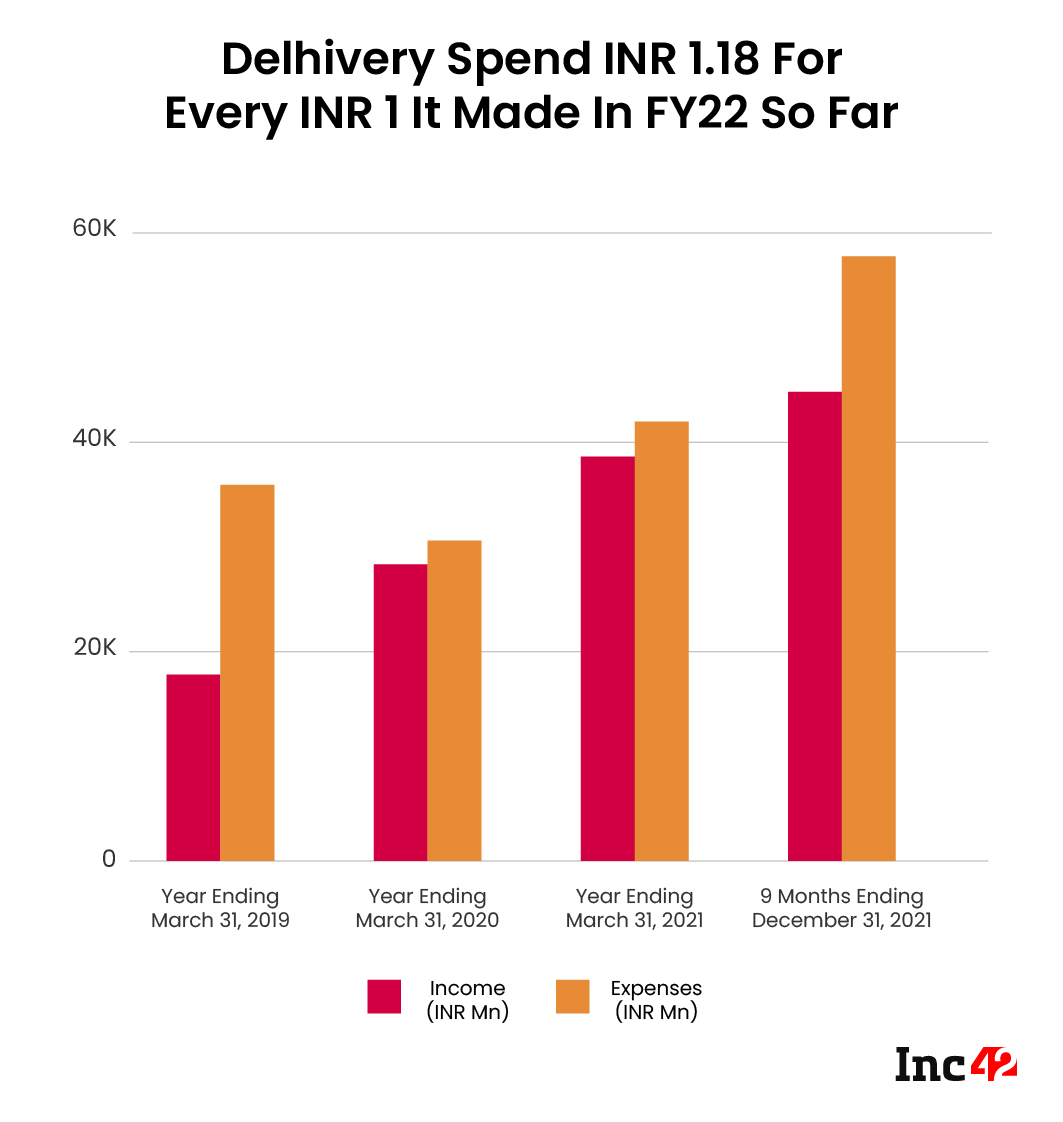

Delhivery recorded an expenditure of INR 5,810.15 Cr, a 38% increase from the same period a year ago. As things stand, Delhivery is spending INR 1.18 for every INR 1 it earns.

Earlier, Delhivery CFO Amit Agarwal told Inc42 that the startup has, since the filing of the DRHP, become almost profitable, with its EBITDA margin at -0.7%.

In a company presentation seen by Inc42, Agrawal noted that over the last 6 months of the 9 months ended December 2021, Delhivery was profitable. However, this will be confirmed once the company files its quarterly results for the last quarter of FY22.

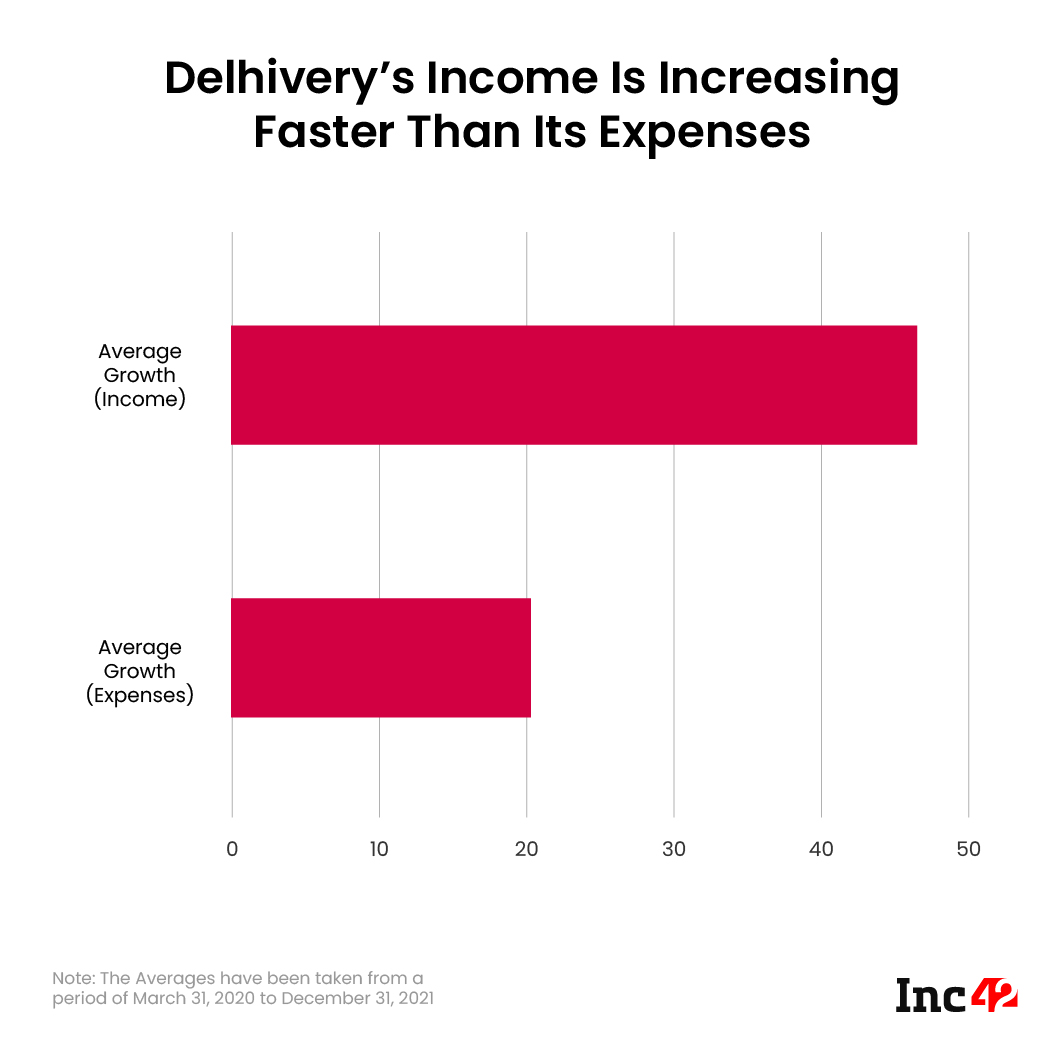

Looking at the averages from March 31, 2020, to December 31, 2021, the income grew more than 40%, while the expenditure grew about 20%.

Agrawal had said that the unicorn will utilise INR 2,000 Cr from the IPO proceeds to fund organic growth initiatives. The CFO said that the amount will be used for “investing in our existing businesses, deepening them, growing them, investing in our existing infrastructure and investing in our technology stack”.

Delhivery will use the rest of the proceeds to fuel inorganic growth opportunities via acquisitions and other strategic initiatives.

Ad-lite browsing experience

Ad-lite browsing experience