The estimated INR 5,000 Cr IPO would make Digit Insurance the second insurtech startup to go public after Policybazaar hit the stock exchanges last year

Founder Kamesh Goyal owns over 45% stake in the company and is part of the promoter group selling its shares in the IPO

As per insurance sector analysts, the critical question for Digit and other digital insurance platforms would be balancing the government’s drive towards affordability with the need to show higher profits to investors

Fairfax and Sequoia-backed insurtech unicorn Digit Insurance

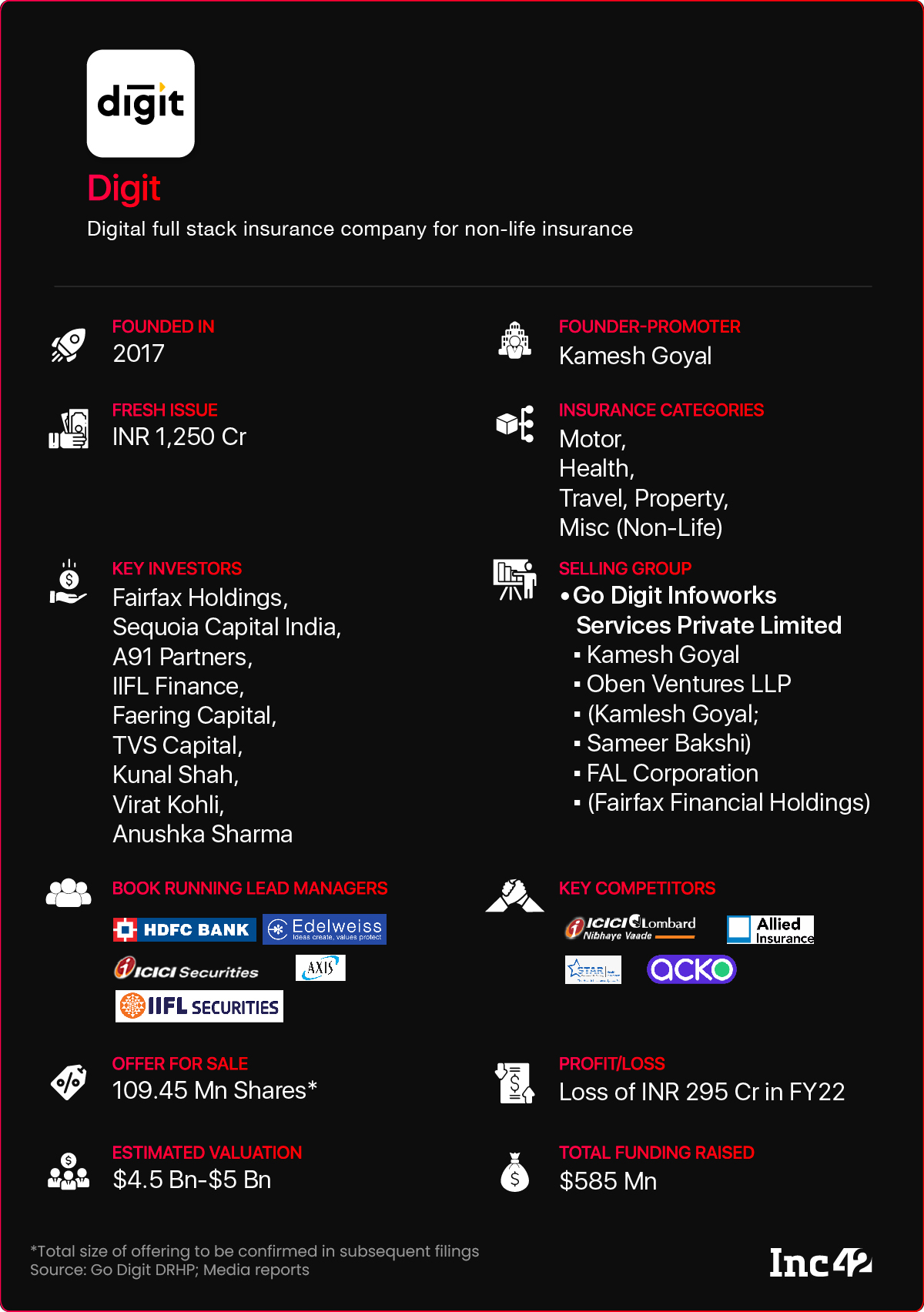

Founded in June 2017, Digit Insurance is a full-stack digital insurance provider in the non-life categories such as motor, fire, marine, health and other segments. The current DRHP is bereft of many of the details pertaining to the IPO. But we do know that the offering will include a fresh issue worth INR 1,250 Cr and an offer for sale (OFS) of 109.45 Mn shares from existing shareholders. Unconfirmed reports peg the total size of the IPO at INR 5000 Cr.

The total offer size will be made clear in the subsequent filings with the market regulator, including the RHP before the subscription window. The company has named ICICI Securities, Morgan Stanley, Axis Capital, Edelweiss, HDFC Bank and IIFL Securities as the bookrunners for the IPO. Here’s a snapshot of the pertinent details of the Digit IPO.

The IPO would make Digit Insurance the second insurtech startup to go public after Policybazaar hit the stock exchanges last year. While Policybazaar is an insurance aggregator and marketplace, Digit has an Insurance Regulatory and Development Authority (IRDA) licence to create and sell general insurance policies i.e. in the non-life category. In fact, Policybazaar is a distribution channel for Digit.

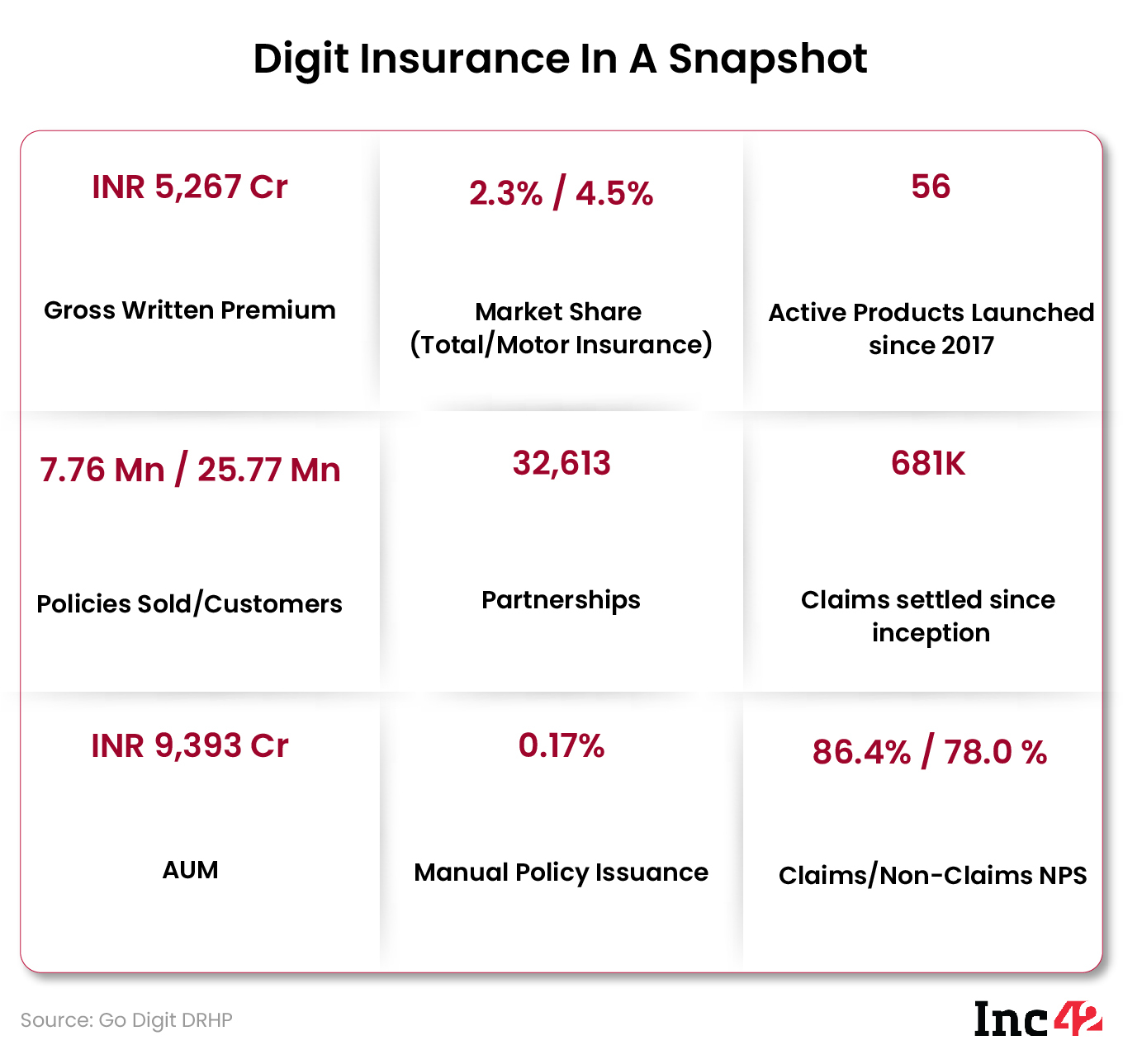

Founded in 2017 by Kamesh Goyal, Digit Insurance offers insurance policies in multiple verticals. Digit claims to have served more than 25 Mn customers at the end of FY22 across car, bike, health and travel insurance segments. It claims to have issued more than 7.7 Mn policies till date, with the total assets under management coming up to INR 9,393 Cr by the end of the fiscal year.

Digit says the net proceeds from the offering will be used towards augmentation of its capital base and expansion of business and improving the solvency margin and solvency ratio, as well as increasing the brand visibility in the insurance space. Diving deeper into the DRHP, we are able to see the key people at the insurtech unicorn as well as it what it perceives to be risks in its sector, despite the massive insurance opportunity in India.

Unraveling Digit Insurance’s Shareholding

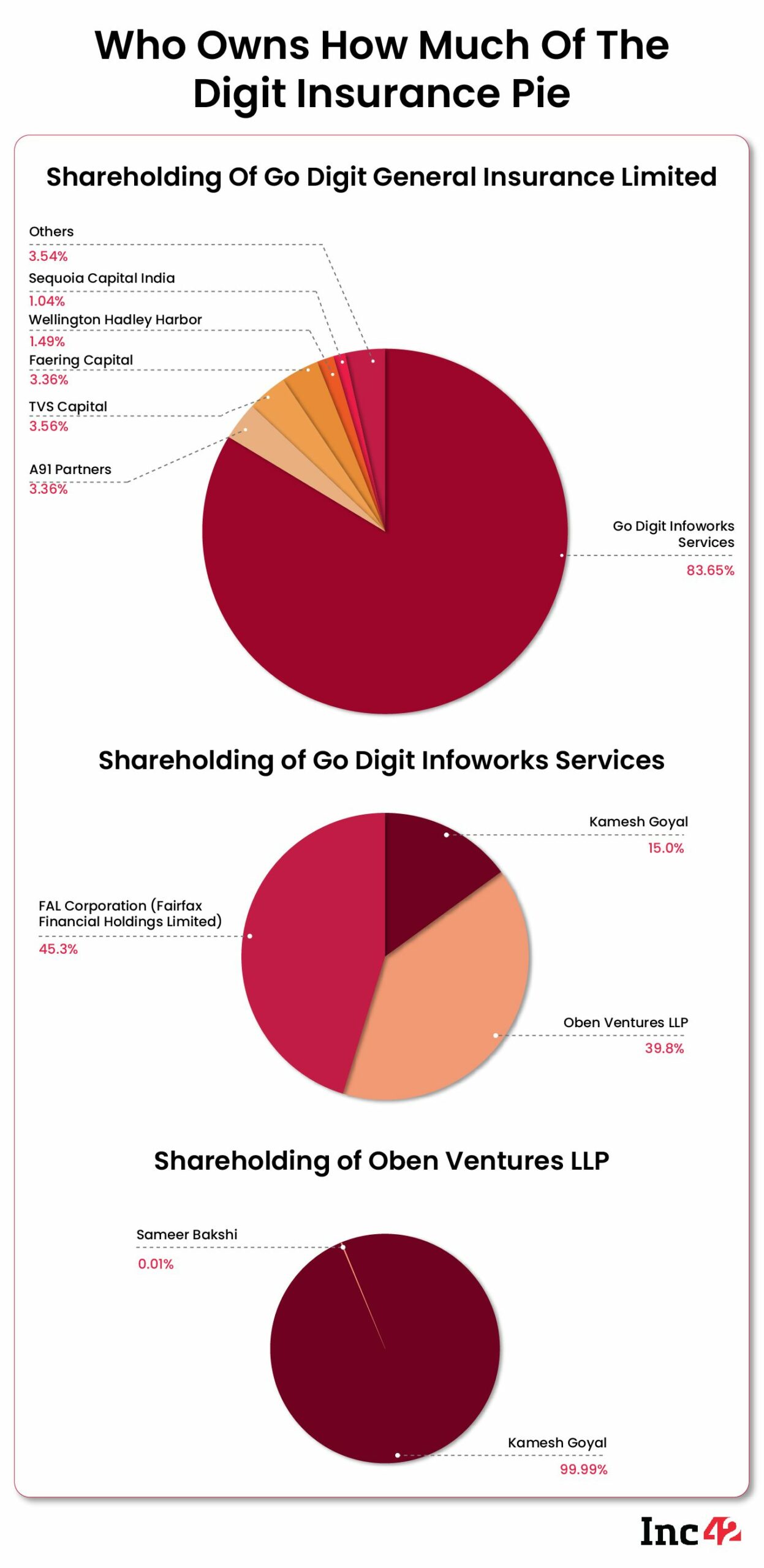

Digit’s operations are split between two companies with Go Digit Infoworks Services Private Limited (GDISPL) acting as the promoter and the holding entity, and the business being run by Go Digit General Insurance Limited (Digit), which began life as Oben General Insurance Limited in 2016. In June 2017, Go Digit General Insurance Limited was registered as a fresh entity, as per the DRHP.

As for the shareholding in the company, the filing does not explicitly state how much stake founder Kamesh Goyal holds in the company. That’s because Goyal owns a stake directly as well as through another entity which is part of the promoter and holding entity GDISPL.

As seen in the visual below, Goyal is a 99.99% owner of Oben Ventures LLP, which owns 39.79% stake in GDISPL. Besides this, Goyal also directly owns 14.96% stake in GDISPL. It’s a bit of a Matryoshka Doll structure.

Given that GDISPL owns 83.65% stake in Digit, our estimate is that Goyal holds just over 45% stake in the company.

Besides GDISPL, Digit’s shareholders include A91 Partners, TVS Capital, Faering Capital, Wellington Hadley Harbor Partners, Sequoia Capital India as well as a host of angel investors and employees that have received ESOPs.

In 2021, Digit raised INR 121 Cr in a funding round which took its valuation to $4 Bn. According to reports earlier, the company is likely to go for an IPO at a valuation of $4.5 Bn – $5 Bn, however, this will only be cleared up close to the IPO date.

As per the DRHP, only the promoter entity will be offloading shares in the IPO along with other shareholders Nikita Mihir Vakharia, Mihir Atul Vakharia, Nikunj Hirendra Shah, Sohag Hirendra Shah, Subramaniam Vasudevan and Shanti Subramaniam.

None of the existing investors in the company are exiting the company by selling their shares at the time of the public offering. However, this could change in subsequent filings.

How Digit Earns Its Revenue

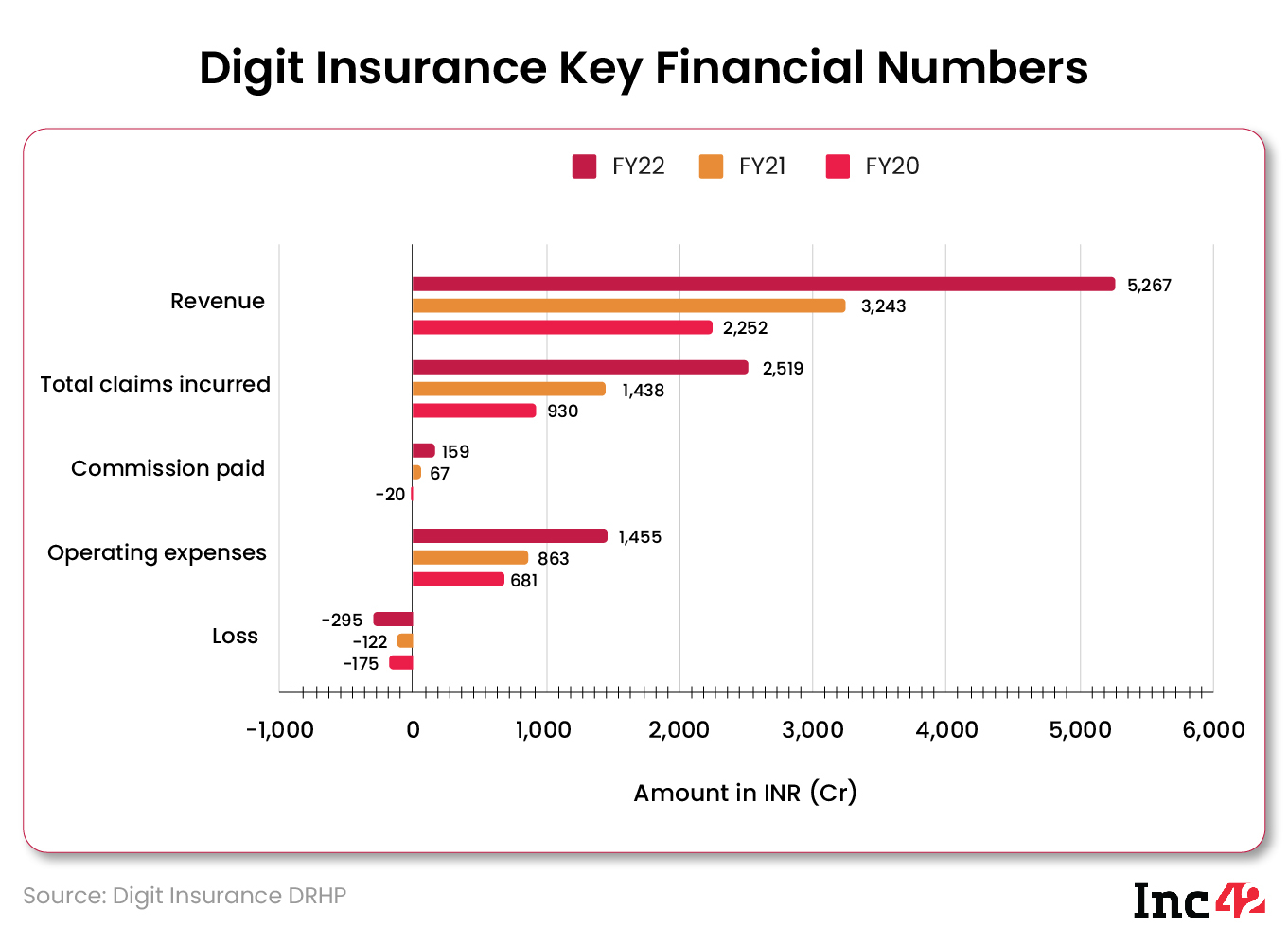

According to its FY22 financial report, Digit Insurance booked an operating loss before tax of INR 375.15 Cr, more than double the INR 185.49 Cr loss reported in FY21. Similarly, the startup’s loss after tax remained at INR 295.86 Cr, up 141% from the INR 122.76 Cr it reported the previous fiscal year.

The insurtech unicorn reported INR 6,095.24 Cr in premia received in FY22, which includes advance receipts, up from INR 3,616.79 Cr, a 68% increase. The total number of customers in motor, health and personal accident insurance increased by 41.5%, 17.9% and 11.6%, respectively.

Total investment income represents the income earned by the company from investment of assets, both policyholder and shareholder funds, and primarily comprises interest income, amortisation of premium or accretion of discount on debt securities.

Digit’s income from investments increased from INR 308 Cr in FY21 to INR 436 Cr in FY22, an increase of 41.7%, driven by an increase in the AUM thanks to growth in policies issued and new customers. Besides this the additional capital infusion from share issuances brought in gross proceeds of INR 1,026 Cr. The total investment income in FY20 was INR 177 Cr.

The overall AUM increased from INR 5,590 Cr in FY2021 to INR 9,393 Cr by the end of March 2022, which is a robust growth of 68% in the past two years.

According to the filing, the combined market size of non-life insurance products is approximately $11.83 Bn as measured by gross value of premia in FY2022 and this is estimated to grow to 19.46 Bn by FY2026. Private non-life insurers have captured a significantly higher market share, increasing from 40.3% in 2013 to 58.1% in 2022.

Digit claims the general insurance market remains fairly fragmented with no single private player holding over 10% market share as of March 31, 2022.

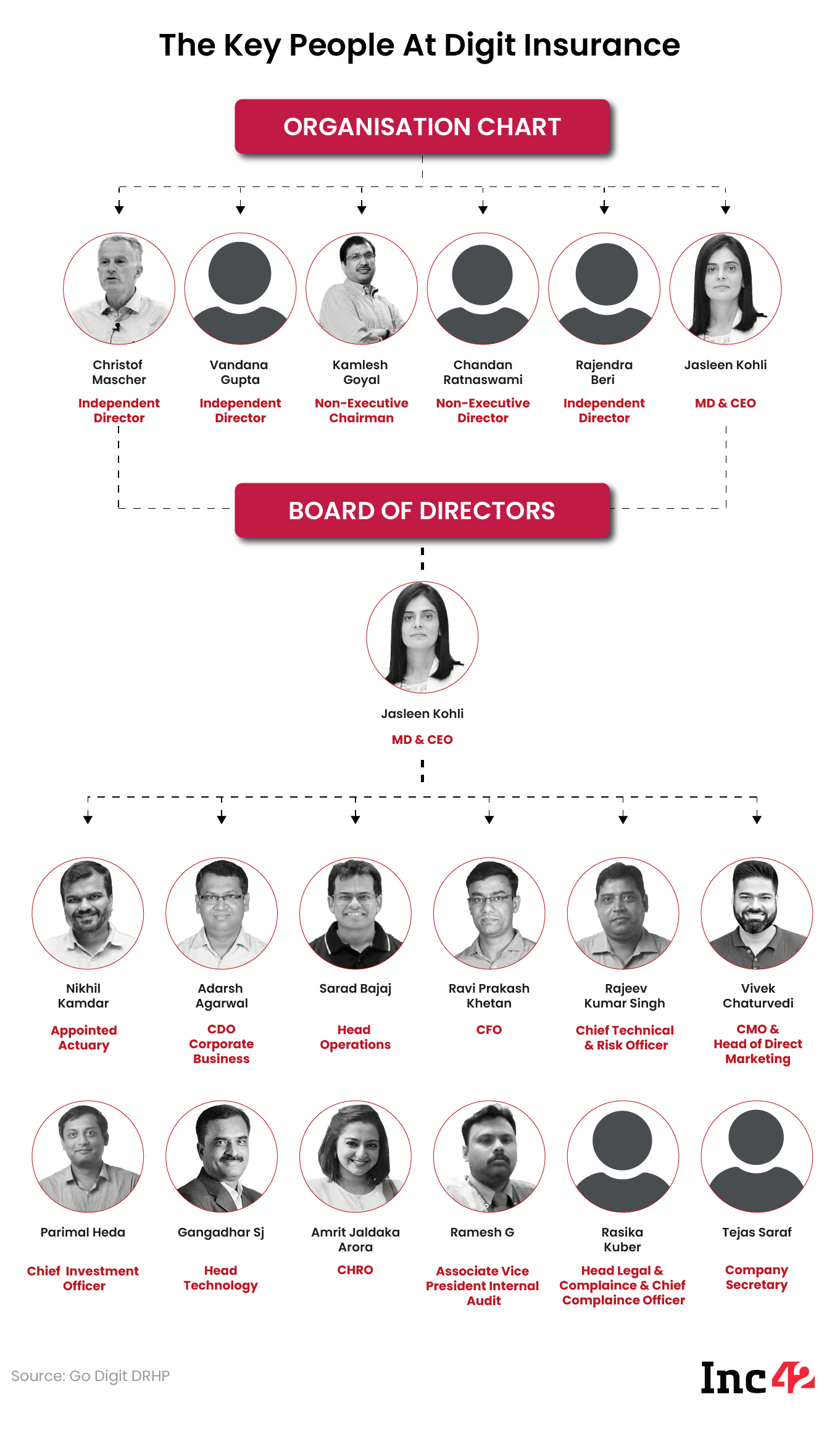

The Key People At Digit

Digit’s Board of directors include founder Goyal; CEO & MD Jasleen Kohli; Fairfax Holdings nominee Chandran Ratnaswami; former chairman and managing director of New India Assurance Company Limited Rajendra Beri; pathologist and Doctor of Medicine Vandana Gupta; and Christof Mascher, a former COO at Allianz SE, who was appointed to the board in July 2022.

As for the key managerial personnel, the company has listed all the function heads in the DRHP as per SEBI’s Issue of Capital & Disclosure Requirements (ICDR).

Kamesh Goyal

Founder and chairman of the company, Kamesh Goyal is a science and MBA graduate from Delhi University and has several years of experience in the insurance industry. Before founding Digit, he was the CEO of Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance.

Jasleen Kohli

The MD and CEO of Digit Insurance, Jasleen Kohli is an MBA graduate of K J Somaiya Institute of Management Studies and Research and was the head of operations of Bajaj Allianz General Insurance prior to joining Digit. She was appointed as the chief executive and MD in April this year and owns 0.07% stake in the company. Kohli will draw a salary of INR 9.8 Cr per annum besides perquisites and other benefits in FY23, and she earned a salary of INR 2 Cr in FY22 till March 2022.

Ravi Khetan

Ravi Khetan is the chief financial officer at Digit and has been with the company since May 2017, when it still operated as Oben Insurance. The qualified chartered accountant joined Digit from Bajaj Allianz General Insurance and was paid INR 4.7 Cr in FY22.

Nikhil Kamdar

Nikhil Kamdar is the appointed actuary and has been with Digit Insurance since January 2018, and previously worked with Swiss Re, Bajaj Allianz General Insurance, and Mercer Consulting (India). The total remuneration paid to him in FY2022 was INR 54.6 Lakh.

Other KMPs at Digit Insurance

Besides this, the KMPs at Digit as per the DRHP include chief technical and risk officer Rajeev Singh, chief investment officer Parimal Heda, chief compliance officer Rasika Kuber, company secretary and compliance officer Tejas Saraf, chief distribution officer Adarsh Agarwal, head of operations and moto claims Sharad Bajaj, chief marketing officer Vivek Chaturvedi, head of technology Gangadharayya Jadagerimath, chief HR officer Amrit Arora, associate VP Ganesan Ramesh.

It must be noted that KMPs in a DRHP include the core management personnel who may or not be included in the list of material KMPs post listing. As seen in the conflict of interest controversy in the Zomato-Blinkit acquisition, SEBI has different criteria in the ICDR and Listing Obligations & Disclosure Requirements (LODR) that govern KMP nominations.

Risks For Digit & Insurtech Players

Digit has outlined the typical risks associated with any startup looking to list such as the lack of profitability, the short life of the business, the possibility of a natural calamity increasing the number of claims, the potential threat of regulations and policy, the plethora of competition and more.

However, the real problem for insurtech startups is the fact that the focus of the government and the insurance regulator has been on increasing the accessibility, affordability of plans, and this makes it harder for companies to recoup the marketing and allied costs in acquiring customers.

The three As — affordability, accessibility and acquisition — have given insurtech startups plenty to think about.

The question is how to balance the push for affordability with the need to show profit margins. In the public markets, Digit will need to deliver consistent revenue accounts growth and profitability to prove long-term value to shareholders.

We will dive into the competitive landscape of general insurance in India and view how Digit stacks up to the legacy institutions, other public cos and startups. Watch out for that later this week, but back to the question of risks for Digit.

When it comes to affordability, the IRDA has consistently pushed to reduce the upfront costs to the insured so that India’s insurance penetration can be pushed up to global standards. According to IRDA data, insurance penetration in India went up in FY21 to 4.2% from 3.76% in FY20, but this is just above the global average of 4%, which is poor for a country with India’s population base.

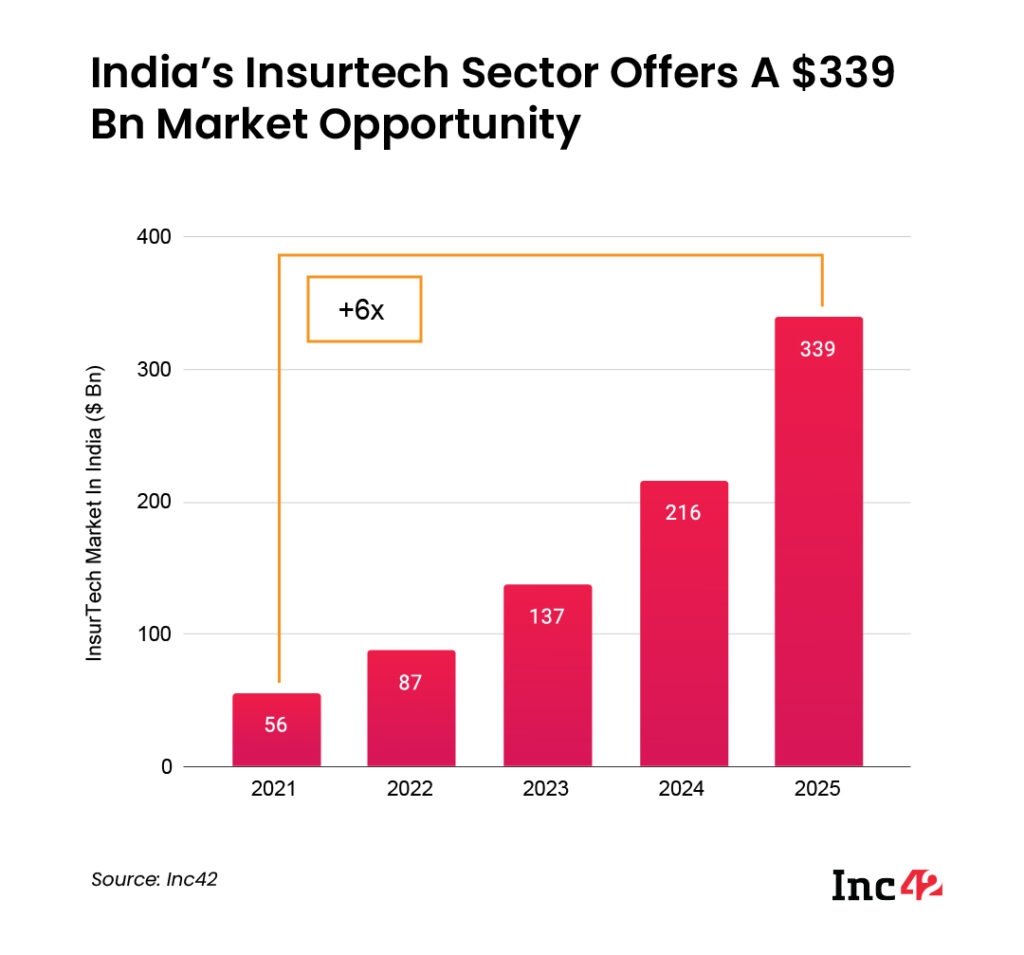

This low coverage base is what makes insurtech such a huge opportunity. As per a senior leader at a B2B digital insurance platform, the government is doing everything it can to enable digital platforms since it believes technology can reduce the cost of insurance.

The second problem is accessibility, which the regulator has recently looked to solve by increasing the maximum number of insurance partners for banks. Here the objective is to provide customers as much choice as possible when they procure insurance through banking windows.

The final A of acquisition is where startups such as Digit Insurance might struggle to match the network of larger general insurance companies. However, startups might hope that the IRDA regulation around banking partners might help them reach a wider audience without overspending on marketing.

At the moment, Digit’s IPO is still months away and we won’t know for a while how exactly the market might change. Regulations are always a roving threat for fintech companies, and despite the large opportunity for insurance players, there is some heavy competition in this field. Plenty still hangs in the balance.

Ad-lite browsing experience

Ad-lite browsing experience