Starting as a discovery and reviews platform Foodiebay in 2008, the Zomato that we know today is a global foodtech behemoth with a presence in 16 countries

By becoming India’s first-ever foodtech brand to go public, Zomato has created history in the consumer internet market

As Zomato marches towards a $1.1 Bn public offering, a look at its twelve-year journey is a case study that will continue to inspire many more Internet entrepreneurs

India’s consumer internet segment has truly arrived. The much-awaited red herring prospectus of food delivery platform Zomato is historical for several reasons. Zomato’s $1.1 Bn public offering that was unveiled in the last week of April comes at a time when many experts and critics questioned the sustainability of the food delivery models in the Indian context.

Gurugrum-based Zomato has seemingly proved them wrong a decade after it first launched in a different avatar as a restaurant discovery platform in 2008. The 12-year journey of Zomato under the helms of two IIT graduates — Deepinder Goyal and Pankaj Chaddah (who left the company in March 2018) — is an inspiration for several other second-generation internet entrepreneurs in India after the dotcom bust in the early 2000s.

In 2005, before Goyal even co-founded Zomato with Chaddhah, the former had already tasted failure with his earlier venture named foodlet.com which offered online food delivery. The startup failed to garner demand from users and Goyal pulled the plug on it after working on it for almost a year. In an interview in 2015, Goyal said that foodlet.com was ahead of its time.

“I started the first online food ordering company in India, ever. It did not work; 2005 was way too early,” Goyal said in the 2015 interview.

However, Goyal was relentless in finding a way to improve how Indian consumers discovered and consumed food. He then co-founded ‘Foodiebay’ along with Chaddah in 2008 (which was the first avatar of Zomato). Conceptualised as a restaurant discovery and rating platform, it aggregated food menus and contact details of those establishments. The idea was to help hungry Indians discover food nearby their locality (or the same city) along with an option to leave online reviews showcasing their dining experience.

As Zomato marches towards a $1.1 Bn public offering, it may not only change how future investors perceive the foodtech market but the entire restaurant industry as well. Some of the notable IPOs in the restaurant industry including Barbeque Nation, and BurgerKing that were announced during the pandemic has not seen much demand from retail investors yet. Both company’s share prices have only declined consistently, although they saw some upward movement during the last few weeks. Hence Zomato, which is part of a duopoly in India’s foodtech, will be closely watched by both the restaurant and internet industry investors.

From Food Discovery To Delivery

In 2008, when Zomato (called Foodiebay at that time) had just started, the smartphones and the internet revolution was in its infancy in India and most restaurants promoted their menus offline using paper flyers and catalogues. At that time, touch screen smartphones with executable mobile apps didn’t exist and India’s internet penetration rate was hovering below 5%. So, when Goyal and Chaddah had just graduated from college to join Bain Consulting in 2007, they realised that going through a pile of physical menus flyers that came with the daily newspaper was a broken experience.

Like every other internet entrepreneur in the early 2000s, the rush to fix such irregularities in the offline consumer experience had given rise to several “startup ideas”. Ashish Fafadia, Partner at Blume Ventures while speaking with Inc42 recalls that Zomato had launched in an era where the tech startup ecosystem in India was just shaping up and the founders were able to raise interest and funding from investors even with business models which weren’t readily monetisable.

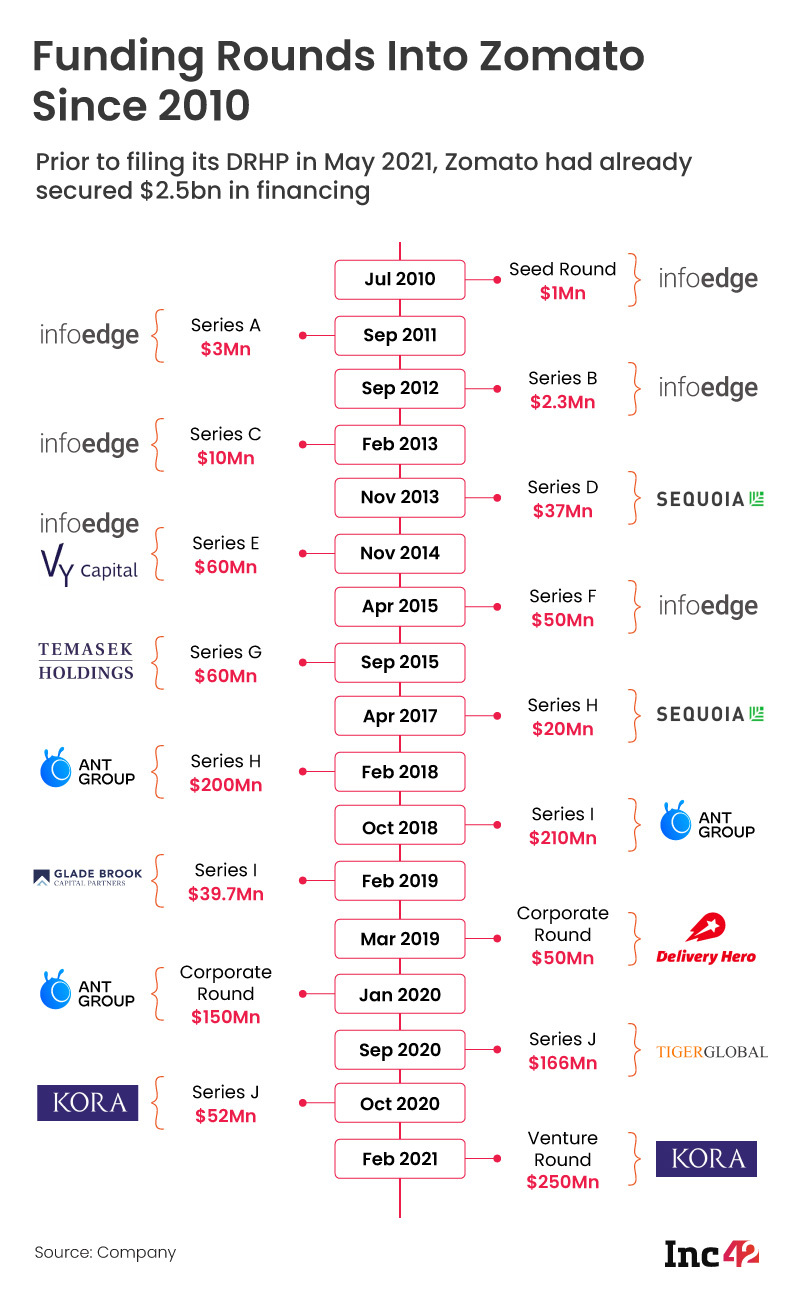

But with Foodiebay, the two founders did not go rushing to raise capital. The first seed funding worth INR 4.7 Cr into Foodiebay came from Naukri-parent InfoEdge in August 2010 – after two full years of bootstrapping the venture. In the first year (2008) alone, the platform added more discovery details of more than 1,400 restaurants in the Delhi NCR region. In those initial years, Foodiebay did not spend on publicity or marketing and mostly depended upon word of mouth to grow its user base.

In less than two years after its launch, Foodeibay was able to add 2 Mn customers, 8,000 restaurants, and also expanded into five cities, backed by the largest internet company at that time. In a blogpost in November 2010, Goyal pondered over the future of the company. He did indicate that his startup wanted to go beyond just being a food discovery portal —a decision that would catapult Zomato into what it is today — a global brand with a presence in over 15 countries and 10,000 cities. In late 2010, Goyal and his team decided to rebrand the startup as ‘Zomato’ to reflect its ambitions, and to avoid a possible lawsuit from eBay over the use of the name ‘Foodeibay’.

“We saw that if we wanted to touch broader horizons then the name “Foodiebay” wasn’t going to be the best option since it might restrict our perception as just a food website. And right now was the time to reflect deeply and think about what we should be christened as especially since we are going to invest heavily in marketing the brand. Another thought that was at the back of our minds was to prevent any overstepping of eBay when we start accepting online payments,” Goyal wrote in the blogpost in November 2010.

Although venturing into food delivery did change Zomato’s fortunes, the startup’s eventual goal was to capture both the demand and supply side of the restaurant market. This is also evident from the various other businesses that Zomato ventured into over the years. Currently, Zomato’s primary revenue source included ad sales, food delivery, and Zomato Pro subscriptions. For its next leg of growth, Zomato is now doubling down as a direct service provider for restaurants by offering online discovery, table booking, cloud kitchen infrastructure and B2B raw material supply for restaurants via Hyperpure. It has even indicated the desire to enter food-adjacent categories such as grocery — which it eventually shelved — and now nutraceuticals and health supplements.

Experts that Inc42 spoke with indicate that B2B supply to restaurants is an important revenue generator for Zomato for its next leg of growth. It not only helps Zomato maximise the revenue per restaurant, but is a key value proposition for potential cloud kitchen customers, where Zomato provides access to kitchen facilities and food delivery to business owners. Zomato’s DRHP filing shows that it generated gross income worth INR 112.14 Cr from Hyperpure sales during a nine-month period from April 2020 to December 2020.

“Our purchase of stock in trade and changes in inventories of traded goods was INR 119.31Cr in the nine months ended December 31, 2020. This represents our cost of goods sold for our Hyperpure operations. As a percentage of total income, it was 8.72% in the nine months ended December 31, 2020,” Zomato said in its DRHP.

Currently, Zomato operates large warehouses for storing Hyperpure inventory in locations including Delhi NCR, Mumbai, Pune, and Bengaluru and already caters to more than 6,000 restaurants. According to the company’s DRHP, Hyperpure services were “least impacted” due to COVID-19 since the demand for B2B grocery supply remained high due to supply chain disruptions during the pandemic.

Creating A Global Empire

However, it’s important to remember that Zomato did not get into food delivery until 2015 — a year after its main rival Swiggy entered the market. There is a reason why: it is simply that food delivery economics did not make sense due to lack of demand, and enough supply of riders on the ground. This is evident from the bloodbath that took place in the market between 2014-2018. Several startups including TinyOwl (drastic end), Foodpanda (now defunct), Spoonjoy, JustEat and even UberEats (exited to Zomato) tried and burnt their hands in the market.

“(Launching) Food delivery was the turning point for (Zomato) because that was a large pain point to solve for both consumers and restaurants. No individual restaurant (in 2014-2015) had the scale of orders even today to afford a dedicated delivery unit. Today, most member restaurants derive nothing less than 30% of their business via Zomato and Swiggy. In fact, it has levelled the playing field between branded QSRs like Dominos and KFC having their own franchised dedicated delivery force and standalone restaurants which are subscale,” says Anup Jain, Partner, Orios Ventures

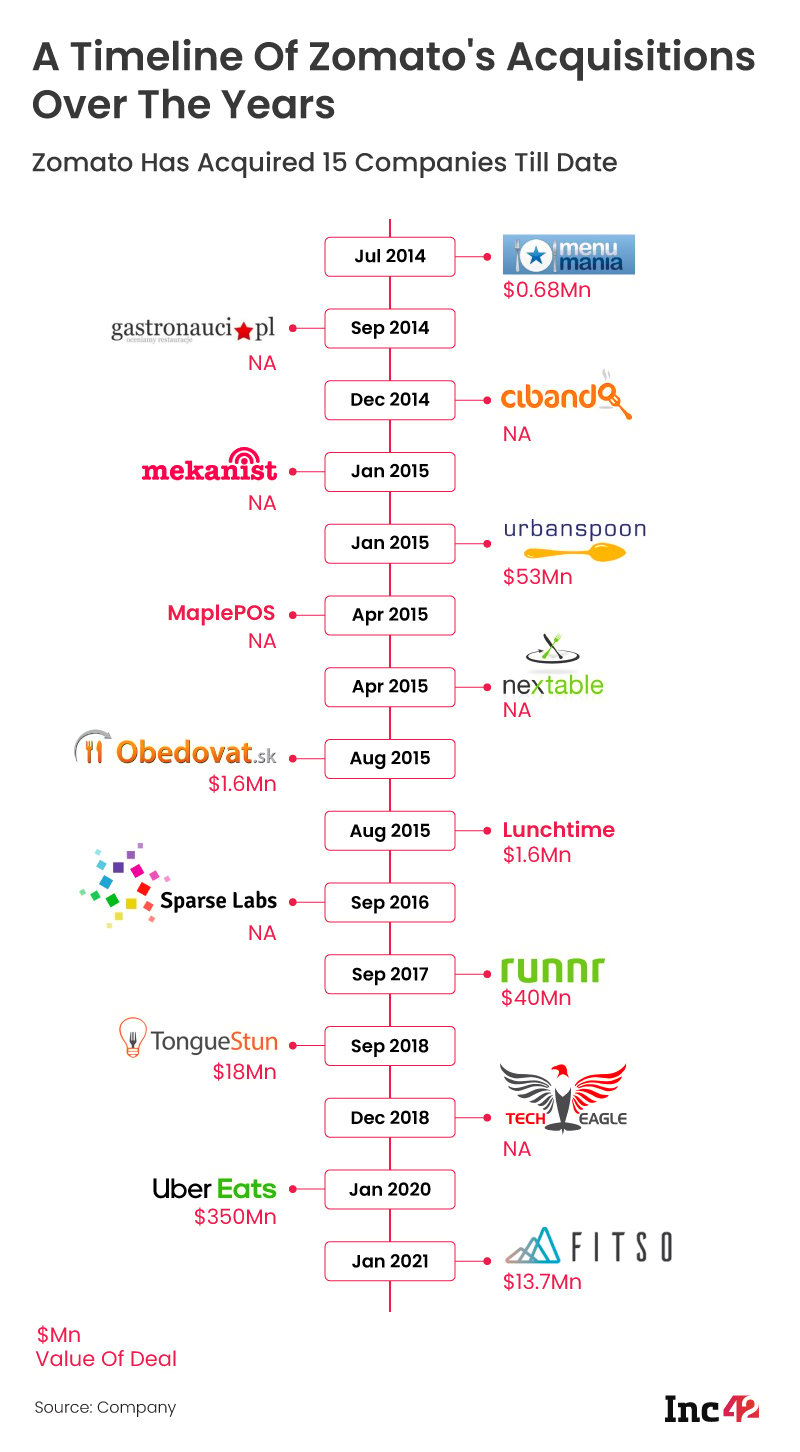

Going by Zomato’s delayed entry into food delivery, even amidst a bloodbath, it’s clear that the entry was a planned exercise, rather than a reactionary decision. One of the most important acquisitions that helped Zomato achieve scale was that of B2B logistics provider Runnr in 2017. The acquisition helped the food delivery startups to kick-start creation of its own delivery fleet. Because until the Runnr acquisition, most restaurants listed on Zomato used their own delivery personnel. Runnr’s co-founders Vatsal Singhal and Mohit Kapoor also joined Zomato in leadership roles. Although they both left the Zomato in later 2019 to launch their own fitness startup.

“For us at Zomato, we saw that we were going to be working with a team of extremely driven individuals (at Runnr) who had figured out how to solve for a vital piece of our puzzle—the one that affects our user delight: logistics…For the record, we have always maintained that the most cost-efficient delivery fleet is the restaurant’s own, where they can utilise the same staff during off-peak hours for back-of-house and marketing activities. That belief is still intact,” Goyal said in a blog while announcing the acquisition in 2017

During the last 12 years of Zomato’s journey, it acquired more than a dozen startups under its belt. It has so far acquired 14 startups around the world, and with its many subsidiaries, it has a presence in every continent, except Antarctica.

Most of Zomato’s acquisitions were focused on supplementing its restaurant discovery and search platform in various countries including Turkey, UAE, and the US. It also made various strategic acquisitions in restaurant management technology, which has helped Zomato augment its SaaS play. One of Zomato’s lesser-known apps (amongst consumers) named ‘Zomato for Business’ allows restaurant owners to take care of their online presence along with features such as analytics and revenue tracking for free. Bundling this with other software-based services such as Hyperpure, and dine-in management, Zomato has a bird’s eye view into its restaurant partners, and valuable data that has transformed the company into a full-stack restaurant service provider.

Vinay Singh, Partner of Fireside Ventures says that Zomato’s 360 degree approach which offers enterprise resource planning (ERP), and customer lifecycle management (CLM) puts itself in direct competition with other software providers in the market. Hence, Singh also expects Zomato to make more acquisitions in its non-food delivery verticals in search of more revenue and growth.

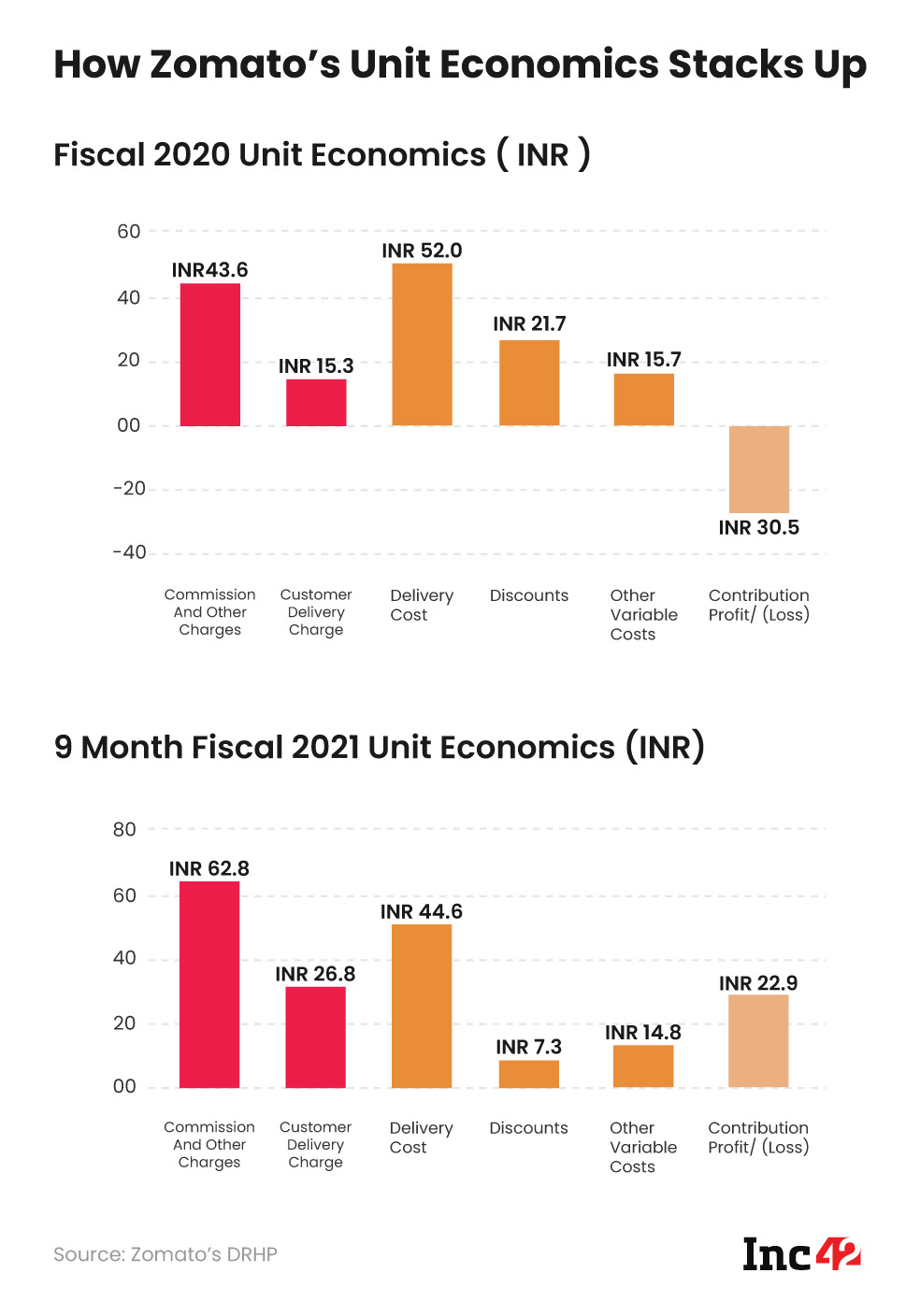

Fixing Units Economics

Zomato’s latest report card disclosed in its recent DRHP shows that the startup has turned unit economics positive. It is in fact making money on each order currently. As of Q3 FY21, Zomato’s contribution margin stood at +INR 22.9 per order on an average. This is an impressive improvement from the negative INR 30.5 margin logged in FY20 (between March 2019 and March 2020). Contribution margins refer to the money made per order after deducting all other costs.

One of the biggest obstacles for food delivery companies in India (or anywhere in the world) has been to crack the formula for positive unit economics — which means making more money than spending for an average order. The DRHP filing shows that Zomato was able to achieve this by strategically hooking customers to its platform via high discounts in the years prior to covid-19 disruption (2019-2020).

After the pandemic struck in 2020, Zomato began dropping discounts significantly and instead began charging higher delivery charges from customers and also raised commissions earned from restaurants.

A positive margin means that Zomato has somehow found a way to utilise its logistics fleet efficiently which was a problem in the initial years. It has also significantly cut down on discounts and advertising expenses, and has also found fresh revenue channels from subscriptions and increased commission income from restaurants. Zomato’s premium subscription service Zomato Pro recorded 1.4 Mn members in India as of Dec 31, 2020.

Just five years back, the unit economics in food delivery did not make sense. But today, due to the increased density of orders and the number of restaurants coming online, it seems like Zomato’s is on the right path. However, the going hasn’t been easy. Zomato burnt through $2.1Bn to get to where it is today — a multi-billion dollar company making history as the first foodtech firm in India to go public.

Investors in the food and restaurant ecosystem that Inc42 spoke with point out that the current duopoly held by Zomato and Swiggy in the foodtech market could change with cloud kitchen brands like Rebel Foods (which owns Faasos) catching up to the billion-dollar mark. But brands like Faasos, Freshmenu, and Box8 are in fact, heavily dependent on Zomato, Swiggy, and Dunzo as an important distribution channel. And this is what makes India’s foodtech segment an interesting case where we could see the emergence of new billion-dollar food brands that run on top of the aggregator ecosystem.

“Although the two aggregators (Swiggy and Zomato) will continue to control the food delivery space there is still a massive market waiting to be tapped in smaller cities. So while aggregators may end up being worth $20 Bn – $30 Bn in the future, there is an opportunity for many cloud kitchen brands to build billion-dollar food brands within the same market,” says Ashvin Chadha, co-founder of Anicut Angel Fund which has several portfolios in the D2C foods and restaurant space.

Over a hundred foodtech startups have mushroomed since the idea of online food delivery and discovery germinated in the 2000s. When Foodiebay first popped up in 2008, the two co-founders Goyal and Chaddah originally focused on helping restaurants find new customers. Although venturing into food delivery may have helped Zomato to carve its name into foodtech ecosystem, Goyal seemingly did not give up on his original thesis. Throughout his journey from Foodiebay to Zomato, he knew that bringing restaurants to the Internet ecosystem cannot be achieved with food delivery alone. But with renewed interest from ecommerce giant Amazon which is currently pushing through food delivery in India using discounts as user acquisition model, Zomato may too have to burn more cash in the near future thus affecting the path to profitability.

Ad-lite browsing experience

Ad-lite browsing experience