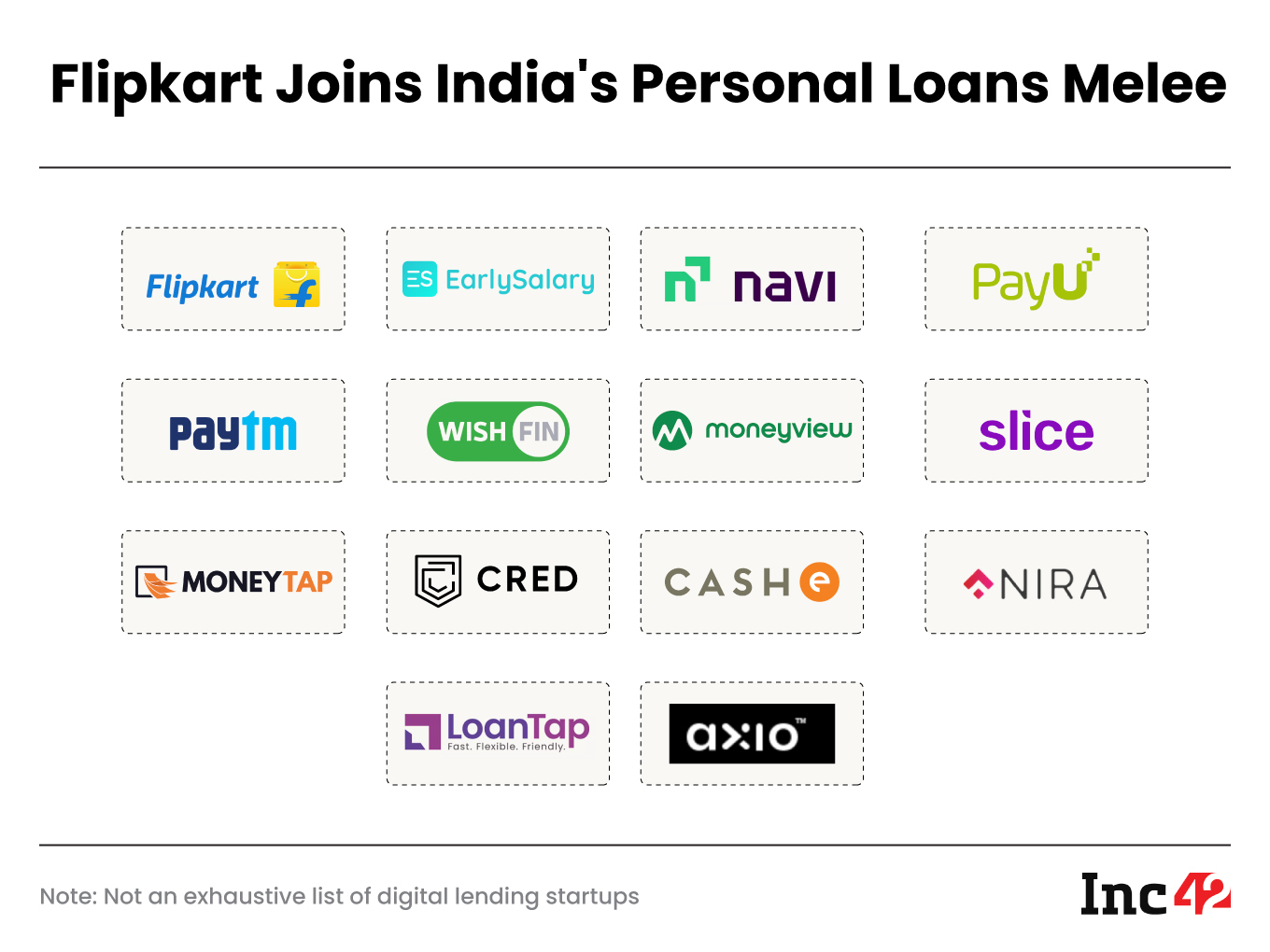

With eyes on the personal loan business, can Flipkart take on the likes of Navi, CRED, Paytm, Money View and others?

Consumer fintech is already largely digital lending, and now even ecommerce and consumer services players have joined the flock. This past week two major consumer internet giants — Flipkart

This just goes to show that the digital lending opportunity is going beyond fintech. While Swiggy has announced an entry into the co-branded credit card segment, Flipkart’s eyes are on the personal loan business. And it’s also stepping on sister concern PhonePe’s shoes with this major lending push.

How will this bigger financial services play (to add to the BNPL biz) change Flipkart in the long run? Especially since this is a completely different problem to solve than ecommerce and that’s before we even think about the revenue implications in the long run. We take a look after this detour to the top stories from our newsroom this week:

- PharmEasy’s Bubble: From an INR 6,250 Cr IPO to reports about raising funds at 90% valuation cut, PharmEasy’s fortunes have swung wildly in less than a year. Our in-depth story on what has gone wrong

- Startups On Debt Spree: Debt funding in Indian startups rose 80% YoY in H1 2023, as equity investments have slowed down. But is this causing an overreliance on debt among startups?

- Prime Venture Partners’ Moneyball: As VCs get conservative, they are seeking founders who have inherently built a mindset of not pushing for growth at all costs, says Prime VP’s Sanjay Swamy

Flipkart Enters The Loan Zone

Flipkart has always been a marketplace and now instead of selling physical products, it’s selling loans. It’s being seen as a critical tool to pull the ecommerce major from the red into the black as personal loans have several revenue streams and is generally the largest segment in retail lending.

The ecommerce giant will leverage the combined user base of Flipkart and Myntra to reach an audience of close to 300 Mn, and shopping data and behaviour will be a key data differentiator for Flipkart in competing against the likes of Navi, CRED (also a new entrant), Paytm and others in the personal loans space.

As per a report in The Arc, Flipkart is building an underwriting model in-house to ease the risk assessment process before loan disbursals. Like most of its rivals, the company will provide personal loans of up to INR 5 Lakh, with flexible repayment cycles ranging from 6 months to 36 months.

Ecommerce Giants Turn Lenders

Of course, personal loans is not the first lending category that Flipkart has entered. It launched a BNPL solution in 2017, as it looked to boost the order size and allow customers to pay for products in multiple instalments without a credit card.

As the BNPL market exploded with individual startups and larger players, Flipkart’s rival Amazon also joined the fray in 2020. Since then, BNPL has grown substantially, but the low ticket size and the constant churn of retargeting users who pay the outstanding has become a marketing drain on many ecommerce players.

For Flipkart, the lending play is particularly important given that the threat of JioMart has grown considerably in the past year. Plus, the launch of Jio Financial Services is another potential disruptor for Flipkart, Amazon and Tata Neu. The Tata Group’s super app also has a loans marketplace, with Tata Capital being the lending partner in this case.

Clearly, Flipkart is not the only ecommerce marketplace that wants to disburse loans, which begs the question of whether other consumer internet businesses will also come after the lending pie?

Even Swiggy has jumped on the bandwagon as per reports this week. The foodtech and quick commerce giant is said to be launching a co-branded credit card with HDFC Bank to compete with Zomato, Myntra, Paytm and others.

In May, Swiggy cofounder and CEO Sriharsha Majety claimed that the company has achieved profitability in its food delivery business, while Instamart quick commerce was said to be on track towards positive unit economics. The credit card play will undoubtedly help boost Swiggy’s dining-out business, for which it acquired Dineout last year.

Flipkart On PhonePe’s Turf

With the personal loan launch, Flipkart has pipped PhonePe to the post. Following PhonePe’s separation from Flipkart earlier this year, the sister companies have been playing in the other’s court.

Stepping on Flipkart’s shoes, PhonePe has also entered the ecommerce space with the launch of its ONDC-native app Pincode.

And now Flipkart has gone for B2C lending, which is still missing from PhonePe’s armoury. PhonePe’s digital lending ambitions took a temporary hit after it decided to not go ahead with acquisition of ZestMoney, but it has already entered the merchant lending space to get a toehold.

This week, it was also reported that Flipkart has started a $700 Mn employee stock option plan (ESOP) buyback as part of its separation from PhonePe. The company’s marketplace arm, Flipkart Internet’s standalone net loss surged 1.5X to INR 4,361 Cr in FY22 from INR 2,881.3 Cr in FY21. The Bengaluru-based company’s total income rose 31% YoY to INR 10,659 Cr in FY22.

Digital Lenders Vs Pretenders

Personal loans — depending on the commission and fee structures — can be extremely lucrative from a unit economics standpoint. Just look at Paytm, which saw its loan disbursals surge 167% YoY to INR 14,845 Cr during the April-June 2023 quarter, while the number of loans also increased 51% YoY to 12.8 Mn.

The growth in the value of loans and number of loans disbursed was 7.56% and 18.25%, respectively, on a quarter-on-quarter basis. Overall, the Vijay Shekhar Sharma-led fintech giant has issued 24.7 Mn loans worth INR 27,399 Cr so far in 2023. To reach even close to this scale, Flipkart will need to tap its existing user base aggressively.

One Delhi NCR-based startup founder, who has built a loan book of INR 900 Cr in the past seven years, claims it’s not easy for consumer giants to simply add a personal loans feature and reap the rewards. After a point, the business needs to differentiate itself through technology and world-class underwriting. Flipkart has not exactly proved this yet.

The fact that its user base is spread beyond the metros is perhaps the biggest advantage for Flipkart as a loan origination partner for Axis Bank. Flipkart’s millions of users can actually be a great leveller when it comes to competing with the likes of Navi and CRED.

Kunal Shah-led CRED, which has around 60 Mn users, claims it had helped create a loan book of INR 10,000 Cr for its lending partners through the CRED Cash offering for its members with high credit scores. And recently it has ventured into the personal loans segment for the masses too.

Flipkart will also be up against the likes of Moneytap, Bajaj Finserv, Moneyview as well as a host of other apps such as Slice, Jupiter Money, Lazypay that have pivoted to personal loans in recent months after RBI’s changes for PPI-based lending products last year. In short, it’s a digital lending rush and Flipkart is already late to the party.

So will this be the move that snaps the ecommerce giant’s loss-making streak? And even if it does, can Flipkart really turn its focus away from the cashburn-heavy ecommerce and become a lending-first company?

Sunday Roundup: Startup Funding, Tech Stocks & More

- Startup Funding: The funding rounds for Leverage Edu, Battery Smart and GIVA accounted for nearly 70% of the $155 Mn raised by Indian startups this past week.

- What’s Hurting Nykaa Fashion: Competition from Myntra and deep-pocketed players like AJIO and Tata CLiQ has pushed back Nykaa’s fashion vertical at a critical time for the company

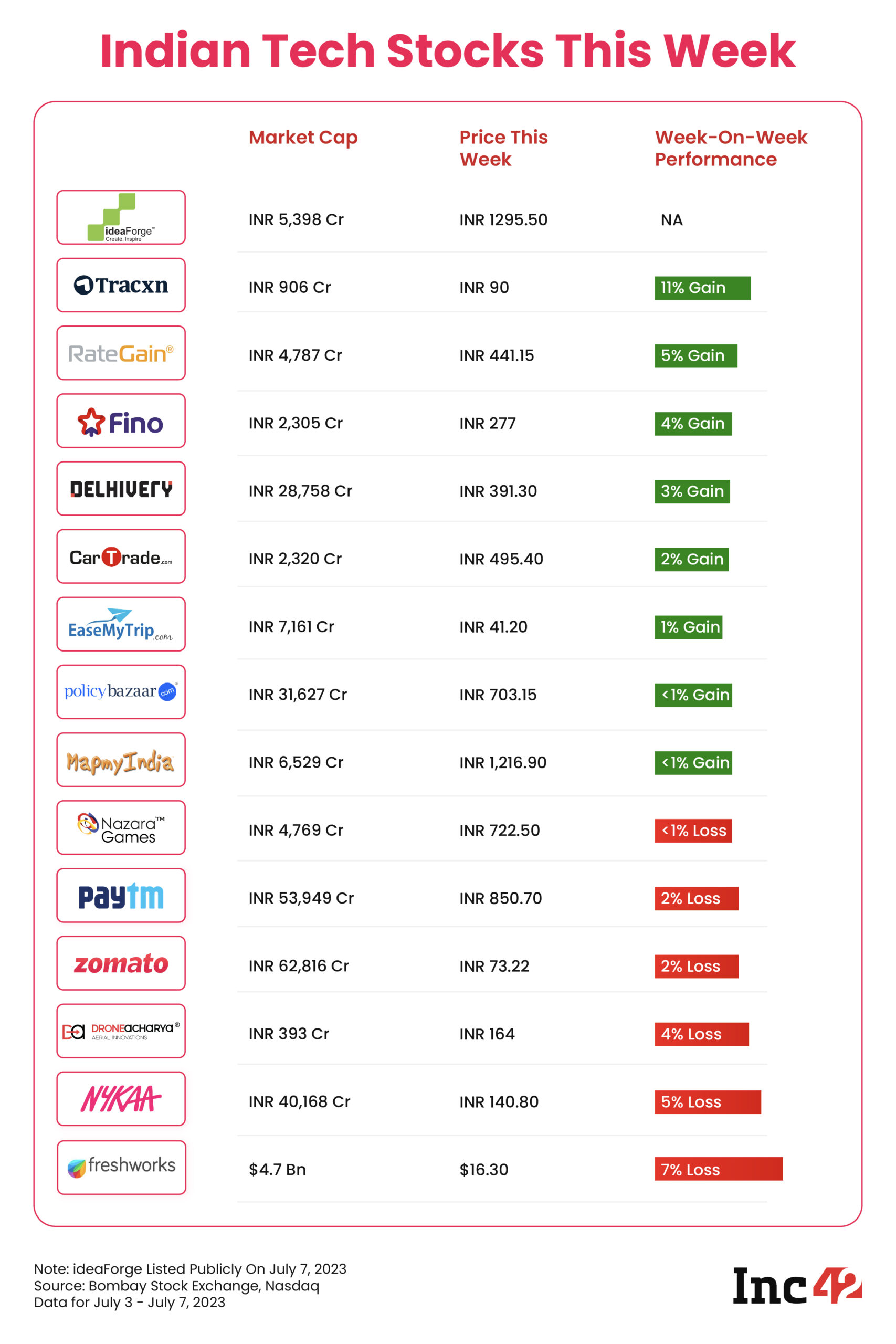

- ideaForge Pops: Drone manufacturer ideaForge listed on the NSE and BSE at a 94% and 93% premium, ending the week at INR 1,295 or 90% higher than issue price

- Fantasy Cricket Boom: With 24% YoY growth fantasy sports platforms in India saw gross revenues of INR 2,800 Cr during IPL 2023, according to a RedSeer report

- Rejig At BYJU’S: Hit by controversies, the edtech giant is said to be appointing an advisory committee to counsel CEO Byju Raveendran on board composition and governance structure

That’s all for this week. We will see you next Sunday with another weekly roundup, and till then you can follow Inc42 on Instagram, Twitter and LinkedIn for the latest news as it happens.

Ad-lite browsing experience

Ad-lite browsing experience