SUMMARY

Paytm plans to extend this feature to allow customers to pay at merchant outlets with the blink of an eye

Paytm has already started testing the facial recognition tool among its employees

The company is expected to roll it out through an app update shortly

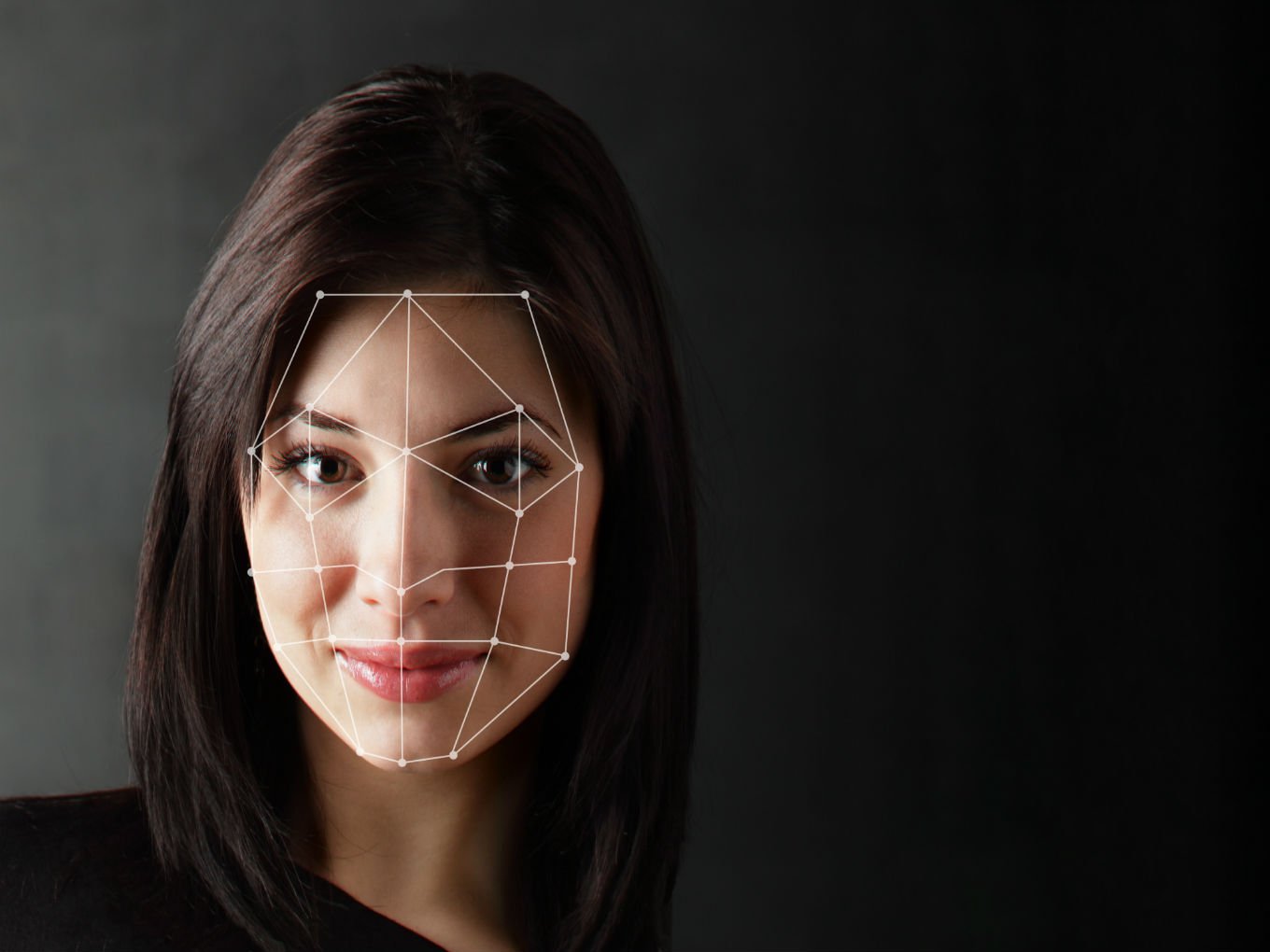

With the increasing competition in digital payments in India, the Noida-based payments giant Paytm has always tried to keep ahead of the competition with its unique approach and in-house innovations. The next in line is going the Apple way. The Indian decacorn is currently testing using the facial recognition feature for unlocking the payments application.

Paytm plans to extend this feature to allow customers to pay at merchant outlets with the blink of an eye.

The company believes that a biometrics-based authentication tool could enhance the security of the app. Since, the offline payment modes are vulnerable to phishing attacks that trick customers into revealing their passwords or mobile pin numbers to fraudsters.

The company claims that this will be an important security update for Paytm users that is designed to prevent phishing attacks by providing an additional security layer of biometric security. Additionally, it would also remove the complexity of resetting passwords to log in to accounts.

Facial Recognition For Paytm Users

Amid increasing competition and regulatory requirements, Paytm is able to bet on the new feature while adhering to Reserve Bank of India’s security guidelines on digital payments, “two steps of verification are required—one is what the payer has, and the other is what the payer knows. The face could be the first factor of authentication. For transactions up to INR 2,000, RBI allows single-factor authentication.”

The company plans to bring in face recognition as a factor of authentication for stored value transactions like wallet payments, which do not require the second-factor authentication.

Further, Paytm has already started testing the face recognition tool among its employees on Google’s Android platform and is expected to roll it out through an app update shortly.

Paytm has tested this feature extensively with over 10,000 distinct faces and witnessed nearly 100% accuracy. To achieve this, the app maps over 200 distinct parameters on the human face for high accuracy.

Offline payments through face recognition, however, would take longer.

Deepak Abbot, Senior Vice President, Paytm said, “We consider the security of our user’s accounts to be of paramount importance. As a large number of users are linking their bank accounts on the app for instant money transfers and UPI, we feel that our users would appreciate the additional layer of security and ease that Face Login offers. Our tech team is currently working on enhancing our proprietary algorithms to make it more intuitive for users. This will make accessing Paytm account even simpler and faster; prevent phishing attacks and offer instant access on the go.”

The company has already identified devices that can be installed at select merchant locations and used for such authentications.

To ensure a check on fraud, the face recognition feature will be checking for the eye white, which is a recognition of whether a person is alive or dead, and also make the customer blink once to show he or she is alive.

Paytm’s good days started with the demonetisation announced in November 2016. Since then, the company has been on an upward growth trajectory, diversifying its portfolio into insurance, lending, payments bank, events, etc.

From reaching 300 Mn customers on Paytm to launching Paytm Payments Bank, the company is making waves in the digital payments industry, ecommerce, and even ticketing.

The Indian payments giant is also collaborating with PayPay, SoftBank and Yahoo Japan’s newly launched digital payments company.

At the time when players like Amazon Pay and WhatsApp Pay are struggling to roll out their full-scale operation in the country, and growth of several online money transfer companies like Google Tez (now Pay) and, PhonePe among others, Paytm’s bet to keep itself innovative and useful is a testament to its multi-fold growth in last two years.