Out of the 1,14,64,664 on offer in total, bids have been placed for 58,13,975 shares.

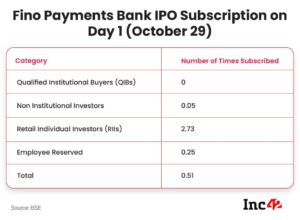

Retail investors bid for 56,56,475 shares, against the allocated portion of 20,75,031 shares, thereby subscribing the retail portion by 2.73 times.

Qualified Institutional Buyers (QIBs), however, did not place bids on the first day of the IPO

The first day of Fino Payments Bank’s initial public offering (IPO) witnessed a mixed response.

While it received a robust demand from retail investors, the institutional investors and QIBs are yet to place their bids.

The overall offer was subscribed 0.51 times or 51% on Friday. Out of the 1,14,64,664 on offer in total, bids have been placed for 58,13,975 shares.

At the end of the first day, retail individual investors (RII) bid for 56,56,475 shares, against the allocated 20,75,031 shares, thereby subscribing the retail portion by 2.73 times.

Employees have subscribed 0.25 times or 25% of the shares reserved for them. They bid for 13,100 shares out of the 51,993 set aside for them.

Non-institutional investors, which include corporates and individuals other than the retail investors, have so far bid for 1,44,400 shares (0.05 times or 5%) out of the 31,12,546 shares allocated for them.

Qualified Institutional Buyers (QIBs), however, did not place bids on the first day of the IPO. A total of 62,25,094 shares have been reserved for them. The shares earmarked for QIBs amount to 54% of the total shares on offer in the IPO.

Traders and market analysts said the institutional investors are expected to pitch in on the third day of the offer. The offer ends on Monday, November 1.

Yesterday, Fino Payments Bank raised INR 538.78 Cr from anchor investors. It allocated over 93.37 Lakh shares to 29 anchor investors.

“Under Anchor Investors (AIs) portion in the Public Issue of Fino Payments Bank Limited, 93,37,641 equity shares have been subscribed today at Rs 577/- per equity share,” it said.

Major global investors who allocated shares under the anchor investor portion are Fidelity International, Invesco, Pinebridge Global Funds, HSBC.

“Out of the total allocation of 9,337,641 equity shares to the anchor investors, 3,646,425 equity shares were allocated to 5 domestic mutual funds through a total of 17 schemes,” said the filing. The mutual funds which were allotted shares include Motilal Oswal MF, Aditya Birla Sun Life Trustee and Tata Mutual Fund.

The Fino Payments Bank’s IPO has opened at the price band of INR 560 – INR 577 per share and will end on November 2. The offer would consist of a fresh issue of shares worth up to INR 300 Cr and an offer for sale of up to 15,602,999 equity shares. The OFS would also include a portion of stocks reserved for employees aggregating up to INR 3 Cr, according to Fino’s red herring prospectus (RHP).

At the given price band for the IPO, the company aims to raise up to INR 1,200.3 Cr.

Founded in 2007, Fino PayTech received the Reserve Bank of India’s (RBI) approval to set up a payments bank in September 2015.

The payments bank began its operations in June 2017, and it competes with Paytm Payments Bank, Airtel Payments Bank, and Jio Payments Bank.

Ad-lite browsing experience

Ad-lite browsing experience