Between January to September 2020, so far $8.1 Bn has been invested into Indian startups across 652 funding deals

According to Inc42 Plus analysis, enterprise tech stood as the top-performing sector in Q3 2020

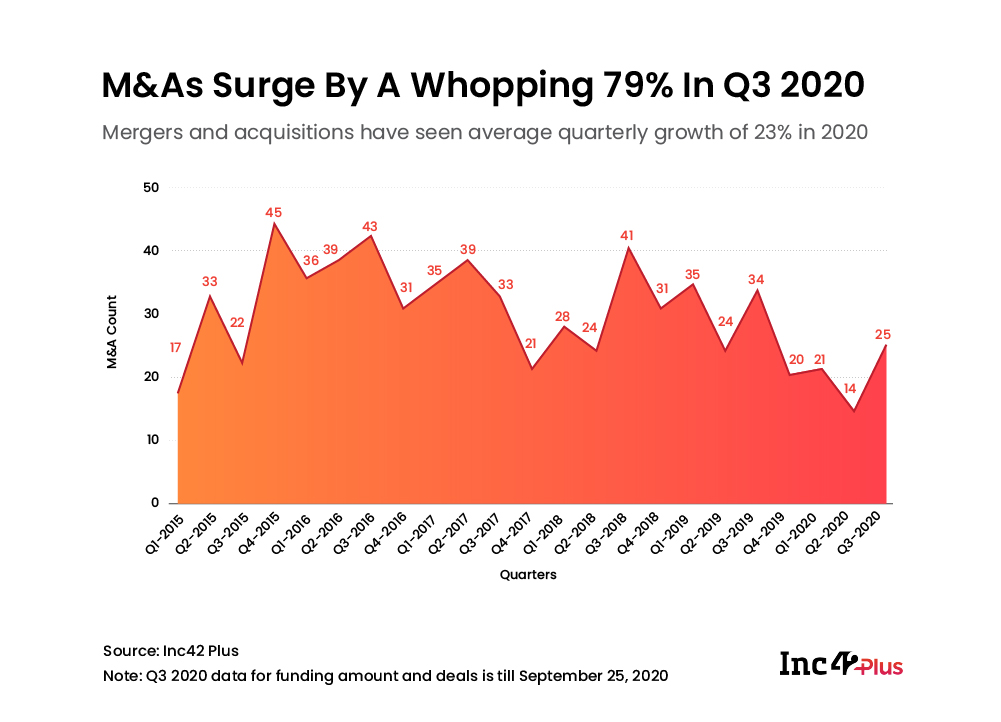

M&As surged by a whopping 79% in Q3 and it saw an average growth of 23% in 2020

The Indian startup ecosystem has grown in leaps and bounds with fundings picking up pace in Q3 2020. However, the pandemic has put investors in a tough position with cash burn and difficulty in raising funding rounds. In a bid for better returns on investments, startups are opting for the path of mergers and acquisitions.

The growth in M&As in Q3 2020 is a clear indication of a consolidation wave, stronger in some sectors than others. M&As surged by a whopping 79% in Q3 and it saw an average growth of 23% in 2020.

Last year, the startup ecosystem saw 111 M&A deals, recording a 10% Y-o-Y fall. This is the lowest number of mergers and acquisitions deals between 2015 and 2019.

The biggest moment for the Indian startup ecosystem in terms of mergers and acquisitions (M&As) was in 2018 when Flipkart was acquired by global retailer Walmart in a $16 Bn deal.

According to Inc42 Plus analysis, around $8.1 Bn has been invested in Indian startups across 652 funding deals between January to September 2020. Out of which 51% or $4.1 Bn was in Q1 2020. In terms of deal count, Q3 2020 had the highest contribution, accounting for 40% or 261 out of the 652 deals recorded this year.

Top Picks Of Pandemic-Hit 2020

This year BYJU’S acquired Mumbai-based online coding platform WhiteHatJr for $300 Mn which is considered the biggest merger and acquisition (M&A) deal in the Indian edtech sector till date.

BYJU’S is also the biggest acquirer in the Indian edtech space, as revealed in an Inc42 Plus report, “The Future Of Edtech In India: Decoding the $10 Bn Market Opportunity”. Since 2017, BYJU’S has been leveraging its acquisitions to build an edtech empire.

BYJU’S also acquired Unitus Ventures’ funded edtech startup LabinApp for an undisclosed amount.

Walmart-owned Flipkart acquired Bengaluru-based mobile gaming startup Mecha Mocha for an undisclosed valuation. Reliance also made its entry into the online medicine delivery market by acquiring epharmacies startup Netmeds. Reliance Brands has plans to acquire 100% stake in lingerie retailer Zivame for $160 Mn (nearly INR 1,200 Cr).

According to Grant Thornton’s deal tracker, aggregate M&A and PE deal volumes reported a 37% and 22% fall respectively compared to deal volumes in April 2019 and March 2020. However, its May 2020 deal tracker reported, (excluding four PE transactions in Jio), a 16% and 25% growth compared with May 2019 and April 2020, respectively.

Enterprise Tech Leads The Pack

The pandemic forced many businesses to adopt digital B2B solutions which eventually led to fundraise from more and more startups. According to Inc42 Plus analysis, enterprise tech stood as the top-performing sector in Q3 2020 whereas, in terms of seed funding, enterprise tech and media and entertainment were the top sectors in Q3.

Seed funding deals play a crucial role in the increase of mergers and acquisitions as underfunded startups are less likely to prove themselves worthy of M&As. Seed-stage deals in Indian startups witnessed a meteoric fall of 40% in Q2 from Q1 2020, which is the highest among all other stages, but in Q3, seed funding.

Last year, startups saw 306 seed funding deals worth $252 Mn, seed-stage deal value saw a massive fall.

In terms of deal count, the top three startup hubs dominated, accounting for 83% or 527 out of 634 deals till Q3 2020.

With the funding deals, the exit deals in the Indian startup ecosystem have also picked up due to lockdown. The restrictions on transport, travel and increased social distancing hampered the talks and deal flow in the Indian startup ecosystem, but nevertheless, M&As have picked up in the past quarter.

With six mergers and acquisitions, edtech startups saw the highest number of exits in Q3 2020, followed by enterprise tech. The most notable exit this quarter was BYJU’S acquisition of WhiteHat Jr for $300 Mn in an all-cash deal.

Ad-lite browsing experience

Ad-lite browsing experience