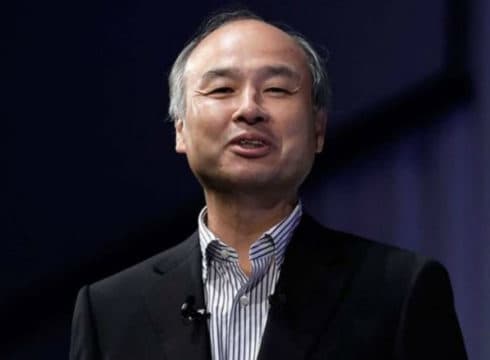

Masayoshi Son told portfolio company leaders that public investors aren’t going to tolerate gimmicks

He said they should get in shape years before they consider going public

Recently, SoftBank portfolio WeWork had to postpone the IPO

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

After the last two months of criticism and retail investors’ wariness for WeWork, the company’s largest investor, SoftBank has made it a point to ensure it never makes the same mistake again.

In one such effort, Japanese conglomerate’s Masayoshi Son in a gathering with his portfolio companies said that they need to become profitable soon and stressed the importance of good governance. A Bloomberg report said that Son told portfolio company leaders that public investors aren’t going to tolerate gimmicks, like super-voting rights or complicated share structures, that privilege founders over other stakeholders.

He said that they should get in shape years before they consider going public. However, this lesson has been a long-time coming for SoftBank’s portfolio companies, which include Indian unicorns Ola, OYO, PolicyBazaar, Delhivery, Paytm, etc.

The latest tussle for SoftBank has been the public listing of its one of the biggest investments— The We Company i.e. WeWork. SoftBank, which has invested over $9 Bn in the company, had valued WeWork at $47 Bn in the last funding round this year. However, when the company filed its draft papers to go public, WeWork CEO Adam Neumann, as well as business model etc, came under the line of fire of public investors.

Amid raging criticism, the company had been finding it tough to even get a valuation of $10 Bn in the market. The company’s mounting losses, inability to turn profits anytime soon, economic downturn affects, complicated business structures, etc became a sour grape for WeWork, Adam Neumann, Masayoshi Son as well as public investors.

The company delayed its IPO, Neumann was then asked to step down and has been replaced by two chief executives— Artie Minson and Sebastian Gunningham, who are working on strategies to build up the business in the right direction for a public listing. This may include shutting down a few side businesses as well as mass layoffs.

Further, it is not the first time that one of SoftBank portfolio companies had raised the eyebrows of public investors. Uber’s IPO this year also caused havoc and has been a turbulent public listing since.

So when Masayoshi Son tells his portfolio leaders to speed up on profitability, the concerns are well-founded and timely. In India, SoftBank’s portfolio who are gearing up for public listing includes hospitality giant OYO, cab-hailing unicorn Ola, digital payments giant Paytm.

Even though these companies have been burning heavy cash, their focus on profitability has been visible over the last few years. For instance, recently, Paytm CEO Vijay Shekhar Sharma said that he wants to take the company public and will begin preparing for it in the next 12-18 months but wants to generate more cash before that happens.

Ola, which on its part has even started a pre-IPO fund, has been making every ride profitable from last year and is now taking up the plan ahead amid international expansion, etc. OYO, which is raising another $1 Bn funding round, is also gearing up for a public listing in the years ahead and is already focusing on its balance sheet.

As an influential investor, SoftBank’s calls for profitability in portfolio companies ahead of a public gimmick may be a timely lesson for all the IPO-enthusiasts and gives a perspective to market sentiment for burning technology startups.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.