Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Last week, a news floating over the web made Lazylad go completely gobsmacked – making it shout to everyone – “we are not shutting down”. When we reached out to the founders to know more on this, they confirmed to us that they are not shutting down and have just pivoted their business model from B2C to B2B.

Long Story Short

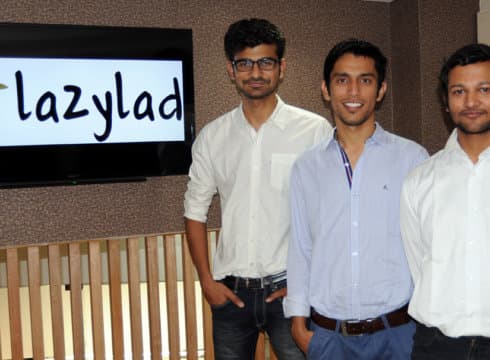

Launched in April 2015 by Saurabh Singla, Paresh Goel, and Ajay Sethi, Lazylad, managed to grow well over the past one year. With $600K funding raised till December 2015, it quickly expanded to seven cities and was doing 500-700 average daily orders. The platform was doing pretty decent in the hyper competitive hyperlocal space with 400% monthly increase in terms of merchants registering on the platform and a virtual wallet and iOS application launched.

However, since February this year, the startup started facing problems owing to low investor sentiments and sudden crash of the online grocery market in India. The portal which was ready to achieve operational break-even in next six months, suddenly got surrounded with the survival threat.

“We had commitments for our hyperlocal model for Series A round, but yes it didn’t go as planned as the grocery market really crashed,” accepted Saurabh. This further resulted in cost-cutting at various ends, leading to 30 layoffs, and brainstorming to build survival strategies.

Lazylad’s New Beginning

In February 2016, Lazylad was doing around 400-500 orders a day, but the revenues were declining. So, in order to generate immediate revenues for keeping the cash flows, the team started helping Kirana stores source FMCG goods directly from brands. These are small local brands, having their presence only in one city or one state, thereby having quite low visibility.

With the help of its technology, Lazylad started connecting these retailers with local manufactures, thereby making them source higher margin products at discounts. At the same time, it also created ground for local Indian manufactures to penetrate into new markets.

This was all going under proof of concept period, with B2C application continuing in parallel.

In next four months, from February till May, the team strengthened the technological aspects of B2B model. A mobile application was developed to share with retailers and manufacturers only. This allowed retailers to order goods online themselves, get access to daily analytic reports and lay their hands on other value added services, for example, message service to customers.

The orders are processed via Lazylad, who further provides procurement of goods from manufacturers to the retailers doorstep.

Also, PoS were installed at the retailers end. Although, they were a hit, as said by Saurabh, the number of retailers they currently have for the B2B marketplace is way too higher than the number of POS deployed as of now.

“Our vision is to empower the small mom and pop shops and convert them into convenience stores. So our focus has been to deploy our technology at the retailer’s front and increase their ROI through different VAS,” explained Saurabh.

Lazylad is currently having 400 partnered stores on its B2B marketplace. Around 20-25% margins are passed to the retailers, while the founders take in 10-15% margins. It is also working to combat its operational challenges such as maintaining the credit period with the retailers, making retailers at ease with the technology and more.

Farewell To B2C Model

The success of the B2B pilot mode made the founders stopped the discounting model, i.e. the B2C model completely in June 2016. The B2C application was closed in May with final stats of 14000 retailers, 20, 000 unique customer base, 1 Lakh + app downloads and 1 Lakh+ transactions.

With B2B and B2C models running parallely, the revenues got doubled every month till May. However, the growth pace slowed down.

“We have found the positive unit economics model in the B2B space. We are carrying forward with the same and we are doing pilots around various models for the next couple of months. And we still hope to reach our target of achieving break-even soon with B2B model,” said Saurabh.

The Other Similar Stories

In April this year, another hyperlocal startup Peppertap shut down its customer centric app. The Gurgaon-based on-demand delivery startup then pivoted to full stack ecommerce logistics portal.

Started in 2014 by Navneet Singh and Milind Sharma, PepperTap app, used to allow users to look into more than 5000 unique products across categories including grocery & staples, fruits & vegetables, and household goods. As of February this year, it was delivering over 20K orders a day and had raised close to $50 Mn while in the on-demand delivery space.

Bangalore-based Roadrunnr has a bit different story. It started in 2015 as B2B delivery platform, but then soon changed its model to ecommerce delivery. And recently, it rebranded itself as Runnr and again pivoted its business model to become a food ordering and delivery app.

The others who didn’t find scope in B2B or B2C, either started decreasing their scale or went completely off the radar. For instance, in January 2016, Grofers stopped its operations in nine cities. At the same time, Shadowfax restricted its operations to only three cities so as to focus on generating cash flows and achieving operational efficiency.

Also, there are portals like Localbanya, MovinCart and Townrush, which had to completely shut down their operations, and biggies like Flipkart, which pulled back soon after testing waters in the hyperlocal delivery segment.

Our Take

The continuous pressure of high customer acquisition costs and negative funding environment has made hyperlocal startups realise that nothing comes for free. The earlier graph highlighting the skyrocketing demands, is now depicting the fall of hyperlocal era. Where earlier, industry pundits were predicting that hyperlocal commerce will replace ecommerce, the segment is now busy rejuvenating itself.

However, there is still no lack of positive sentiments from market analysts. The on-demand hyperlocal market in India has been predicted to reach $339.8 Mn (INR 2306 Crore) by 2020.

So, will the strategy to pivot business models or scale down their operations help on-demand delivery startups in the long run? The question is yet to be answered.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.