SUMMARY

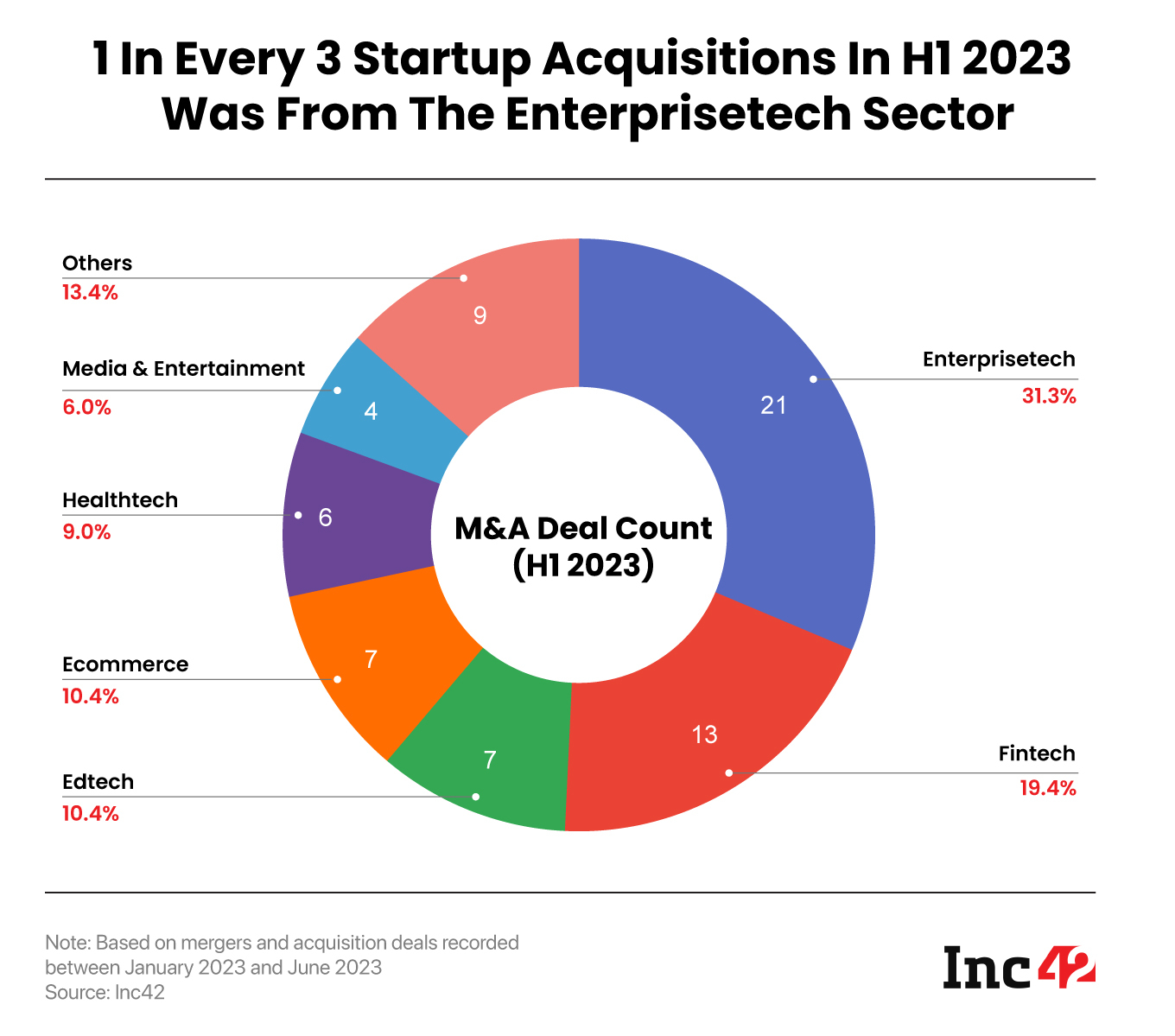

According to Inc42’s Indian Startup Funding Report H1 2023, the enterprise tech sector saw the maximum acquisitions in H1 2023

Of the total 67 acquisitions in H1, one-third, or nearly 23 acquisitions, were from the enterprise tech sector alone

“This is good. In a way India is moving away from just consumer tech businesses to real businesses,” said Anil Joshi of Unicorn India Ventures.

India’s enterprise tech startup ecosystem has seen remarkable growth in recent years, attracting significant investments from both domestic and global investors. Since January 2014, these startups have raised a staggering $13 Bn across more than 1,600 deals. The sector reached its peak in 2021 and 2022, securing an impressive $7.2 Bn in funding in over 500 deals.

What sets this sector apart from other sectors such as consumer services, ecommerce, edtech, and fintech, among others, is its profitability quotient, as 50% of the total 14 unicorns in this sector are in the black. This high profitability percentage highlights the sector’s potential for sustainable growth and return on investment. This paved the way for investors to remain bullish on the sector in the first half (H1) of 2023.

According to Inc42’s Indian Startup Funding Report H1 2023, the enterprise tech sector saw the maximum acquisitions during the period under review. Of the total 67 acquisitions in H1, one-third, or nearly 23 acquisitions, were from the enterprise tech sector alone.

“This is good. Getting exits only proves that solutions which have been built by founders and supported by investors are real solutions and are in demand. In a way India is moving away from just consumer tech businesses to real businesses,” said Anil Joshi, Managing Partner of Unicorn India Ventures.

Key Reasons Triggering Consolidations In The Space

Since the onset of the pandemic in 2020, the wave of digitalisation and technology adoption has made 64 Mn Indian MSMEs a lucrative market both for tech leaders and investors. As a result, the domestic enterprise tech ecosystem in the country has created a number of business opportunities for startups at all stages.

The rising investor ecosystem supported this bandwagon of emerging startups, giving the founders the freedom to create innovative solutions. Earlier there were just a handful of VCs who would invest in the core enterprise tech space, however, today 2,000-plus investors, including domestic investors like Blume Ventures, Indian Angel Network, Better Capital among others consider enterprise tech as a high-potential bet.

Despite this, the experts that Inc42 spoke with believe that much is to be done to make the solutions, emerging from this space, scalable if we want to see more soonicorns and unicorns in this realm.

Even if an enterprise is flush with funds and resources, it still makes sense for it to join hands with a larger organisation to grow faster, we were told.

“Both investors and founders are aware that an exit at the right time can make them get good returns, as beyond a point, a company becomes non-viable,” Anil said.

Further, most of the tech-enabled businesses were groomed much faster during the pandemic because they were able to render services remotely and capture foreign markets.

A clear example of this is Indian enterprises acquiring international startups. It is pertinent to note that a few years ago most acquisitions that took place in the Indian enterprise tech space were mostly led by US investors or companies, but this trend is now changing.

In the last six months, we have seen many Indian startups acquiring US-based startups in the sector. For instance, Noida-based RateGain acquired US-based Adara in January 2023. Similarly, Bengaluru-based BetterPlace acquired Jakarta’s MyRobin in February 2023. These are just two of the many examples of Indian enterprise tech startups championing the acquisition arena.

How Good Or Bad Is This For The Indian Enterprise Tech Sector?

Mergers and acquisitions is a common business strategy. Given that markets are tight, funding and payment cycles have become longer and the macroeconomics landscape is uncertain outside of India, there is no better time to consolidate.

“In this situation, if a startup does not have enough cash runway to support the business functions and is looking to raise funding, then it’s high time to think about an acquisition opportunity,” said Monish Darda, CTO and cofounder of enterprise tech unicorn Icertis.

One of the positive sides of consolidation is that it helps create many serial entrepreneurs as well as investors in the sector. Once the acquisition lock-in period expires, which usually takes one to three years, entrepreneurs are free to deploy their golden parachute in any way they please — either to become an investor or start a new venture.

While Mukesh Bansal launched Cure.Fit, now a healthtech unicorn, in 2016 after selling Myntra to Flipkart in 2014. Similarly, Flipkart founders Sachin and Binny Bansal announced to set up VC funds worth $1 Bn and $400 Mn, respectively, after Walmart bought Flipkart for $16 Bn in 2018.

Also, when an entrepreneur joins a startup’s board as an investor or starts a new venture, they immediately gain credibility from the ecosystem because they have already gone through the churn and have proven their mettle before.

Can India Grow As An Enterprise Market?

India’s potential as an enterprise market has evolved significantly. Previously, challenges such as cheap labour, lack of automation, price sensitivity, and low technology adoption pushed Indian enterprise tech startups to seek markets beyond the country’s borders.

However, the ecosystem is now optimistic about various verticals such as health tech, AI, ML, blockchain, and cybersecurity. The focus on efficiency, digital transformation, contract lifecycle management, and cost-saving solutions has positioned Indian startups to address global enterprise needs effectively. Furthermore, the advent of new technology is expected to revolutionise how enterprises operate.

“Apart from that, within the application of technology, creating a robust and frictionless user experience as well as switching to a low code/ no code approach, allowing users to do more in the platform without needing help from tech on it, will be the two key things the ecosystem will need,” Icertis’s Darda said.

In the investor ecosystem, established venture capitalists are increasingly recognising the potential of enterprise tech startups. They now understand that startups in this sector can address global demands while maintaining predictable revenue streams and lower cash burns. This allows investors to take calculated risks and informed decisions while investing.

Finally, with many global VCs looking at India as an opportunity, we are likely to see more investments and deals in the sector even in the second half of the year, purely due to low risks and decent returns.

Ad-lite browsing experience

Ad-lite browsing experience