Under the partnership, the NPCI will offer technology and insights to the Bank of Namibia for developing a digital payments system that will boost real-time P2P and P2M transactions

The upcoming payments system is envisaged to improve accessibility, affordability, interoperability, scalability and adaptability

Last year, IT minister Ashwini Vaishnaw said that India signed MoUs with around 30 countries across the globe for deploying the UPI stack

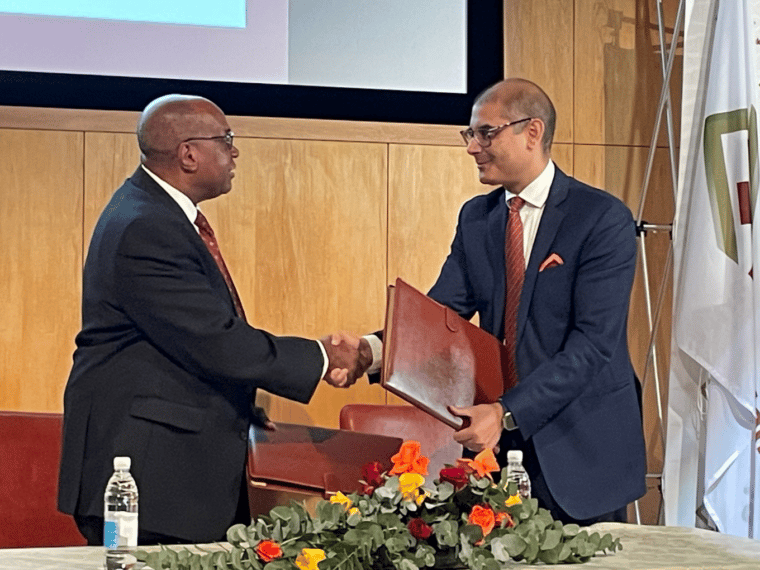

The National Payments Corporation of India’s (NPCI’s) international arm, NPCI International Payments Limited (NIPL), has signed an agreement with the Bank of Namibia to develop a digital payments system for the African nation akin to homegrown Unified Payments Interface (UPI).

Under the partnership, the NPCI will offer technology and other insights to the Bank of Namibia to help develop a digital payments system that will look to boost real-time person-to-person (P2P) and merchant payment transactions (P2M) in the country.

The collaboration will look to revamp Namibia’s financial ecosystem with a particular focus on enhancing accessibility and affordability for rural and informal populations.

“… By leveraging technology and experiences from India’s UPI, the partnership seeks to help Namibia modernise its financial ecosystem. This includes improving accessibility, affordability, connectivity with both domestic and international payment networks, and interoperability,” said an NPCI statement.

It added that the new payments platform is envisaged to drive financial inclusion and reduce dependency on cash. NPIL CEO Ritesh Shukla said that the new platform will be scalable and adaptable to “embrace future technological advancements and market demands”.

The upcoming system will also minimise infrastructure costs for Namibian financial institutions and spur the local fintech ecosystem and digital entrepreneurship.

“We are proud to join hands with (the) Bank of Namibia to enable the deployment of UPI-like real-time payments system in Namibia for the digital public good of its citizens. We are excited about this partnership, which will enable Namibian citizens to transact instantly leveraging technology and experiences from India’s UPI,” said Shukla.

Commenting on the partnership, Bank of Namibia governor Johannes !Gawaxab said, “…This system aims to connect individuals, businesses, and government entities across Namibia, including the payment of social grants, enabling more efficient economic interactions and supporting the growth of digital entrepreneurship.”

With this, Namibia has become the latest country to jump on the UPI bandwagon. Last year, IT minister Ashwini Vaishnaw said that India has signed memoranda of understanding (MoUs) with around 30 countries across the globe for deploying the UPI stack.

So far, countries such as Sri Lanka, Mauritius, Bhutan, Nepal, the UAE and Canada have deployed the payments infrastructure in their respective countries in some form. Alongside, the NIPL is also in talks with banks and authorities in countries such as New Zealand and the US to deploy the payments system.

In February, it was reported that the NPCI and multiple Indian and US banks were in advanced talks to establish a real-time payment linkage between the two countries.

The development also comes at a time when UPI has made digital payments a household thing in India. In April, the payments infrastructure clocked 13.3 Bn transactions worth over INR 19.6 Lakh Cr.

Earlier this year, RBI governor Shaktikanta Das said that India accounted for 46% of the global digital transactions due to UPI.

Notably, the NPCI and the central bank have taken a number of steps to increase adoption of UPI. In 2023, the RBI allowed banks to offer pre-sanctioned credit lines to users via UPI.

On top of that, the NPCI has also launched several new features such as UPI Lite, which supports low-value transactions; UPI Lite X, which supports offline transactions; and Hello! UPI, which lets users make payments with their voice.

Ad-lite browsing experience

Ad-lite browsing experience