SUMMARY

The regulatory scenario for cryptocurrencies in India is unclear and the future for the country’s nascent but growing Indian crypto exchanges is uncertain

However, global crypto players aren’t being dissuaded by these hindrances inherent in the Indian crypto market, and are preparing to tap into an opportunity potentially worth $12.9 Bn

London-based Cashaa’s tie-up with the Jaipur-based United Multistate Credit Cooperative Society will help Indian customers avail traditional along with crypto banking services online

India's Crypto Economy

India's Crypto Economy is a brand-new weekly newsletter (delivered every Thursday) from Inc42 to help you decode the rapidly growing crypto economy and its implications on business, work and life. We launched this newsletter on the 4th anniversary of our weekly series “Crypto This Week” which completed 190 editions in May, 2021.

The year so far has seen Indian crypto ecosystem get galvanised as global crypto players look to enter the Indian market.

The regulatory scenario for cryptocurrencies in India is unclear and the future for the country’s nascent but growing Indian crypto exchanges is uncertain. However, global crypto players aren’t being dissuaded by these hindrances inherent in the Indian crypto market, and are preparing to tap into an opportunity potentially worth $12.9 Bn.

Last week, London-based crypto-friendly neobank Cashaa said that it would partner with India’s United Multistate Credit Cooperative Society to build a crypto-friendly financial institution called Unicas.

A credit cooperative society is a member-owned financial cooperative, democratically controlled by the members, who often belong to the same social, cultural, religious or economic class. Such societies are formed to tend to their members’ financial needs.

Cashaa’s tie-up with the Jaipur-based United Multistate Credit Cooperative Society will help Indian customers avail of traditional along with crypto banking services, both online as well as through 34 physical branches of Unicas, proposed to be set up in different cities across North India. In September this year, Cashaa as a part of its Indian market expansion plan raised $5 Mn (INR 35 Cr) from a Dubai-based investment fund O1EX.

In a savings-driven economy such as Indian, Unicas will offer its customers crypto savings accounts which will offer interest on deposited crypto. Cashaa, which has seen an 800% jump in its operations and business during the Covid-19 pandemic, said that it felt that this was an opportune moment to start in India for inducting emerging technologies into its banking domain. Co-operative credit societies in India operate outside the ambit of the Reserve Bank of India (RBI). Cashaa’s tie-up with one such organisation could spur other credit cooperative societies to initiate similar tie-ups to introduce crypto banking services for their users.

Just last week, an exclusive Inc42 report mentioned that US-based crypto giant Coinbase was looking to expand its operations to India, where it already has investments in Mumbai-headquartered crypto exchange CoinDCX. Coinbase’s entry in India is contingent on the company’s executives conducting meetings and interactions to understand the regulatory scenario for the cryptocurrencies in India. Tellingly, the confusing regulatory scenario and intermittent speculations about an impending ban on crypto in the country dog the burgeoning industry’s growth.

Taking note of the same, Arjun Vijay, cofounder and COO of Giottus Cryptocurrency Exchange, told Inc42 that creativity and innovation cannot thrive when there’s a sword hanging above one’s head.

“Clear regulations give confidence to the researchers, developers, founders, and other stakeholders in the ecosystem to focus on developing solutions for the next generation. India with its huge software manpower has the right ingredients to become the Silicon Valley for the next wave of internet startups if India takes the proverbial leap of faith,” he said.

Regulations will also pave the way for institutions to begin investing in this space. If the largest institutions in the international arena like Blackrock and Vanguard can choose to diversify by investing in the cryptocurrency space why should the Indian Institutions be barred from doing so?”

Advising that India should take note of the developments in Hong Kong, where the country’s securities watchdog has said that all crypto exchanges would be regulated, blockchain and emerging tech evangelist Sharat Chandra said, “SEBI should take note of these developments in the APAC region and bring in regulations with respect to cryptocurrency entities in India.”

Prices

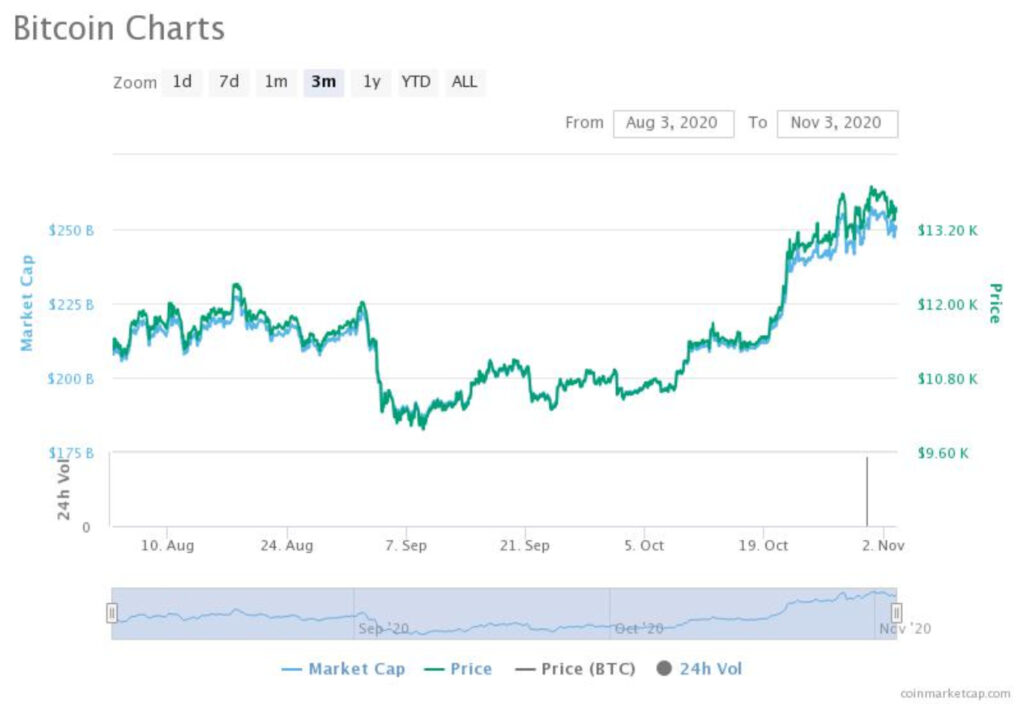

By the time of publication, Bitcoin was trading at $13,493, a marginal increase from last year’s price of $13,425. Its market cap was around $250 Bn.

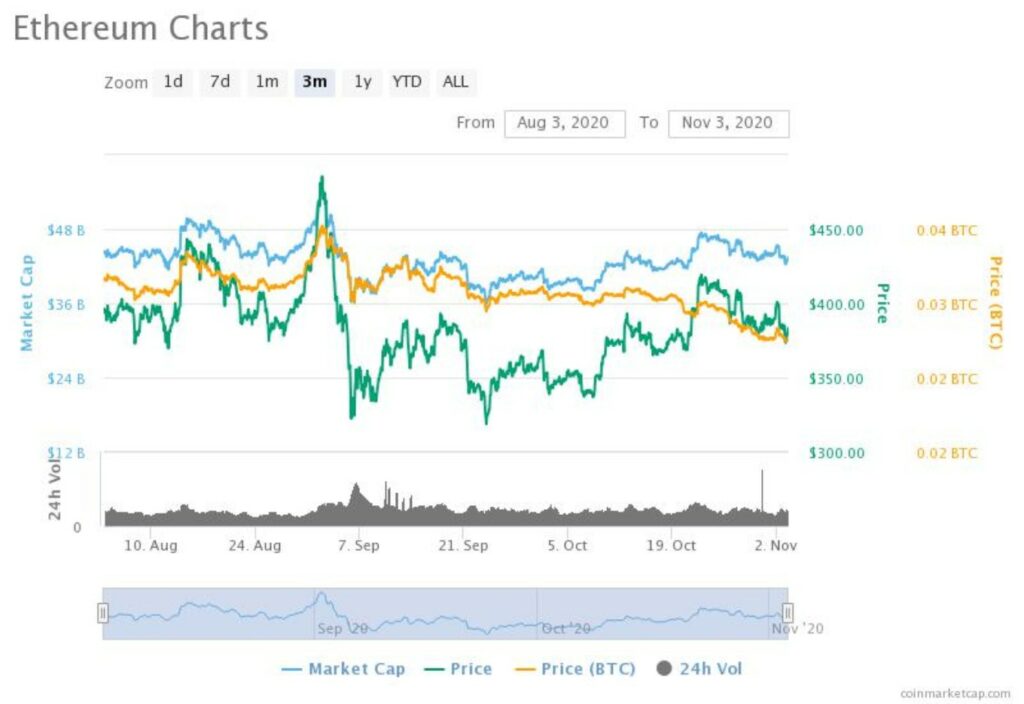

Ethereum was trading at $379, a 6.1% fall from last week’s price of $404. Its market cap was around $42 Bn.

Other News

Hong Kong Says All Crypto Exchanges To Be Regulated

On Tuesday (November 3), Hong Kong’s securities watchdog, the Securities and Future Commission (SFC) said that all crypto exchanges operating in the city, whether or not they trade securities, will need to be regulated. Previously, the SFC had put in an opt-in regulatory framework for crypto exchanges, allowing several players to operate outside the regulatory net. The move by Hong Kong is important in driving home the importance of adopting crypto through positive government regulation, something which crypto stakeholders in India have been lobbying for since quite some time.

“Crypto Ban Will Get Thrashed”

Sathwik Vishwanath, CEO and cofounder of Unocoin, India’s first crypto exchange, has said that proposals for a complete ban on cryptocurrencies in India will likely “get thrashed” if they ever come for debate in Parliament. Vishwanath told cryptonews.com that crypto exchanges operating in India have no issue with being regulated by a government agency. However, he added that the lack of clarity about the regulatory scenario for cryptocurrencies in India is not helpful, as it leads to lesser customers and lack of business. Read the full story here.