Existing investors Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo and Sequoia Capital also participated

The round has provided an exit to the angel investors that had backed BharatPe in the past as well as ESOP holders

The company plans to raise a debt funding of $750 Mn over the next two years to back the lending vertical

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Delhi-based B2B fintech platform BharatPe has taken a big leap towards the unicorn club by raising $108 Mn in Series D funding round at a post-money valuation of $900 Mn. The funding round was led by the company’s existing investor Coatue Management, with the participation from other existing investors Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo and Sequoia Capital.

The company has raised about $90 Mn of this funding through a primary share sale, while the rest was through a secondary share to provide an exit to angel investors as well as ESOP holders. BharatPe did not disclose which investors would be exiting the company. Overall, it has raised $268 Mn in equity and debt till date.

The company has claimed that the Series D round got oversubscribed within the last two weeks of December 2020, making it one of the fastest round closure for any startup in the Indian ecosystem. CEO Ashneer Grover claims the company has about $200 Mn in the bank, which will be used to deliver $30 Mn total payment volume (TPV) and build a loan book of $700 Mn with small merchants by 2023.

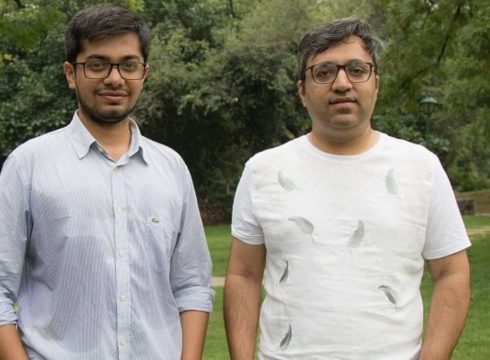

BharatPe was founded in 2018 by Grover and Shashvat Nakrani. It is primarily a merchant-focused payments platform that offers a single interface for all existing UPI apps and other payments systems, and has recently branched out into lending and other verticals.

“2020 has been an unprecedented year for all. However, we at BharatPe have grown exponentially – our payments business has grown 5x and our lending business has grown 10x in the last 12 months. This growth reiterates the trust that the small merchants and kirana store owners have showed in us,” Grover added.

The development coincides with $35 Mn (INR 249 Cr) debt funding for the company raised from Alteria Capital, InnoVen Capital, Trifecta Capital and ICICI Bank. The company plans to raise debt funding up to $750 Mn in the next two years to facilitate its plans to go big on lending.

As a part of this plan, BharatPe is also in contention to take over scam-hit Punjab and Maharashtra Cooperative (PMC) Bank. It submitted a joint expression of interest (EoI) to the Reserve Bank of India (RBI) in collaboration with financial services firm Centrum Group. PMC is currently going through all the proposals it has received and has set a deadline of March 31, 2021 for the announcement.

The company claims to have over 5 Mn merchants on board across 50 cities and plans to get 10 Mn users on board by 2022. It also intends to expand its services to 65 cities by March 2021.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.