Fintech companies are currently waiting for RBI’s rule on digital verification

Supreme Court has scraped part of Aadhaar Act which allowed private companies to use the unique ID for eKYC

Telecom regulator has barred companies from using Aadhaar-based verification

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

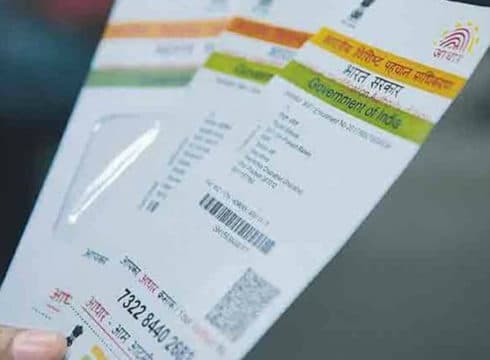

After Unique Identification Authority of India’s (UIDAI) asked fintech companies to stop Aadhaar-based verifications, fintech players are reportedly looking to develop alternative mechanisms for customer authentication.

Companies are searching for other means for digital Know Your Customer (KYC) while they wait for Reserve Bank of India’s (RBI) final decision on legal and acceptable ways for completing the e-KYC process. Aadhaar eKYC is a paperless process, wherein the identity of the customer is verified electronically using their Aadhaar number.

In October, some mobile wallet companies requested RBI to help them with an alternative solution to Aadhaar-based eKYC authentication.

According to reports, fintech companies have already made multiple presentations to sector regulators on ways for them to continue customer onboarding using Aadhaar, with assistance from industry bodies like the Payments Council of India and Digital Lenders’ Association of India.

This development comes after the Department of Telecommunications (DoT) barred the use of Aadhaar by telecom companies for e-KYC authentication.

The debate on using Aadhaar for verification has been going on since Supreme Court’s ruling on the Aadhaar case which stated that henceforth, Aadhaar will be mandatory only for filing income tax returns and allotment of PAN. It will not be important for opening bank accounts or getting SIM cards.

Under the landmark judgment, the Supreme Court also scrapped Section 57 of the Aadhaar Act, which allowed private companies to ask for Aadhaar details of their users.

This decision has left many companies in a lurch, as telecom and fintech companies were relying on Aadhaar-based e-KYC authentication for customer onboarding.

With the companies not being allowed to do so, they will now have to go back to the time taking and costly process of physical identification or come up with new ways to authenticate users without using Aadhaar.

Bhavin Patel, co-founder, and CEO LenDenClub had earlier told Inc42, “The Supreme Court highlighted some of the flaws in Aadhar law due to which private companies have been barred from using Aadhar for identity verification. This may affect the fintech as well as other financial companies which use only Aadhar as their identity verification mechanism”.

Just prior to the DoT ruling on Aadhaar use, telecom operators had appealed to the government to explore legal ways for using Aadhaar.

Companies had suggested either approaching the SC for allowing voluntary use of the Aadhaar number for e-KYC process or introducing a legislative framework.

Meanwhile UIDAI extended the deadline for the implementation of virtual ID, UID token and limited e-KYC (know your customer) for Authentication User Agencies (AUA), including banks and financial institutions, till January 31, 2019 from October 31.

[The development was reported by ET]

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.