Mubadala Investment will acquire a 1.85% stake in Jio Platforms

It joins private-equity firms General Atlantic, Silver Lake as investors in Jio

Jio's fundraising spree has prompted global interest in India's telecom sector by Google and Amazon

Mukesh Ambani-led Reliance Industries announced today that Mubadala Investment Company (Mubadala), the Abu Dhabi-based sovereign investor, will invest INR 9,093.60 Cr in Jio Platforms for a 1.85% equity stake. The investment has come at an equity value of INR 4.91 Lakh Cr and an enterprise value of INR 5.16 Lakh Cr.

Morgan Stanley acted as financial advisor to Reliance Industries and AZB & Partners, and Davis Polk & Wardwell acted as legal counsel. Khaldoon Al Mubarak, managing director and group CEO, Mubadala Investment Company, said, “We are committed to investing in, and actively working with, high growth companies which are pioneering technologies to address critical challenges and unlock new opportunities. We have seen how Jio has already transformed communications and connectivity in India, and as an investor and partner, we are committed to supporting India’s digital growth journey.”

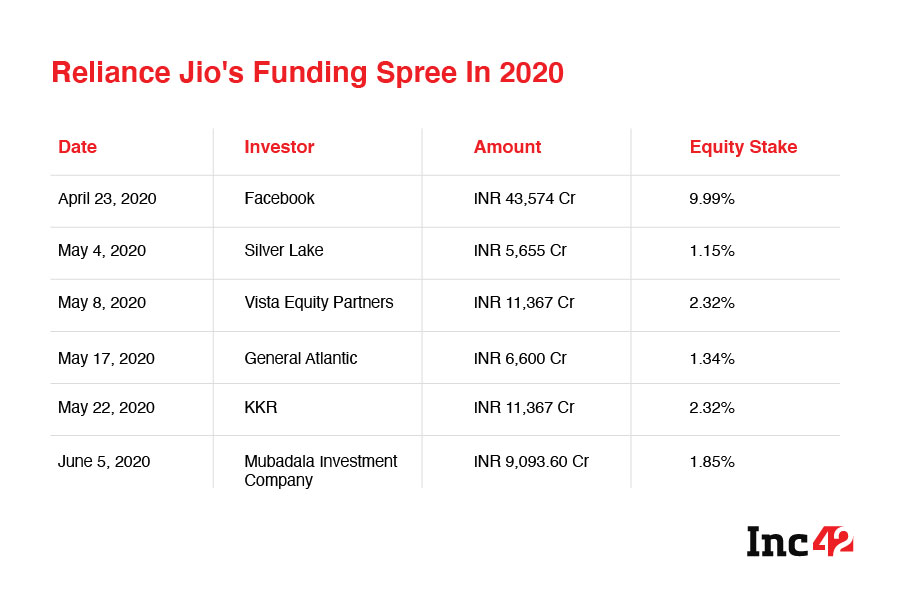

Over the last few weeks, several reports have suggested that Mubadala and Saudi Arabia’s $320 Bn sovereign wealth fund Public Investment Fund (PIF) may also participate in Jio’s fundraising spree. With this investment, Jio Platforms has raised INR 87,655.35 Cr from global investors such as Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR and Mubadala in less than six weeks.

Abu Dhabi’s Mubadala has made an investment in more than 50 countries across several sectors like aerospace, information and communications technology, real estate and infrastructure, petroleum and petrochemicals, healthcare, renewables, utilities, semiconductors, metal and mining. It has over 5 global offices and over $229 Bn Assets Under Management.

Mubadala has also been one of the key limited partners in SoftBank’s Vision Fund I, which recently announced $17.7 Bn in losses. Since the WeWork controversy devaluation and losses, the Abu Dhabi investment fund has been sceptical about SoftBank’s Investment as well.

Jio Platforms is Reliance’s umbrella company digital services like Reliance Jio, Jio Fiber, MyJio, JioTV, JioCinema, Jio Mart JioNews and JioSaavn under one banner. Through this series of investments, Reliance said it wants to facilitate wide-scale digital adoption in India in the consumer and B2B space. Ambani believes that comprehensive digitisation is a vital part of revitalising the Indian economy as he has stated on many occasions in the past.

The company says that Jio Platforms has made significant investments across its digital ecosystem, powered by leading technologies spanning broadband connectivity, smart devices, cloud and edge computing, big data analytics, artificial intelligence, Internet of Things, augmented and mixed reality and blockchain.

Jio Platforms was also reported to be in talks for an overseas public listing. However, the stock exchange for the listing hasn’t been decided yet. The company is planning to list itself over the next 12 to 24 months, but no final decision has been taken on the timeline and size of the listing.

With the company’s constant fundraising over these past months, the interest in the telecom sector has grown significantly. The reports have surfaced that Amazon is reportedly in talks with Bharti Airtel to pump in $2 Bn. Amazon is eyeing India’s digital economy with this investment in the telecom business. If completed, the transaction will give Amazon a roughly 5% stake based on the current market value of Airtel.

At the same time, parallel discussions are going on between tech giant Google and debt-ridden Vodafone Idea. According to reports, Google may buy up to 5% stake in debt-laden Vodafone Idea.

Ad-lite browsing experience

Ad-lite browsing experience