Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Waiting in the long checkout queue of a hypermarket is the most boring job. But imagine if this wait turned out to be the silver lining for you? Wouldn’t that be something? This is exactly what happened to Mukesh Singh – while standing at the checkout queue of a hypermarket with his pregnant wife, he stumbled upon his next startup idea.

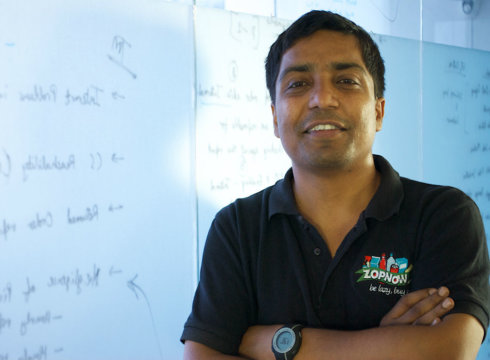

“We were expecting our first kid and she was six months pregnant. The customer at the counter was haggling for two bucks of change and we were getting frustrated. This was the time the idea of online grocery came to my mind and both the kids – ZopNow and Naman – were born almost at the same time,” begins Mukesh Singh, founder, Zopnow, as he recalls the initial days of starting up.

Founded in September 2011 by Mukesh Singh and now under the leadership of CEO Raj Pandey, Zopnow was one among the early starters in India’s online grocery business. ZopNow, today, has over 25Kproducts in its catalogue which includes fresh fruits and vegetables and high quality staples, with a 7am delivery promise.

Having raised $10 Mn in a funding round led by San Francisco-based Dragoneer Investment Group, along with its existing investors including Accel Partners, Qualcomm Ventures and Times Internet, ZopNow also offers eGrocery as a Service (SaaS) solution to large brick and mortar retailers. It is aiming to take the SaaS model global with Middle East and Southeast Asia as immediate markets.

The Wisest $11 Spent: Conceptualising ZopNow

For Mukesh, ZopNow was his fourth venture as a startup. Almost all his ventures have been based on a personal need followed by a product/market check with a limited launch.

“I ventured into animation as my first startup when I was 23, largely because I was interested in the domain. At 35 years, I was wiser with two successful IPO war stories (eGain, MakeMyTrip) under my belt, and had a better idea about the market size and the need we would address with ZopNow. As a person, I felt that I needed an online grocery service provider who can deliver a good range of products within the same day. After a quick market survey I realised that there are many more people who have similar needs and that’s how the ZopNow journey started,” opines Mukesh.

When it comes to naming the startup, his guiding philosophy was to pick a generic name that was not necessarily tied to grocery domain but generic enough, easy to spell, relatively short, something that communicates energy, and available domain names at low cost.

“Jokingly, we used to say that Google has two o’s. We went over Wohoo, BuyEasy, CornerStore and many others. Majority of the domains were bought and getting the .com was turning out to be a pain,” recalls Mukesh.

Eventually, after several days of research and pondering over name, he ended up with the name ZopNow that satisfied almost all the criteria, while running on the Gurugram Golf Link road.

“During the run, I saw a Tata Ace with some generic message written at its rear door that had a spelling mistake. That was the time I realised that the best way to get a .com domain would be to pick something that is a twist on a spelling – ‘Zop’ was the twist on Shop. Given we were convinced about the same day delivery, ‘Now’ was a good one to have in the name. That’s how the ZopNow name was conceived. Yes – we bought the domain for $11 and probably the wisest $11 we invested,” says Mukesh.

The 150 strong-team is well-rounded with expertise across multiple facets – ecommerce, cloud technology, retail, operations, finance and marketing. It also boasts of global experts from Amazon, J.P. Morgan, Myntra, P&G, Pillsbury, and Dell.

“The team was built brick by brick as we painstakingly vetted each candidate and ensured cultural fit and owner-operator ethos in addition to role fit. This was especially important after we had one not so pleasant leadership team challenge,” Says Mukesh.

Zopnow: A Marketplace With Scaled Partners Like Metro And Star Bazaar

Although it started off as an inventory-keeping online retailer, it shifted focus later to building a smart and efficient technology platform for powering online retail. It signed HyperCity up as its first partner for this strategy and re-launched operations in Bengaluru. Within a year of its launch in Bengaluru Mumbai, Pune, and Hyderabad it was successful in sealing another partnership with the ‘More’ chain of hypermarkets and supermarkets.

“We ran a classic A/B experiment of inventory lead vs inventory light to see if we could solve for range and fill-rate with an asset-light model. Once we had confidence that deep technology integration with partners and IP could solve for inventory, the asset-light choice was a no brainer. Last-mile logistics is the biggest cost of eGroceries and asset-light model has superior economics,” shares Mukesh.

In its journey towards becoming a dominant player in powering the online grocery business in the most sustainable manner with an unbeatable customer experience, it launched online retail stores for More and HyperCity along with their respective branded apps. The entire technology and operations – though powered by ZopNow – provides a seamless omnichannel shopping experience to customers of these retailers.

Talking about business models, Zopnow is a marketplace with scaled partners like Metro, and Star Bazaar. It utilises its scaled stores as fulfilment centres and that gives it tremendous range and freshness. Its technology allows to pick, pack, and checkout in the least possible time, compared to industry standards. Also, its last mile is highly optimised due to proximity of stores to customers. “Our scaled local operations is a key part of our business model and strategy. We are completely asset-light,” says Mukesh.

The technology is completely in-house and has been cloud-hosted since day 1. It was built using open source technology and seasoned over four years.

“Our technology solution-driven automation helps our partners be 3x-4x more productive as compared to the majority of general purpose technologies. eGroceries is unique and has its own idiosyncrasies and there is no off-the-shelf solution that operates at scale, like ours does. Our partners who use this platform tell us that the total cost of ownership and the operational productivity achieved with our solution make it the most economical solution,” says Mukesh.

To ensure that fruits and vegetables are sourced directly from farmers and are delivered quickly to customers, the company worked with scaled hypermart retail partners. “As our partners have large stores in prime locations, veggies are kept at the desired temperature and the customer proximity allows us transit time measured in minutes and not days. Lastly, we train people on appropriate packaging and our IP decides picking sequence to minimise time,” he adds.

Less Than 0.2% Market Penetration: Early Stages Of Grocery Commerce In India

The startup journey is incomplete without hurdles. Every entrepreneur witnesses this phase to establish a successful enterprise. For Mukesh, getting retail expertise and a blue collar workforce was the trickiest part of its journey.

“Angel funding and finding the technology team was easy, retail expertise and blue collar workforce management was the tougher part, as we started. We self-funded the startup, initially, and got a great team of technologists on board – arguably the best in the business. As with everything – it was all about team and right set of people. Sanket who is Chief Product Officer – backend at Zopnow brought the merchandising and operational expertise of groceries and the tech team worked as a corner kirana (local grocery) to get seeped in and simultaneously embed the process in technology,” says Mukesh.

Considering maximum range, delivered the same day with maximum savings for their loyal customers as their USP, ZopNow is targeting $100 Mn GMV including overseas earnings in the next 4 quarters of 2017. The concept of hyperlocal emerged in late 2010 when companies like Zomato, Ola, Meru realised the opportunity they can capitalise in this untapped market. But the true bubble of hyperlocal came in 2015 when startups like Grofers, Faasos, and TinyOwl received million dollar fundings from renowned investors – making this sector one of the hottest sector in the startup ecosystem.

Figures tell us that during H1 2015 to H2 2015 their was almost 50% increment in the number of deals. Furthermore, it states that around 81% of total hyperlocal startups that secured funding were funded in 2015, indicating hyperlocal to be one of the emerging sector in the future. But with major shutdown of startups like Peppertap and M&As in the foodtech and grocery sector burst the hyperlocal bubble. Figures tell us that near about 25% of total number of startups in the hyperlocal market have shut down in first half of 2016 and 10% have been merged or acquired by bigger players in the market.

With such a bleak outlook, many other players like Grofers, BigBasket have put their brakes on expansion in 2016. Meanwhile, Zopnow quietly launched its services in 10 major Indian cities and continues to grow at a fast pace. Therefore, the company is entering into a high growth phase in 2017.

“With less than 0.2% penetration, Zopnow is still in the early stages of grocery commerce in India. We welcome the consumer education that other ecommerce companies do. The pie is huge and there is room for multiple players,” says Mukesh.

With the recent demonetisation policy by government, as markets witnessed a swift decline in hard cash and with people opting for plastic money, the card and ewallet transactions on ZopNow’s platform have grown more than 50% along with 35% increase in growth of new customers, compared to the period before when INR 500 and INR 1,000 notes were a legal tender. According to CEO Raj Pandey, the online grocery industry seems to be the unintended beneficiary of the move as the customer cannot postpone essential purchases for their home.

Our Aim Is To Scale Cost-Effectively

Like horizontal ecommerce has done in the last 10 years, eGroceries is expected to achieve mid-single-digit penetration over the next 3-4 years. Since penetration today is so low, they are talking about 80x-100x growth from these low levels. While the opportunity is huge, the important thing is to scale cost-effectively, as margins are razor thin in this business.

“We have built a lean model and have perfected product/market fit and put relationships in place in the top 10 cities. We are entering a high growth phase phase but will do so cost-effectively. General merchandise, that our partners already carry, will start to be a higher contributor to our basket,” concludes Mukesh.

Editor’s Note

In India, groceries hold a 60% share of the total Indian retail market. And with increasing Internet and smartphone penetration, the online groceries market is finally taking its place in India. With players like BigBasket, Grofers, Aaramshop, the sector is gaining momentum and this can be proved by the huge investments attracted by venture capitalists and angel investors, alike.

eGroceries has idiosyncrasies that require a highly specialised platform compared to other ecommerce verticals. Zopnow’s SaaS customers value the fact that their technology is actually a solution that has worked with multiple grocery chains, unlike other generic out-of- box solutions. This provides them an additional avenue to monetise the IP they have built.

The company has been operational for more than 3 years and has managed to grab a large pie of market share in the cities where it is currently operational. It will be interesting to watch how far it will reach with technology at its core and with other, more focussed players nipping at its heels.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.