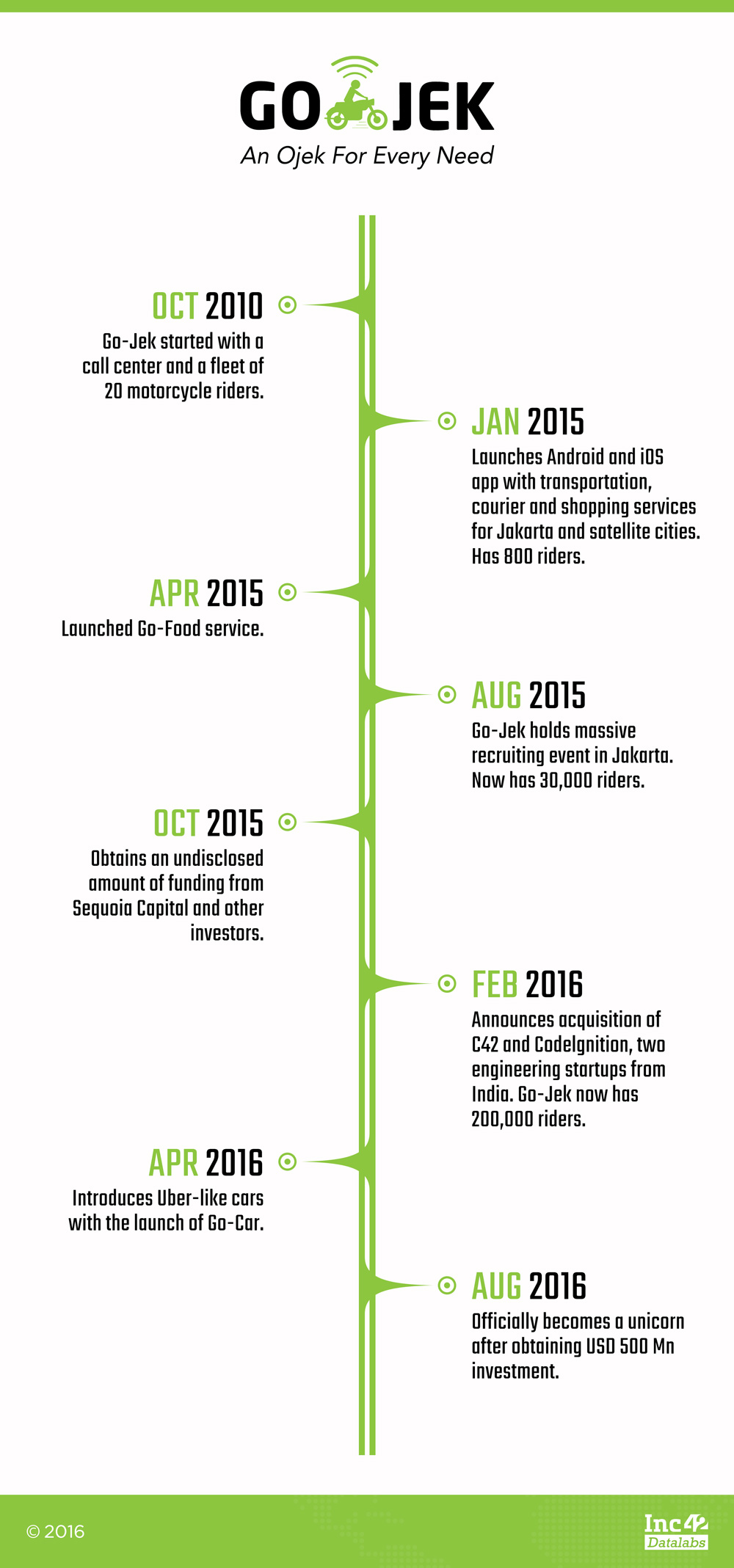

In 2011, a Harvard graduate student – Nadiem Makarim – opened a call centre with 20 drivers recruited from the tribal regions of Indonesia. The idea was that commuters would phone into a call centre and request ojek drivers to pick them up on-demand and take them wherever they wanted to go. That’s how Go-Jek was born, as a company that was propositioned to help get tribals more business and make a better living.

In case you’re new to the scene or have been living in a remote cabin somewhere, Go-Jek, founded by Nadiem, is one of the fastest-growing and most visible tech startups in Indonesia. The courier, transport, and shopping service legitimises previously informal motorcycle taxis — ojeks in Indonesia —not only by outfitting drivers with green uniforms and helmets, but also by organising them through a mobile app which lets users book these drivers.

Go-Jek is one of the most highly-funded startups – backed by Sequoia Capital India and Yuri Milner’s DST Global – in Indonesia.

For the first couple of years, it didn’t get significant traction as it was just a website, but its fortunes changed when it launched an app in January 2015. Considering Indonesia’s mobile-first adoption, the plan was a success as since then, Go-Jek added more and more drivers, launched new services, and expanded to more cities. Now you can see the Go-Jek drivers’ ubiquitous green jackets anywhere in Jakarta and other big cities including Surabhaya, Yogyakarta, and Bali in Indonesia.

In October 2015, it raised an undisclosed amount from DST Global, NSI Ventures, and Sequoia Capital. Following that, in August 2016, it raised $550 Mn in a round led by KKR & Co.(Kohlberg Kravis Roberts & Co.) and Warburg Pincus. Other investors in the round were existing investors and Capital Group, Farallon Capital Management, Formation Group, Northstar Group, and Rakuten.

After its recent $550 Mn fundraise, at $1.3 Bn valuation, Indonesia’s ride-hailing and on-demand services startup Go-Jek has officially become a unicorn. Go-Jek needed only one and a half years from launching its mobile application to becoming a force to be reckoned with.

Says Sidu Ponappa, Head of Engineering, Go-Jek India, “Once the product became available across the archipelago, the company grew at a M-o-M growth of more than 100%. Since that time, the overall system has scaled by more than 900% in about 18 months.”

From Logistics To Ride Hailing To Hyperlocal: The Go-Jek Way

Originally GoJek started as a simple B2B logistics platform – a transportation system for items. What prompted the business to scale further was ride hailing. By April last year, the company had expanded into Go-Foods, i.e food delivery. “Go-Food, to give you a sense of proportion, currently handles more than the total Indian food delivery segment combined,” he adds.

Now Go-Jek works across different parameters in different segments. It is a transportational service, it offers digital payments, e-wallets, and has recently also dived into hyperlocal services, the first one being Go-Food itself.

“It Has Been And Will Be A Social Enterprise, Always.”

The company claims that the key driving force for anything it does is the income of its drivers. “The drivers who work with us and stay with us, do so because they make a good living,” says Sidu, focussing on the company’s responsibility towards its drivers. The advantage that Go-Jek has over other companies working in the same sectors is that these companies function in one, or maybe two verticals. Either they are doing transport, or they are doing food delivery, or they are maybe doing just logistics.

He adds, “But the same driver working with Go-Jek would function as a ride-hailing service provider; in the lunch hour will deliver food and in between also deliver a couple of parcels. For them, they have a variety of different avenues to receive orders. So in that sense, if you look at our unit economics, we have some of the most efficient unit economics in the world because we have so many different avenues to create business for our drivers.”

The startup offers 12 on-demand services including motorcycle taxis, courier, food delivery, and cars. Currently operating in 14 cities, it claims to have more than 200,000 drivers working with it.

An Elusive Product Simplified

One looks at Go-Jek and wonders how does it all work. The process is very simple and depends on what the user wants. If they are traveling, they simply decide where it is they want to go and the driver with the best ratings and within a geographical proximity is assigned them.

Other products offered are variations of the same model, and maybe the next time if a user says that “I’ve forgotten my keys at home, can you go home and pick-up my keys and come back and drop them at my office. Or, hey, it’s lunch time, this is where I’m and this is the food I want,” and the driver will deliver the keys and the food.

The underlying product is very very simple. The app calculates the estimated cost of product that needs to be transported or a person that needs to be transported. And then connecting all of this and making the experience very smooth is GoPay, Go-Jek’s digital wallet. The wallet ensures that you can make cashless transactions. Sidu claims that GoPay has extremely high penetration in Indonesia and tie ups in comparison with comparative products in India.

Users can add money to their GoPay wallets by going to most ATMs in most cities in Indonesia. Additionally, they can also add money to their wallet by simply giving cash to their Go-Jek drivers.

For Go-Jek, every driver works as a deposit machine for GoPay and a walking machine you can withdraw cash from as well. So essentially, every driver works as a mobile ATM.

This sort of technology has not been made possible today in India but has already been done by GoJek. From a usability standpoint, it’s incredibly seamless, it actually has more GoPay users than non GoPay users.

The company says that their product has been profitable since its launch and it chose to put the profits aside to tackle competition. “The only reason we are not doing so is because of the competitive environment, because our competitors offer heavy subsidies on their products and we have to match those subsidies to retain our customers. But if you take the subsidies out of the equation, we are already profitable across several of our operations,” says Sidu.

Big Numbers, Big Games, Big Acquisitions – The India Connect

When prompted to talk about the growth of the company, Sidu says, “Everything changed the moment Go-Jek went digital. Nothing quite compares with going digital in Indonesia. Go-Food killed the competition within nine hours of its launch. Our weakest product would have a valuation, somewhere between $30-$40 Mn, globally.”

The company currently claims to have $26 Mn app downloads, and traction has apparently increased by 900 times. The drivers cover something around 5 Mn kms a day, that is effectively seven-eight round trips to the moon and back. The only drawback the company states is that currently it is primarily present only in the urban centres.

The startup grew faster than anyone ever expected – not even its founder and investors. It launched its mobile app in January 2015 and within a year, it claimed to have over 11 Mn downloads. With this enviable, rocket-fast growth in users came the enormous tech challenge of keeping pace. And this is where, the company stumbled. Drivers and passengers often complained about frozen bookings, rides that couldn’t be canceled, and “errors” in the app.

In short, the demand and usage was just too much for Go-Jek’s tech team to handle. That’s where its investor Sequoia Capital stepped in. The VC fund did a bit of matchmaking. It connected Go-Jek to two emerging startups in Bengaluru and Delhi- C42 and CodeIgnition.

In February 2016, it acquired Indian tech muscle in the form of two startups: C42 Engineering and CodeIgnition. With it, the bike taxi company opened a technology centre in Bengaluru, its first overseas office. And all the founding members of C42 and CodeIgnition are now part of Go-Jek’s tech leadership team.

Founded in 2010 by Sidu Ponnappa, Niranjan Paranjape, and Aakash Dharmadhikari, C42 has been playing tech consultant for clients like Flipkart, Staples Labs, Quintype, UrbanLadder, and ThoughtWorks before being absorbed into the Go-Jek tech team. On other other hand, CodeIgnition was founded by Ajey Gore with Sumit Gupta, Shraddha Gore, Shobhit Srivastava, and Mehak Kahlon in 2013 and claims expertise in tech infrastructure automation.

Then in September 2016, it acquired Bengaluru-based on-demand healthcare marketplace Pianta for an undisclosed amount. “The company then decided to go on with another acquisition, instead of waiting to let its team grow organically. The acquisition was aimed to fast track the development of Go-Jek’s logistics and transportation platforms to support its Indonesia operations,” elaborates Sidu.

Following that, earlier this month, it acquired Pune-based mobile application developer, Leftshift. Post-acquisition, Leftshift completely assimilated itself into the company’s India arm, Go-Jek Engineering India. This gave Go-Jek a very strong mobile and design capability, in fact one of the best in the India.

India, Indonesia: The Road Ahead

The company, going further aims to strengthen the platform itself and stitching the whole thing together for the convenience of both ends – consumers as well as businesses.

“We are in the process of making the platform available to a lot of third parties, both consumers and businesses, so we already have a few partners on board. GoTek, our technical product is being launched in collaboration with an Indonesian partner. We are looking to bring on more and more partners in the system.”

India, for the foreseeable future, will remain as a product- and tech-base for the company. The company shows no intentions to enter the Indian market from a business point-of-view. When asked why, Sidu adds, “Indonesia is a couple of years ahead of India in consumer behaviour and demand and the penetration of technology, as well. Indonesia seems to be also ahead of the curve in terms of technology adoption by the consumer. Indonesia would make a very strong analogue to what we can expect to see in India two or three years from now.”

Editor’s Note

Go-Jek is a platform, it is not a single product. The Go-Jek team had the foresight to create a balance in the fleet of verticals it offered. What the unicorn is transforming into is a product where you can do the majority of your daily activities via its digital platform. So whether it is travel or food, prepaid, or money, or paying bills, you can effectively live your life within the Go-Jek ecosystem in Indonesia.

If we look at the Indonesian market when compared to India, there is greater purchasing power, higher penetration of Internet/mass communication, and more importantly, a greater familiarity with such devices on the side of customers. In other words, it truly is a mobile-first economy. There is an enormous demand for Go-Jek’s services that has consequently led to its massive development.

On the other hand, there are strong social and cultural parallels between the market and factors like low bank balance and high cash, a porous difference between upper class and middle class, in terms of income. In that stance, Indonesia is very comparable to India.

For a disruptive innovation like Go-Jek to work in India, that will create a revamped demand within existing customers, India’s task in the coming years is to find a way to elegantly monetise this wave of disruptive technologies.

Ad-lite browsing experience

Ad-lite browsing experience