SUMMARY

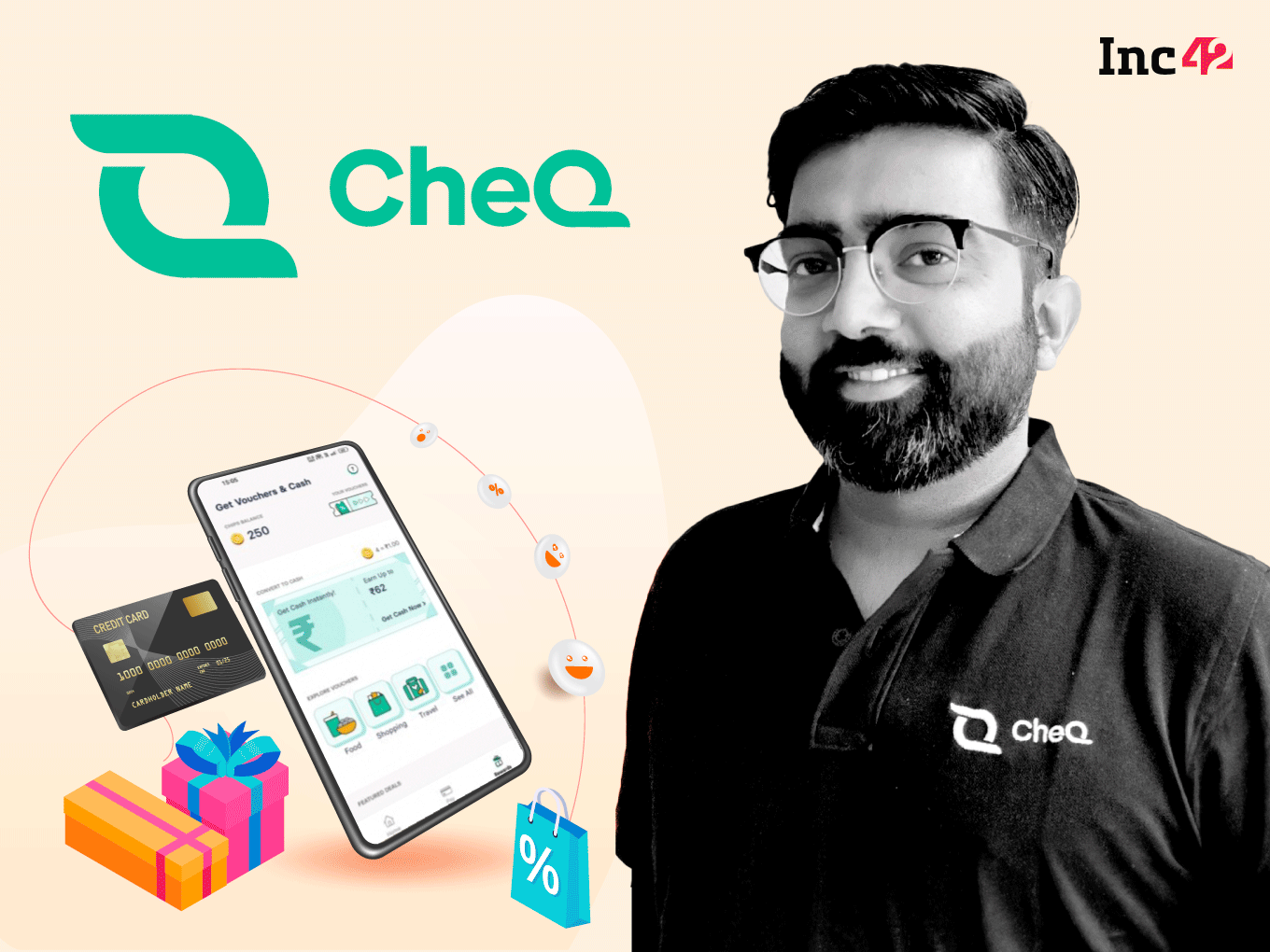

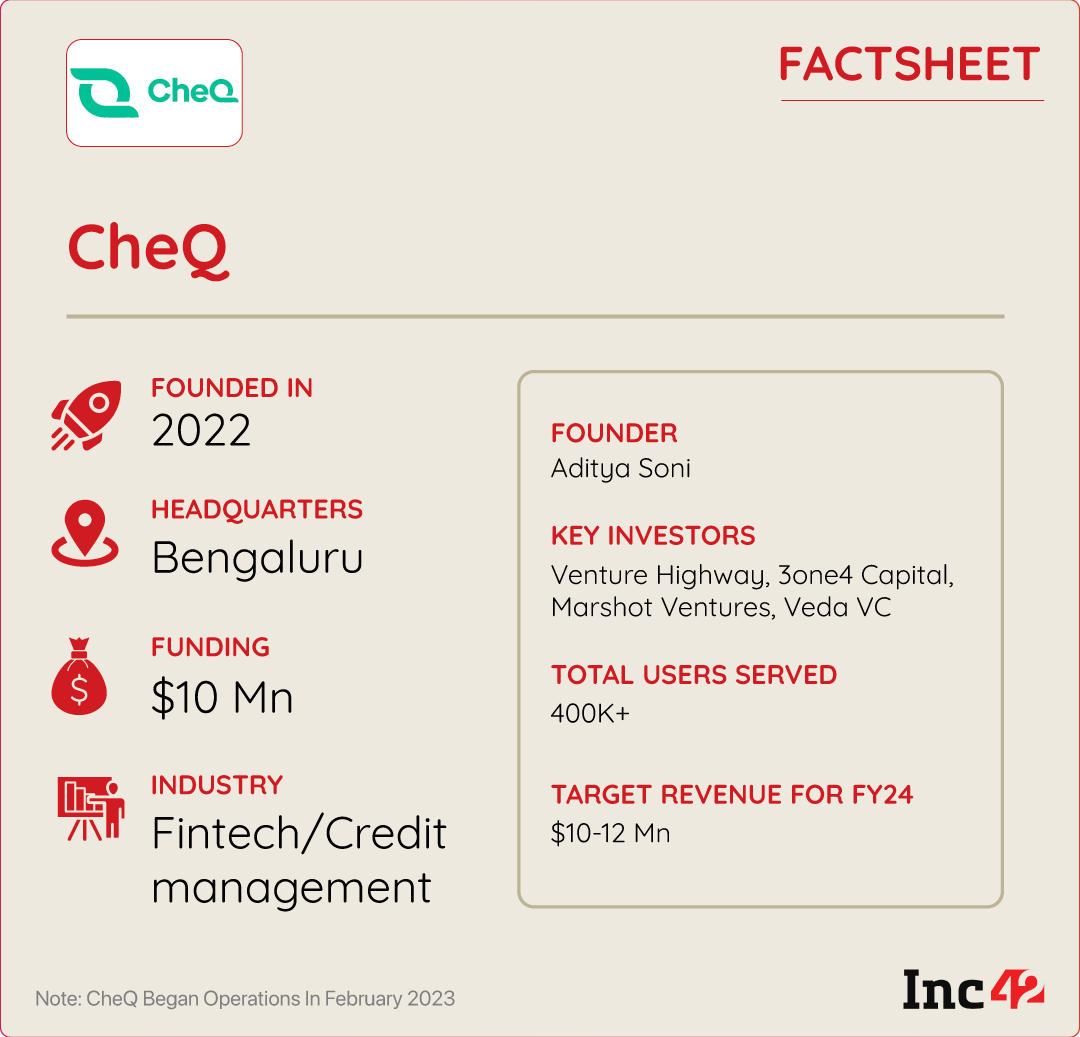

In 2022, former Flipkart executive Aditya Soni left his comfortable job and embarked on an entrepreneurial journey with credit management startup CheQ

The platform offers a 1% reward, known as CheQ Chips on every transaction which can be encashed, used to get vouchers or to pay subsequent bills on the app

In a span of just over four months, CheQ claims to have served 400K+ users

Digital payments are becoming the norm globally, but unlike the West where this wave is led by credit cards, the India story is centred around unified payments interface or UPI. Since 2016, UPI has become the de facto digital payments channel, but India’s credit card market has also grown exponentially in that time frame.

Although the primary narrative around credit cards in India is focussed on under-penetration, the fact is that credit card usage has somehow outpaced debit card transactions in the past couple of months.

India currently has over 86 Mn issued credit cards — more than 10 Mn have been added in the past year and the number of CCs has more than doubled since 2020. Credit card usage has jumped 20% in April 2023 compared to last year, while debit card usage has dropped by 31% in the same time period.

Startups solving for credit card management are also spurring on new users who often need hand-holding and incentives to enter this new payment system. From dedicated apps to ‘super fintech apps’ such as Paytm, PhonePe, Amazon Pay and Google Pay — pretty much every major player is eyeing the credit management space through various services.

Their target: Acquire a slice of the 86 Mn credit card users and drive the shift from traditional debit card payments to smart payments, credit management and more.

While most would be familiar with CRED, the first mover in this credit card management space, the Bengaluru-based unicorn is diversifying into other areas to grow into its $6.4 Bn valuation. This has opened up the space for CheQ — the latest entrant in this segment founded by Aditya Soni, former business head of payments at Flipkart.

Soni left his relatively comfortable job at the ecommerce major and took the entrepreneurial plunge in 2022 to set up CheQ.

The Bengaluru-based fintech startup commenced operations on 23rd February 2023 and rewards-focussed credit management solutions have already struck a chord with the relatively young credit card customer base, Soni said. In fact, in a span of just over four months, CheQ claims to have served 400K+ users.

Simply put, CheQ enables users to pay credit card bills and loan EMIs through its platform. Its flagship ‘Pay Together’ feature also allows users to pay multiple bills through a single transaction. Further it offers a 1% reward, known as CheQ Chips every time they pay these card bills or EMIs. The in-app currency can be encashed and the money is transferred to the user’s bank account. However, CheQ Chips can also be used to buy brand vouchers or pay subsequent bills on the app. (more on that later).

So far, it seems similar to Kunal Shah-led CRED, but CheQ’s vision is to become a holistic credit management company, rather than a jack-of-all-trades fintech app.

“Credit management as a service is missing for young Indians and we want to address this gap. CheQ is creating a new category of credit management for India’s working population by providing a comprehensive solution for their credit health,” said Soni.

While CheQ has set its sights on India’s growing credit card market, digital lending has skyrocketed in India in the past few years and CheQ is looking to cash in on this market too by helping people manage their personal loans.

To enable this, the app lets users repay personal loans from a range of lenders and provides a cohesive view of their overall credit exposure, besides credit cards.

Despite being a newcomer, CheQ has already facilitated about 1.5% of all retail credit repayments in India in May, Soni claimed. It has also raised funding from Venture Highway and 3one4 Capital and is targeting a revenue between $10-12 Mn in FY24.

The revenue confidence stems from the aforementioned growth seen in the credit space. According to the founder, the startup boasts a presence across 300+ Indian cities and 1K+ pin codes.

This growth can also be attributed to the rules around card tokenisation that have simplified online card payments. It’s also in line with the aspirational nature of Indian retail consumers.

Of The Tech Stack, Challenges & Opportunities

“We want to be India’s most efficient credit management company which fundamentally makes us ubiquitous to all things credit,”—CheQ founder, Aditya Soni.

Even before his stint running the payments business at Flipkart, Soni had seen the Indian BFSI space closely during his time as a product manager at CitiBank. This, he claims, gave him an opportunity to get a ringside view of Indians managing personal finance. “The financial crisis of 2008 taught us to approach investment and savings with caution because tough times don’t come with a warning,” Soni says.

Indeed, that was around the same time when the likes of Zerodha emerged onto the scene, and soon others also joined the investment tech wave. But Zerodha is today synonymous with retail investing and stock market education, which Soni hopes to do with CheQ for the credit management space.

He adds that he has seen a similar pattern in the credit card industry as more and more people are opting for credit cards. This is clearly the credit card moment for India, however, a 2022 report by paisabazaar suggested that only 43% Metro users have a credit score of 750 or more which is considered a healthy credit score. On the other hand, 36% customers from Non-Metros meet the healthy credit score criteria, the report highlighted

For context, a credit/bureau score is a numerical representation of an individual’s creditworthiness based on their credit history.

While the startup has great ambitions for the future, particularly in improving the credit health of Indians, it has adopted a pragmatic strategy to start with. Its initial focus is on assisting users in timely bill payments, providing reminders for any delays and enabling them to monitor their credit health through a central dashboard.

It is also worth noting that while Soni’s industry connections aided the startup in securing $10 Mn in seed funding in June 2022, attracting skilled tech talent can be challenging for a young startup.

However, he claims that CheQ was able to navigate through these challenges seamlessly. “I don’t have a tech background but our aim was always to have a strong leadership in place,” Soni recalls.

Hence, when Bipin Toro, the former COO of customer engagement platform Reward360 and Akash Kedia of Germany-based online broker Trade Republic joined as CheQ’s heads of engineering and product respectively, the startup successfully put together a skilled tech team, the most critical piece of the company’s product.

CheQ’s tech stack works on two fundamental layers. The first layer involves a direct integration with financial institutions such as ICICI Bank, Axis Bank and SBI. With this, customers can directly pay the credit amount to the banks.

Besides a direct interface with the banks issuing credit cards, CheQ has integrated with payment gateways and aggregators, including Razorpay and Cashfree, which means users can pay multiple credit card bills at once across several banks using a single payment window.

The second layer involves analysing a user’s credit exposure and providing valuable insights — such as credit score improvements, payment history and other credit-related information. Users get a collated view on the CheQ dashboard, and can gain a comprehensive understanding of their financial health, Soni says.

The CheQ Business Model

The first step involves a user downloading CheQ’s mobile app, and going through the verification process. This involves fetching the credit report from an RBI-approved bureau partner, which has attached data around credit cards and loans availed by the user.

Users are also required to do a one-time tokenisation which is mandated by the RBI to enable credit card bill payments. Tokenisation is essentially a way for apps to store credit/debit card details through unique codes or “tokens” and not the actual credit card numbers or card verification values. This ensures the security of a card holder as the actual card details are not shared with the app or the merchant during a transaction.

CheQ has gone for a more open approach to customer acquisition, unlike CRED. Any individual with an active credit card or a personal loan can use the app and there is no selection criteria. For context, CRED only allows users with a credit score of 750 and above to join the platform.

The home screen on CheQ is the personal dashboard which displays a user’s credit score and outstanding dues and upcoming payments. This is also where one can see the CheQ Chips balance.

This is how a typical transaction works on CheQ:

Let’s say user X has to pay INR 80K as their credit card bill. When paying through CheQ, X is charged CheQ’s 0.2% processing fee (up to INR 99) but also receives 1% of the paid amount as Chips, in this case 800 CheQ Chips.

Often users might call reward points pointless, but CheQ Chips can be used in three ways: X can convert them to actual rupees in a 4:1 ratio (800 CheQ Chips that can be converted into INR 200). X can get a payout in their bank account or use it to pay the next bill.

The user can also convert the chips into vouchers, worth INR 0.5 or INR 1 per chip. The vouchers can be used on CheQ’s partner brands across sectors like travel, beauty, shopping, health and more. The list of partner brands includes Flipkart, Myntra, Swiggy, Ola, Blinkit, Cleartrip, EaseMyTrip, The Man Company, Wow Skin Science, PVR among others.

Currently, CheQ has two revenue streams — the processing fee charged from users when they pay the bill as well as a commission charged from partner banks and other financial institutions for facilitating credit collection.

CheQ’s Push For Sustainability

It’s the former revenue stream that has attracted some controversy. Some users did not like CheQ’s transition to a processing fee recently.

For an app that was only launched in February, this was a bold move. But Soni says this was to ensure a fast, reliable and secure repayment solution. He added that the reward system offers significantly higher value than the processing fee which would allow the startup to offer a seamless user experience.

For context, on May 25 2023, CheQ made the decision to implement a 0.2% processing fee on all transactions, capped at INR 99.

CheQ claims that no other fintech player has introduced a processing fee as early in their journey as it has.

“We have strategically introduced a processing fee to uphold our high standards. This approach enables us to focus on maintaining our commitment to customer satisfaction without resorting to cross-selling or engaging in intrusive marketing activities on the app,” Soni tells us.

Of course it is a road less travelled and the competition might shape the future for this processing fee. But CheQ’s founder insists that the startup is pushing for sustainability, which means revenue generation and diversity is key.

This move also coincides with the ongoing funding winter. According to an Inc42 report, the fintech sector witnessed a 40% YoY decline in funding value and 13.5% in deal count in 2022, indicating that the funding winter is showing no signs of relenting.

The startup ecosystem is undergoing a shift in mindset as investors exercise greater caution when making funding decisions. Instead of focussing on rapid growth, sustainability has become a top priority. This changing trend offers CheQ the opportunity to build a robust brand capable of cornering long term success.

Soni remains confident of this strategic step, even though the move to charge a processing fee created some stir. He is confident that users will come to realise the significance of the processing fee, and many of them already have.

This is because most of CheQ’s users value the convenience of being able to settle all credit card bills at once, and don’t mind the processing fee, the founder claims . Further, he adds that 50% of the new customer acquisition happens through word of mouth marketing and the brand spends very less on advertising. The founder anticipates referrals to grow in the future — highlighting that the processing fee has not shaken user confidence.

What’s Next: CheQ’s Roadmap

In 2023, the credit management platform is giving priority to technological advancements while simultaneously focussing on acquiring and expanding its customer base.

Further, Soni says the startup has plans to launch marketing and communication strategies to acquire new customers and retain existing ones. Instead of side-stepping the processing fee, the marketing would emphasise on it being a necessary step to provide exceptional rewards and convenience to users.

It’s hard to ignore the CRED-sized problem in CheQ’s road ahead. Since inception in 2018, CRED has not only raised millions, but has grown a reputation for being a cutting-edge fintech company. In 2023, CRED’s ambitions have extended beyond credit card management too — the startup has diversified into consumer loans, UPI payments and even travel bookings.

Does CheQ plan to take a similar ‘super app’ route? At the moment, Soni is not thinking about that. He wants CheQ’s niche to remain in the credit management space and create a differentiated product that can generate sustainable revenue.

It is yet to be seen whether CheQ’s focussed and product-led approach to solve the credit management problem is able to win over India’s credit card users in light of several rivals in this space. Despite the competition intensifying, CheQ’s journey so far shows promise and this is the best time to enter the credit management space.