SUMMARY

It’s Imperative To Look At Battery Value Chain To Ascertain How The Current Battery Market Will Be Able To Fulfill Ever Increasing Demand

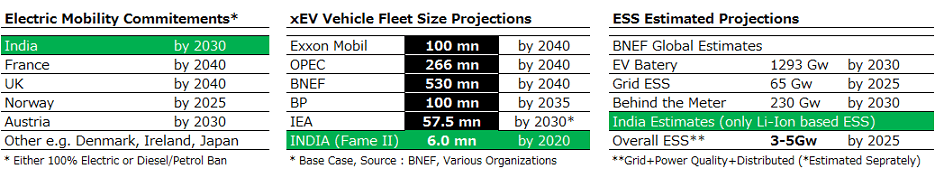

The commercialisation of the lithium-ion battery in the 1990’s fuelled a 20-year surge in the telecommunication and computing industries following the rapid development of light & powerful, rechargeable batteries. Next wave of emerging “Electric Vehicles” (xEVs) is currently a global agenda point based on the same battery technology. Beyond traditional markets (e.g. Portable Electronic Devices PEDs) and emergence of xEVs, other high potential market of stationery storage (ESS) is beginning to gain lot of traction with several applications across the value chain now started reaching towards commercial viability.

Unprecedented xEVs growth projections with several nations committing towards 100% electric mobility & multiple ESS applications getting commercially viable, poses a huge demand for batteries, thus it’s imperative to look at battery supply chain without which battery market will not be able to fulfill ever-increasing demand.

The Lithium Pipeline

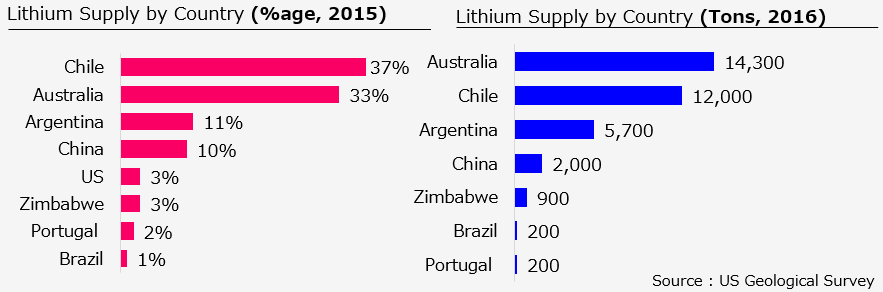

Global lithium demand was 184 kilotons (kt) in the year 2015, increasing battery demand @ of ~40-45% YoY basis will account for ~40% global lithium demand. Several estimates projected global lithium demand to reach between 525 – 550kt by 2025.

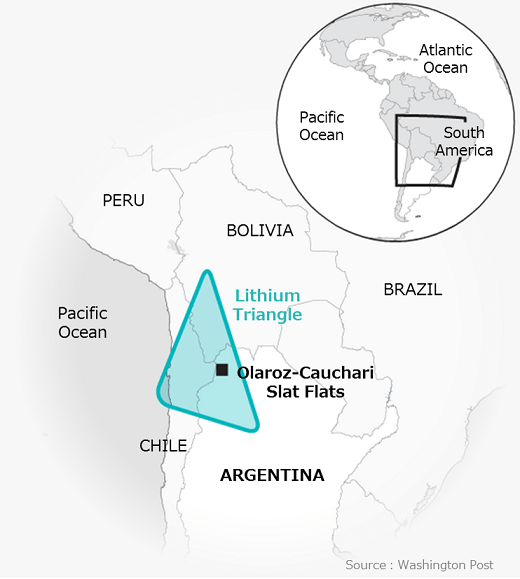

Current major producers of lithium are Australia, Chile, Argentina & China with Australia and Chile accounting for more than 75% of the total. These four countries also have the largest lithium reserves. Chile, in particular, projected to have more than 50% of known reserves.

However, three countries Argentina, Bolivia & Chile posed to dominate world’s lithium supply, also known as South America’s Lithium Triangle. Assuming battery replaces oil and as BNEF projected the year 2025 as the inflection point for xEVs to go cheaper than ICE, South America surely seems to be the “New Middle East”.

Contrary you will be surprised to know that “Lithium-Ion Battery” contains lithium as a raw material as small as just a fraction of 1% per watt (0.6-0.7 Lithium Carbonate Equivalent /Kwh) or less than ~2% of the overall battery cost.

Rather than worrying about lack of lithium supply in future, I believe Industry should be more worried about other earth metals like Cobalt, Nickel, Magnesium, Graphite and even permanent magnet for the electric motors specifically for the xEVs industry.

Surely for some of the metals, it’s will be a complete “GAME CHANGER” with YoY rising metal commodities pricing, since very few countries, In fact, one or two countries (China being one of them) control ~90% of the rare earth metals market.

Rest of the Battery- From Mines to Market

Graphite

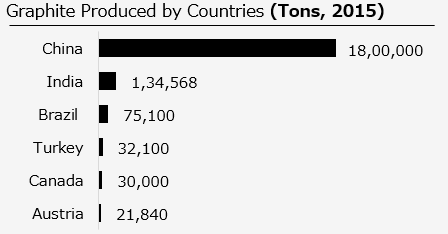

Downplaying lithium supply issues, other materials like graphite, cobalt, nickel & magnesium, also contributes significantly to the overall battery cost. While the average cost of an anode is ~25-30% of a battery, graphite is ~50% of the anode turning to 15% of the cost of a cell.

Meanwhile, the average cost of the cathode is ~35% with lithium being ~50% of the cathode cost, equating to ~17.5% of the cost of a cell (based on FY 2015 prices).

Meanwhile, the average cost of the cathode is ~35% with lithium being ~50% of the cathode cost, equating to ~17.5% of the cost of a cell (based on FY 2015 prices).

If not more, graphite is almost near to lithium in terms of price contribution to the battery, however unlike lithium, it is potentially overlooked and has not witnessed a similar kind of price inflation, potentially because prices are generally driven by vis-à- vis largest consuming sector i.e. steel, a globally stressed market.

Looking at the graphite value chain, battery OEMs use both “Natural Spherical Graphite” and Synthetic Graphite for cell manufacturing. Moreover, natural spherical graphite exhibits low-cost profile and much lower environmental impact (low carbon footprint for manufacturing).Graphite reserves are dominated primarily by three countries (Turkey 36%, Brazil 29%, and China 22%), however, the current production is dominated by China. An estimate of 2015, the production in China accounts for ~ 85% of the world’s total.

COBALT – Blue Metal Skyrocketing Demand

Surprisingly, some materials are not extracted and refined at the same place and so is the case of cobalt, which is one of the most expensive material in Li-Ion battery. The cathode is fundamentally important to both the performance and cost competitiveness of Li-ion cell.

Surprisingly, some materials are not extracted and refined at the same place and so is the case of cobalt, which is one of the most expensive material in Li-Ion battery. The cathode is fundamentally important to both the performance and cost competitiveness of Li-ion cell.

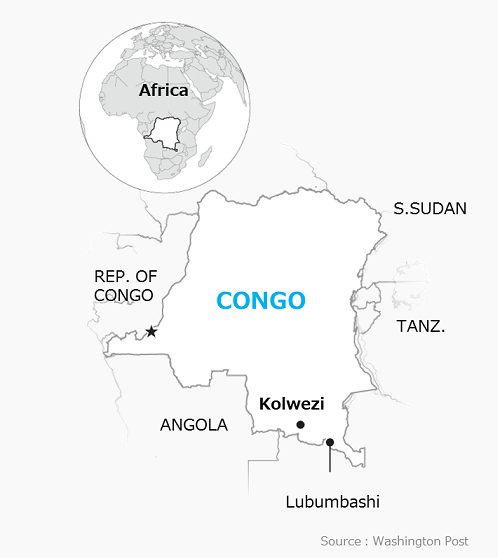

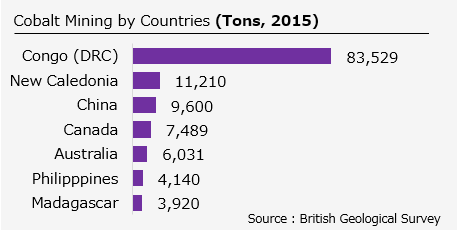

In 2015 DRC (Democratic Republic of Congo) produced most of the mined cobalt, but China was the largest producer of the usable  refined metal. With unprecedented demand of xEVs and several “Energy Storage” applications becoming economically viable, there is a multi-fold increase in LiB demand, in turn, rare earth metals like COBALT.

refined metal. With unprecedented demand of xEVs and several “Energy Storage” applications becoming economically viable, there is a multi-fold increase in LiB demand, in turn, rare earth metals like COBALT.

After DRC, Canada and Australia seemingly play an important role in ramping up both mining and refining especially after cobalt prices are doubled in the past year (cobalt last traded at $32,000 a ton at end of 2016 at LME which is up ~36% from the previous year).

Extensive work, both on ramping up cobalt production as well as new chemistries with lower cobalt top-up is underway. There are positive indications with Australia poised for largest growth in production with ~31% rise in cobalt production by 2021 and battery OEMs trying hard to tweak recipes for batteries by adding more nickel to it.

Nickel

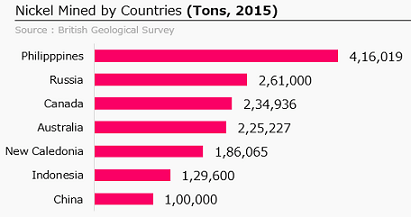

Though nickel is the least centralized metal in the battery, it is abundantly available and mined widely.

Having said so, price swings of nickel can potentially impact battery OEMs. In 2014, Indonesia banned nickel exports which resulted in prices to soar by ~50%.

Having said so, price swings of nickel can potentially impact battery OEMs. In 2014, Indonesia banned nickel exports which resulted in prices to soar by ~50%.

In 2015, major producers only held a share of up to 20% (Philippines mining) and 30% (China refining). Australia is estimated to have 24% of the global reserves.

Conclusion & Way Forward

The Supply of raw material for Li-ion batteries is not under threat in times to come, however surging demand will open up new areas for extraction with its own pros & cons.

Further, on one side prices for Li-Ion batteries are falling much faster than expected with several estimates projecting it to reach less than US $100/Kwh, however, on the other hand, rare metal markets are not ramping up at same pace, with skyrocketing prices for some of the metals like cobalt posing serious concerns over price downtrend in future.

While all sort of supply issues/questions exists for these energy metals, the demand situation is much more straightforward, the number of electric cars in the world passed the 2 million mark last year and several nations committed to outlaw the sales of petrol and diesel powered cars by 2040, and carmakers viz. VOLVO pledged to only sell electric or hybrid vehicles by the year 2040.

Currently, the most important unanswered question is: Where on earth do we dispose-off tonnes of lithium-ion batteries when they wear out? One of the possible solutions could be to recycle these batteries to address larger issues of supply chain risks with a robust “Circular Economy Ecosystem” in place, however, we are yet to see a well-established high scale Li-ion battery recycling.

In EU as low as just 5% of lithium-ion batteries are getting recycled, however there are likely signs of optimism, basis that unlike in case of consumer electronics, where batteries form a relatively small part when compared with xEVs & most likely end up lying somewhere in the corner of a house or chucked into landfill, in case of xEVs producers will most likely be responsible for collecting and recycling the used batteries. Regulations issued by EU authorities are already in place laying the foundation in the similar direction.

Solved? Not exactly, currently viable smelting & other recycling processes are capable to recover many metals, but they might not be able to directly recover vital lithium. Some of the reputed investment bankers mentioned in one of their reports that no recycling of lithium can happen in the decade ahead. Much more development is needed to come closer to closed loop re-cycling & reclaim all the material with questions around RoI of recycling (cost vs recovery)

One of the potential solutions can be standardisation of batteries in a way enabling it to be responsibly re-cycle able, however, currently, it seems to be a far-fetched view since the current race is all about price trend.