Startups should raise funds regularly, as nearly 38% of startups fail because they either run out of cash or fail to raise funds on time

While raising funds, both founders and investors must understand the complexities of the investment, including each party's rights, obligations, and involvement

Read to understand the concept of startup funding and why it has become even more critical with a funding winter in the backdrop

Funds help a business grow by allowing it to scale and reach new markets, among other things. These factors boost sales and assist startups in establishing a credible market position. Startups should also try to raise funds regularly, as nearly 38% of startups fail because they either run out of cash or fail to raise funds on time.

It is especially important in the Indian context because India has the world’s second highest number of startups, with 69% of all startups globally beginning as home businesses. Investment in startups has also increased in India, with Indian companies raising $42 Bn in 2021. As a result, understanding the concept of startup funding has become even more critical.

The first stage is typically self-funding or bootstrapping, in which an entrepreneur determines how much money he or she can contribute from his or her own pockets and approaches family and friends for lower-interest loans. This stage has fewer complications and documentation requirements.

The real funding begins in the second stage, the seed stage. This is the stage when entrepreneurs borrow money from incubators, microlenders, and accelerators, among others. The funding raised in this round is used to conduct market research to learn about customers’ demands and preferences.

Following this stage of funding, venture capital funding is required when a company’s products or services reach the market. There are different rounds of venture capital funding known as Series A, B and C.

Aside from funding from lenders and incubators, entrepreneurs can also raise funds through an Initial Public Offering (IPO). Through an IPO, a company raises funds from the general public, including institutional investors and individuals, by selling shares.

The Rights Associated With Startup Funding

The rights of the investors and entrepreneurs in the business are primarily determined by legal agreements in startup funding. Typically, investors gain some rights, such as an equity stake in the company. Entrepreneurs, on the other hand, have the right to receive funding and support from investors within the time frame agreed upon.

Type Of Instruments That Can Be Issued By A Startup To An Investor For Fundraising

These instruments involve:

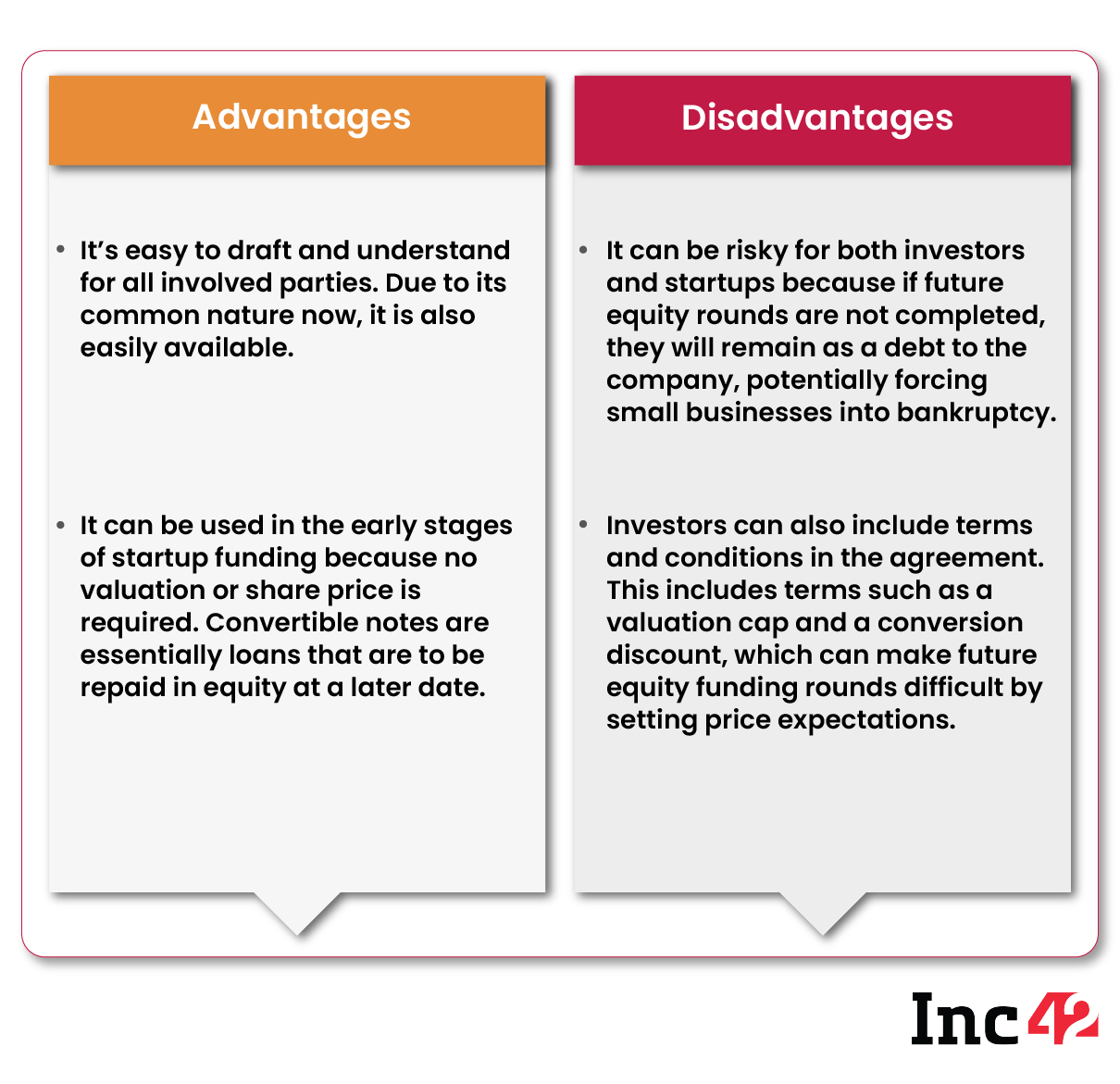

Convertible Note

This is an instrument that converts a startup’s debt into equity. If the startup receives additional funding, the person holding this note will be able to convert it into equity. If the startup does not receive additional funding, the person holding the note is entitled to be repaid for the debt plus interest upon the realisation of the maturity date, as stated in the Convertible Note agreement.

These notes also include a ‘cap or target valuation’ and a ‘discount.’ The cap or target valuation represents the highest valuation that the startup will pay regardless of the company’s valuation at the time the note is converted, while the discount represents the lowest valuation that the startup will pay. According to the Companies (Acceptance of Deposit) Rules, 2014, startups in India can issue convertible notes to investors in amounts exceeding INR 25 Lakhs.

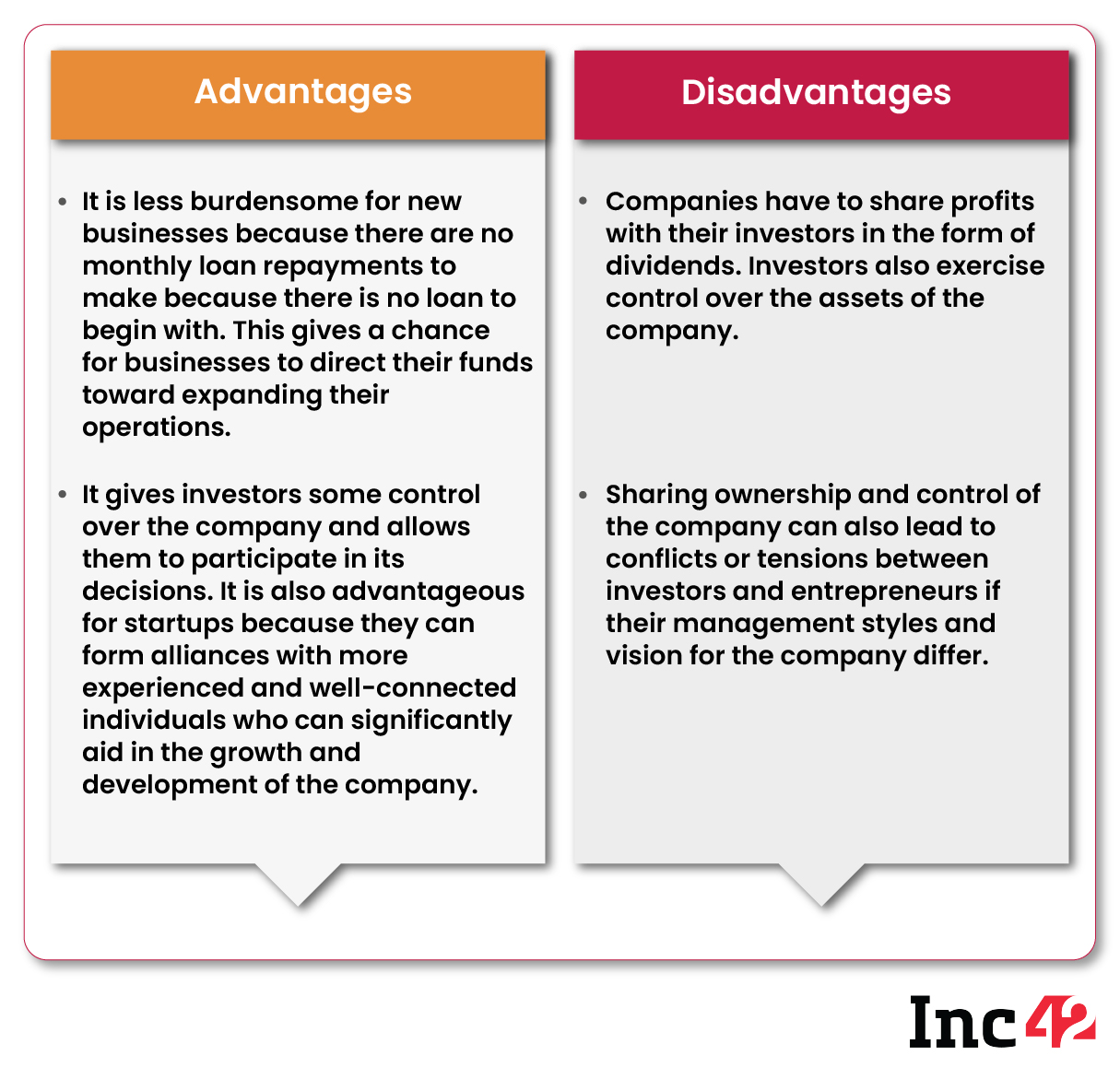

Equity: Allotting equity entails determining the company’s valuation and the per-share price based on that valuation, and then issuing those shares to investors.

SAFE (Simple Agreement For Future Equity): This type of contract, also known as an “equity derivative contract,” converts the initial funds invested in a startup into the future stock of the company. It lacks a maturity date and an interest rate, making it more malleable for negotiation. They also include contingency events, so that based on the occurrence or non-occurrence of certain events, they indicate whether the principal amount should be repaid or converted into stocks is best for the investor’s interests.

SAFE (Simple Agreement For Future Equity): This type of contract, also known as an “equity derivative contract,” converts the initial funds invested in a startup into the future stock of the company. It lacks a maturity date and an interest rate, making it more malleable for negotiation. They also include contingency events, so that based on the occurrence or non-occurrence of certain events, they indicate whether the principal amount should be repaid or converted into stocks is best for the investor’s interests.

SAFE notes can also be used in India in the form of Compulsorily Convertible Preference Shares (CCPS) as per sections 42, 55 and 62 of the Companies Act, 2013 read with Companies (Share Capital and Debentures) Rules, 2014 and Companies (Prospectus and Allotment of Securities) Rules, 2014.

While raising funds, both founders and investors must understand the complexities of the investment, including each party’s rights, obligations, and involvement. It is important to remember that signing the wrong type of agreement can have far-reaching consequences.

Ad-lite browsing experience

Ad-lite browsing experience