SUMMARY

Decoding Hidden Terms In Convertible Notes Being Used In Southeast Asia

If you have heard me speak publicly or if you follow this blog you’re likely familiar with my hatred towards convertible notes. Lately though, I have come across some notes that founders are signing with well-known accelerators, further strengthening my belief that notes are evil, especially the modern version of a SAFE note. I decided not to ignore these issues as most investors in the region are doing, and rather speak up openly about them. In the post I’ll refrain from taking out names openly.

As I mentioned in my earlier blog post, at GREE, we prefer to sign on equity rather than notes, due to multiple reasons. We have signed notes in the past, and will continue to do so in the future when the founder is insistent on doing things this way, but will definitely encourage each company we are investing in to consider the demerits of signing on a note.

The biggest demerit for the founder is the fact that a capped note in-effect hands over a full-ratchet anti-dilution clause to the investor. The biggest demerit for the investor is that we never really know how much we own in the company making life difficult for us, especially if the company issues multiple layered notes.

But this post is not about generic notes. I want to discuss “SAFE” notes that are currently being issued by two well-known accelerators in the region. One of these notes, modelled on the famous YC SAFE note, has been twisted to form a convoluted and extremely founder-unfriendly agreement. Worse still, the notes are being presented as a “founder-friendly” agreement and some unfortunate entrepreneurs are falling into the trap.

The YC SAFE Note

I will not go into the details of the famous notes issued by YCombinator, there is enough material on the internet for you to understand these. Suffice to say, that YC had very good intentions while issuing these notes. The notes they created help in saving the founders from negotiating complex control and pricing terms too early in their company whilst protecting them from any hidden clauses that might lurk in documents served by an ill-intentioned investor. However, investors in the US are also starting to voice their opinions on how the YC SAFE notes are doing more harm than good. While YC’s intentions may be good, there is a case to be made that the notes are causing harm to at least a few companies.

Regardless of whether YC SAFE works for/against the founder in the long run, one thing most founders (and even investors) don’t realise is that YC takes equity in the company first and then issues a note.

We know this, because of our investment in Saleswhale (a YC company), and have first-hand access to all the documents there. Here is how the process works for YC (at least from my knowledge of investing in one YC-backed company).

- Issue $20k for 6.06% equity.

- Issue $100k on a YC SAFE note at $10M price

(in this particular SAFE note, the cap of $10 Mn is the conversion price and even if the future equity round happens at a valuation less than $10 Mn, the note will still convert at $10 Mn. Thus, this is a convertible note where the price is exactly $10 Mn regardless of next round valuation.)

While every other accelerator, angel investor, and founder is raising/investing on a SAFE note similar to what they say YC uses, what they do not realise is that YC itself is actually taking equity and is using the note only for protecting its interest for the next round. Figure that one out for me.

The SAFE Note by Accelerator X

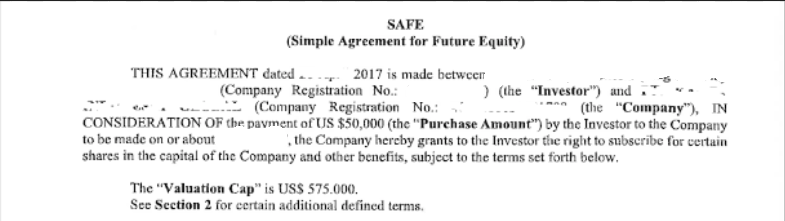

“SAFE Note” issued by Accelerator X

Coming to the point of this post. While conducting DD on a company that has recently graduated from a well-known accelerator in the region, I managed to see the note that the founder signed with the accelerator a few months ago.

It was shocking.

The accelerator has taken a clean YC SAFE note and has unashamedly modified key clauses to issue a horrendous document that no professional investor will push on to a founder, especially in the company’s first round. The note starts off very similar to a typical SAFE note. The template, the font, everything is the same. But then start the problems.

$50K investment for a valuation cap of $575K: Starting off from the smaller issues. I have said this multiple times and I say this again, capped notes are dumb for founders. You are setting a ceiling for your price and no floor. So you have a minimum dilution (in this case of 8%) and no maximum dilution (depends on next round raise). If you manage to raise the next round above the cap, the accelerator wins as the note converts at a lower cap. If you manage to raise the round only below the cap, the Accelerator wins again by taking even more equity.

Right to increase ownership to 8% during next equity financing: As if the cap was not enough, there is a clause here that gives an option to the accelerator to increase/maintain its ownership at the time of your equity financing to 8%. Let’s say you raise a Seed equity round of $1 Mn at $3 Mn pre-money. Your new investor wants 25%. Your SAFE note investor will be at 6.5% post conversion. The SAFE investor further gets a right to increase ownership to 8% by buying more of your company. The cap table hence will likely look like 25% for your new investor, 8% for your SAFE note investor. That’s 33% dilution without you having even gone past the product market fit stage. Good luck finding a Series A and B investor with that cap table.

4x liquidation preference: Yes, not even fu**ing kidding you. Sure, the accelerator can argue that the investment amount is small but how do you think your next investor is going to react after seeing this? Do you think you’ll be able to negotiate your way out of a 1x participating clause with the next investor? And we all know how multiple liquidation prefs end up for the founder.

Equity financing (next round) to be of minimum $1 Mn, YC SAFE note is at $250K: You’ll ask, why change this term? How does it matter to the accelerator when their note converts as long as the price is set? It matters because this way they’ll get the rights associated with a financing that is at least $1M in amount. These rights (pro rata, liquidation pref) are usually much stricter than what a $200k–500k equity finance round would require. The accelerator now gets to enjoy the rights of a much larger investor and remember that the cap and 8% pro-rata right will always protect the shareholding of the Accelerator. Fu**ed up.

Pro-rata rights for not just this round but all rounds, transferrable to any partner: Basically, the accelerator has a lock up on 8% of your company henceforth and can bring in whosoever they choose to take up that 8% in future rounds. A lot of early investors at later stages don’t get to enjoy pro rata rights. Especially if you waive it one time, you never get it back. But in this case the Accelerator and its affiliates will get to enjoy this 8% pro rata right forever. Further, the affiliate term is so loose that arguably even a mentor (including me) can get the right to participate in the 8% ownership if the Investor is fine with that.

Right to block sale of company at a valuation less than $2 Mn: Wow. So not only will you give back to the accelerator 4x the money if you sell too early, your sale can be blocked if it is at too low a number. So let’s say your company doesn’t work out (quite likely at an accelerator stage), you can’t even take an acqui-hire route unless the accelerator allows it.

The whole purpose of the YC SAFE note was to make it easier for founders to close rounds without negotiating any terms except for valuation. Based on the twisted clauses above, I doubt that agenda is being achieved in the modified SAFE note. In case you are curious, was it the end of life for the company in question here given that they signed this note? No. Luckily for them investors in the next round are pushing for renegotiation of the terms of these documents. Whether or not the accelerator budges, remains to be seen.

The SAFE Note By Accelerator Y

I then came across another accelerator which goes about touting founder friendliness. This accelerator also invests on a SAFE note. Unfortunately, I have not yet seen the exact note terms but I have managed to come across the high-level terms.

$75K investment on uncapped SAFE convertible note at 50% discount: Pause. Gulp. Read again. 50% discount. I have never seen a 50% discount in any note. Usually the number hovers between 0 and 20%. Why will an investor coming with a Seed cheque a few months after the Accelerator’s investment be fine with the Accelerator walking away with half the price? I don’t know many investors who’ll be ok with this, unless the Accelerator helps the company perform exceptionally well in the few months it spends with the company, something I am yet to see happen in this part of the world.

Two-year maturity: If the company is unable to raise in two years, the note converts at $1 Mn post-money. YC SAFE has no maturity period, so I am already starting to wonder that this is another twisted SAFE note.

Converts at same class shares on a qualified raise of $200K at post-money of at least $2 Mn: Now, I am super suspicious of this clause. It says the note converts to same class shares and if that’s the case then the founder is in-effect handing over a 2x liquidation preference over to the accelerator.

How does “same class of shares” correspond to multiple liquidation preference? You can read Mark Suster’s brilliant explainer here, but I’ll summarise for you. Let’s say the notes convert because of a $1 Mn seed round at $4 Mn pre-money valuation. The note thus needs to convert at $2 Mn valuation to respect the 50% discount. Now the way the cap table will be structured is that the accelerator will simply receive double the number of shares it would have received if it had invested in the $4 Mn valuation round. Since the share class is the same as the Seed equity round, assuming each equity share has a non-participating 1x liquidation preference, the accelerator gets liquidation preference for double its original investment of $150K (due to the $75K investment). Surprised? You should be.

Help! What Should We Do?

I hope by now you have woken up to the fact that our startup world is not fairyland. My intention is not to scare you away from accelerators, but to alert you to the consequences of signing a document that you don’t thoroughly understand. I know many founders don’t understand these intricate terms, heck even I didn’t understand all of this when I started my company. I learnt it all the hard way but I would recommend that if you are entering an accelerator that is pushing a SAFE note on to you, follow some basic advice below before signing the dotted line.

- Know your stuff. Read Venture Deals. Read AVC, Feld Thoughts, BothSidesOfTheTable. Be aware of what you are signing up for.

- Compare any proclaimed SAFE note word-to-word with the YC SAFE note and do not sign if you don’t understand the consequences of even a small wording change.

- Hire a good lawyer. It doesn’t cost as much as you think it does. I know of many law firms in Singapore that are trying to engage early with the entrepreneurs and are willing to take a hit on their fee so as to build a long-term relationship with the founders. A few firms that I feel are doing well for the ecosystem: Gunderson Dettmer, Simmonds Stewart, Linklaters and Dentons. Some have confirmed to me that they help process early stage docs for as low as $1,000, trust me that dollar is the best dollar you’ll spend when kickstarting.

For The Accelerators

As for the accelerators, I don’t know what to say. Our firm has been associated with some of these accelerators for a long time, and these terms are not what we would like to see in a deal when it comes to us. And I speak on behalf of the whole investor community when I say this. These concerns are already being voiced among the investors, and the accelerators are risking reputation loss with a solid possibility of investors disengaging themselves from their programme.

You still want to do notes? Then do uncapped, zero discount notes, and be ready to convert whenever an equity round happens. But I don’t think this makes any sense for the accelerators as they would like to come into the company earlier than the investors to make the economics work. So how should an accelerator invest in a company? What’s the cleanest way? In my opinion, even accelerators should just take straight-up equity. Learn from the best accelerator yet, YCombinator.

I suggest you value every portfolio company at $1 Mn post-money (unless they have raised money already in which case you need to go deeper into the negotiation). You invest $50K, and you get 5% from it, plain vanilla. Keep the terms utterly simple, no liquidation preference, no anti-dilution. $1 Mn valuation is very palatable as a valuation for a pre-Seed investor coming after you, writing $100K-$300K cheques. 5% extra dilution is not enough to act as a turn-off for a Seed or Series A investor.

And 5% ownership is enough to make the accelerator model work. Let’s say there are 10 companies in a batch and the accelerator ends up owning 5% in each company by spending a total of $500K. Assuming the accelerator doesn’t even back its winners in a future round, after multiple rounds the diluted ownership in a well-performing company will be around 2% (assuming three further rounds of 30% dilution each as a worst-case scenario). Even if this company exits at a decent $50 Mn valuation, the accelerator still makes $1 Mn out of the sale and returns 2x of the money.

If dilution is lower in this same company, the accelerator can easily make 3x from just one company. 3x is what most early-stage investors aim for. Are we really saying that not even 1 of the 10 companies the accelerator batch has invested in can exit at $50 Mn? Why run the programme then and what “value add” has been provided?

It’s time we initiate an end to this craziness called convertible notes. After decades of education, when founders have finally started understanding equity terms, the industry has managed to come up with another obfuscation mechanism in the form of a SAFE note. It’s not in the interest of anyone, neither the company’s nor the investor’s nor the founder’s!

[This post by Nikhil Kapur first appeared on Medium and has been reproduced with permission.]